Warren Buffett made his reputation through his listed holding company Berkshire Hathaway. The company employs more than 350,000 people worldwide. It is diversified in sectors as different as textiles, insurance, energy, transportation and industry. Warren Buffett and his trusted sidekick Charlie Munger are both major shareholders of Berkshire Hathaway. When Warren can't or won't buy a company as a whole, he takes equity stakes in those companies.

Let's take a closer look at his portfolio. He tracks only his U.S. listed holdings based on the 13F published quarterly on the SEC (Securities and Exchange Commission) website. The last report was published on August 15, 2022 and closes the second quarter of this year on June 30, 2022. These quarterly reports list the assets under management of investment managers or listed holding companies with control over more than $100 million in assets and which hold so-called "long" US positions. The Form 13F covers Registered Investment Advisers (RIAs), banks, insurance companies, hedge funds, trust companies, pension funds and mutual funds. This report is published no later than 45 days after the end of the related quarter. This list includes only US positions. Indeed, these funds or holding companies are only required to report shares traded on a U.S. exchange.

In the case of Berkshire Hathaway, many holdings are no longer listed since the conglomerate bought them out in their entirety. His 13F therefore only lists US listed positions in which he holds a minority or majority stake via his holding company.

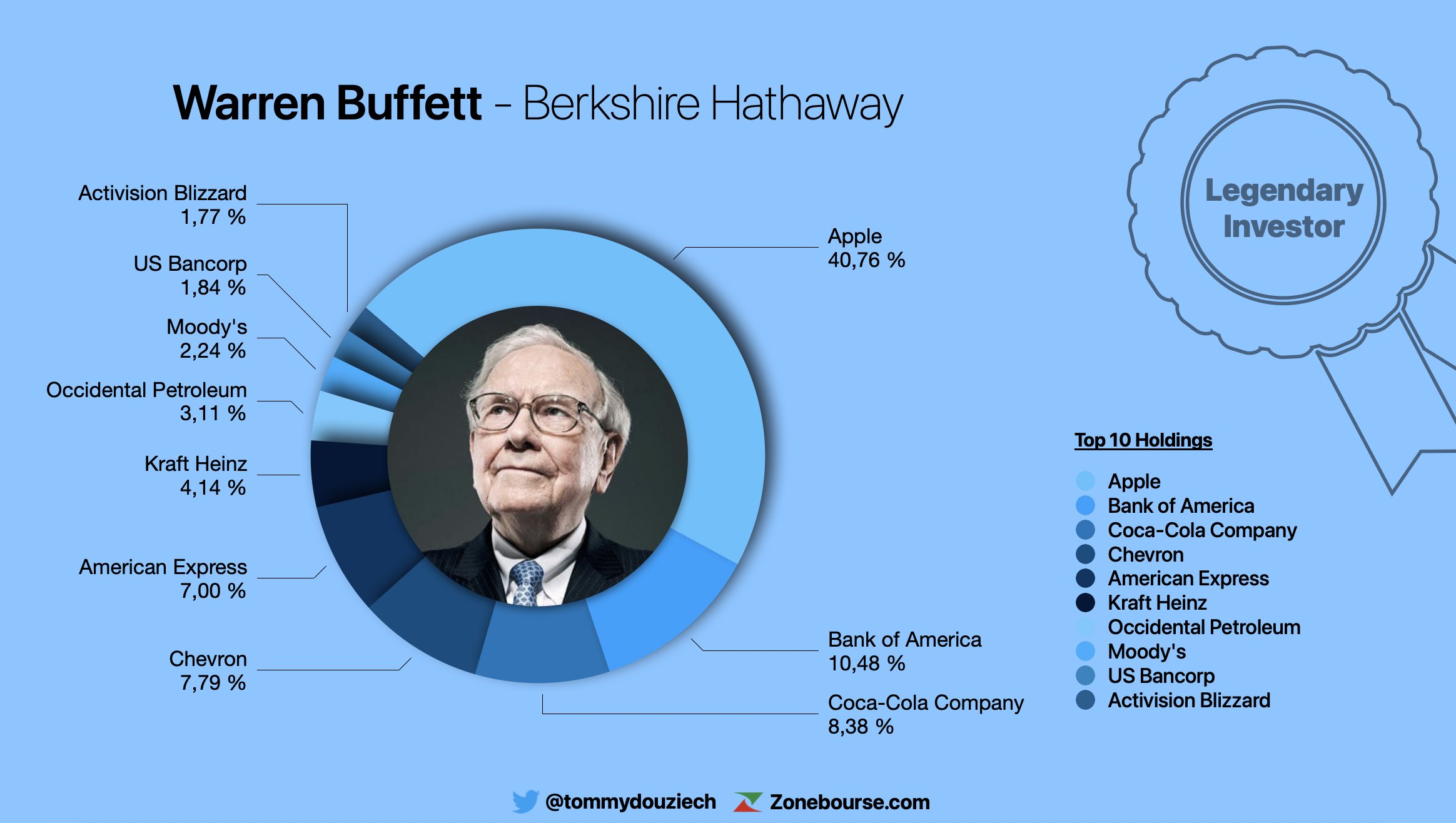

Warren Buffett holds 47 positions for a total of more than 300 billion dollars.

Here are his top 10 holdings:

In the second quarter, the legendary investor increased his positions in Ally Financial (+234%), Occidental Petroleum (+16%), Celanese Corp (+16%), Paramount Global (+13%), Markel Corp (+11%), Activision Blizzard (+6%), Chevron (+1%) and Apple (+0.5%). Instead, it shed US Bancorp, Kroger, General Motors, STORE Capital Corp and sold Royalty Pharma Plc and Verizon Communications outright.

By

By