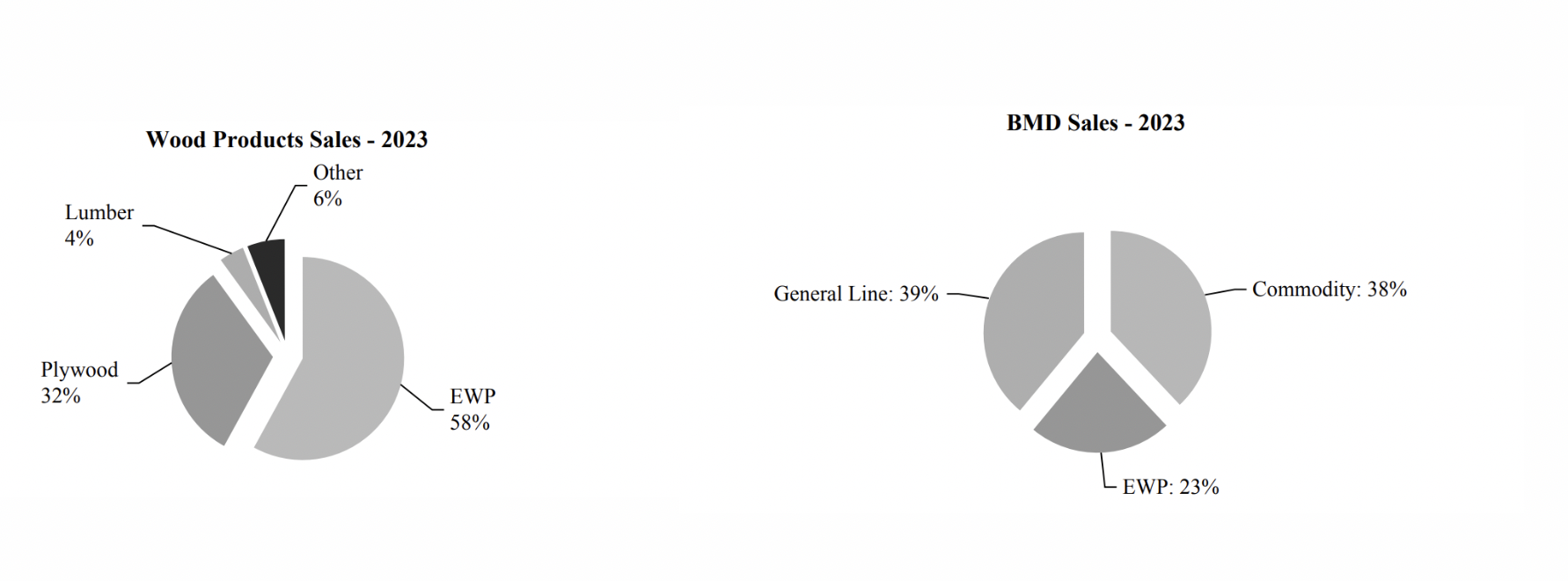

Boise Cascade operates through two primary segments: Wood Products and Building Materials Distribution (BMD). The Wood Products segment produces engineered wood products (EWP) including laminated veneer lumber, I-joists, and laminated beams, as well as structural, appearance, and industrial plywood panels, and ponderosa pine lumber. BMD, the largest customer of the Wood Products segment offers a wide range of building materials such as oriented strand board, plywood, lumber, and various general line items.

Boise Cascade's products are designed for new residential housing construction, including single-family, multi-family, and manufactured homes, repair and remodeling of existing housing, and light industrial and commercial building projects.

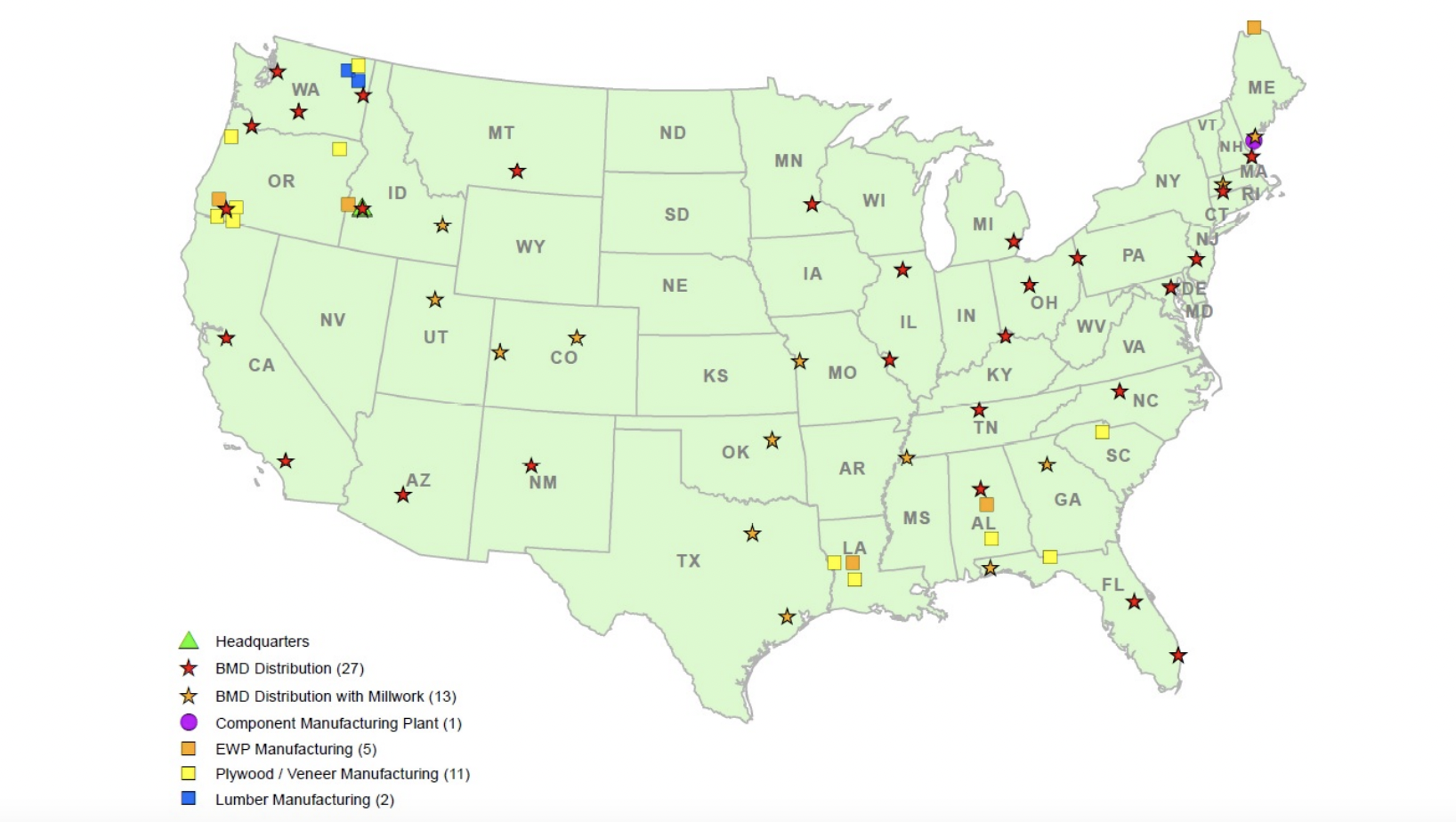

Boise Cascade operates a large-scale manufacturing enterprise with significant North American presence in engineered wood products (EWP) and plywood. The manufacturing facilities include 5 EWP facilities, 11 plywood and veneer plants, and 2 sawmills, positioning the company as a leader in these sectors. The BMD segment is the primary source of revenue, accounting for approximately 76% of the company’s sales in 2023. External clients range from wholesalers to home improvement centers, dealers, and industrial converters across North America.

The company's product lineup includes EWP’s products like Versa-Lam® LVL, Versa-Stud® LVL, and BCI® Joists. The plywood products offered include both sheathing and sanded varieties. Additionally, Boise Cascade is focusing on a go-to-market strategy for its mass timber products, which are primarily veneer-based applications targeted at commercial markets.

Boise Cascade plans to expand EWP sales through investments in Southeast U.S. mills, including those acquired from Coastal Plywood. Additional growth is anticipated in multi-family and light commercial construction, as well as in the emerging mass timber market, aligning with sustainable construction trends.

BMD sells a broad line of building materials, including oriented strand board (OSB), plywood, and lumber (commodities); general line items such as siding, composite decking, doors and millwork, metal products, roofing, and insulation; and EWP.

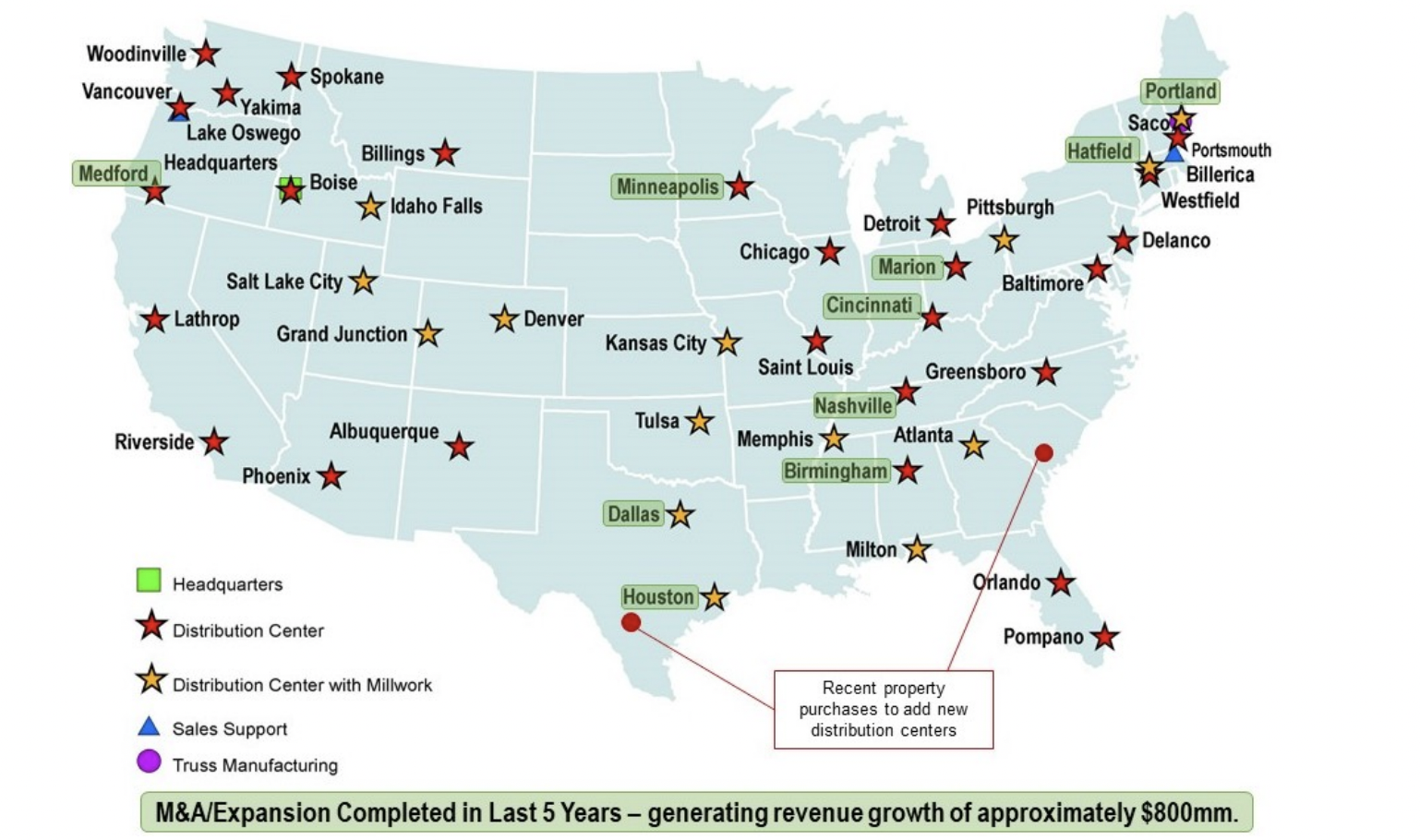

The BMD segment of Boise Cascade stands as one of the largest U.S. wholesale distributors of building products. BMD operates 38 distribution facilities, which include specialized door and millwork services in 18 manufacture centers. The product portfolio is extensive, encompassing siding, composite decking, doors, metal products, roofing, insulation, engineered wood products (EWP), framing lumber, and structural panels.

To foster growth, BMD aims to expand in existing markets such as Marion, Kansas City, Denver, and South Florida. Additionally, there are plans to establish a physical presence in underserved markets, specifically South-Central Texas and the South Carolina Coast, to tap into new customer bases.

Its customer relationships range from locally owned single-location facilities to large national dealers and home improvement centers across the U.S., with Builders FirstSource and Home Depot being its largest customers.

In EWP, competition exists against several major North American EWP producers, such as Weyerhaeuser Company, Pacific Woodtech Corporation, and Roseburg Forest Products, as well as several other smaller firms. EWP products also face competition because EWP may be substituted by dimension lumber and truss products in many building applications.

In plywood, competition is with Georgia-Pacific, the largest manufacturer in North America, other large producers such as Roseburg Forest Products, foreign imports produced principally in South America, and several smaller domestic producers. Plywood products also face competition from OSB producers, because OSB can be substituted for plywood in many building and industrial applications.

Company’s wholesale distribution competitors include BlueLinx Holdings, Specialty Building Products, Weyerhaeuser, Dixie Plywood and Lumber, OrePac, Woodgrain, and Capital Lumber. Boise enjoys leading supplier partnership to expand its presence with companies such as Hoover, Nucor or Steves.

Recently, Boise Cascade completed the acquisition of Brockway-Smith Company (wholesale distributor specializing in doors and millwork) with a purchase price of $162.8 million with the objective to expand the door and millwork business into the Northeast U.S. markets.

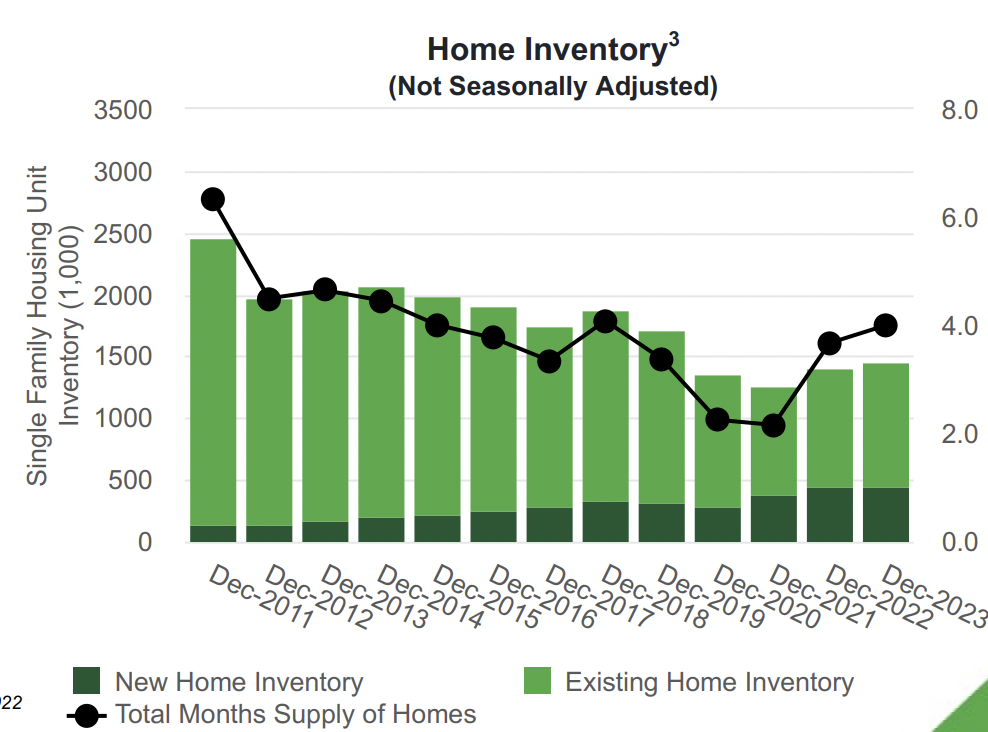

Elevated home prices and interest rates continue to pose affordability challenges, even with recent declines in mortgage rates. However, demand indicators for new single-family construction remain strong, bolstered by robust wages and employment, favorable demographics, and a low housing supply.

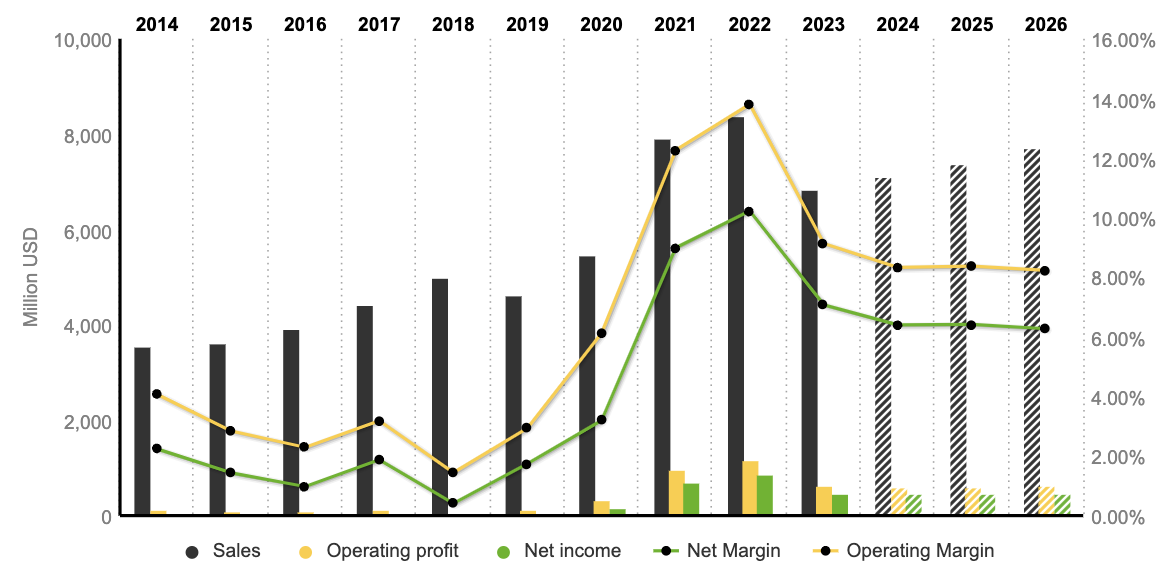

For the year 2023, income from operations was recorded at $624.4 million, a decrease from $1,157.8 million in 2022. In the Wood Products segment, income fell by $238.1 million to $337.1 million, down from $575.2 million in 2022. This decline was mainly due to lower plywood and EWP sales prices and volumes, alongside increased depreciation and amortization expenses from the Coastal Plywood acquisition, partially offset by lower wood fiber costs and higher plywood sales volumes. In the BMD segment, income dropped by $291.3 million to $335.8 million, from $627.1 million, influenced by a $276.0 million decrease in gross margin, largely from declines in EWP and commodity product margins and reduced sales volumes across all product lines.

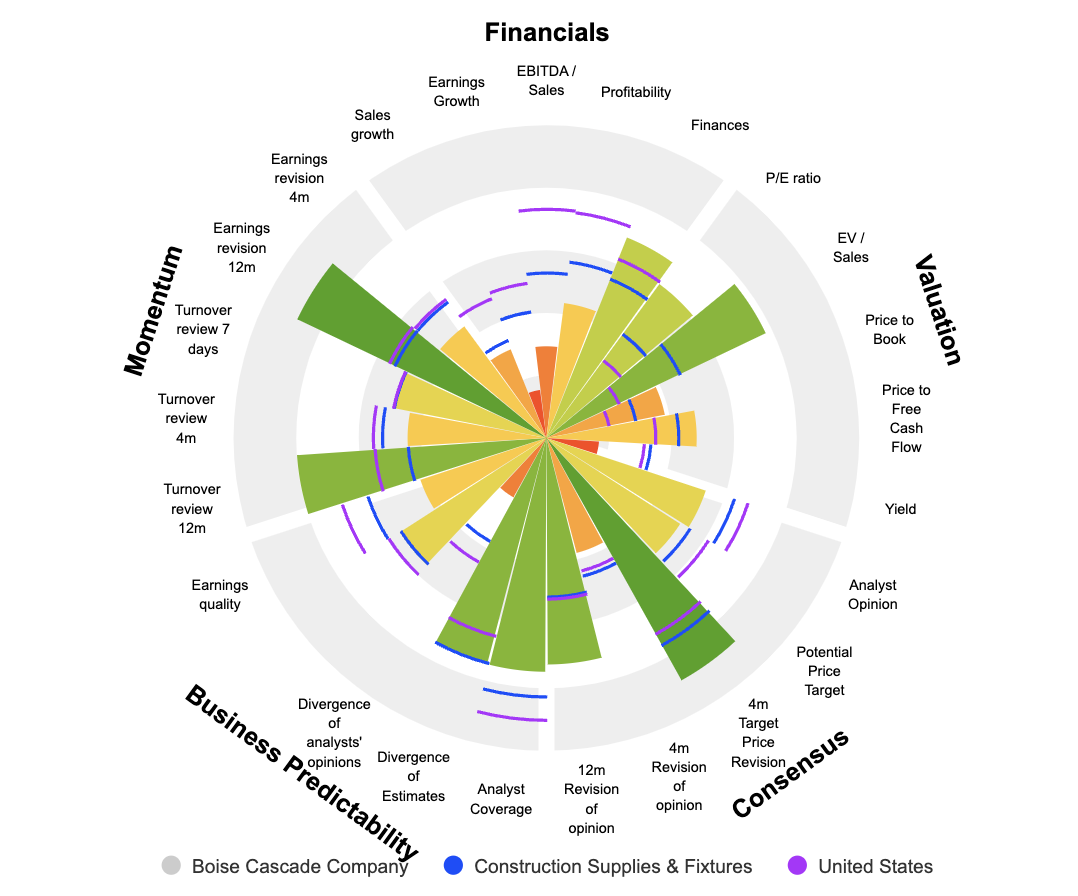

Favorable housing market conditions, supported by rising consumer confidence due to anticipated interest rate cuts and moderated inflation, offer a positive outlook for the wood industry. Boise is expected to benefit from strong demand in repair and remodel (R&R) activities, as well as increased funding for infrastructure and carbon/ESG-related projects. Revenue forecasts predict a CAGR of 3.1% until 2026. The operating and net margins are expected to stabilize at approximately 8% and 6%, respectively. Currently, the P/E ratio stands at 10.7x, which is lower than its 10-year median of 17.2x which appears to be a justified valuation.

By

By