The lineage of the American specialist in building materials, with a particular focus on aggregates, can be traced back to the year 1939, marked by the establishment of Superior Stone in Raleigh, North Carolina. This enterprise subsequently united its operations with those of the American-Marietta Corp in 1959. It held a prominent position as a nationwide manufacturer of construction materials, paints, chemicals, and various building products. Just two years following this initial merger, in 1961, an additional consolidation occurred with Glenn L. Martin, culminating in the formation of the renowned Martin Marietta Corporation.

Transporting ourselves back to 1994, a pivotal year in the company's history, marked by its debut on the New York Stock Exchange. From 1995 onwards, the company experienced a momentous surge in growth, fueled by a series of strategic acquisitions. Notable among these were six acquisitions in 1995, followed by nine in 1997, and one each in 1998, 2014, and 2018 – the latter being the second-largest acquisition within the group. This steady expansion trajectory has propelled the company to a notable distinction: it held the esteemed position of being ranked No. 1 as the "World's Most Admired Company" by Fortune Magazine, in 2009.

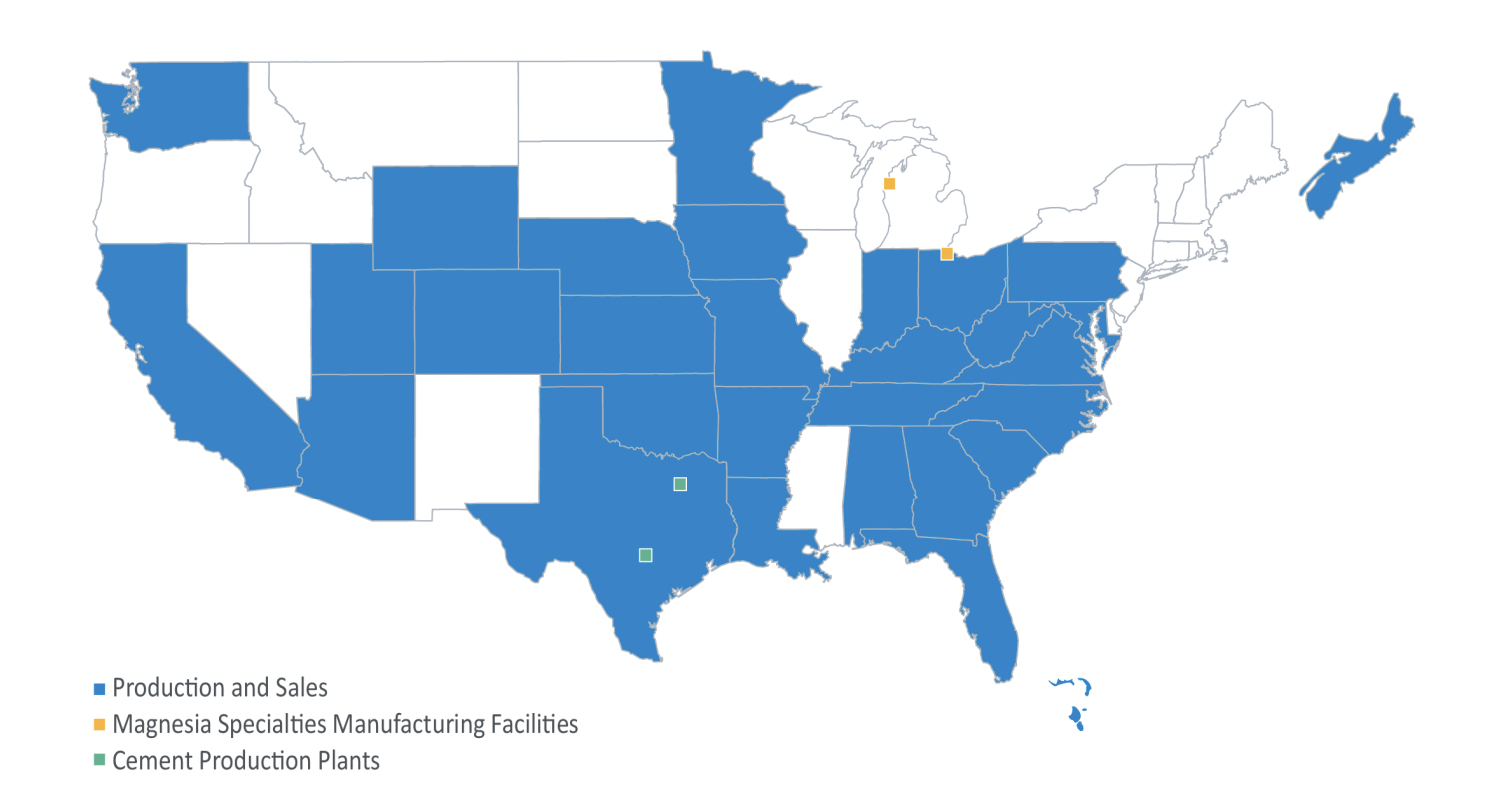

The corporation offers a comprehensive range of construction materials, including cement and its downstream products like ready mixed concrete, asphalt, and premium paving services. Its strategic focus centers on markets where the company leads in aggregates. It operates two cement plants in Texas, engages in ready mixed concrete operations in Arizona, California, and Texas, and runs asphalt operations in Arizona, California, Colorado, and Minnesota. Paving services are provided in California and Colorado.

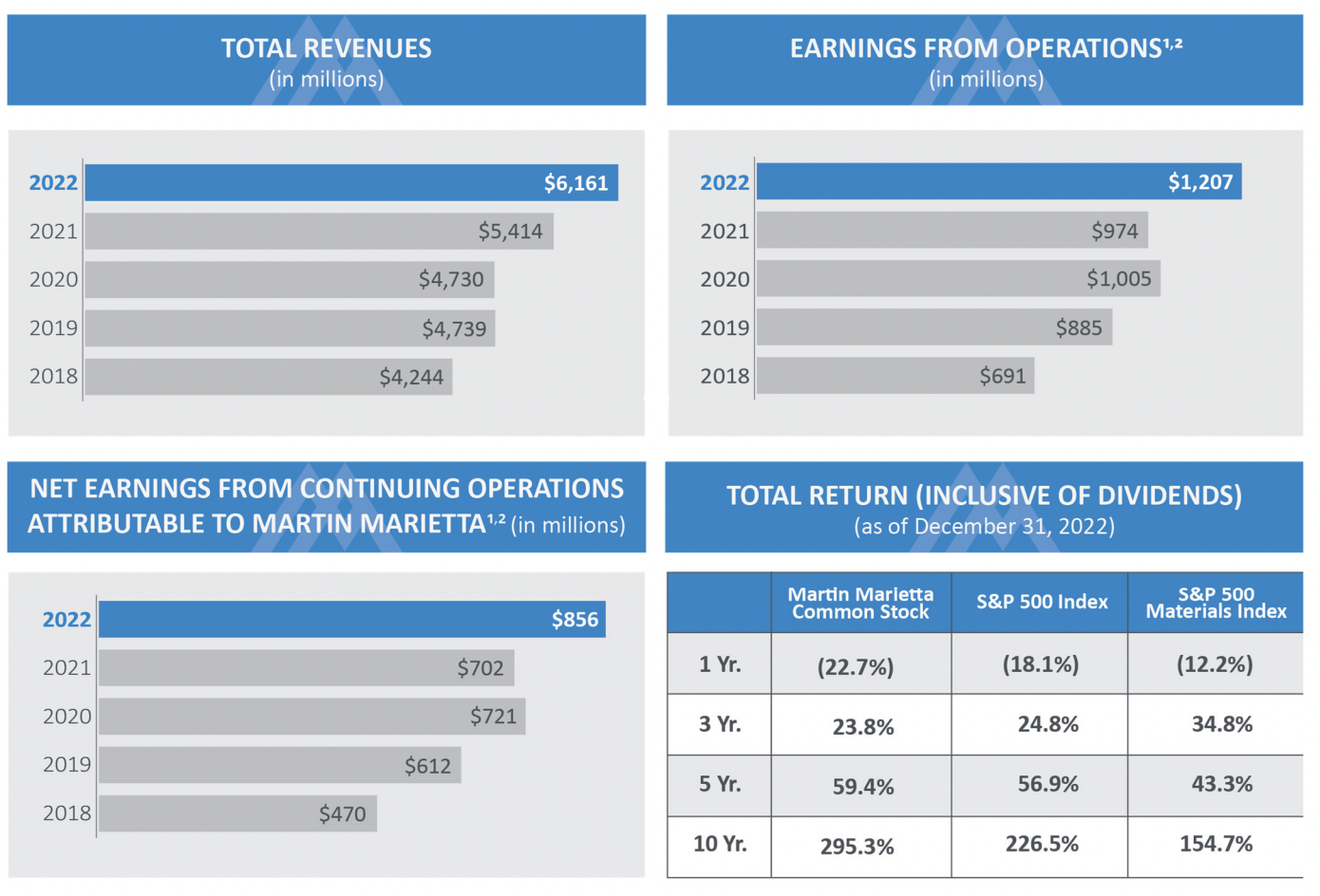

The year 2022 materialized as "Another Record Year Despite Historic Volatility and Acquisition Integration." The primary revenue streams of the group are derived from aggregates and construction materials, constituting 94.5% of the total. Among these, aggregates account for 58.7% of the revenue, followed by ready-mix concrete at 21.9%, road surfacing materials and asphalt at 9.9%, and cements at 9.5%. Additionally, magnesia-based chemicals contribute 5.5% to the overall revenue. Notably, the group's revenue is predominantly generated within the United States, with 98.6% stemming from this market. Geographically, 55% of this revenue originates from the West Coast, while 40.1% is attributed to the East Coast. This impressive performance is underpinned by the dedication of nearly 9,400 employees.

Since 2010, the company has been using the Strategic Operation Analysis and Review (SOAR) to outline the group's long-term goals. For example, Martin Marietta invested around $8 billion in acquisitions, helping the group establish a strong presence in ten important megaregions. This is evident through their leading positions in different regions and successful acquisitions.

One of the group's most important projects over the next few years is the U.S. federal government's $1.2 trillion project to invest massively in the country's infrastructure (adopted in 2021). American roads, for example, will benefit from $110 billion in upgrades, with $40 billion earmarked for the renovation and construction of bridges. The same applies to railways, canals, airports, etc.

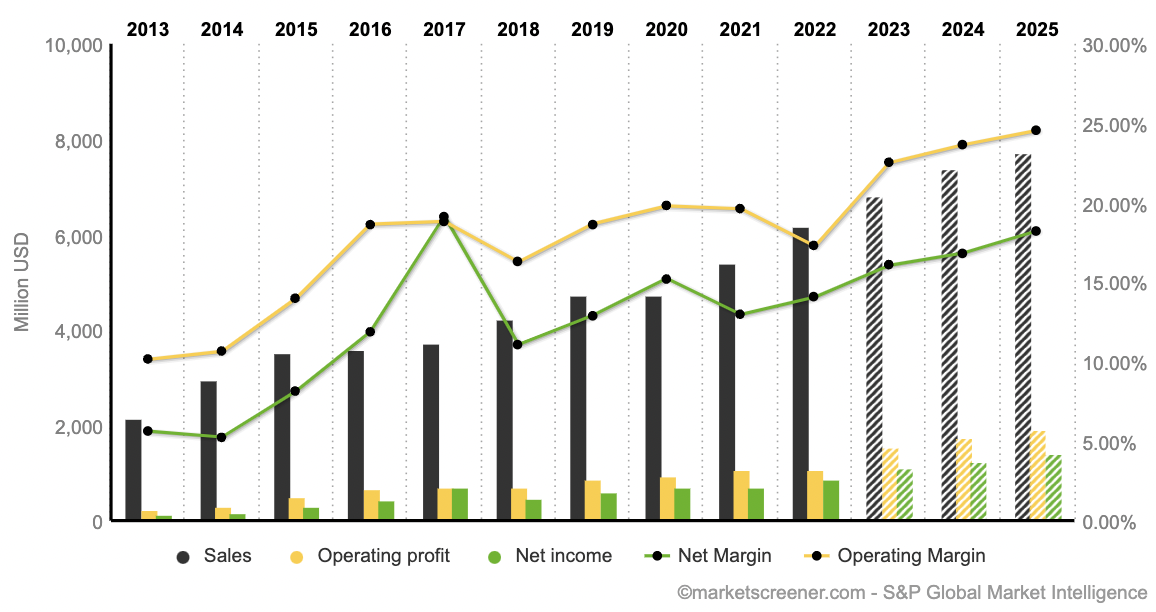

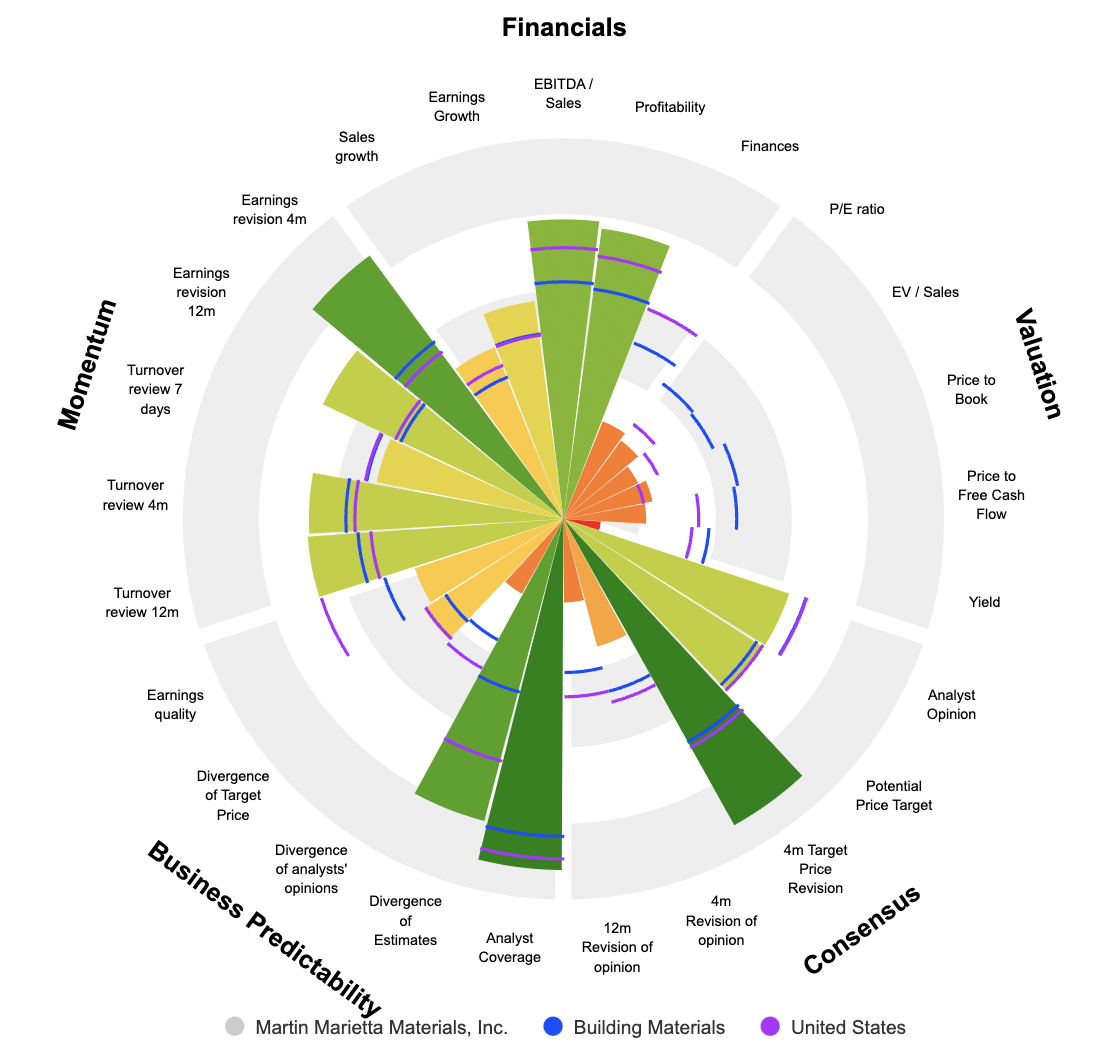

With a P/E of 24.4 times earnings, this is a reasonable valuation, neither too expensive nor a bargain. On the face of it, nothing too exciting, even if earnings per share have grown over the past decade from $2.61 in 2013 to $13.9 in 2022, representing a CAGR of 18.2%. However, P/E estimates for 2023 and 2024 are 24.5- and 21.3-times earnings, which seems to underline a certain homogeneity in the analyst consensus.

Simultaneously, the group's sales have steadily increased from 2,156 to 6,161 million dollars in 2022, showing a consistent annual growth rate of 11.07%. This positive trend extends to EBITDA and EBIT, which have risen by 309% and 385% respectively over the same period, reaching $1600 and $1064. The management's effectiveness is evident in the expanding net and operating margins, projected to rise from 17.3% to 22.5% and 14.1% to 16.1% from 2022 to 2023. Additionally, a robust Free Cash Flow (FCF) of $509 million in 2022 is set to increase to $1188 in 2025, enhancing the company's potential for future acquisitions.

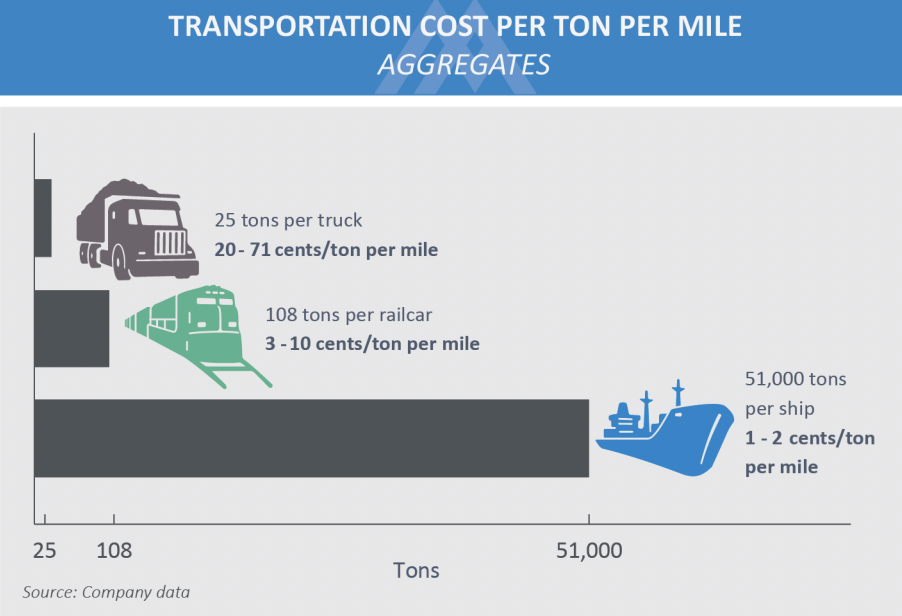

Martin Marietta maintains a distinct materials transportation advantage, underpinned by pivotal figures. Scarce indigenous rock sources in select U.S. coastal areas and stringent inland market regulations emphasize material scarcity. Addressing this, the company's long-haul distribution network bolsters local supplies and diversifies sales routes, mitigating market risk. By leveraging rail, water, and truck transport, the company strategically serves varied regions. However, reliance on rail operations introduces challenges, including track congestion and weather disruptions. To fortify their stance, Martin Marietta aims to expand capacities and optimize their distribution network, backed by 78 aggregates yards, 11 cement terminals, and an ongoing commitment to efficiency.

However, it would be a mistake to ignore the key risks that might affect the Group, despite its strong standing in the sector. While the U.S. recession has been averted, the global economic slowdown significantly impacts industries like raw materials and construction. Despite Martin Marietta consistently generating profits, these sectors are facing challenges. Although it hasn't yet ventured into the international market, it could be its next strategic move (very likely) and the economic downturn in China could impede its growth. Moreover, it is grappling with elevated interest rates that complicate major infrastructure and investment projects. Additionally, visibility is a concern, given the group's exposure to cyclical industries.

The share price has risen by more than 27% since the beginning of the year, so a slight fall would potentially be a good long-term investment opportunity. The group's results are robust, with good growth prospects. As entry conditions for newcomers are very complicated/limited, the group has a moat, and should still have many good years ahead. This is the kind of quality/defensive stock where it's worth keeping an eye on if a good opportunity arises.

By

By