In recent years, China's online video streaming market has experienced explosive growth, and iQIYI (incorporated in 2009) has been at the forefront of this trend. It provides video entertainment services, including movies, TV series, and variety shows, as well as introducing innovative features like interactive viewing experiences and personalized recommendations. However, like many companies in the highly competitive video streaming market, iQIYI faces numerous challenges that it must overcome in order to continue to grow and thrive.

copy.png)

One of the most significant challenges that iQIYI must contend with is around copyright acquisition. China's online video platforms have found it difficult to acquire overseas copyrights due to policy reasons and skyrocketing prices. As a result, video platforms have been forced to purchase costly domestic copyrights, resulting in a sharp rise in royalties. This has put pressure on them to attract more users and gain a larger market share. To address this issue, the Chinese group has turned to self-produced programs as a means of enriching its content. However, the cost of producing original content is also high, and competition among video platforms (Youku, Tudou, ViKi, Tencent, Netflix, Amazon Prime, Disney+, Hulu, HBO, Paramount, Warner Bros…) is intensifying, making it increasingly difficult for those companies to turn a profit.

To maintain and increase its customer base, iQIYI, with more than 100 million subscribers, focuses on providing targeted services to each of its customer segments, especially its VIP members, and leveraging big data analysis to push relevant content to them. Its customer segments consist of four different types of users. The first segment includes potential users who only occasionally watch videos on the platform. The second segment is made up of registered members who use the platform more frequently than viewers. These customers receive targeted video recommendations through big data analysis, which can help them become VIP members. The third segment is registered VIP members who receive special services, such as the option to skip ads (highest level of customers). Lastly, video content producers who upload professional videos to the platform make up the fourth segment. iQIYI conducts a rigorous review of these videos to ensure high quality, which is used to attract more users and increase user stickiness. Video content producers also receive a share of the platform's revenue.

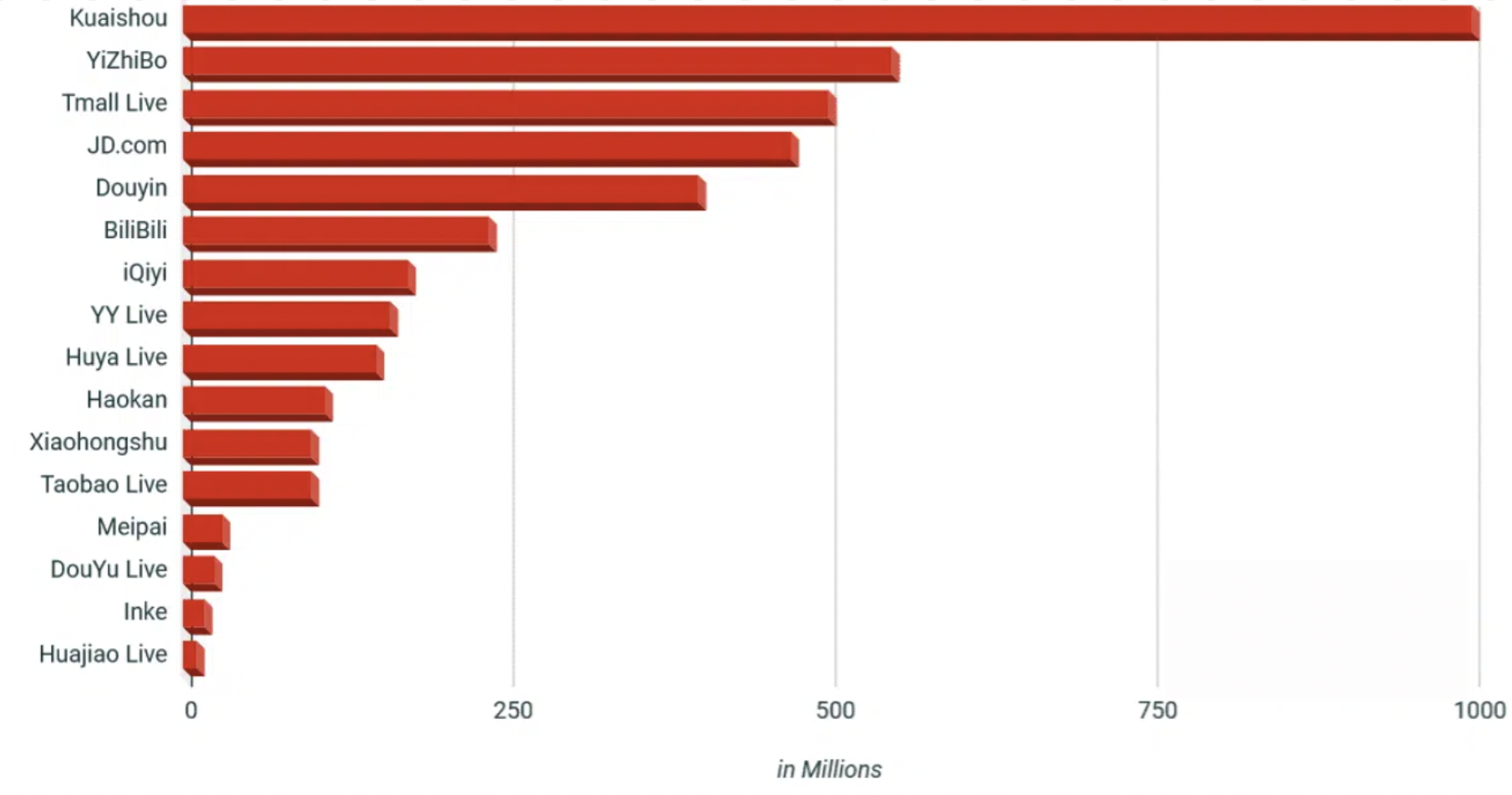

Tenba Group - Most Popular Streaming Apps in 2022 (Monthly Active Users)

In terms of channel strategy, the business has developed innovative ways to attract and retain users. One such strategy is to rely on Baidu, the leading search engine in China, to keep user transfer costs down. By ranking first in Baidu's search for any movie or TV show, the company ensures that users can easily find the content they are looking for, which helps to increase user satisfaction and loyalty. Moreover, it has expanded its TV casting capabilities to allow for third-party app casting; providing users with the ability to stream mobile games, videos, music, and other content on a larger screen. This feature aims to address the limitations of a small mobile phone screen and enhance the user experience.".

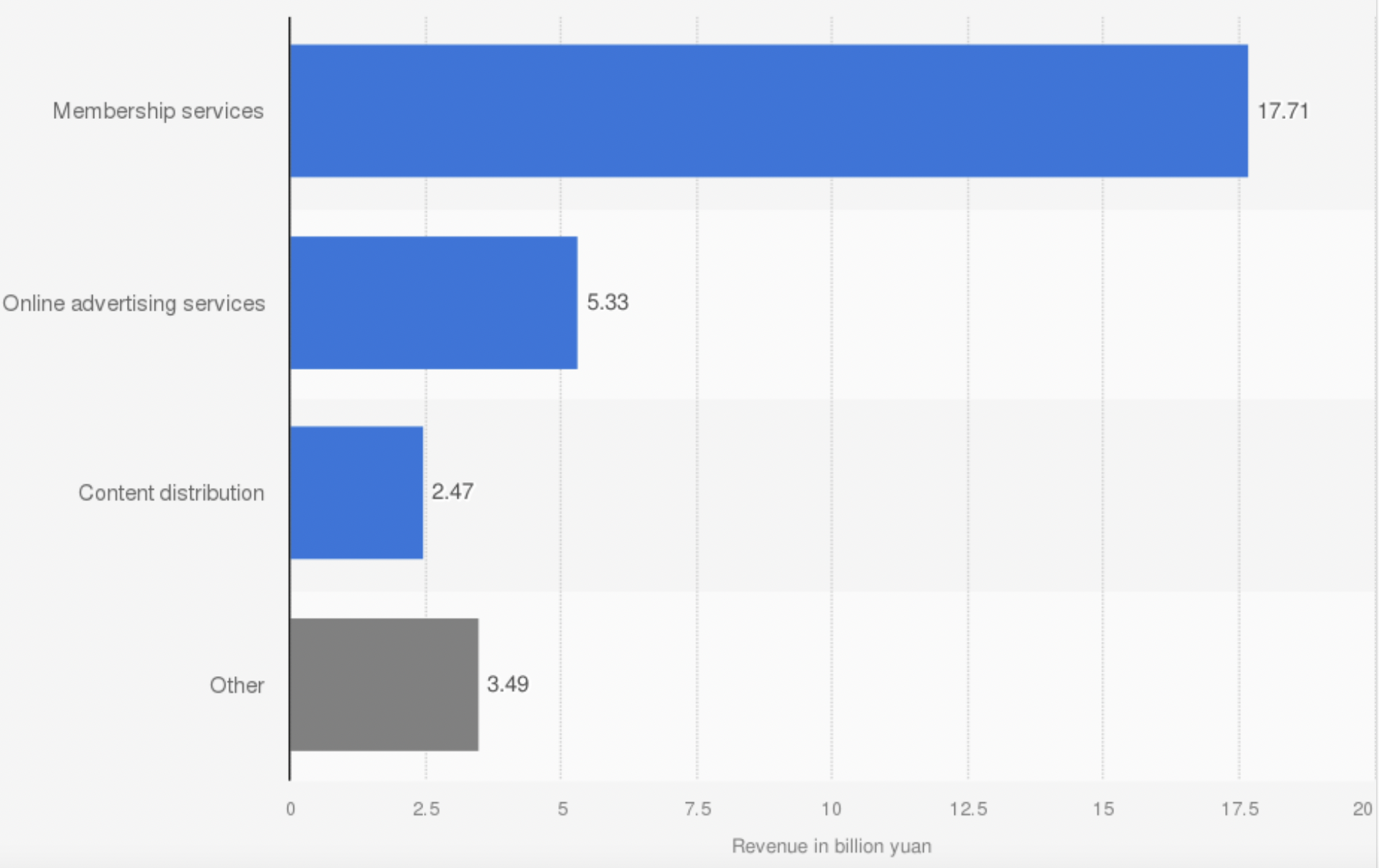

The group generates revenues primarily through membership services, online advertising, and content distribution. They also generate revenues from other monetization methods, including online games, live streaming, IP licensing, talent agency, online literature, and more. The platform has taken advantage of the trend toward self-produced content and has adopted a repurchase model for their self-produced programs as another revenue stream. This means that they will buy back the exclusive rights to broadcast their self-produced programs after a certain period. This model has been successful as it allows them to gain more control over their content and ensures that they have a constant stream of high-quality programs to offer their viewers. Additionally, it provides them with an opportunity to generate revenue through licensing the broadcast rights to other platforms. This has become a significant source of income for the group and has helped them maintain their position as one of the top video streaming platforms in China.

Statista: Annual revenue of Chinese online video site iQIYI in 2022

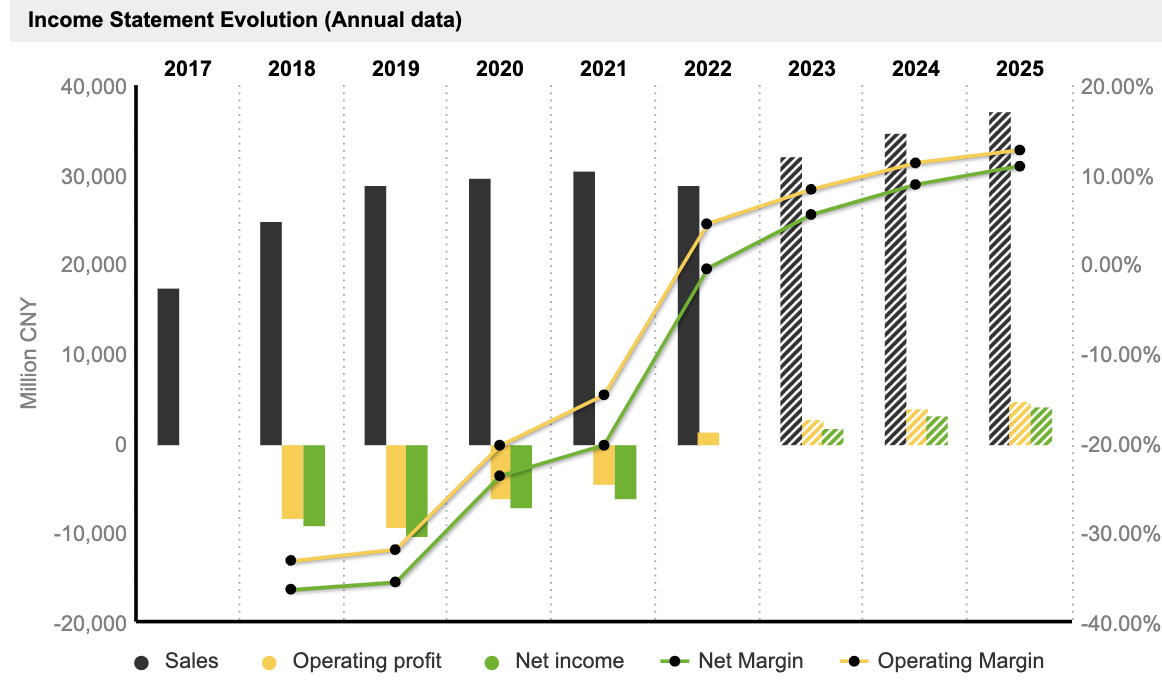

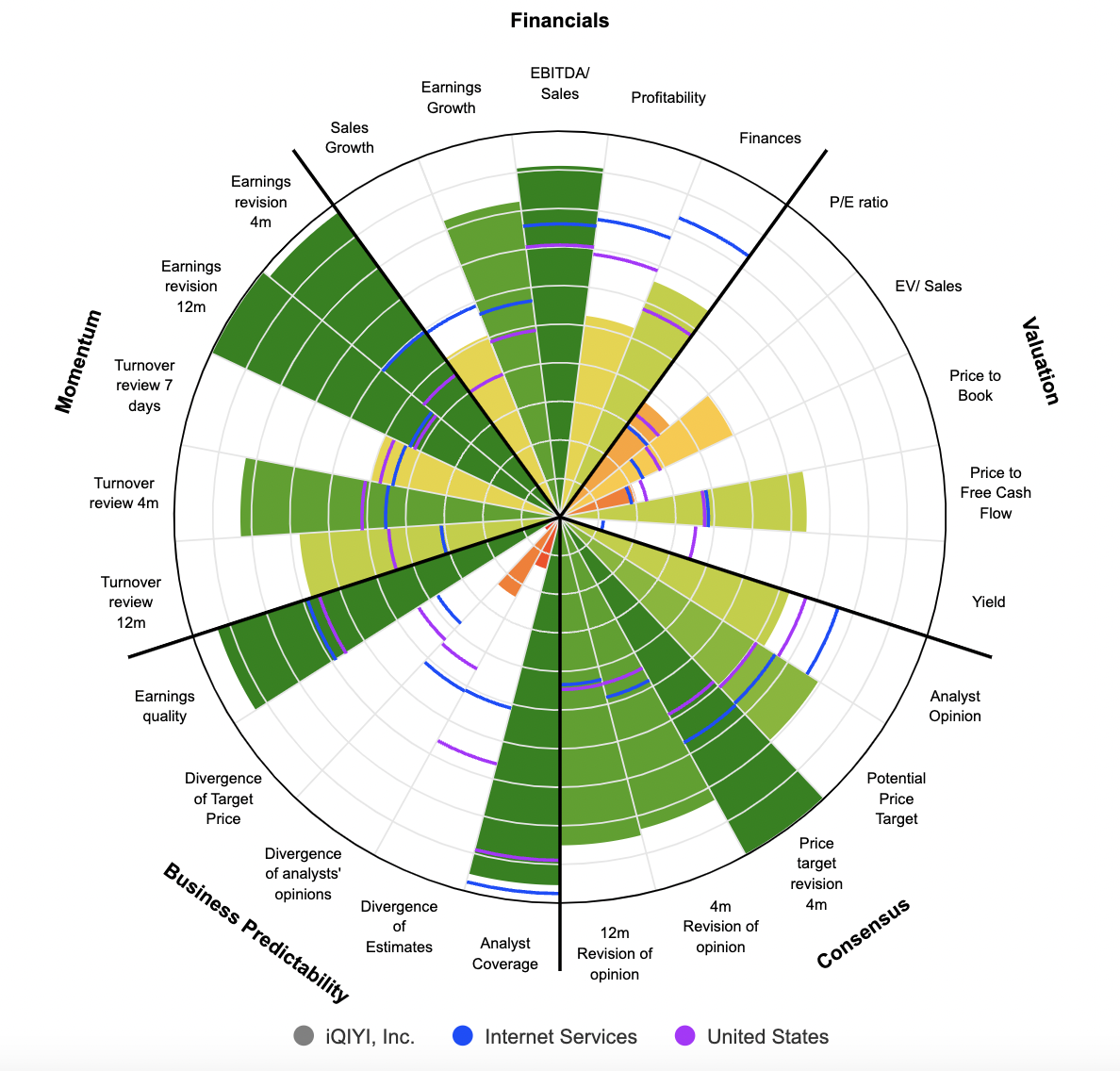

Despite iQIYI's market capitalization being down 41% since its IPO in March 2018, its revenue has shown steady growth. The company's revenue increased from $17378 million in 2017 to $28998 million in 2022 and is projected to reach $37206 million in 2025. In terms of stock valuation, iQIYI is expected to pay 23 times its earnings and 3.49 times its EV/EBITDA in 2023.

The company's EBITDA has had a CAGR of 20.6% between 2017 and 2021, reaching $12287 million, with operating margins of 4.5%. At the same time, the EBIT increased from $-8306 million to $1312 million. Analysts predict that EBITDA will continue to grow, increasing by 36% to $16753 million by 2025, with margins expected to be around 13%.

While the company has struggled with negative ROA and ROE figures in recent years, with lows of -28% and -85.7%, respectively, forecasts suggest that these metrics will improve significantly. The projected ROA and ROE figures for IQIYI in 2025 are 4.60% and 25.0%, respectively, which are comparable to those of Netflix.

IQIYI’s video platform has gained popularity among young people in China and worldwide due to its focus on trendy and authentic content in various genres. The company's emphasis on creating top-notch content has allowed it to enter the realm of high-quality productions, but it faces intense competition and increasing costs due to copyright issues. The group should develop a reputation for self-produced shows to attract more young users and stay ahead of the competition. Overall, it has a promising future in the streaming industry, but it needs to consider various factors that could affect its revenue and profitability.

By

By