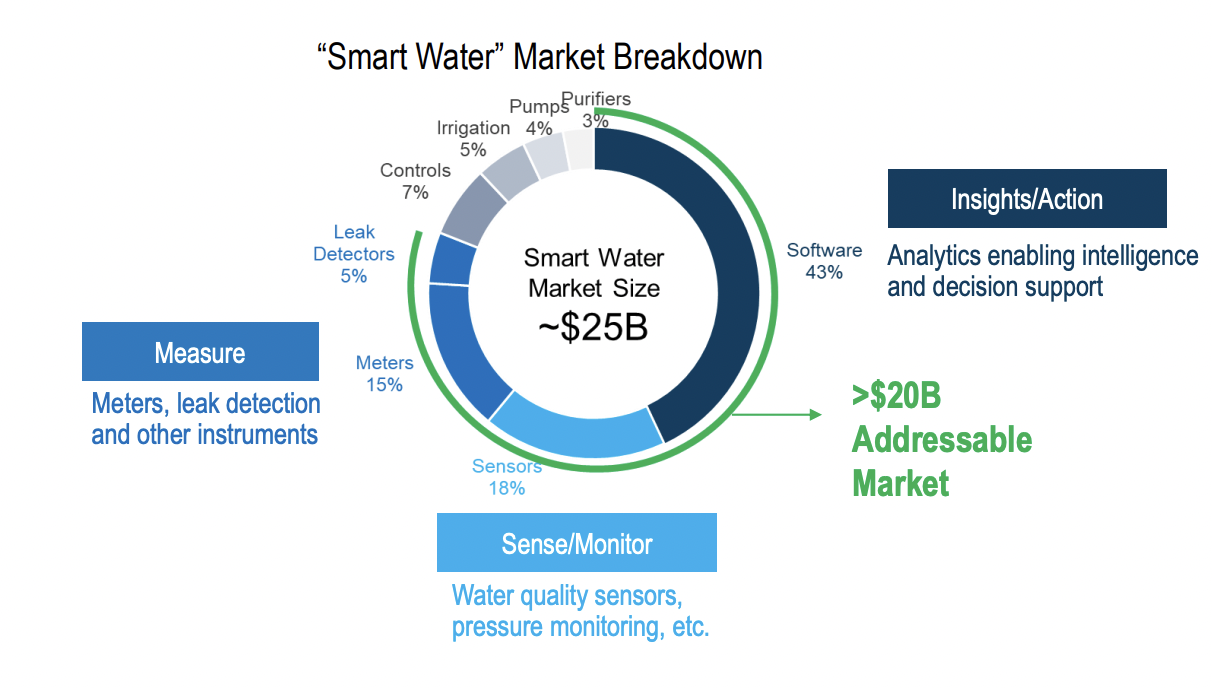

Over time, it has evolved from basic water meters to advanced flow measurement technologies, serving a wide range of industries including water utilities, municipalities, and industrial customers. With a century-long history marked by innovation, the company has developed various metering solutions, from electromagnetic to ultrasonic and coriolis flow meters. Going global, Badger Meter has installed based in 50+ countries, 5 R&D centers, facilitated by strategic acquisitions aimed at expanding its reach and product offerings. In recent updates, the company maintains its leadership in flow measurement technology, prioritizing sustainability and smart water solutions. Notably, Badger Meter focuses on smart metering and connectivity, providing solutions to help customers effectively manage water resources.

Strategic acquisitions are vital for the company's growth, exemplified by the following:

Between 2010 and 2014, Badger Water expanded its industrial flow measurement applications by acquiring Racine Federated and enhanced smart water offerings through the acquisition of AquaCue, leveraging cellular radio and BEACON software expertise. In 2017, Badger Water effectively acquired D-Flow, incorporating advanced ultrasonics expertise. Since 2020, the company has further strengthened its position by acquiring s::can and ATi, leaders in real-time water quality monitoring using optical and electrochemical sensing, and most recently, Syrinix, renowned for providing intelligent water solutions with high-resolution features.

Badger Meter offers a comprehensive suite of fluid measurement solutions across various industries. Their product lineup includes Mechanical Water Meters for residential, commercial, and industrial use, Electromagnetic Flow Meters known for accuracy and suitability in wastewater and industrial processes, and Ultrasonic Flow Meters for obstruction-free liquid flow measurement.

Coriolis Mass Flow Meters provide direct mass flow measurement for liquids, slurries, and gases in industries like food, pharmaceuticals, and chemicals. Turbine Flow Meters operate by turbine rotation and find applications in water distribution and HVAC systems.

The company's offerings extend to Valve Positioners and Controllers for automated process control, Flow Monitors and Controllers with digital displays for flow rates and control functionalities, and Data Solutions and Software for collecting and analyzing flow data. Badger Meter also provides a range of valves tailored to diverse applications, emphasizing their commitment to precision and efficiency in fluid measurement.

Examples of Badger Water Products Portfolio

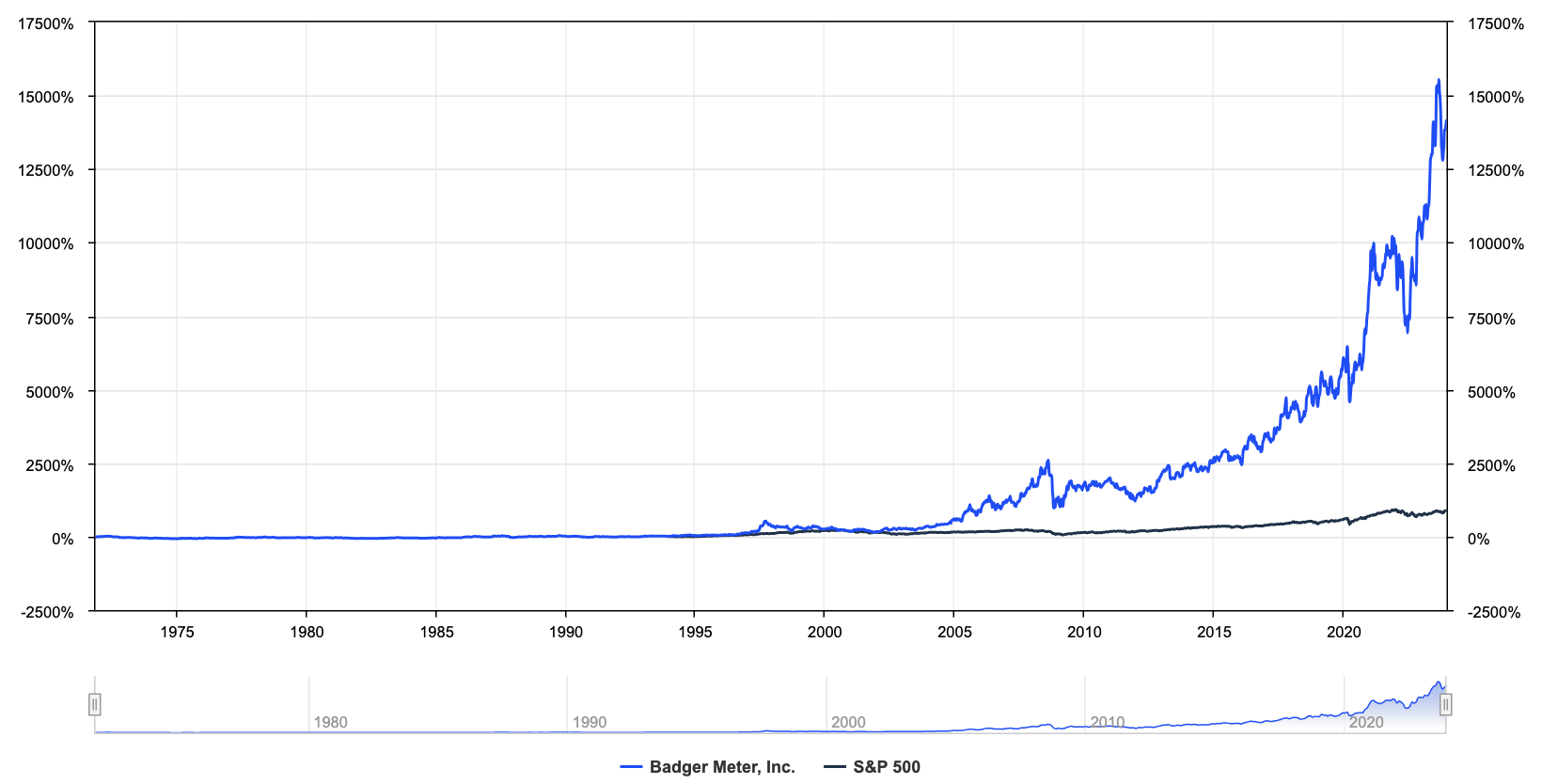

Badger Meter has consistently outperformed the S&P 500 over the past two decades, demonstrating its capacity to deliver sustained returns to its shareholders over the long term.

The company encounters competition for both its utility water and flow instrumentation product lines, ranging from moderate to strong. Key competitors for utility water meters include Xylem ("Sensus") and Roper Technologies ("Neptune"), and collectively with Badger Meter, these companies are estimated to account for over 85% of water meters in the North American market. The remaining market share is divided among competitors like Master Meter, Mueller Water Products, Kamstrup, and Diehl Metering GmbH, depending on the metering technology.

Badger Meter faces challenges from both supply chain disruptions and regulatory and compliance issues. The company's reliance on a complex international supply chain for raw materials and components exposes it to potential delays, increased costs, or inventory shortages due to factors like natural disasters, trade conflicts, or transportation issues. Additionally, the highly regulated business environment in which Badger Meter operates makes it susceptible to the impact of changes in compliance standards. Non-compliance with regulations poses risks such as fines, legal actions, and potential harm to the company's reputation.

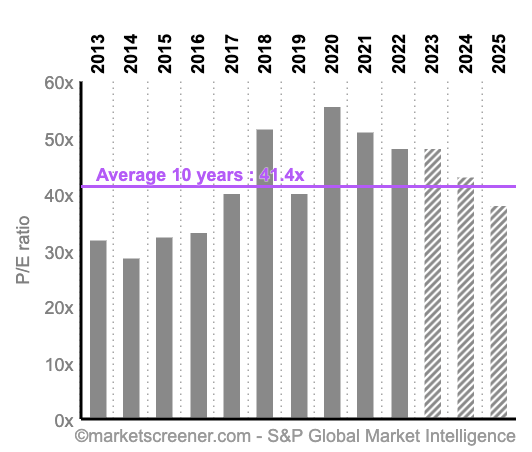

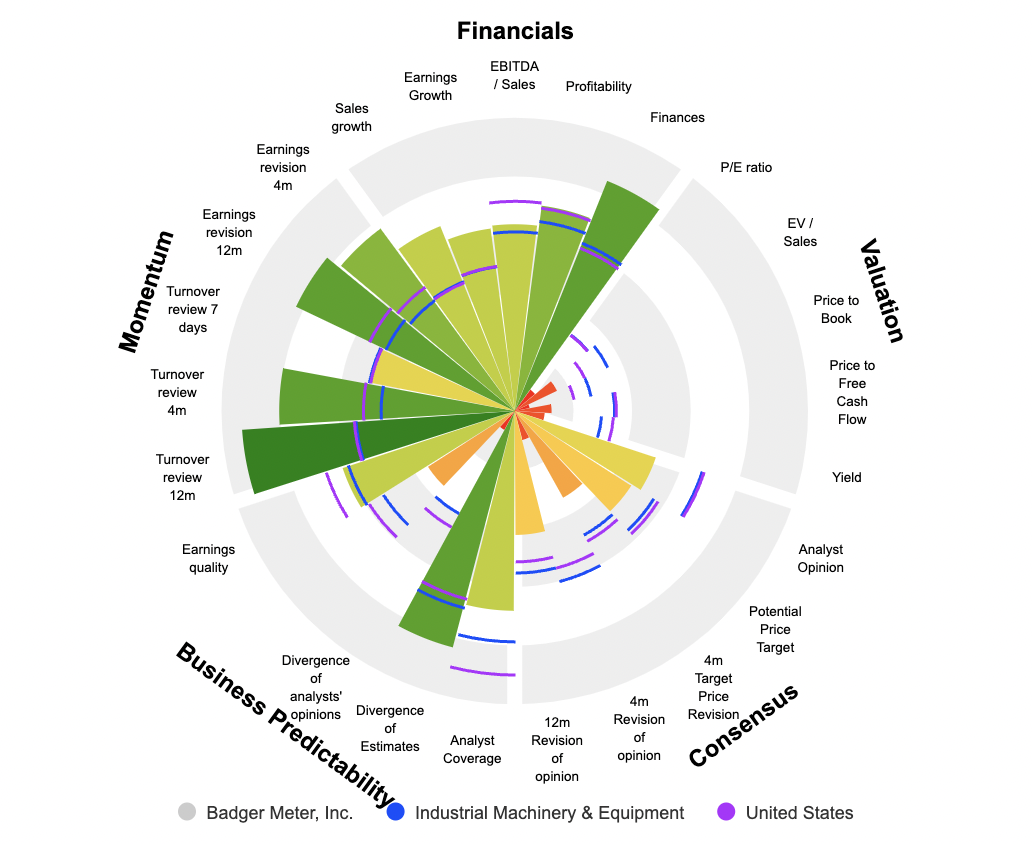

With a P/E of 48.2 times earnings, this is a quite high valuation. On the face of it, nothing too exciting, even if earnings per share have grown over the past decade from $0.85 in 2013 to $2.26 in 2022, representing a CAGR of 10.27%. However, P/E estimates for 2023 and 2024 are 48.3- and 42.9-times earnings, which seems to underline a certain homogeneity in the analyst consensus.

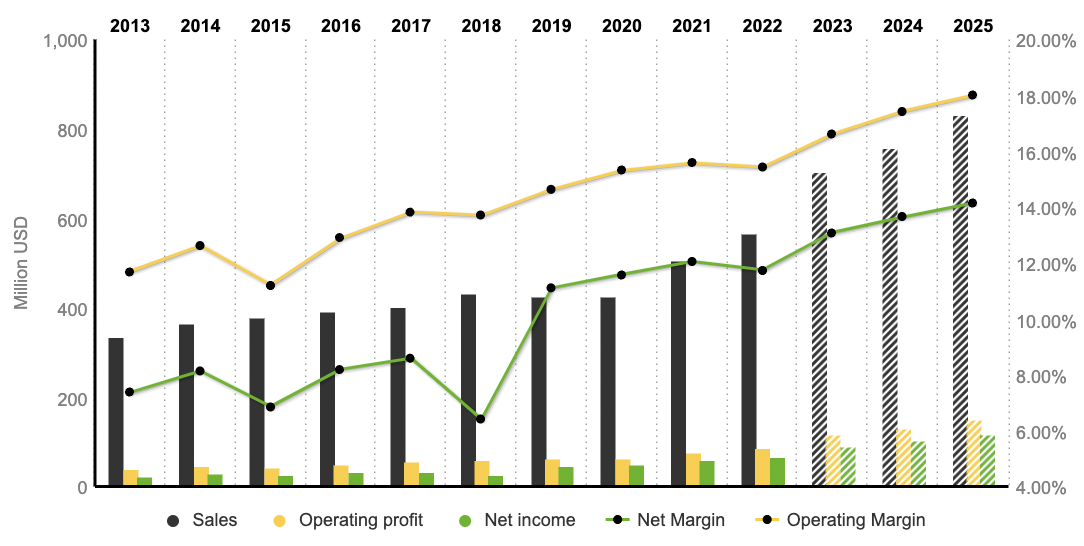

Simultaneously, the group's sales have increased from $334 millions to 566 million dollars in 2022, showing a consistent annual growth rate of 5.4%. This positive trend extends to EBITDA and EBIT, which have risen by 116% and 123% respectively over the same period, reaching $114 and $87.3. The management's effectiveness is evident in the expanding net and operating margins, projected to rise from 11.8% to 13.1% and 15.4% to 16.6% from 2022 to 2023. Additionally, a robust Free Cash Flow (FCF) of $76,6 million in 2022 is set to increase to $121 million in 2025, enhancing the company's potential for future acquisitions.

The business’s ROE which indicates the profitability of the company and its ability to generate profit with the money invested was at 15,7% in 2022 and should increase to 20% by 2025; while the ROA which measures the efficiency of a company in utilizing its assets to generate earnings, with a projected value of 14% in 2023.

Badger Water is a "dividend aristocrat" whose dividend per share has grown uninterruptedly for 31 years ($1.08 in August 2023).

The company's proficiency in detailing flow meters, crucial instruments for monitoring gas or liquid flow, reflects its commitment to advancing technologies. The integration of smart sensor technology in water quality monitoring and wastewater solutions provides valuable insights for industry professionals. The company has consistently demonstrated its ability to generate strong returns on invested capital and effectively integrate acquisitions. However, it is crucial to acknowledge potential risks associated with market fluctuations, regulatory changes, and technological challenges that may impact the company's performance.

By

By