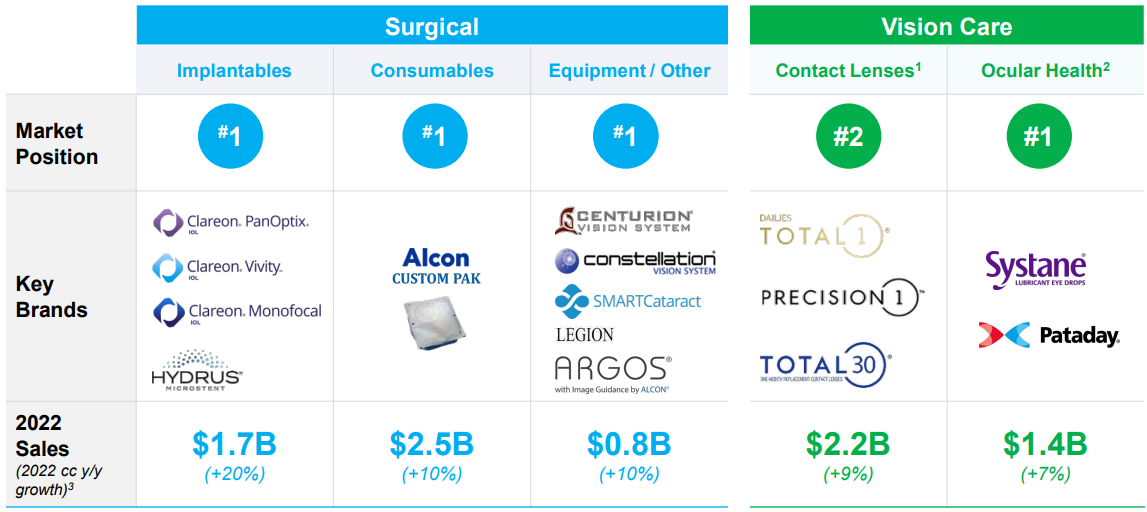

Alcon is one of the world leaders in the ophthalmic industry, with five businesses in ophthalmic surgery and vision care:

In surgery:

* Implantation products account for 19% of sales. These are mainly artificial lenses implanted during surgery or devices used to treat illnesses such as glaucoma.

* Consumables (28% of revenues) are mainly procedure kits that provide surgeons with the products - disposable or not, manufactured by Alcon or by other laboratories - needed for operations.

* The company also produces equipment (9%) such as phacoemulsification devices - the gold standard method of extracapsular lens extraction - as well as lasers, microscopes and the like.

In eye care:

* Disposable, reusable and coloured contact lenses account for 25% of sales

* The company covers a wide range of eye health products (16%), including products for dry eyes, irritation and ocular hypertension, as well as disinfectant solutions, drops and more.

The margin for surgical activities (essentially BtoB, aimed at professionals) is around 27%, compared with just 17% for eye care activities, which are more geared towards the general public.

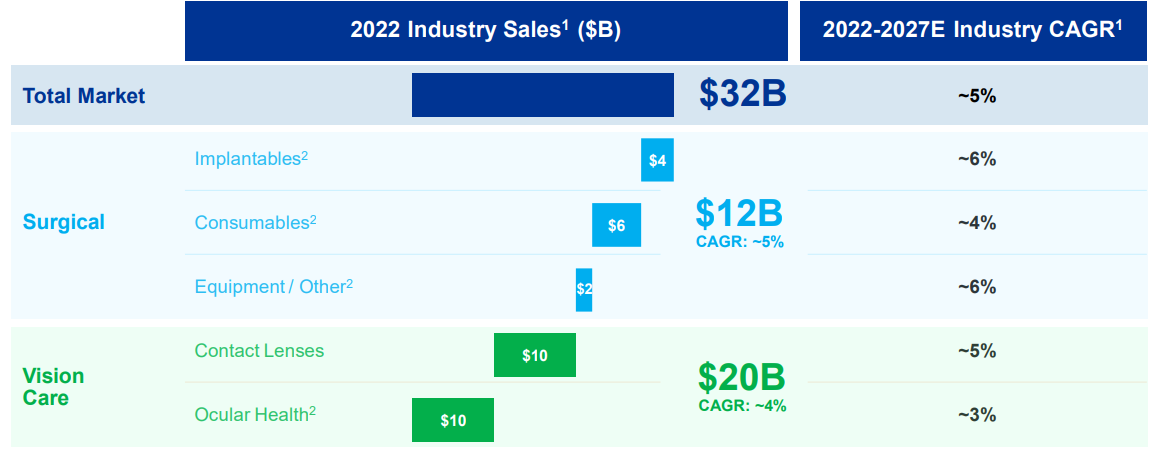

Alcon is the world leader in four of these activities. It is the world's second-largest contact lens manufacturer, although it faces fierce competition (particularly in this segment) from solid, profitable companies such as The Cooper Companies and Essilor-Luxottica. In all, the group is targeting a huge market of over $32 billion, with annual growth rates of between 3% and 6% depending on the business.

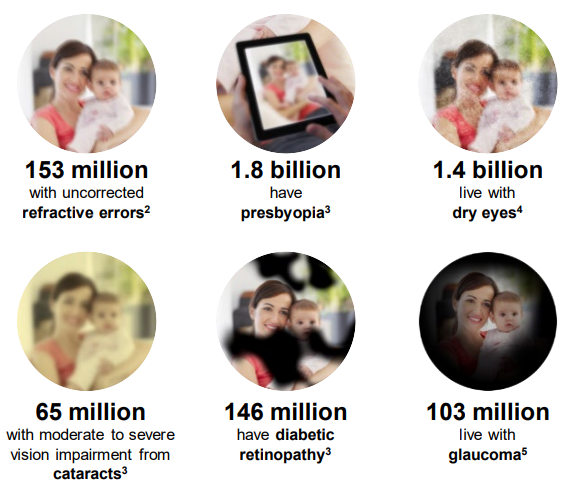

Worldwide, more than 2.2 billion people suffer from visual impairment or blindness. The needs are far from being met, particularly in less developed or developing countries. The WHO states in a report that more than half of these cases could be avoided, or corrected fairly quickly. But the difficulty of adopting a profitable business model in these regions is currently holding back the company's ability to meet this excess demand. For the time being, 55% of the company's sales are generated outside France - mainly in Europe - and 45% in the United States.

Demand exceeds supply (source: Alcon)

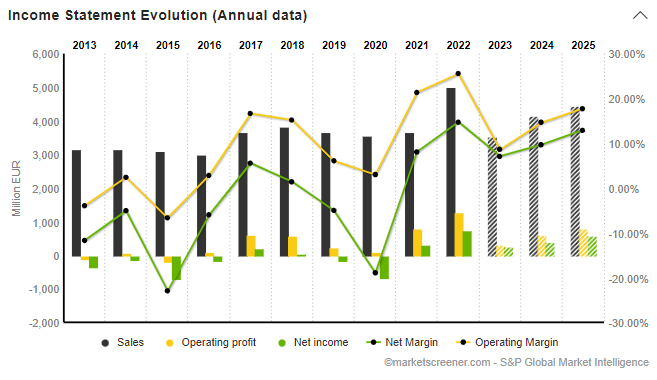

These good results should not obscure the fact that the company is emerging from a major restructuring, inherited from an unsuccessful marriage with Novartis. For Alcon, the adage that it is better to be alone than poorly accompanied rings true. From now on, the company will have to prove that it can stand on its own two feet. The fundamentals are solid, the market is buoyant and the company's diversification into various businesses is a crucial argument, given that it is the world leader in four of its five activities. The company's financial position has become stable, with debt under control and cash earnings generation beginning to take interesting forms. However, the elements of strong earnings improvement are already included in the share price, so Alcon must not disappoint.

By

By