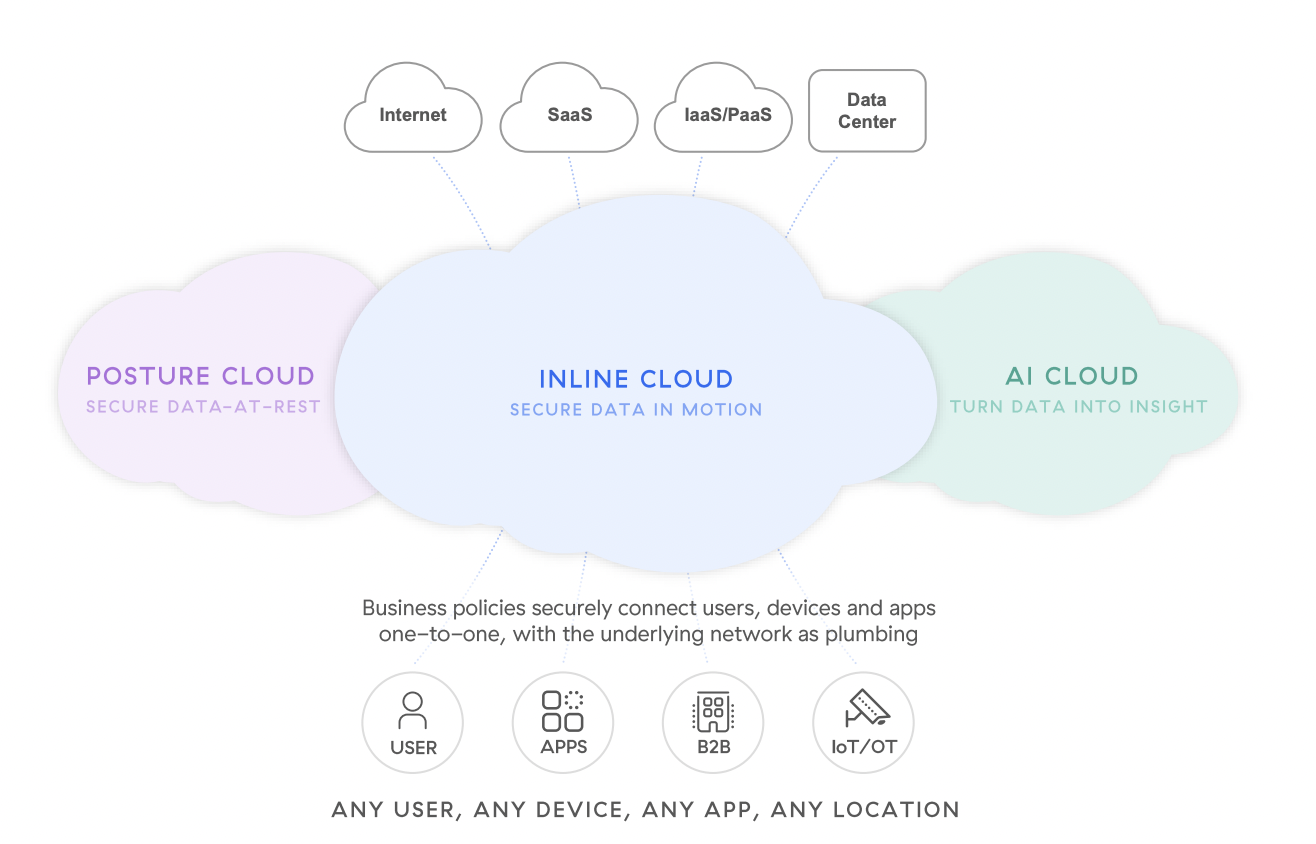

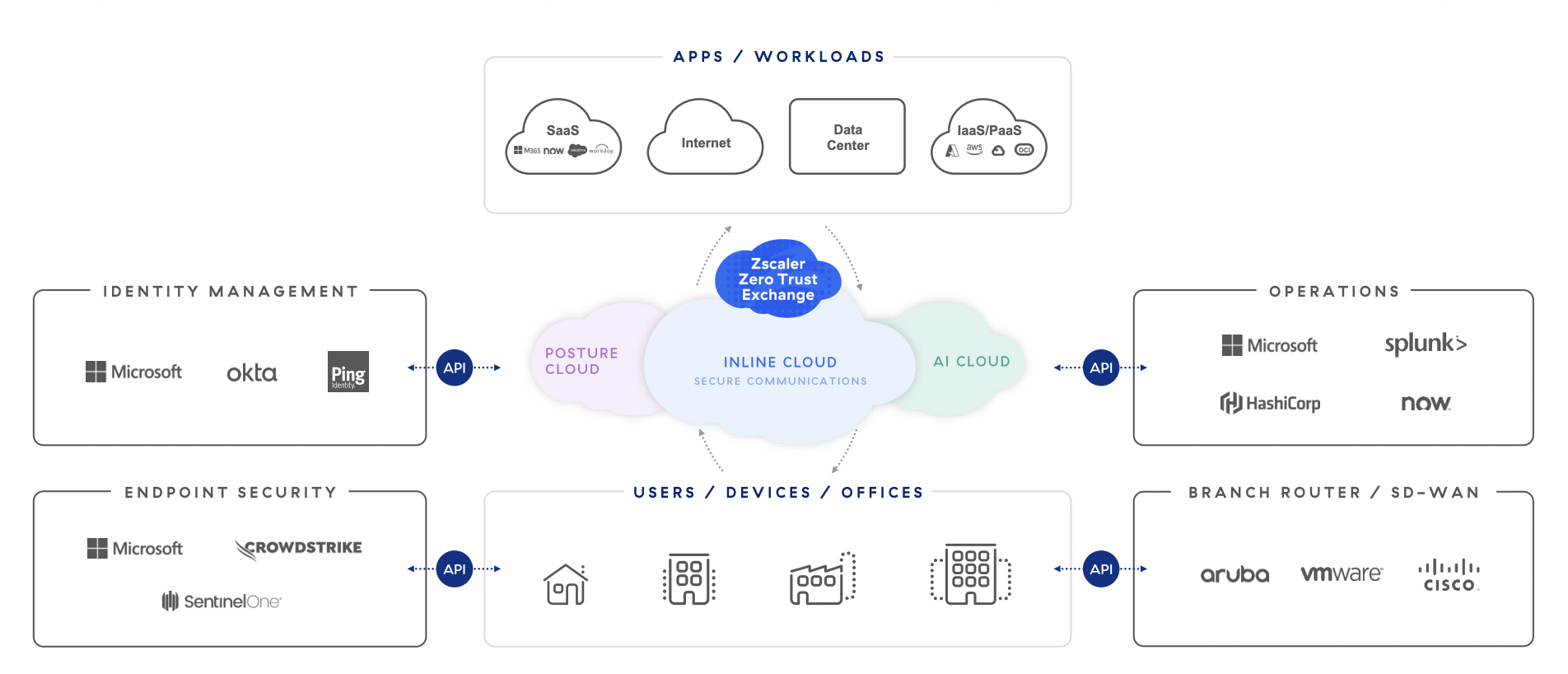

Zscaler's solutions cover secure internet and SaaS access, data protection, local internet breakouts, and secure private application access. These services address various cybersecurity needs, including protection against cyber threats, data loss prevention, and secure access to internal and external applications. Positioned in the market with a robust product portfolio, Zscaler leverages its innovative Zero Trust Exchange platform to offer comprehensive security solutions such as Zero Trust Network Access, Secure Web Gateways, and Cloud Security Posture Management. Their commitment to data protection, workload security, and secure application access has gained trust from numerous enterprises, allowing them to effectively safeguard their networks and data against cyber threats.

The widespread adoption of cloud services, utilized by over 90% of businesses, has become integral to operations, with nearly 70% of enterprise infrastructure now residing in the cloud. Corporate data stored in the cloud has surged from 30% in 2015 to 60% today. This shift has generated substantial demand for cloud-native cybersecurity, rendering traditional on-premise security largely obsolete. From 2016 to 2023, the global cybersecurity market doubled, growing from $83 billion to $166 billion, and this growth is expected to persist.

Projections indicate that the global cybersecurity market is set to reach $425 billion by 2030, boasting a nearly 14% compound annual growth rate (CAGR). The escalated spending is anticipated to come from businesses of all sizes and governmental entities, fueled by their increasing reliance on cloud services. Cloud security ranks among the top three priorities for businesses utilizing the cloud, regardless of size. The complexity of cloud operations and cyber-attacks underscores the necessity for swift innovation in the security sector, with artificial intelligence (AI) at the forefront. The use of AI in cybersecurity is expected to grow in the mid-20%, aligning with the escalating demand. Historical trends highlight innovation as a crucial differentiator, with disruptors like Zscaler and Crowdstrike consistently outperforming legacy firms such as Cisco Systems and IBM. This trend is expected to persist, distinguishing winners from losers in the cybersecurity landscape.

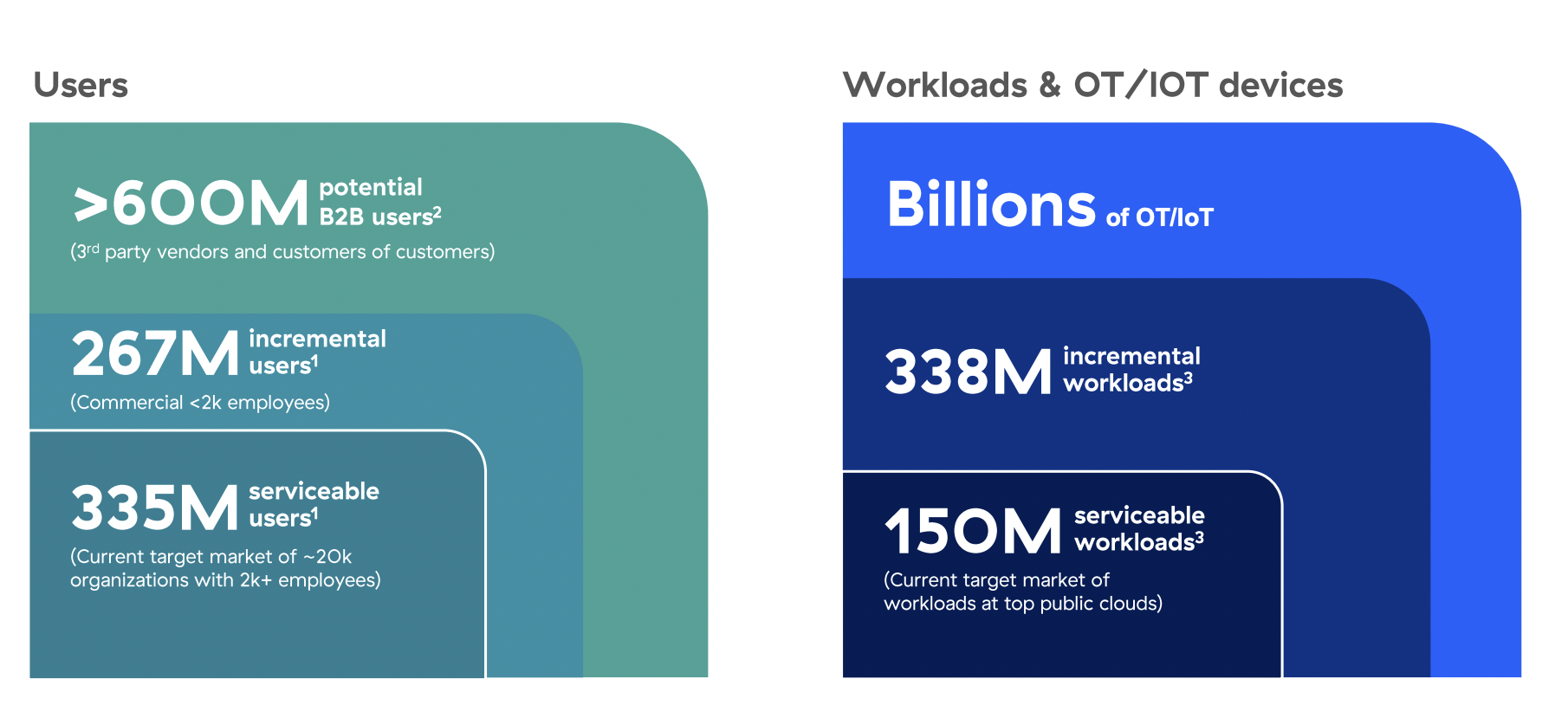

The company's ability to secure growing cybersecurity spending in the evolving cloud-centric industry underscores its robust product offerings and market relevance. Zscaler should continue to capture a larger share of cybersecurity spending as more customers transition their workloads to the cloud.

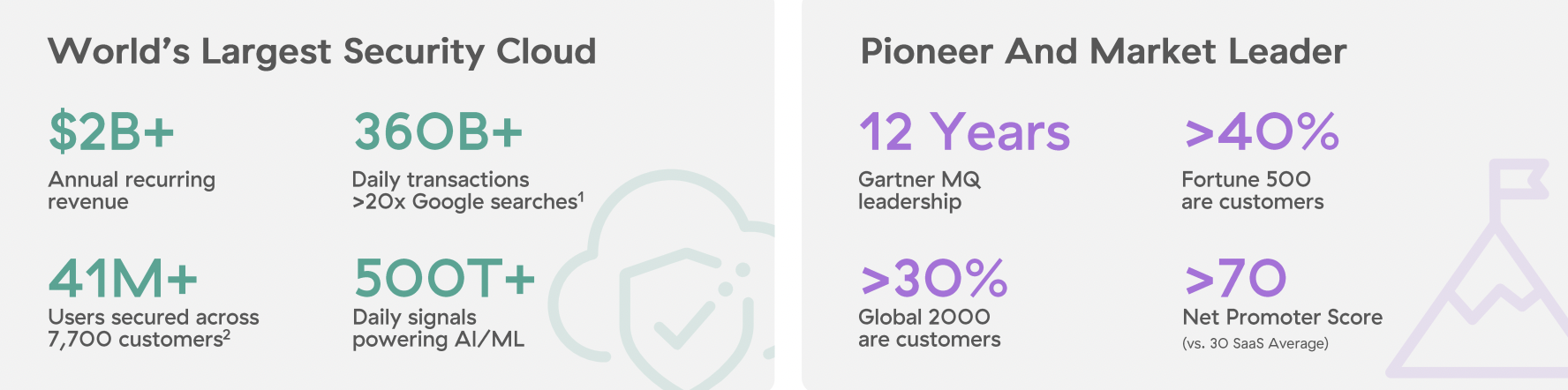

Its competitive advantage is rooted in its early investment in AI and ML (Machine Learning) technologies, establishing itself as a leader in the expanding cloud security landscape. Projections indicate a 16.9% compound annual growth rate (CAGR) in the Zero-Trust security market between 2023-2028. With a broad customer base, including over 40% of the Fortune 500 and 30% of the Global 2000, the company is well-positioned for share expansion.

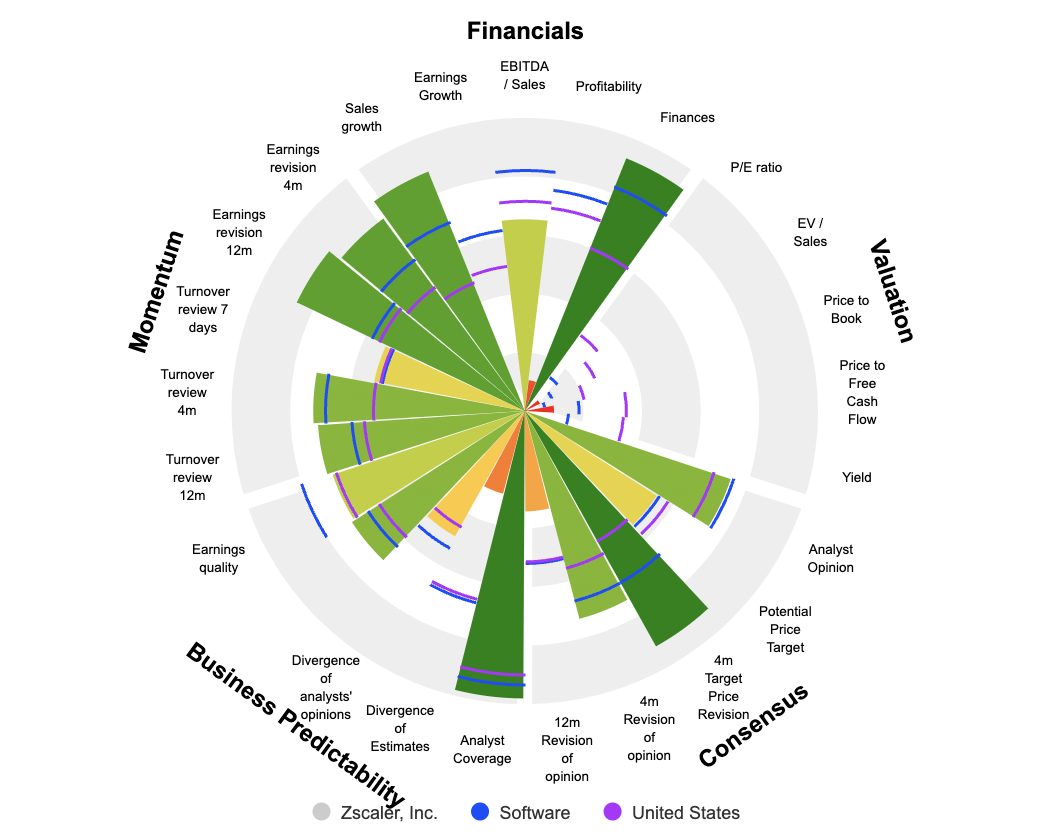

The primary risk lies in the potential for consensus estimates to be overly optimistic. While the cybersecurity subsector has demonstrated resilience with more consistent top-line growth than its counterparts, there is a possibility that this trend may not be sustained indefinitely. The sector could face challenges, either due to a natural slowdown or adverse macroeconomic conditions impacting top-line growth. Its current valuation reflects expectations of future growth, with limited immediate upside potential from a multiple expansion perspective. Microsoft's substantial investment in its SSE offering, particularly Microsoft Azure, poses a potential threat to the business and remains a significant factor that could influence competitors' valuations.

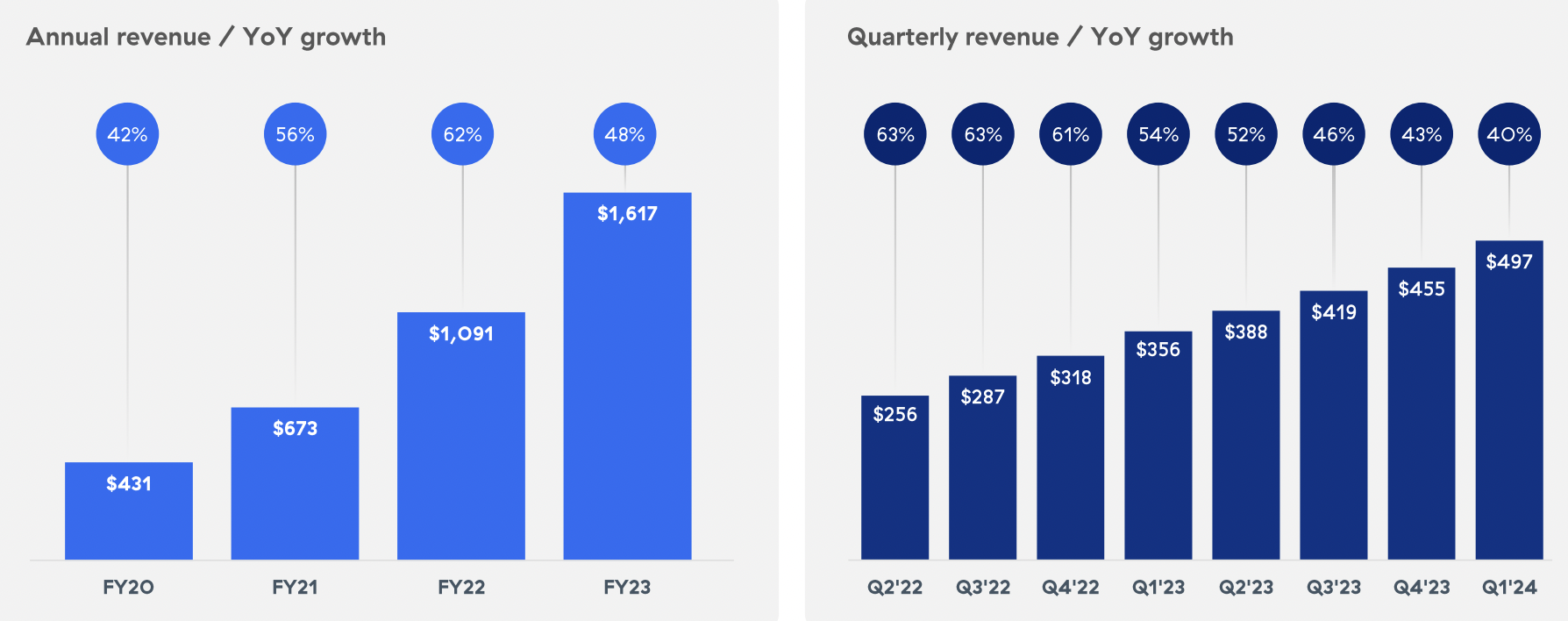

The company has shown remarkable revenue growth, increasing by 275% since 2020. Management anticipates a 33% year-over-year (YoY) revenue growth in the upcoming quarter and a 28% YoY revenue growth for the full year. Additionally, they aim for over 100 basis points (bps) in operating margin expansion. EBITDA has risen from $35.5 million in 2019 to $297 million in 2023, with analysts forecasting $742 million for 2026, reflecting a compound annual growth rate (CAGR) of 12.12%. Operating margin is expected to follow suit, increasing from 14.9% in 2023 to 19.8% in 2026.

The company's management places emphasis on free cash flow (FCF) for business expansion through acquisitions and development. Starting at $2.18 million in 2018, FCF has surged to $334 million in 2023 and is projected to reach $827 million in 2026 with a 25.3% margin. The business's net cash position is currently nearly $1 billion and is expected to reach $2.75 billion in 2026. The return on equity (ROE) soared from 18.4% to 42.7% between 2022 and 2023 and is anticipated to maintain this level for the next two years. Since 2020, non-GAAP gross margin has been 80%.

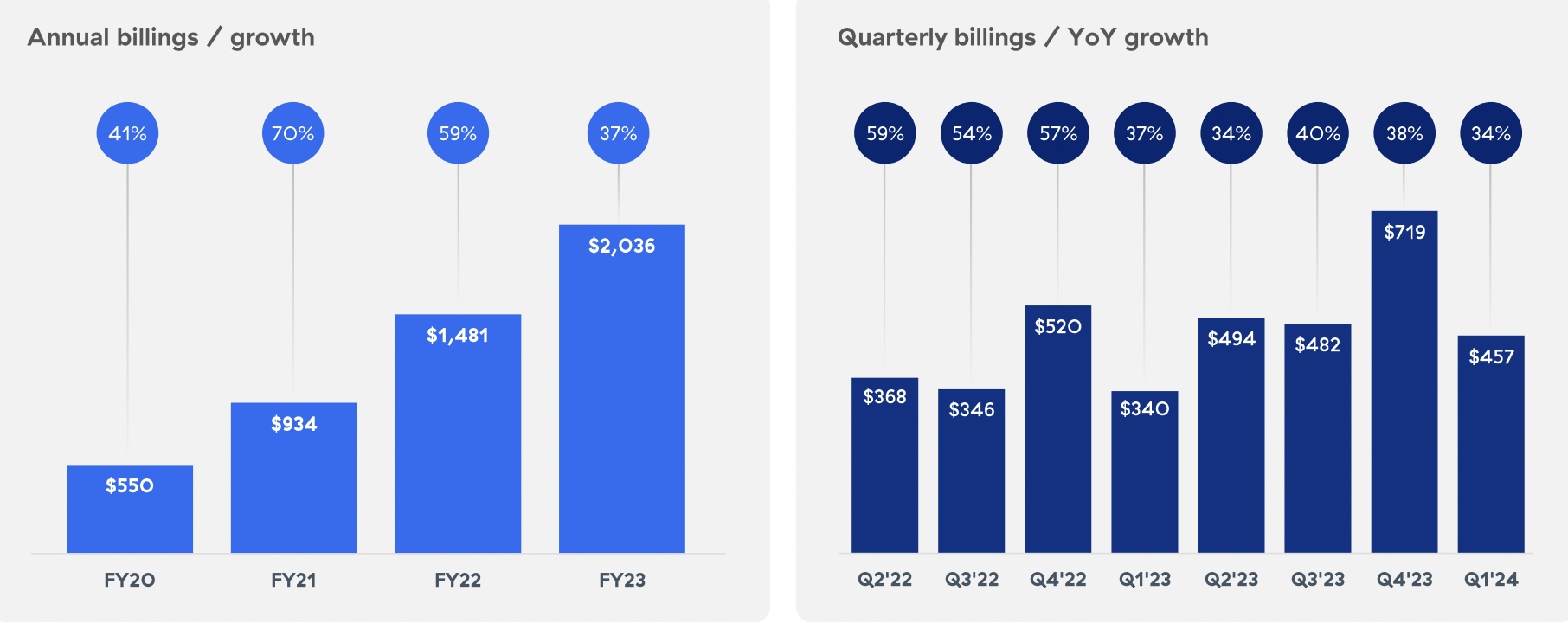

Its strong revenue growth is complemented by a 37% growth in billings. Given that billings growth often precedes future revenue growth, this robust figure has alleviated investor concerns about a potential significant slowdown soon.

Zscaler's strong revenue growth, innovative technologies, and competitive positioning in the cybersecurity market are commendable. However, potential risks associated with a market slowdown, and the competitive threat posed by Microsoft's investments. The company's valuation suggests expectations of future growth, but its ability to navigate challenges and sustain its market relevance will be pivotal for investors. Its future will depend on its ability to gain cybersecurity spend wallet share as more customers' workloads move to the cloud.

By

By