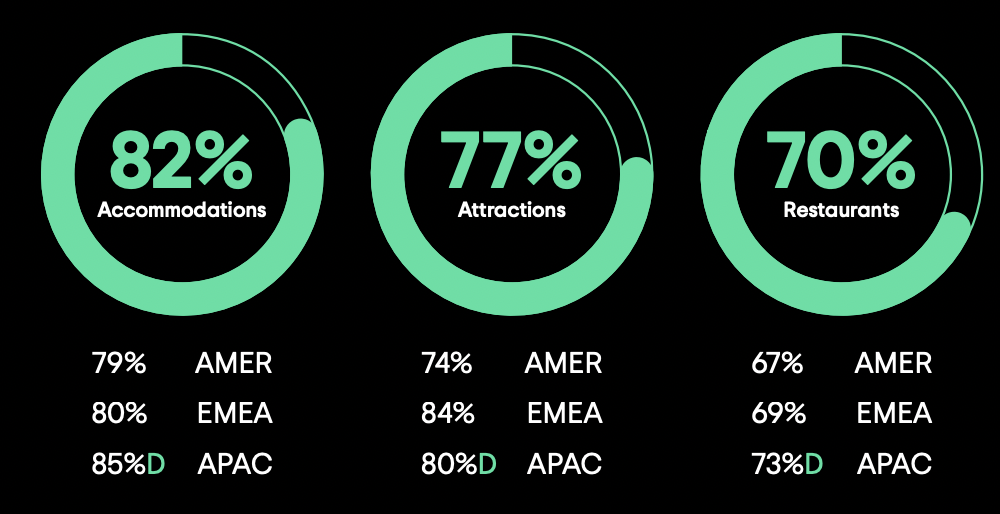

The group, functioning under a collective of brands, is centered on facilitating connections between people and memorable experiences. The organization divides its operations into three primary segments: Brand Tripadvisor (world’s largest online travel guidance platform), Viator, and TheFork. The platform is renowned for its extensive collection of over 1B+ reviews & opinions, encompassing a wide range of travel-related content on more than 8 million experiences, accommodations, restaurants, airlines, and cruises. The platform boasts over 300 million monthly unique users, which include around 130 million active members.

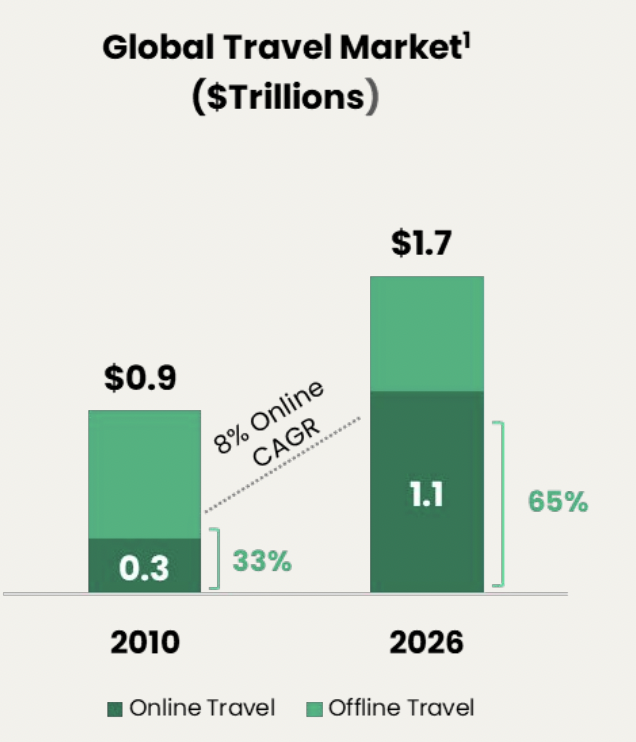

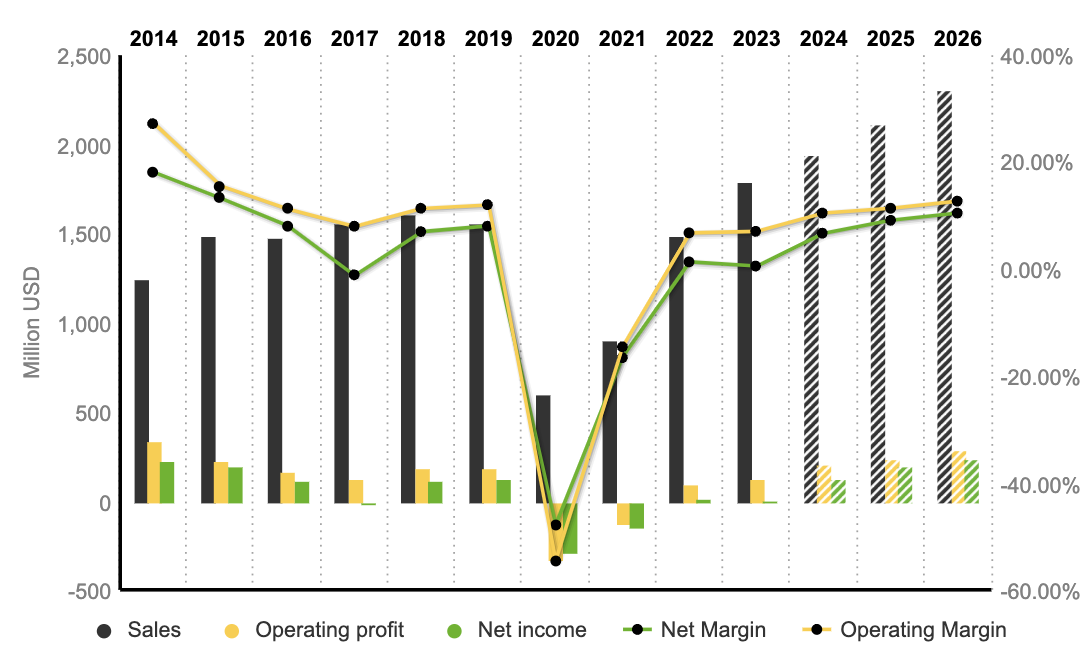

The global travel market is expected to expand from $0.9 trillion in 2010 to an estimated $1.7 trillion by 2026, with online travel's compound annual growth rate (CAGR) at 8%. By 2026, online travel is projected to account for 65% of the market. It shows how TripAdvisor could harness the growth of online travel bookings and enhance its platform to meet the increasing demand for digital travel services.

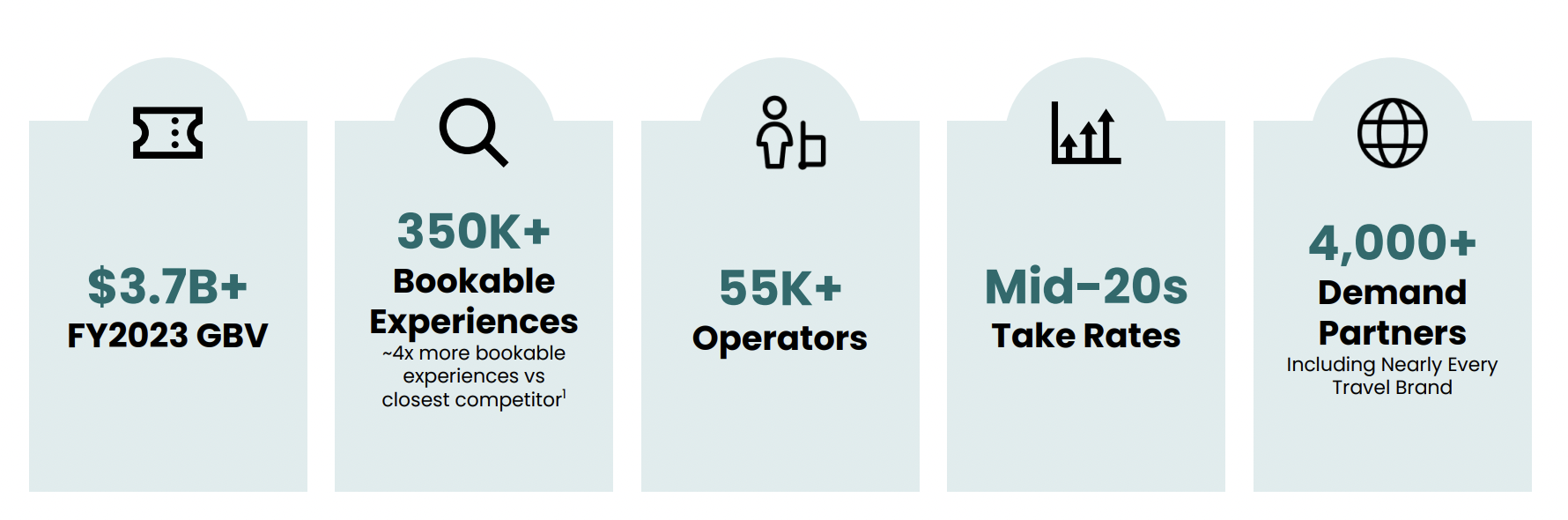

With Viator, we can observe a gradual increase in the proportion of the tours and experiences market being captured by online services. In 2019, online bookings constituted 17% of the market. This figure rose to 26% by 2023 and is projected to reach 30% by 2025, despite the overall market size decreasing from $253 billion to an estimated $280 billion. Viator, as a part of this online segment, reported approximately $3.7 billion (26% CAGR) in gross bookings for fiscal year 2023. This positions Viator within an online experiences market that is part of an $83 billion subset of the broader $280 billion forecasted market size. Company’s is focus on getting a higher rate of repeat bookers, higher subsequent repeat order values.

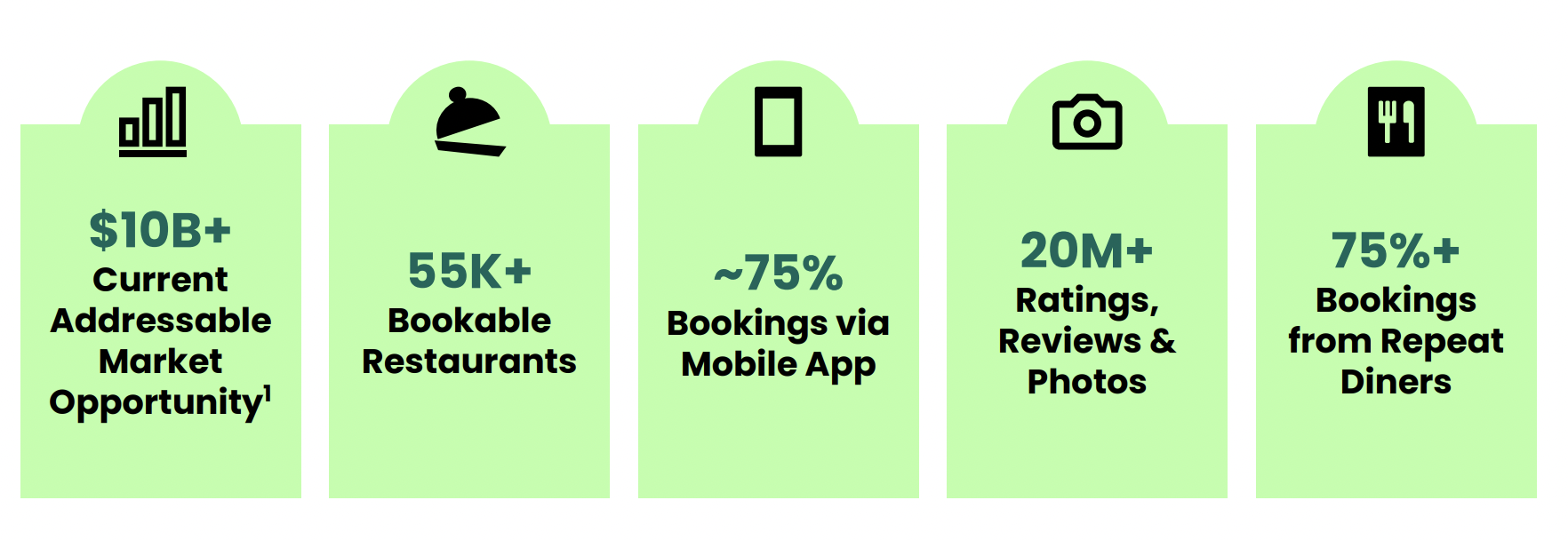

Finally, TheFork is a dominant entity in the European dining reservation market, operating in 11 countries within the region. It has an extensive network of over 55,000 restaurants where customers can make reservations. The market opportunity for TheFork's services is substantial, with an estimated potential of $10 billion.

As of December 31, 2023, the company employed roughly 2,845 individuals, with distribution across regions as follows: 58% in Europe, 34% in the United States, and 8% in other parts of the world. The company also utilizes independent contractors to enhance its workforce. Liberty TripAdvisor Holdings possesses equity securities that constitute about 57% of the company's voting power.

Tripadvisor operates within a competitive landscape, engaging with a broad array of companies that offer overlapping or complementary services across its main business segments:

- Travel and Booking Platforms: Expedia, Booking Holdings, Airbnb, traveloka, Despegar, Trip.com,

- Experience-focused Platforms: GetYourGuide, Klook, and TUI Musement;

- Hotel metasearch providers: Kayak and Skyscanner;

- Search and Social Media Giants: Google, Meta, Twitter, Pinterest, and Snap;

- Emerging online advertising businesses: Amazon, Spotify, and Walmart;

- Artificial intelligence driven travel curators: Travel Plan AI, Aitinerary, Wonderplan, Roam Around

- Traditional offline travel agencies

- Global and regional restaurant technology providers for reservation management: OpenTable, Resy, and Tock.

The company is however partnering with global hotel meta platform and key advertising platform travel brands to ensure growth.

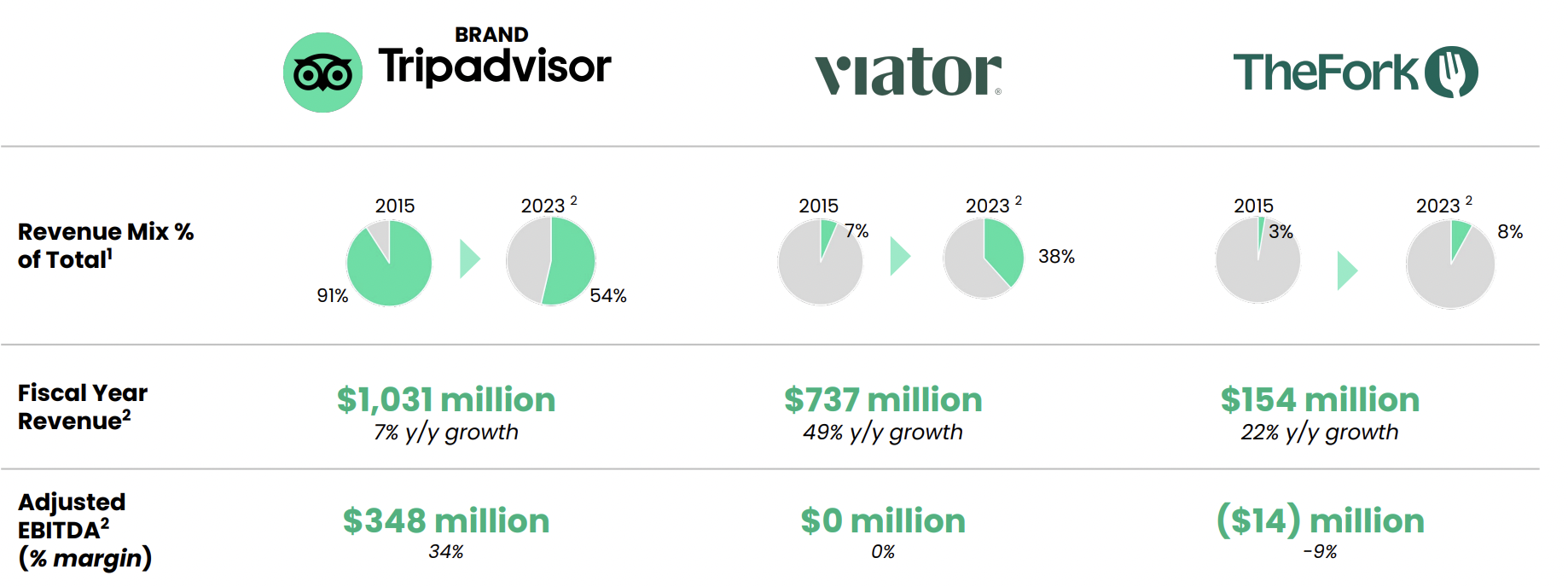

Since 2015, TripAdvisor has made significant strides in diversifying its revenue sources. Initially, a predominant share of its revenue, 91%, came from its core operations. This figure has since decreased to 54%, indicating a successful diversification effort. Viator, in particular, has emerged as a key growth driver within the group, with its contribution to total revenue soaring from 7% to 38% over the past eight years. Similarly, TheFork has experienced growth, with its revenue share increasing from 3% to 8% in the same timeframe.

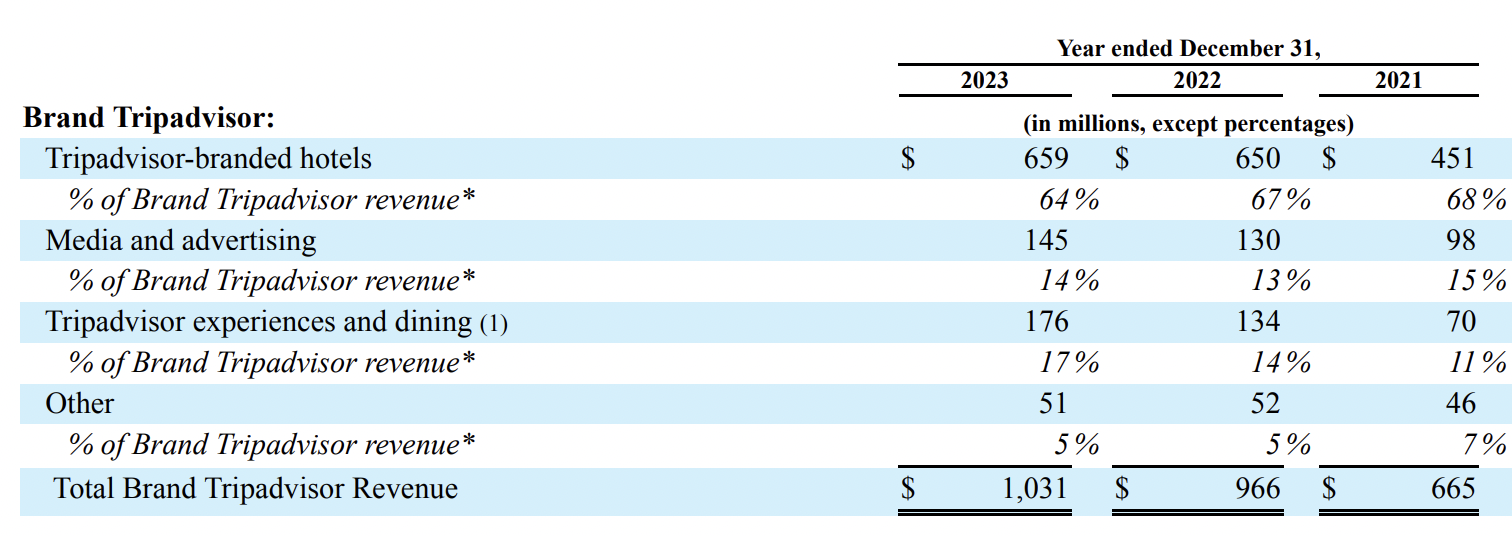

Tripadvisor reported a revenue of $1,031 million, marking a year-over-year (YoY) increase of 7%, and an Adjusted EBITDA margin of 34%.

Viator's revenue saw a substantial YoY increase of 49%, reaching $737 million.

TheFork also reported positive growth, with a 22% YoY increase in revenue, totaling $154 million

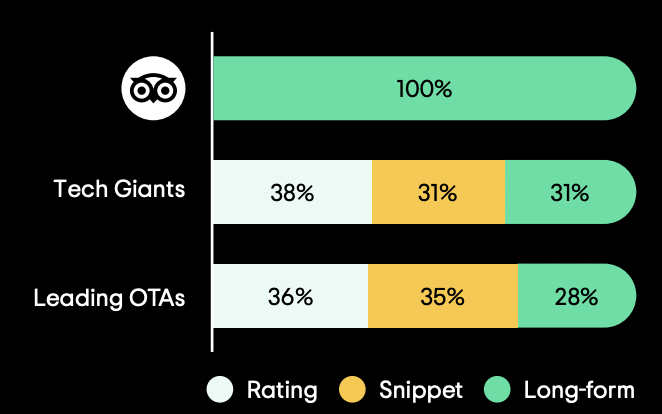

Before Google's SERP updates, substantial direct traffic came from search engines via effective SEO across various segments. However, changes in search algorithms and placements, especially by Google, have negatively impacted SEO traffic and therefore revenue, increasing the prominence of their own products in search results, most notably affecting the hotel meta-search offerings in the Brand Tripadvisor segment.

The Power of Tripadvisor Reviews:

Tripadvisor distinguishes itself in the travel industry by hosting the largest collection of long-form reviews, averaging 688 characters each, which are notably more detailed than those found on other online travel agencies (OTAs) and tech platforms. The platform's reviews primarily come from travelers eager to share positive experiences and commend businesses for exceptional service.

To maintain review integrity, it implements a two-stage screening process, successfully preventing 67.1% of potential fake reviews from being published. Reviews play a crucial role in aiding travelers to confidently plan their trips, contributing significantly to the enjoyment and decision-making process.

Tripadvisor indicates that its performance is closely tied to several critical factors: maintaining and improving user engagement, ensuring that advertising efforts are cost-effective in generating sales leads and bookings, and maintaining the competitiveness of its products. Additionally, the quality of traffic and user perception of its platform, including mobile applications, alongside the reliability and accuracy of its analytics, are essential in demonstrating value.

The company experienced a significant increase in traffic following the COVID-19 pandemic. However, forecasts for the coming year suggest that travel trends may revert to pre-pandemic patterns, potentially leading to slower growth.

By

By