Palantir was founded twenty years ago by Alex Karp and Peter Thiel, with initial funding from the CIA as part of the surveillance programs permitted by the Patriot Act, the body of law that gave the federal administration overriding powers over individual rights under the guise of fighting terrorism. This dimension has never left the company since, and it still derives half of its revenues from contracts with security agencies or military organizations, such as the CIA, NATO or the British army.

This pedigree is as fascinating as it is intriguing. Palantir's data processing tools are said to have helped locate Bin Laden, but they are also allegedly used to track migrant deportations and spy on citizens. We're right in the gray area.

Peter Thiel himself has a peculiar reputation. Elon Musk reportedly called him a sociopath. He is a proven supporter of the far right. He is also a proponent of frankly fanciful libertarian policies, which is ironic since Palantir's main backer is the US government. As for his investment history, there is some good and some bad. Thiel earned his stripes as a billionaire as the founder of PayPal and by sniffing out the nascent Facebook venture(Meta Platforms), even though he exited prematurely. Alex Karp seems to be an odd bird too, but that's not the topic of the day.

Palantir is everywhere

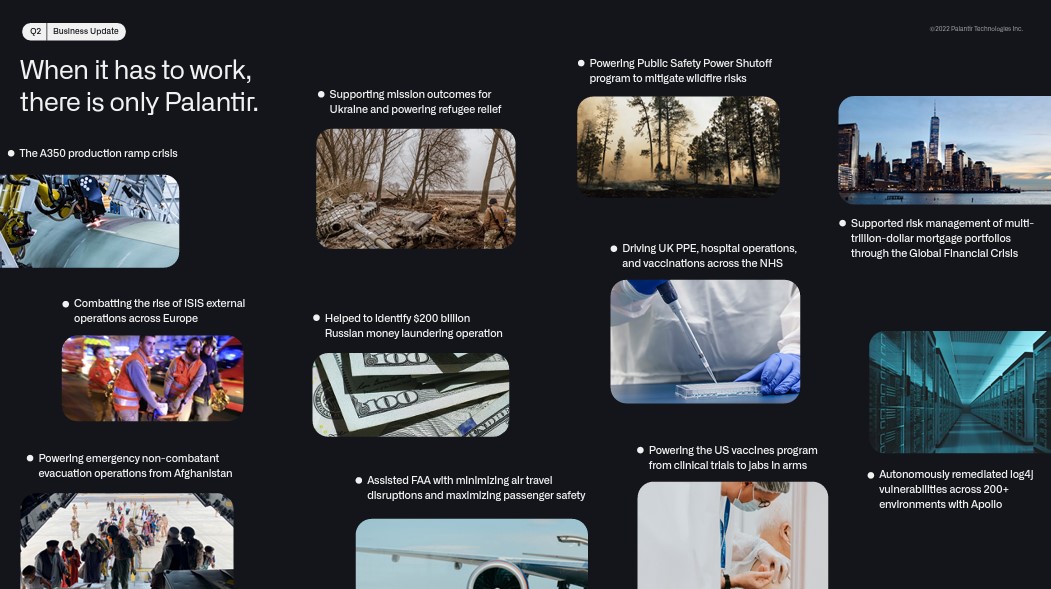

The two founders and a whiff of espionage have created a particular mystique around Palantir, especially among small investors. The fact that the company's name was stolen from Tolkien (in Middle-earth, a Palantir is a kind of crystal ball that allows you to spy from a distance) may also contribute to this. In any case, the American financial media are full of articles about the company. Palantir does its best to cultivate the aura of mystery and prestige that surrounds it. One look at the financial presentation of the second quarter 2022 results is enough to convince you of this. If you look at page 4 below, you can see that Palantir has managed the Airbus A350 production crisis, helped Ukraine, addressed the issue of large forest fires, managed the risk of real estate funds in 2008, identified Russian money laundering flows, fought the Islamic State on behalf of Europe, participated in the management of the vaccine crisis in the US, allowed the evacuation of refugees during the fall of Kabul or protected critical data centers.

The most jaded among you will probably have recognized a very well-sold consulting firm, whose business is much more in renting expensive specialists by the day than in software, even if Palantir boasts of being a CIA-accredited big data software provider. This may explain why we are far from the normative margins of software, since the company is losing money.

What business model?

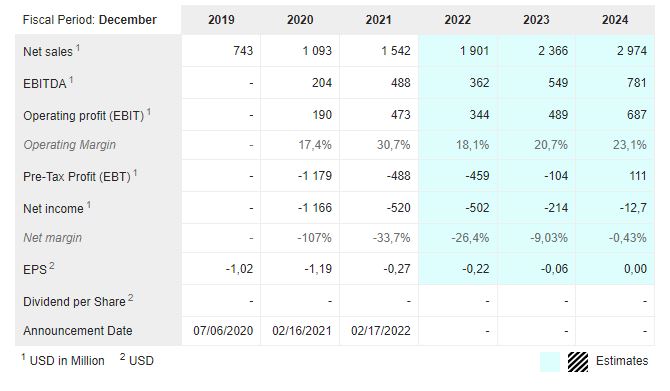

This is another mystery. Palantir is playing the solidity of a defense-exposed model combined with the dynamics of software publishing, the best of both worlds. The problem is that it has the profitability of neither. This is very troubling for a group that is supposed to revolutionize its sector. Still, the business growth rates are impressive, especially since the company has gone after projects from large companies, to emancipate itself from its reliance on government contracts.

In 2021, revenues from the corporate business ($645 million, up by a third) are approaching government agency revenues ($897 million). In addition, retention rates appear to be excellent. Over the past five quarters, business growth has ranged from 28% to 54%, although there has been a marked slowdown in the momentum of government orders (13% in Q2 2022 versus 66% a year earlier).

Show me the money

Over the last three years, revenues have tripled but cash consumption remains high, with $1 billion in cumulative losses over the period. For the moment, Palantir's story is held together only by calls to the market, i.e. $2 billion raised since the company went public. To raise capital, you need investors who believe in the project. And for investors to believe in the project, you have to tell a good story. All this may work for a while, but one day we will have to see the money.

In the meantime, it should be noted that the balance sheet looks clean and contains more than $2 billion in cash, not to mention a $1 billion undrawn credit line. On the other hand, we should be more cautious with the statements of the management, which explains that it has generated a positive adjusted free cash flow over the last quarter... By "adjusted", we mean that the (colossal) expenses on stock options have been restated: i.e. nearly $2 billion over the two years 2020 and 2021 alone. To be compared to a turnover of $2 billion. This means that 80% of the turnover goes into the pockets of employees in options, before paying them salaries and bonuses. This raises questions.

There is another mystery. The adjusted free cash flow does not include the numerous investments in small start-ups that Palantir makes. This seems strange, since these small companies are Palantir's clients. The latest annual report is quiet on strategy but still gives a glimpse of the system. The total value of contracts signed with these holdings/clients was $768M at the end of 2021... To be compared with a total value of contracts at the same time of about $3.8 billion, or about 20% of the total. We should not jump to conclusions, but the least we can say is that this is something to watch.

The company has its dark side, and a speculative quality, very much linked to the Peter Thiel "cult". You either love it or you hate it, in short. It was way too expensive at the time of the introduction, but it went up to USD 45 because everyone was buying anything at the time. Now the stock is back to just above the IPO price. It's still very expensive despite the 80% drop from the highs, unless you think the earnings trajectory will eventually catch up with the growth trajectory.

By

By