The Ferrari name itself evokes a whole area of automotive history. In 1929, Enzo Ferrari founded Scuderia Ferrari, a racing team for Alfa Romeo. In 1940, the team began developing its own racing cars. But, like many of its peers, Ferrari came close to bankruptcy, plagued by the founder's vision of reserving the use of his racing cars for seasoned sportsmen rather than wealthy amateurs.

This policy precipitated the entry into the company's capital of the Fiat group, which acquired 50% of the company in 1969, then increased its stake to 90% following Enzo Ferrari's death in 1988. His son, Piero Ferrari, retains a 10% stake. In 2014, Fiat Chrysler announced a spin-off to separate Ferrari from its parent company, mainly in order to recover liquidity. Since this separation, the Agnelli family, through its holding company Exor, holds 24.44% of Ferrari, while Piero Ferrari owns 10.39%. The famous prancing-horse brand has chosen to list on the world's largest financial market, New York. By 2023, its market capitalization will be $55 billion, higher than that of its former parent company, now part of the Stellantis Group, with a capitalization of $53 billion. Ferrari is currently the eleventh most valuable company in the automotive industry.

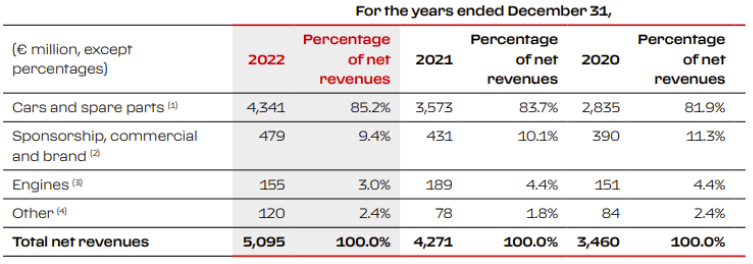

Ferrari aims to break the five billion euro sales barrier in 2022, thanks to a return to growth in 2021 - after a pause in 2020 - exceeding its 2019 sales. These sales are broken down into four segments: car and spare parts sales (85.2% of revenues), Formula 1 sponsors and commercial agreements (9.4%), engine sales and other revenues (3% and 2.4% respectively).

Breakdown of Ferrari sales (source: Annual Report)

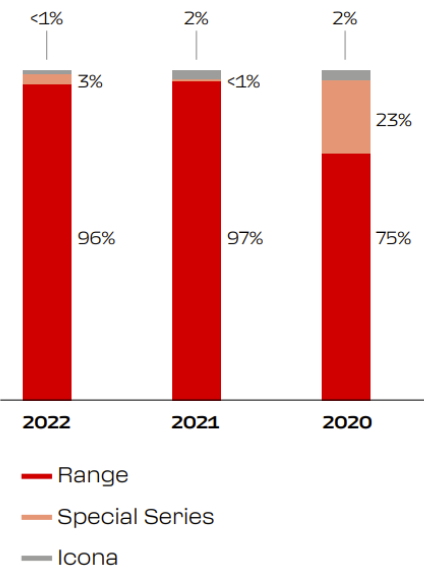

Revenues from the sale of cars and spare parts rose by 18% in 2022, thanks to an increase in sales volume. To appeal to a diverse clientele, ranging from moderately well-off families to the world's wealthiest individuals, Ferrari offers four categories of cars. The first range is the gateway to the Ferrari world, with a starting price of over €150,000. This category, comprising 10 models, accounted for 96% of sales in 2022. The next range corresponds to the special series launched from time to time, and can account for up to 23% of sales, as in 2020 with the 488 Pista model (2019). Ferrari's highest step is occupied by the Icona and supercars, very exclusive models sold at prices in excess of one million euros, which account for only one to two percent of sales, reserved for the most loyal and wealthy customers.

Ferrari category

Car sales by category

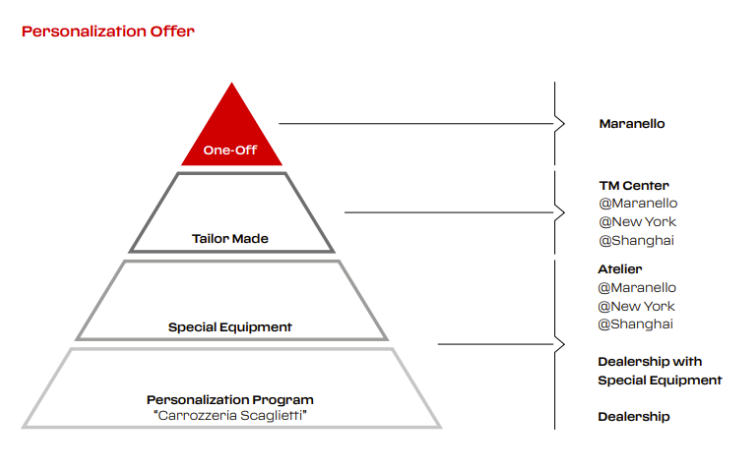

Within the "car sales and parts" category, vehicle customization brings in 18% of revenues: the brand offers additional equipment as well as a personalized tailoring service for vehicle interiors. Ferrari aims to create unique cars that meet the high standards of its customers. More recently, the "One-Off" project has been developed to create unique models at the request of the brand's most loyal customers.

Different levels of personalization

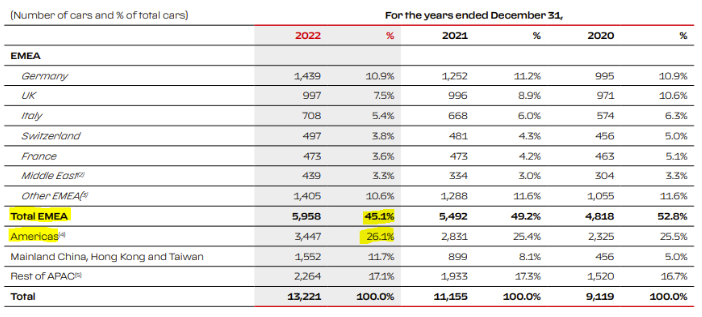

Geographically, Europe leads the way with 45.1% of sales in 2022, with Germany alone accounting for 10.9% of global sales. America comes second with 26.1%, mainly thanks to the United States, the continent's main market. Next come the Middle East with 17.1% and Asia with just 11.7%.

Sponsorships and commercial agreements linked to Formula 1 - Ferrari's second-largest source of revenue - generated over 479 million euros in 2022. The dedicated team receives special treatment because of its historical importance and the influence linked to Formula 1. Thanks to the Group's historic contracts and on-track successes, around a fifth of the F1 industry's total revenues accrue to the Group. Although these revenues are on the rise, thanks to the growing popularity of F1 and the consequent increase in spectator numbers, they are still subject to variations depending on the performance of the racing team.

The single-seater of the reds

The third segment, representing 3% of sales in 2022, concerns the sale of Ferrari engines to other luxury brands in the automotive industry. Maserati has been Ferrari 's main customer since the early 2000s, but this collaboration will come to an end in 2023, as the trident brand has decided to focus exclusively on hybrid cars.

Other revenues, representing 2.4% of sales, are mainly linked to financial services activities, the management of the Mugello racetrack (the famous Florentine circuit) and other sports-related activities.

Financial performance

Ferrari, with sales of five billion euros by 2022, continues to climb, with an average annual growth rate of 13.8% over the last three years. Forecasts predict sales of 6.7 billion euros by 2025.

Among the company's strengths are its operating margins - the highest in the industry - which stand at 24%, generating operating cash flow twice as high as capital expenditure (CAPEX). According to estimates, these margins should increase by 4 percentage points to 28.5% by 2025, mainly thanks to personalization, a crucial lever for the company's future, according to the CEO's statements at the last conference. Net margins are also impressive, at 18.5%.

Ferrari's return on equity (ROE) will reach an exceptional 38.3% in 2022, higher than that of the automotive industry (18.7%) and the luxury goods sector (27.1%). While return on net assets (ROA) stood at 12.7% in the same year.

Ferrari's valuation remains high, as the stock is perceived as a luxury brand rather than a traditional carmaker. This high valuation is reinforced by the visibility of its future growth. At the time of publication, the price/earnings ratio (P/E) stands at 43.9x and the enterprise value/EBITDA (EV/EBITDA) at 23.7x. The payout ratio, which measures the proportion of net profits distributed to shareholders in relation to those reinvested in the company, stands at 25.3x. This gives the company sufficient flexibility to remunerate shareholders while reinvesting in new projects.

.png)

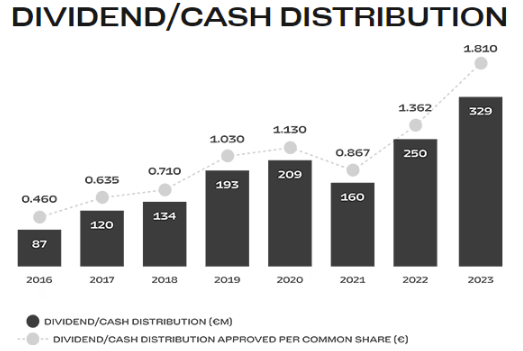

Ferrari has launched a share buyback program worth two billion euros until 2026, in addition to its regular dividends. In 2023, dividends amounted to 329 million euros, or 1.81 euros per share.

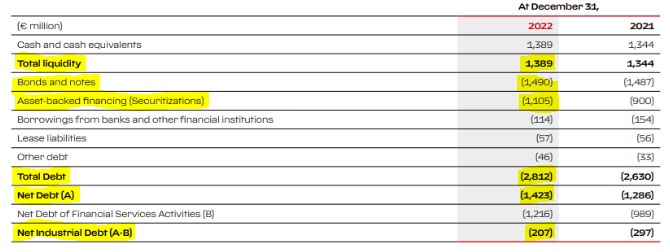

Now for the debt: Ferrari has a net debt of 1.4 billion euros. If we examine the accounts, we see that its total debt amounts to 2.8 billion euros, of which 1.49 billion euros corresponds to a bond to be repaid in 2025. The other debt of 1.1 billion euros comes from debt securities issued by Ferrari customers as part of their retail purchases or leasing contracts. This banking intermediation enables Ferrari to convert these debts into immediate cash rather than waiting for installment payments from customers. This cash can then be used for a variety of purposes, such as new investments, expanding operations or meeting financial obligations. As a result, Ferrari's net industrial debt, i.e. debts solely related to operations, stands at just 207 million euros, thanks to the Group's ability to generate Free Cash Flow - a margin of 11% - allowing it to have a cash position of 1.4 billion euros.

Ferrari faces a number of potential risks. Capital expenditure (CAPEX) is cyclical, depending on the innovations to be incorporated into the vehicles. At present, the automotive industry is undergoing a major transition towards hybrid and electric vehicles, requiring increased investment from all players in the sector, including Ferrari.

The P/E, at 48.3X is so high tells us that it's essential to understand that this company goes far beyond the numbers. It's a choice that investors have to make. Either they believe that the Ferrari brand will continue to dominate the market by increasing its sales, in which case the stock is attractive. Or they believe that past performance is no indication of future potential, in which case it's best to stay away.

In conclusion, Ferrari continues to stand out from its rivals, with solid financial results, steady growth and a strategy focused on personalization. However, Ferrari's transition to hybrid and electric vehicles will be a major challenge, requiring significant investment in research and development.

By

By