AppFolio provides three types of Property Manager via their platform to allow their customer to operate a property management business: AppFolio Property Manager Core; AppFolio Property Manager Plus; AppFolio Property Manager Max. Their core solutions and certain Value Added Services are offered on a subscription basis while other on a per-use basis.

AppFolio Property Manager Core: It provides the basic functionality and serves as their customers’ system of record, best suited for small property management companies that need a system that is comprehensive yet easy to use.

AppFolio Property Manager Plus: It builds on AppFolio Property Manager Core with added features for complex property management, such as affordable and student housing, advanced accounting, in-depth leasing insights, large-scale bulk operations, role-based access, and Stack integrations which allows customers to connect their platform with specialized technology and services offered by third parties.

AppFolio Property Manager Max: It expands on Plus with features for larger businesses, including a comprehensive leasing funnel with Customer-Relationship-Management (CRM), enhanced customization via user-defined fields, full database access via API.

To protect customer and enhance experience, AppFolio has integrated FolioGuard which is a software tool enabling property managers to ensure lease insurance requirements by tracking unit coverage and adding uninsured units to a landlord liability policy through a licensed broker.

Increasing the number of property management units under management is an indicator of their market penetration, growth, and potential future business opportunities. They had 8.2 million and 7.3 million property management units under management in 2023 and 2022, respectively.

The real estate sector is big, enhancing significant growth opportunities for AppFolio. To quantify this potential, the industry features $1.9 trillion in investor assets under management (AuM), 25 million rental property owners, and 624,000 home service providers. Additionally, there are 128 million residents living in rental properties, which include 51 million residential units. Of these, 53% are considered upmarket, and 85% of these upmarket accounts possess a diverse portfolio.

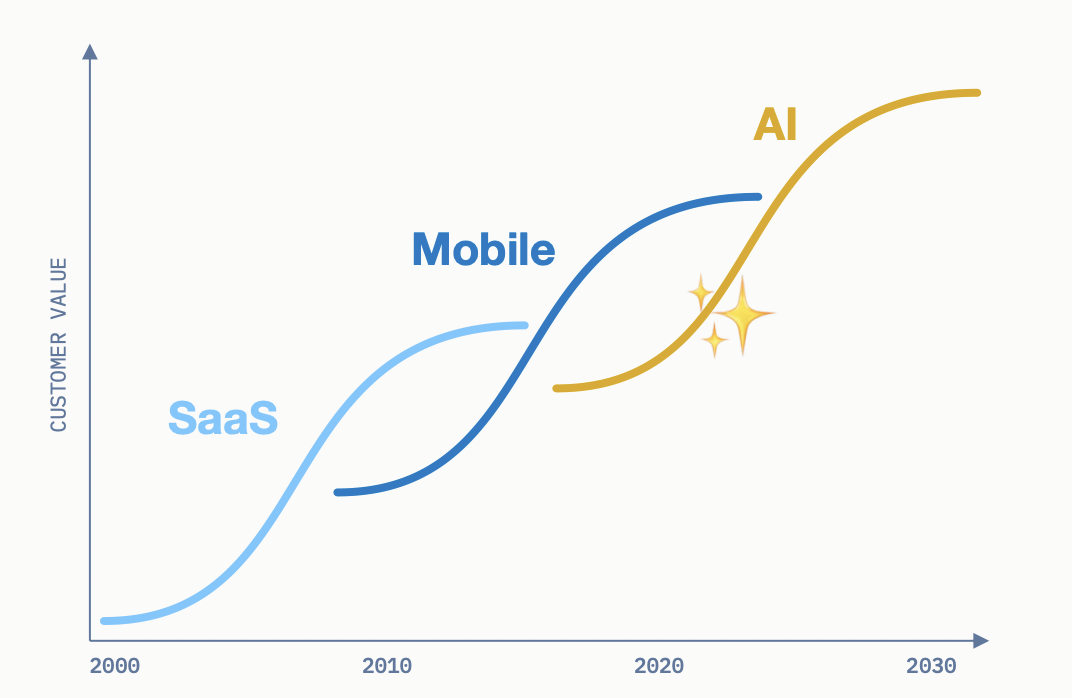

The company views AI as the next major shift, positioning AppFolio as a leading innovator with 8 AI solutions already on the market. Significant developments include the patented AI Leasing Assistant, Lisa, and the recent launch of Realm X, the property management industry's first generative AI conversational interface.

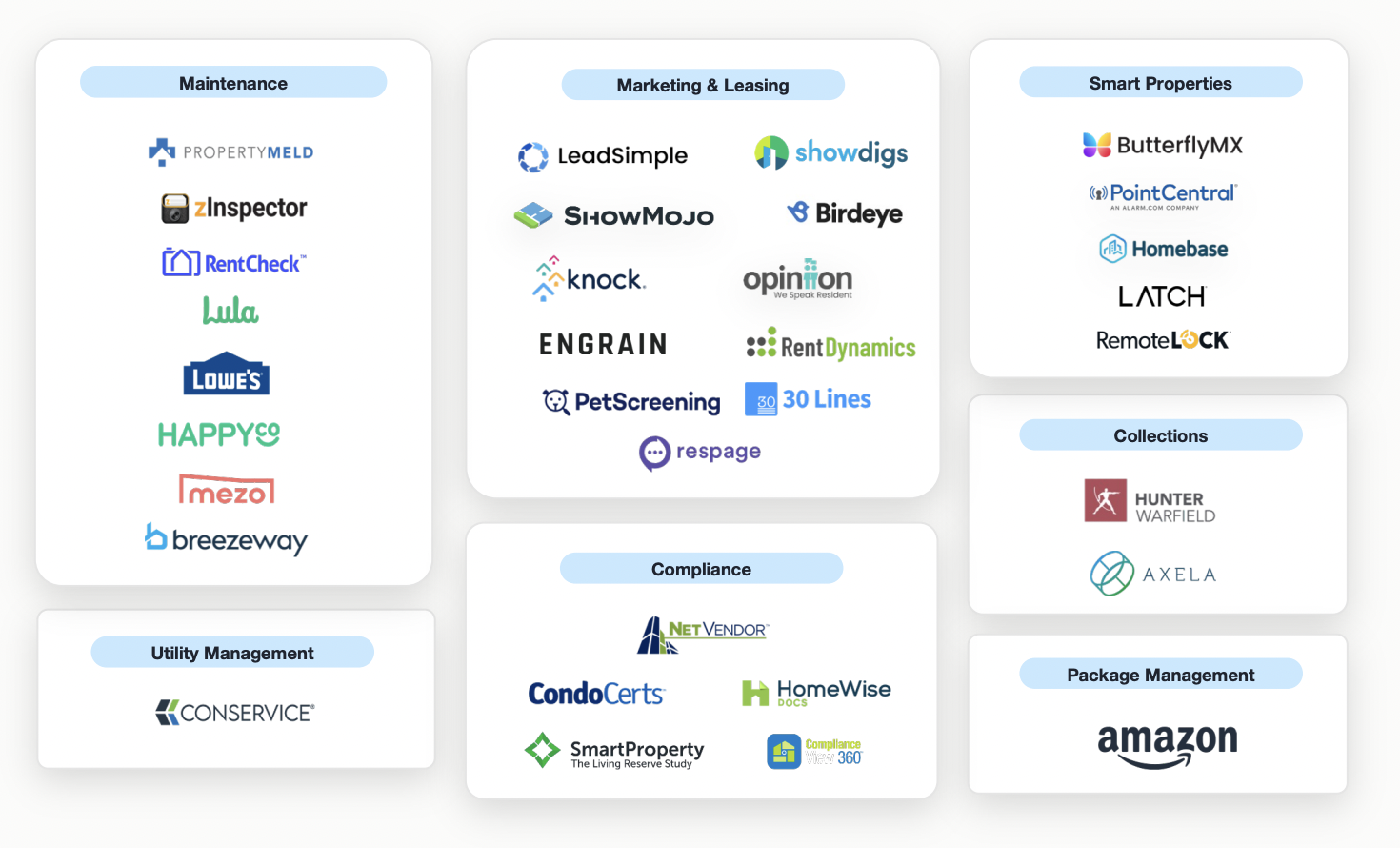

A key challenge for Property Managers is enhancing revenue and profits. To address this, AppFolio collaborates with over 35 companies across maintenance, utility management, compliance, marketing & leasing, smart properties, collections, and package management. Notable partners include Lowe’s, Amazon, Homebase, and SmartProperty.

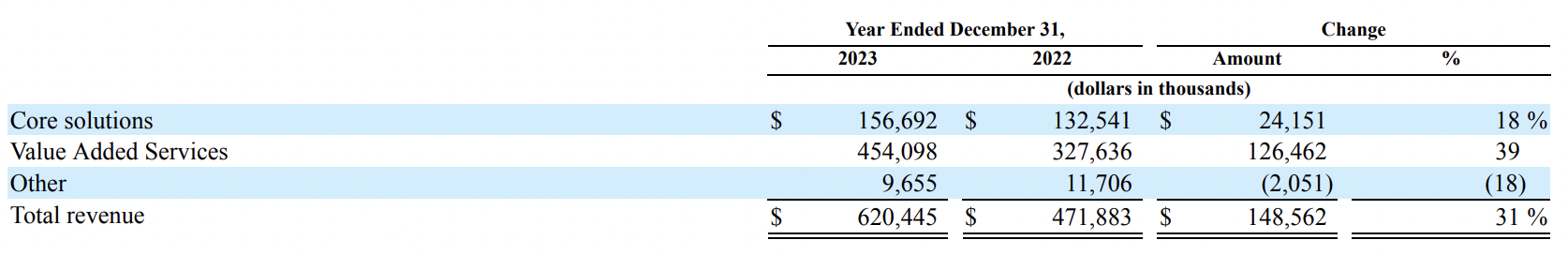

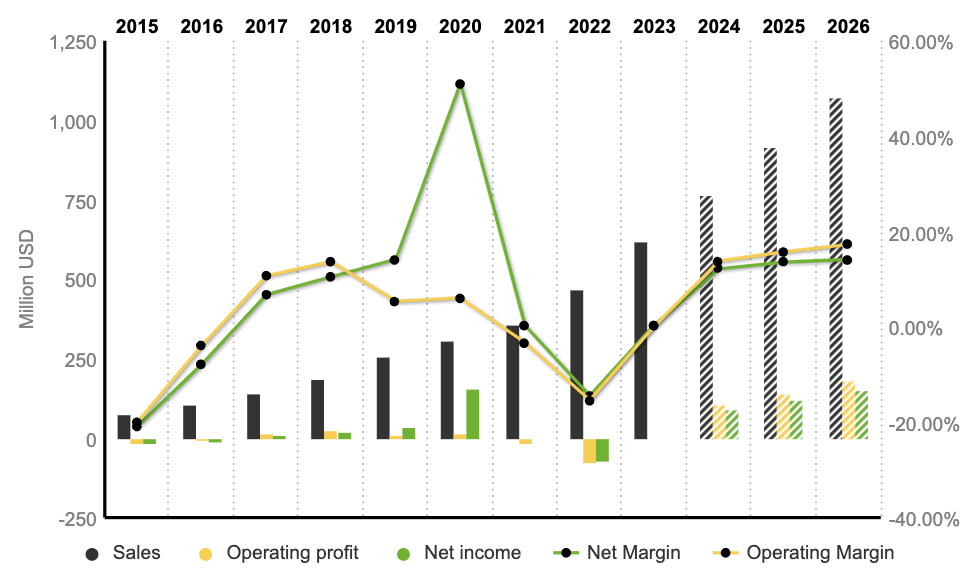

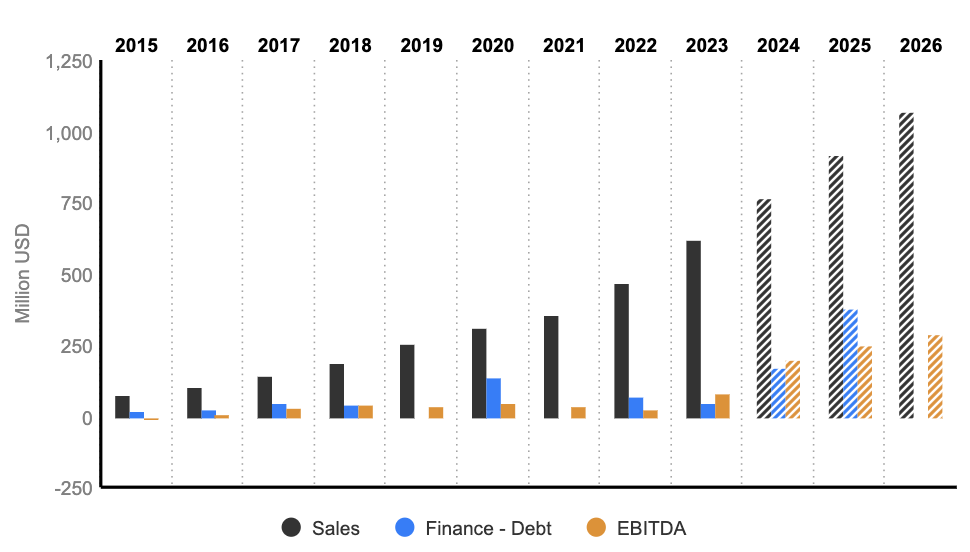

AppFolio reported significant growth in its 2023-financial performance with revenue reaching $620.4 million (+31% YoY) accounting for a CAGR of 21.8% since 2019. Company saw a positive shift from a previous operating loss. The GAAP operating income for the year was $1.0 million (0.2% of revenue) compare to a loss of $72.4 million in 2022. During the same period, the EBITDA increased by 247%, rising from $23 million to $82 million, following a similar upward trend.

Looking forward, AppFolio anticipates its full-year revenue for fiscal 2024 to be between $755 million and $765 million, with non-GAAP operating margin and free cash flow margin as a percentage of revenue expected to be 21% to 23% and 17% to 19%, respectively. The diluted weighted average shares outstanding are projected to be around 37 million for the full year.

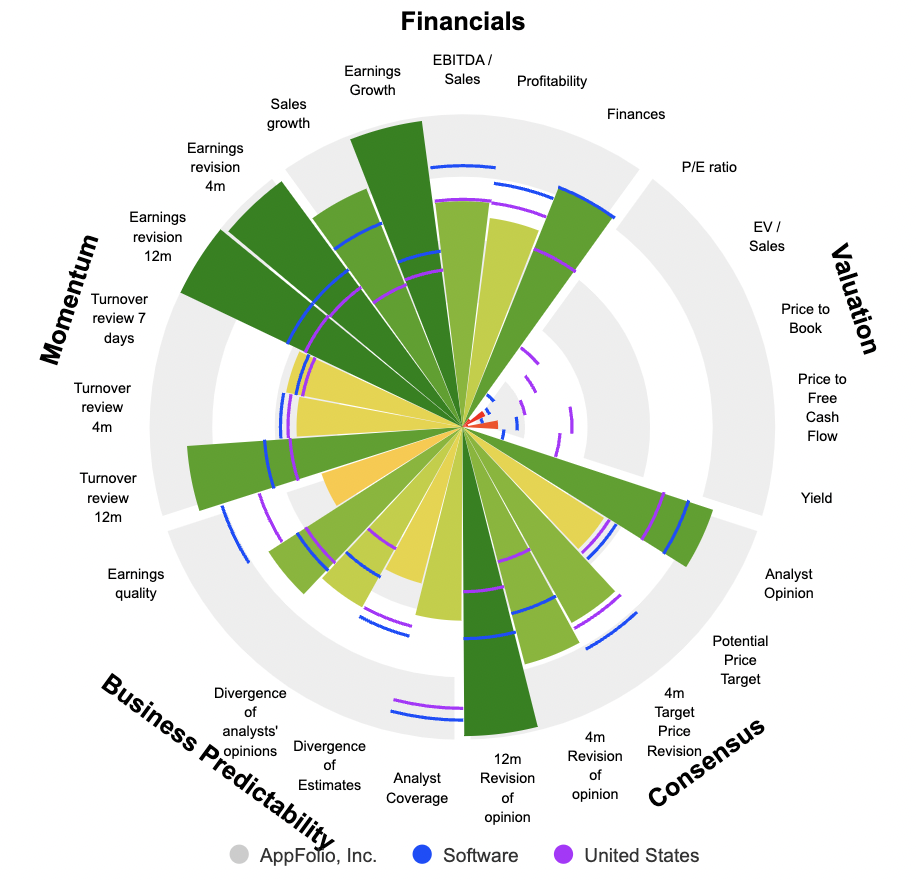

The company boasts strong financial performance, including robust sales and earnings growth, solid profitability, and strong momentum, underscored by positive earnings revisions for the upcoming year. However, it is trading at exceptionally high valuation multiples, leaving little room for error. Any minor dip in revenue or customer count could significantly impact its stock price. To illustrate, the P/E Ratio stands at 2475x for 2023, with projections of 96.9x for 2024 and 73.3x for 2025.

Since its initial public offering, AppFolio has garnered positive reception from investors, recognizing significant growth prospects within the company. Aimed at transforming real estate property management, AppFolio commands a premium valuation, underscoring the principle that quality comes at a cost. Additionally, it is pertinent to note that, in recent months, companies associated with artificial intelligence have received exceedingly favorable responses from the market.

By

By