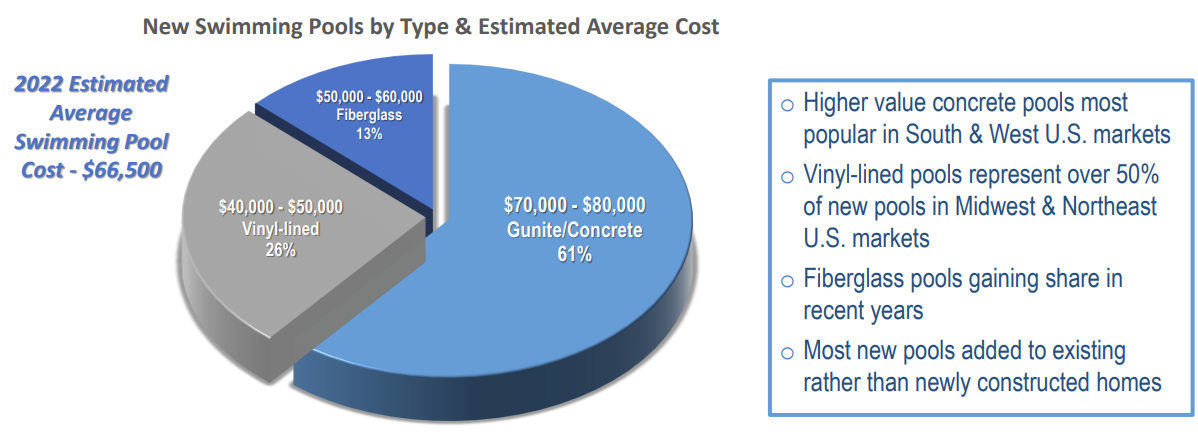

Its name is not misleading. Pool is the all-rounder when it comes to swimming pools. Sales of care products and supplies, as well as minor repairs and maintenance, account for 61% of sales. Major renovations and remodeling account for 22% of the total. New pool construction, which is much more cyclical than the rest, accounts for just 17% of sales.

The new pool market in the USA (source: Pool)

Pool has the advantage of having a significant proportion of its revenues recurring. The company does not disclose the percentage, but maintenance services and the various renovation services depend relatively little on economic conditions.

The vast majority of business is conducted on a B2B basis, i.e. for professionals and retailers. Consequently, contracts are signed in advance, with conditions and rates fixed in advance. The company's visibility on its future is therefore quite optimal.

Pool operates through 439 sales centers, mainly in North America, the most prolific region for the group, where it generates 95% of its sales (including 54% in the quartet of California, Texas, Arizona and Florida alone). Pool operates in 41 American states. This geographical coverage is another advantage, as its strong presence in the United States makes it THE essential company in the sector, with exposure to a large part of the market. In the country, the number of in-ground pools rose from 5.1 million in 2013 to almost 5.5 million last year. Growth is fairly low, but we shouldn't forget that every new pool built also means equipment sales, maintenance, ancillary leisure products, servicing, irrigation, etc. In 2023, the strength of the maintenance services business offset the decline in the number of new constructions.

Evolution of the US pool market. Note that during the 2008 crisis, pool construction held up much better than housing construction (source: PKdata, Fred and Pool).

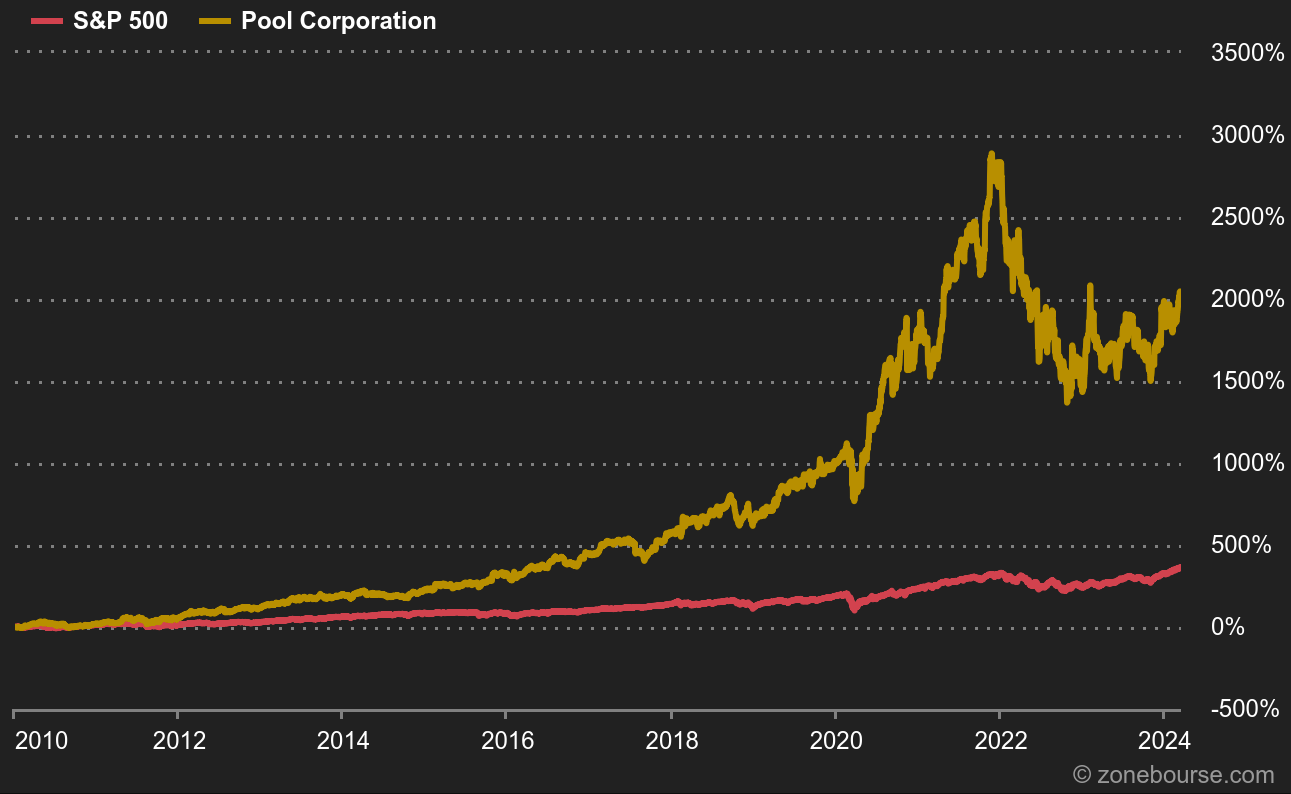

Pool can easily wear two hats: growth and quality. Just look at how the stock has performed against the S&P500 over the long term. To achieve this feat, Pool has often demonstrated its consistency in earnings releases: revenue growth, rising margins, higher earnings per share, a few share buybacks, and so on. The balance sheet is solid and debt is well under control.

Pool vs S&P500 since 2010 (source: MarketScreener)

Pool accelerated with Covid. The group took advantage of exceptional demand to easily raise its prices. With people confined to their homes or unable to go on vacation, swimming pools have once again become a must-have for those households that can afford them. These two years, 2021 and 2022, must therefore be regarded as exceptional in the Group's history. The year 2023 was marked by a phase of normalization. A return to normality that proved highly profitable, with free cash flow reaching record levels.

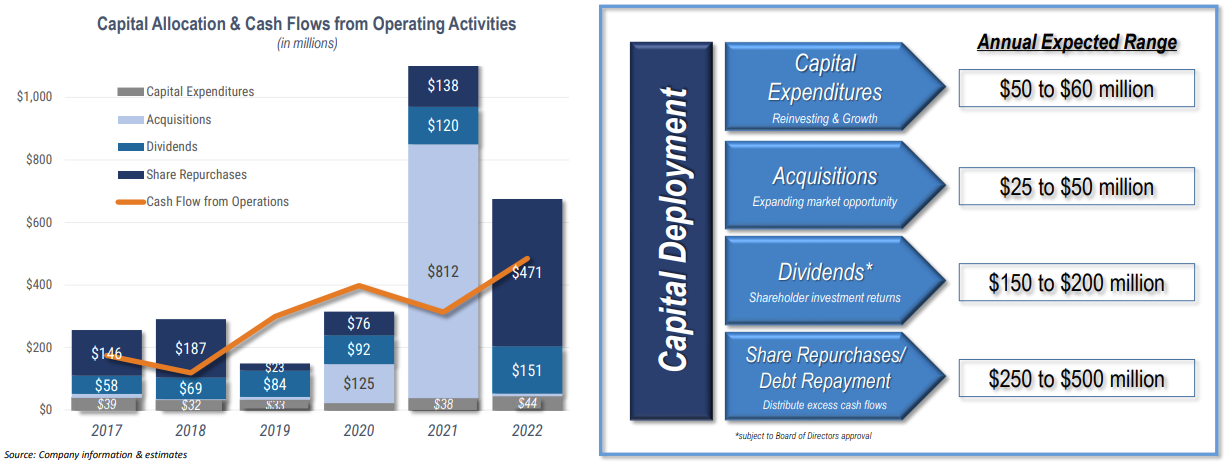

Capital allocation is optimal. The company looks after its shareholders with increasing returns in the form of dividends and share buy-backs. It also wants to accelerate its pace of external growth. It is looking for acquisitions. The market is highly fragmented, with numerous regional and local players, so the group regularly makes acquisitions to strengthen its scope.

Capital allocation (source: Pool)

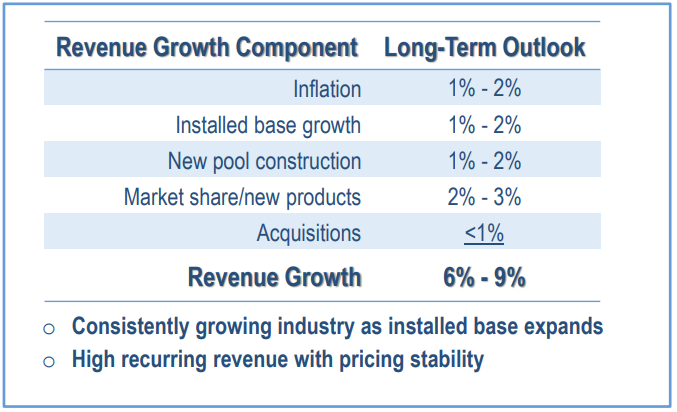

Over the long term, revenue growth is expected to be between 6% and 9%, very slightly less than over the past decade (CAGR of 9.4% since 2014). This outlook must be set against the current valuation. The ratios are close to the multiples seen over the past decade.

Target growth breakdown (source: Pool)

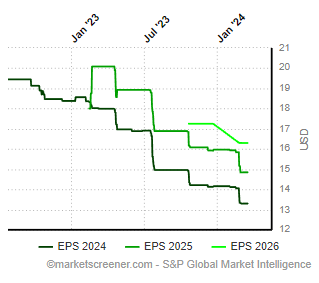

Nevertheless, in the short term, analysts are slightly pessimistic. In a note published following the company's annual results at the end of February, Wells Fargo believes that Pool could struggle to meet its targets for this year. Poor weather conditions in the first two months of the year, raw material inflation and higher-than-expected administrative and general expenses could push the company to publish at the low end of its expectations. On the other hand, analysts - the consensus, not just Wells Fargo - have repeatedly lowered their expectations for the next few years. The current share price exceeds their average target. A pullback in the share price could therefore be desirable for positioning purposes.

By

By