A complete offer for human resources management

Paycom Software 's products and services are designed to help companies manage their employees more effectively and efficiently. There are more than 30 solutions, some of which I will detail later in the article.

The company's solutions include:

- Payroll Management - A fully integrated payroll solution that allows companies to easily and quickly process employee payroll, including tax withholdings, direct deposits and payment card deposits.

- Benefits Management - A solution that allows employees to enroll, modify and manage their benefits online, including health and dental insurance, retirement savings plans, health savings accounts and paid time off.

- Human Resources Management: A solution that allows companies to manage all employee HR data and processes, including leave requests, performance reviews and talent management.

- Talent Acquisition: Analytics tools to prevent top talent from falling through the cracks.

- Compliance: A solution that enables companies to track and comply with HR and compliance regulations and laws.

The current flagship product is probably Beti (for Better Employee Transaction Interface). Customers love this payroll management tool because it offers a significant return on investment. Did you know that approximately 20% of payroll forms are inaccurate? This translates into lost revenue and wasted hours correcting errors. Employees already manage all other elements of their payroll, including time cards, expenses, vacation requests and benefits. Paycom now allows them to process their own payroll. By guiding employees to access, view, manage, troubleshoot and approve their payroll before it is submitted, HR can focus on more strategic tasks.

Recently, the company launched Vault cards in partnership with Visa. This secure, all-purpose payment card allows employees to deposit a portion of their pay into the card and receive their pay in advance (two days in advance for greater financial flexibility). Employees have access to partner offers and benefits and it helps reduce check fraud through secure digital funding.

A Diverse and Loyal Customer Base

Paycom Software sells primarily to businesses of all sizes, but focuses primarily on small and medium-sized businesses. Industries served include finance, manufacturing, services, retail, education, healthcare, utilities and government. The company offers its services to 36,561 customers at the end of 2022 and this number has increased by 20% in 2 years. Paycom Software's customers are primarily in the United States, although it also has international clients. Its customers include companies such as GNC, Kohler, Bridgestone, Delta Dental, Coldwell Banker and Hertz. A diversified customer base since none of them weighs more than 0.5% of the turnover but also a high retention rate (93% in 2022 and still) signaling a certain quality of the services offered and a clear customer satisfaction. Moreover, I think that this retention rate underestimates the real loyalty of the clientele because many of them were acquired through M&A operations.

A competitive environment but a strong positioning

Paycom Software 's competitors in the HCM market include companies such as ADP (Automatic Data Processing), Paychex, Paylocity, Ceridian, Oracle, Ultimate Kronos Group, Workday, Cornerstone OnDemand, Gusto, Intuit, Insperity, Paycor, People Center and SAP. The two behemoths of HCM are Automatic Data Processing and Paychex.

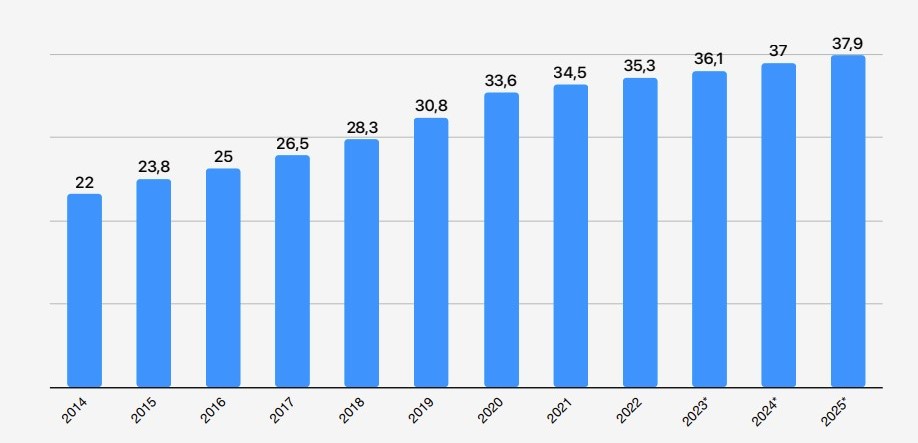

The market - large and structurally growing - for applications and software related to human resource management has grown from $22 billion to $35.3 billion between 2014 and 2022. And according to estimates, it is expected to continue to grow toward $37.9 billion by 2025.

We can note that Paycom Software is growing much faster than the market with revenue increasing from $151 million in 2014 to $1.375 billion in 2022, representing a CAGR (annualized revenue growth) of 27.82%. According to our estimates, the latter is expected to continue to grow at around 16% per year in the coming years to reach $2.5 billion by 2025.

Paycom Software has several competitive advantages over its competitors that drive its growth:

- A fully integrated payroll solution - Paycom Software is one of the few payroll software providers that offers a fully integrated payroll solution that integrates all aspects of payroll management into one system. With Paycom, there is no need to integrate and replicate HR data between different service providers, saving companies time and money.

- Simplified user experience - Paycom Software's user interface is friendly and easy to use, making it easy for employees and HR managers to navigate. It offers the flexibility to customize the solution to better meet the specific needs of each company.

- Continuous learning platform: Paycom Software offers a continuous learning platform for employees to take courses and develop professionally.

- Cost-effective: Compared to its competitors, the company is able to offer similar functionality at a lower cost.

Paycom is also able to expand its geographic footprint. It still generates almost all of its revenue in the United States. It could consider going after more customers in Europe first and then in Asia in a second phase.

A visionary and committed leader

The management team is chaired by Chad Richison - founder, president and CEO since the beginning in 1998 - who still holds 13.9% of the share capital. This alignment between the shareholders and the CEO is very appreciable, especially for such a large tech company (17 billion market capitalization). Moreover, he is still young at 52 years old and could well have 20 + years ahead of him to make this company a success.

Richison founded Paycom in 1998 because of his desire to better serve payroll customers. Prior to that, he was employed at two payroll processing companies, Automatic Data Processing and Payroll 1. He wanted to improve the service offered to clients by founding his own company. This is a strong signal of the entrepreneurial (and innovative) spirit within Paycom. As a matter of fact, Paycom was the first company to offer a fully online payroll service in the late 90s.

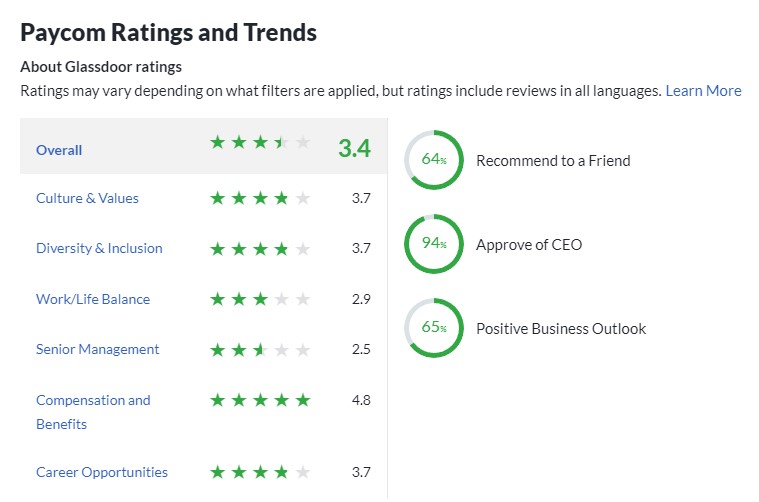

In short, all this to say that this long experience in the company and the sector (more than 20 years) and this high participation ("skin in the game") is an indication of the quality of the management. This is confirmed in the Glassdoor rankings since Richison has a very good image with its employees (see below). The corporate culture at Paycom is strong. The company received the Big Innovation 2023 award, the "Most Trustworthy Companies In American" award in 2023 and is one of the best companies to work for ("Top Workplaces USA" in 2023). This translates into team performance as their solutions have been voted "Best Products for Human Resources".

Let's talk numbers.

First of all, let's point out that the business model is relatively predictable. This is due to the recurring revenues the company generates through the fees customers pay on a regular basis to use the software, the fees related to payroll processing and the fees related to the use of the software. This is due to the recurring revenues that the company generates from the fees that customers pay on a regular basis to use the software, the fees related to payroll processing and the interest generated by the funds that Paycom Software holds on behalf of its customers. These recurring revenues represent 98.3% of the turnover.

Here is the evolution of the profit and loss account in recent years:

Both the number of customers and the turnover are growing in double digits, as we have seen before. But what about the margins and therefore the net profits? Can they be reconciled with the free cash flow?

Well, the margins are important as you can expect from this type of player, but here they are probably beyond your expectations. The gross margin is 87% in 2022, in line with its 5-year average. The operating margin is 27.5% and the net margin is 20.5%. Net profitability has steadily improved from 3.8% in 2014 to 20.5% in 2022. The number of shares has decreased since 2015 from 59.1 million to 55.4 million at the beginning of 2023. As a result, NBI is growing faster than net profits.

Free cash flow is perfectly reconcilable with net profits (leveraged FCF margin of 18.8% on average over the last five years).

The economic (ROIC of 21%) and financial (ROE of 27%) profitability are quite remarkable. It is a (very) profitable business without a doubt.

The future should continue to be bright for Paycom because there is still a lot of ground to conquer, whether it be in the number of companies to be converted to the HR tools of the 21st century, through organic geographical growth in Europe and Asia or through external growth via strategic acquisitions. It should not be forgotten that Paycom's revenues are worth 1.375 billion dollars in a market that is now worth 36 billion.

Recently the company published its figures for the first quarter of 2023 (02/05/2023). It reported non-GAAP net income of $2.46 per diluted share versus $1.90 a year earlier. In addition, it is initiating a quarterly dividend policy at an annual rate of $1.5 for 2023.

As for the balance sheet, it's impeccable. In a positive net cash position. Total assets cover one and a half times total liabilities. There's enough liquidity to cover short-term obligations. Nothing to complain about.

Quality pays off.

Given the company's fundamentals, a valuation by the typical P/E ratio and P/FCF ratio multiples is appropriate. The stock has always paid extraordinarily high on the surface (110 times its net earnings on average since its IPO in 2014). The current valuation is on the low end of its range at 46.9 times its estimated 2023 net earnings, 38.1 times next year's net earnings, and 30 times 2025 net earnings. If we look at valuation by hard currency (cash earnings), Paycom is valued at 38 times its operating cash flow.

This Stock Picks section is intended for long-term investments. If you have the long term in mind (an investment horizon of 8 years for example), you shouldn't really worry about this price. What you will have to watch out for is the competition. So far, Paycom has held up remarkably well because of its incredible ability to retain and acquire customers. However, nothing is guaranteed. One of Paycom's competitors could offer a superior cloud-based HCM solution to what the company currently offers. If this were to happen, Paycom's business could be affected.

Other risks include:

- The very likely economic downturn in the coming months ;

- Key man risk. Paycom owes much of its success to its founder and leader. We will keep an eye on the leadership transition process if he leaves the company for any reason. But given his young age and involvement, it shouldn't happen anytime soon.

- Hacking risks: Because of its operations, the company handles secret and private data about its customers and their employees. A security breach at Paycom could seriously damage its reputation.

Paycom is an exceptional company like few others on the market. The company has strong and consistent growth in all metrics, high profitability and profitability, strong and predictable cash flow due to its ability to deliver on its promise to its customers and employees, and a high level of customer satisfaction. It has strong and consistent growth across all metrics, high profitability and profitability, strong and predictable cash flow from recurring revenues, a "fortress" balance sheet, and a very capable and committed management team. Despite the high valuation, there's still plenty of room for growth for Paycom. This stock deserves its place in a long-term portfolio of growth stocks.

By

By