Pinion: 112.7m at 0.72 g/t Au (oxide)

Dark Star: 36.6m at 3.53 g/t Au, including 19.8m at 5.23 g/t Au (oxide)

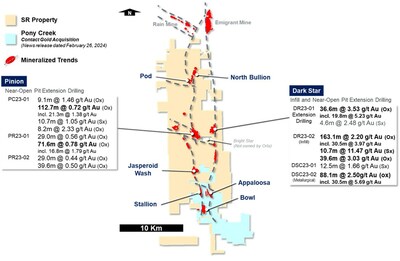

VANCOUVER, BC, March 7, 2024 /CNW/ - Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to provide an update on its exploration activities at the South Railroad Project in the second half of 2023. This news release presents the first of two updates from the 2023 infill and extension drilling, totaling seven drillholes and representing 2,508 metres. Drilling at South Railroad in 2023 totalled 14,695 metres and additional results from other exploration targets will be shared in a subsequent update.

Highlights

- Potential expansion of resources at Pinion and Dark Star deposits through new oxide intersections in step-out drilling:

- Pinion: 0.72 g/t Au over 112.7 metres (oxide)

- Dark Star: 3.53 g/t Au over 36.6 metres (oxide)

- Successful infilling and metallurgical drilling with confirmation of modeled grade, continuity of mineralization, via infill drill program.

- Intersection includes 2.20 g/t Au over 163.1 metres (oxide) and 2.50 g/t Au over 88.1 metres (oxide).

"Since acquiring the South Railroad project in August 2022, Orla has made substantial progress in near-deposit exploration, satellite deposit testing, and expanding our land position along the Carlin Trend. The recent positive drill results outside the projected open pits highlight the project's low exploration maturity and significant growth potential. In 2024, we will focus on expanding resources at existing deposits and continuing exploration across the property, which could soon be expanded to include Pony Creek".

- Sylvain Guerard, Orla's SVP Exploration

2023 Pinion and Dark Star Exploration Highlights

In 2023, Orla extended oxide-hosted gold mineralization at the Pinion and Dark Star deposits, with highly positive drill intersections outside of the projected open pits (Figure 1). Meanwhile, infill drill results met expectations, confirming robust oxide mineralization within projected pits, while supplying material for new metallurgical column test work to further optimize the planned development project.

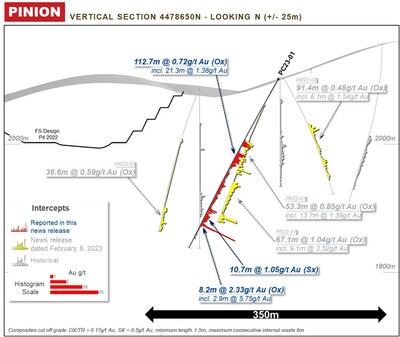

Pinion SE Extension Drilling

At the Pinion deposit, a review of available geological data suggested gold mineralization may be continuous in the southeastern part of the deposit over the Pinion SE target area, where faulting had been previously interpreted as limiting or displacing extension of the mineralization. To test the continuity of gold mineralization, three drill holes totaling 822 metres were completed. All three drillholes intercepted significant oxide-hosted gold mineralization, including 0.72 g/t Au over 112.7 metres (oxide) confirming the continuity of gold mineralization to the southeast without fault displacement interference (Figure 2). These results, combined with historical drill intersections, indicate geological continuity and suggests gold mineralization extends to at least 350 metres outside of the projected open pit.

Significant results from drilling at Pinion:

Pinion |

PC23-01 incl. | 0.72 g/t Au over 112.7 m (oxide) 1.38 g/t Au over 21.3m |

PR23-01 incl. | 0.78 g/t Au over 71.6 m (oxide) 1.79 g/t Au over 16.8 m |

PR23-02 and | 0.44 g/t Au over 29.0 m (oxide) 0.50 g/t Au over 39.6 m (oxide) |

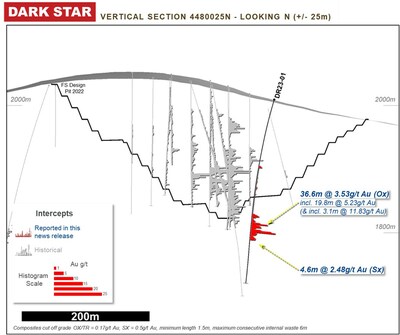

Dark Star Exploration Drilling (Project Open Pit extension and Geophysical Target)

Exploration drilling at the Dark Star deposit consisted of 1,112 metres in two drillholes. Results from these two exploration drill holes identified the potential to extend oxide mineralization beyond the currently defined mineral resources and explained a seismic anomaly identified below the Dark Star deposit.

Drillhole DR23-01 targeted the potential extension of high-grade mineralization east of the currently designed open pit limit, returning wider and higher-grade oxide hosted gold mineralization than nearby drill holes and average resources grade, including 3.53 g/t Au over 36.6 metres (oxide), 5.23 g/t Au over 19.8 metres approximately 50 metres outside of the projected open pit limit (Figure 3). The exceptional results from this extension drilling suggests the potential to define additional oxide mineralization, possibly associated with a previously unknown feeder structure for the Dark Star deposit. Additional drilling is planned for 2024 to follow-up on these highly encouraging results, testing the feeder structure model and defining the potential to grow resources and expand the projected open pit.

Drillhole DC23-01 was drilled in the northern part of the Dark Star deposit to test the potential extension of mineralization and was extended to investigate an anisotropic, antiformal seismic anomaly approximately 400 metres below the Dark Star deposit. Assay results from the upper part of the hole returned low grade Au (1.66 g/t Au over 12.5 metres (Sulphide) from 256.5 metres) approximately 30 metres outside the currently defined open pit at Dark Star. Drilling also intercepted unmineralized Tonka Formation conglomerate at depth, explaining and validating the seismic target.

Significant exploration results from Dark Star:

Dark Star Extension |

DR23-01 incl. incl. | 3.53 g/t Au over 36.6 m (oxide) 5.23 g/t Au over 19.8 m (oxide) 11.8 g/t Au over 3.1m (oxide) |

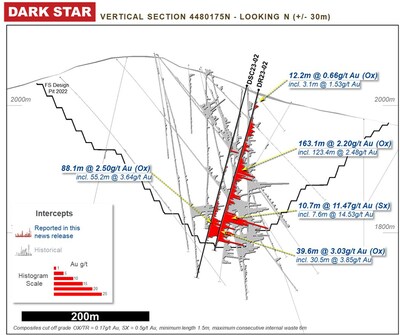

Dark Star Infill and Metallurgical Drilling

One reverse circulation and one core drillhole were completed within the northern pit at the Dark Star deposit (Figure 4) to support ongoing project development work.

The reverse circulation hole, DR23-02, was drilled to confirm continuity of high-grade Au in oxide mineralization at the base of the designed open pit. Highly positive assay results, 2.20 g/t Au over 163.1 metres (oxide), incl. 3.97 g/t Au over 30.5 metres, confirmed the modeled grade, limits of gold mineralization, and continuity of high-grade mineralization at the base of the designed open pit.

The core drillhole, DSC23-02, was drilled to provide material for run-of-mine column test work. The strong assay results, 2.50 g/t Au over 88.1 metres (oxide), incl. 5.69 g/t Au over 30.5 metres1, from hole DSC23-02 are consistent with historical drill data and the mineral resource estimate block model. The run-of-mine column test work is expected to be undertaken in 2024.

________________________________________ |

1 | Hole DSC23-02 was chip sampled, rather than quarter-cut, to preserve the maximum amount of core for metallurgical test work. All remaining core from the reported mineralized interval is expected to be consumed during the metallurgical testing. |

Dark Star Infill and Metallurgical Drilling

Dark Star Infill Drilling |

|

DR23-02 incl. and incl. | 2.20 g/t Au over 163.1 m (oxide) 3.97 g/t Au over 30.5 m (oxide) 2.56 g/t Au over 27.4 m (oxide) |

DSC23-02 incl. | 2.50g/t Au over 88.1m (oxide) 5.69g/t Au over 30.5m (oxide) |

2024 Pinion and Dark Star Planned Exploration

Orla is committed to growing the Pinion and Dark Star deposits through exploration in 2024. As part of the broader South Railroad exploration program totaling approximately 14,000 metres, Orla plans to drill 4,400 metres across 16 holes, with a focus on exploration near the Pinion and Dark Star deposits. Near-deposit exploration in 2024 will seek to define the extension of oxide mineralization beyond the currently defined open pit extents, building on the drill success from 2023, and supporting resources expansion efforts.

The 2024 exploration program at South Railroad is planned to commence in the spring of 2024 and is expected to continue through October 2024.

South Railroad Project Resources & Reserves and Pinion & Dark Star Geological Setting

The South Railroad Project covers a strike length of over 25 kilometres along the southern part of the prolific Carlin Gold Trend, Nevada. Gold mineralization at South Railroad occurs mainly as disseminated Carlin-type ore-stage pyrite in stratiform breccia and stratigraphic horizons within a complex fault network. The property hosts multiple zones of oxide, transition and sulphide mineralization, throughout the entire land package, with current oxide measured and indicated mineral resources of 1.8 Moz (75.3 Mt at 0.74 g/t Au) inclusive of proven & probable mineral reserves of 1.6Moz (65.2 Mt at 0.77 g/t Au) at the Pinion and Dark Star deposits.

Qualified Persons Statement

The scientific and technical information in this news release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as defined under the definitions of National Instrument 43-101 ("NI 43-101").

To verify the information related to the 2023 drilling programs at the South Railroad property, Mr. Guerard has visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Assurance / Quality Control –2023 Drill Program

All gold results at South Railroad were obtained by fire assay fusion and optical emission finish (FA-PB30-ICP) at American Assay Labs in Sparks, Nevada, USA. Over limit gold assays were determined using fire assay fusion with gravimetric finish (GRAVAu-30). Gold cyanide extraction was determined using a 2-hour cyanide leach (AuCN30). All other elements were determined by 4 acid and boric acid dissolution with ICP-OES+MS method (ICP-2AM50). Quality Assurance/Quality Control and interpretation of results were performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Certified reference material (standards), blank, or rig duplicate were inserted approximately every tenth sample for Quality Assurance/Quality Control purposes by the Company. American Assay Labs is independent of Orla. There are no known drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the drilling data at South Railroad.

For additional information on the Company's previously reported drill results, see the Company's press releases dated February 8, 2023 (Orla Mining Drills Significant Gold Intersections at Multiple Oxide Targets upon Reactivation of Exploration at South Railroad Project, Nevada),

The mineral reserve estimate for the South Railroad Project consists of 333 koz of proven gold reserves (8,960 k tonnes at 1.17 g/t gold) and 1,271 koz of probable gold reserves (56,239 k tonnes at 0.72 g/t gold). The open pit mineral resource estimate for the South Railroad Project consists of 343 koz of measured gold resources (9,561 k tonnes at 1.13 g/t gold), 1,410 koz of indicated gold resources (65,450 k tonnes at 0.68 g/t gold), and 653 koz of inferred gold resources (21,805 k tonnes at 0.93 g/t gold). The underground mineral resource estimate consists of 66 koz of inferred gold resources (457 k tonnes at 4.49 g/t gold). For additional detail, see the South Railroad Report (as defined below). Mineral resources are inclusive of mineral reserves.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled "Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico" dated January 11, 2021 (the "Camino Rojo Report"), is available on SEDAR+ and EDGAR under the Company's profile at www.sedarplus.ca and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled "Project Pre-Feasibility Updated NI 43-101 Technical Report on the Cerro Quema Project, Province of Los Santos, Panama" dated January 18, 2022, is available on SEDAR+ and EDGAR under the Company's profile at www.sedarplus.ca and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study entitled "South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada" dated March 23, 2022 (the "South Railroad Report"), is available on SEDAR+ and EDGAR under the Company's profile at www.sedarplus.ca and www.sec.gov, respectively. The technical reports are available on Orla's website at www.orlamining.com.

Forward-looking Statements

This news release contains certain "forward-looking information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements regarding: the potential mineralization at South Railroad based on the 2023 drill program, including potential resource expansion, open pit extension and other growth potential; the Company's 2024 drill program, including the goals and timing thereof; and 2024 metallurgical work. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the future price of gold and silver; anticipated costs and the Company's ability to fund its programs; the Company's ability to carry on exploration, development, and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning and reclamation estimates; the Company's ability to secure and to meet obligations under property agreements, including the layback agreement with Fresnillo plc; that all conditions of the Company's credit facility will be met; the timing and results of drilling programs; mineral reserve and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves on the Company's mineral properties; that political and legal developments will be consistent with current expectations; the timely receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction, and operation of projects; the timing of cash flows; the costs of operating and exploration expenditures; the Company's ability to operate in a safe, efficient, and effective manner; the Company's ability to obtain financing as and when required and on reasonable terms; that the Company's activities will be in accordance with the Company's public statements and stated goals; and that there will be no material adverse change or disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation of mineral resources and mineral reserves; the Company's dependence on the Camino Rojo oxide mine; risks related to the Company's indebtedness; risks related to exploration, development, and operation activities; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations, including the COVID-19 pandemic; foreign country and political risks, including risks relating to foreign operations and expropriation or nationalization of mining operations and risks associated with operating in Mexico and Panama; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; delays in or failures to enter into a subsequent agreement with Fresnillo plc with respect to accessing certain additional portions of the mineral resource at the Camino Rojo project and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for the Camino Rojo project being only estimates and relying on certain assumptions; loss of, delays in, or failure to get access from surface rights owners; uncertainties related to title to mineral properties; water rights; financing risks and access to additional capital; risks related to guidance estimates and uncertainties inherent in the preparation of feasibility and pre-feasibility studies; uncertainty in estimates of production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold and silver; unknown labilities in connection with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price of the Company's securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating history; litigation risks; the Company's ability to identify, complete, and successfully integrate acquisitions; intervention by non-governmental organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend; risks related to the Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's ability to satisfy the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive foreign investment company for U.S. federal income tax purposes; information and cyber security; gold industry concentration; shareholder activism; and risks associated with executing the Company's objectives and strategies; as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 20, 2023, which are available on www.sedarplus.ca and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For United States reporting purposes, the United States Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Corporation is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Appendix: Drill Results

Table 1: Pinion SB Composite Drill Results (Composites Ox/Tr 0.17g/t Au cog & Sx 0.50g/t Au cog)

HOLE-ID | From

(m) | To

(m) | Core

Length

(m) | Au

(g/t) | CN

Rec

(%) | Au GXM | Oxide

Domain | Including

0.5g/t Au COG | Including

1g/t Au COG | Including

2g/t Au COG |

|

|

|

|

PC23-01 | 108.81 | 117.96 | 9.1 | 1.46 | 85.2 | 13.39 | Oxide | 7.62m @ 1.71g/t Au & 82.4% CN Rec | 7.62m @ 1.71g/t Au & 82.4% CN Rec | 4.57m @ 2.1g/t Au & 84.2% CN Rec |

|

|

PC23-01 | 125.58 | 238.29 | 112.7 | 0.72 | 73.8 | 80.62 | Oxide | 24.38m @ 1.3g/t Au & 66.5% CN Rec

4.57m @ .55g/t Au & 68.5% CN Rec

36.58m @ .63g/t Au & 82.1% CN Rec

11.22m @ 1.29g/t Au & 57.8% CN Rec | 21.34m @ 1.38g/t Au & 72.4% CN Rec

1.52m @ 1.34g/t Au & 66.4% CN Rec

6.71m @ 1.7g/t Au & 49.1% CN Rec | 1.52m @ 2.62g/t Au & 46.6% CN Rec

1.22m @ 2.6g/t Au & 42.3% CN Rec |

|

|

PC23-01 | 238.29 | 249.02 | 10.7 | 1.05 | 15.3 | 11.31 | Sulphide |

| 9.14m @ 1.11g/t Au & 16.7% CN Rec |

|

|

|

PC23-01 | 249.02 | 257.25 | 8.2 | 2.33 | 81.9 | 19.16 | Oxide | 8.23m @ 2.33g/t Au & 81.9% CN Rec | 2.87m @ 5.75g/t Au & 91.3% CN Rec | 1.65m @ 8.98g/t Au & 93.4% CN Rec |

|

|

PR23-01 | 64.01 | 92.96 | 29.0 | 0.56 | 75.4 | 16.14 | Oxide | 18.29m @ .77g/t Au & 75.3% CN Rec | 1.52m @ 1.56g/t Au & 72.4% CN Rec |

|

|

|

PR23-01 | 105.16 | 176.78 | 71.6 | 0.78 | 83.7 | 55.71 | Oxide | 38.1m @ 1.29g/t Au & 83.6% CN Rec

1.52m @ .56g/t Au & 80.6% CN Rec | 1.52m @ 2.04g/t Au & 90.2% CN Rec

16.76m @ 1.79g/t Au & 78.8% CN Rec

3.05m @ 1.56g/t Au & 94.7% CN Rec | 1.52m @ 2.04g/t Au & 90.2% CN Rec

1.52m @ 6.68g/t Au & 81.6% CN Rec |

|

|

PR23-02 | 97.54 | 126.49 | 29.0 | 0.44 | 81.1 | 12.75 | Oxide | 12.19m @ .57g/t Au & 83.8% CN Rec

1.52m @ .76g/t Au & 1.3% CN Rec

1.52m @ .66g/t Au & 100.8% CN Rec | 1.52m @ 1.04g/t Au & 89.4% CN Rec |

|

|

|

PR23-02 | 140.21 | 179.83 | 39.6 | 0.50 | 88.3 | 19.98 | Oxide | 16.76m @ .9g/t Au & 89.7% CN Rec | 9.14m @ 1.1g/t Au & 91% CN Rec | 1.52m @ 2.07g/t Au & 90.3% CN Rec |

|

|

Criteria: Cut off grade Ox/Tr 0.17g/t Au & Sx 0.50g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m |

Table 2: Dark Star Composite Drill Results (Composites Ox/Tr 0.17g/t Au cog & Sx 0.50g/t Au cog)

HOLE-ID | From

(m) | To

(m) | Core Length

(m) | Au

(g/t) | CN Rec

(%) | Au GXM | Oxide

Domain | Including

0.5g/t Au COG | Including

1g/t Au COG | Including

2g/t Au COG | Including

10g/t Au HG |

|

|

DR23-01 | 106.68 | 109.73 | 3.0 | 1.17 | 95.0 | 3.58 | Oxide | 3.05m @ 1.17g/t Au & 95% CN Rec | 1.52m @ 1.49g/t Au & 96.6% CN Rec |

|

|

|

DR23-01 | 124.97 | 126.49 | 1.5 | 0.20 | 89.1 | 0.31 | Oxide |

|

|

|

|

|

DR23-01 | 131.06 | 132.59 | 1.5 | 0.26 | 91.6 | 0.40 | Oxide |

|

|

|

|

|

DR23-01 | 140.21 | 144.78 | 4.6 | 0.44 | 95.2 | 2.01 | Oxide | 1.52m @ .61g/t Au & 91.4% CN Rec |

|

|

|

|

DR23-01 | 150.88 | 152.40 | 1.5 | 0.43 | 92.4 | 0.66 | Oxide |

|

|

|

|

|

DR23-01 | 182.88 | 219.46 | 36.6 | 3.53 | 82.7 | 129.19 | Oxide | 36.58m @ 3.53g/t Au & 82.7% CN Rec | 36.58m @ 3.53g/t Au & 82.7% CN Rec | 3.05m @ 3g/t Au & 97.4% CN Rec

19.81m @ 5.23g/t Au & 81.5% CN Rec | 3.05m @ 11.83g/t Au & 87.2% CN Rec |

|

DR23-01 | 219.46 | 224.03 | 4.6 | 2.48 | 22.8 | 11.34 | Sulphide |

| 4.57m @ 2.48g/t Au & 22.8% CN Rec | 4.57m @ 2.48g/t Au & 22.8% CN Rec |

|

|

DR23-02 | 18.29 | 30.48 | 12.2 | 0.66 | 82.0 | 8.10 | Oxide | 4.57m @ 1.27g/t Au & 84.5% CN Rec | 3.05m @ 1.53g/t Au & 81.9% CN Rec |

|

|

|

DR23-02 | 41.15 | 204.22 | 163.1 | 2.20 | 82.9 | 358.59 | Oxide | 158.5m @ 2.26g/t Au & 82.9% CN Rec | 19.81m @ 2.06g/t Au & 88.2% CN Rec

123.44m @ 2.48g/t Au & 82% CN Rec | 18.29m @ 2.08g/t Au & 88.2% CN Rec

9.14m @ 2.17g/t Au & 82.2% CN Rec

30.48m @ 3.97g/t Au & 77.6% CN Rec

27.43m @ 2.56g/t Au & 87.1% CN Rec

6.1m @ 6.88g/t Au & 68.2% CN Rec | 1.52m @ 12.33g/t Au & 45.6% CN Rec |

|

DR23-02 | 204.22 | 214.88 | 10.7 | 11.47 | 28.1 | 122.40 | Sulphide |

| 10.67m @ 11.47g/t Au & 28.1% CN Rec | 10.67m @ 11.47g/t Au & 28.1% CN Rec | 7.62m @ 14.53g/t Au & 26.2% CN Rec |

|

DR23-02 | 214.88 | 254.51 | 39.6 | 3.03 | 74.0 | 120.04 | Oxide | 32m @ 3.7g/t Au & 76% CN Rec | 30.48m @ 3.85g/t Au & 77.4% CN Rec | 30.48m @ 3.85g/t Au & 77.4% CN Rec | 1.52m @ 14g/t Au & 15.8% CN Rec |

|

DR23-02 | 260.60 | 262.13 | 1.5 | 0.23 | 64.1 | 0.36 | Oxide |

|

|

|

|

|

DSC23-01 | 215.19 | 216.71 | 1.5 | 0.20 | 99.0 | 0.31 | Oxide |

|

|

|

|

|

DSC23-01 | 256.49 | 268.99 | 12.5 | 1.66 | 22.6 | 20.71 | Sulphide |

| 10.82m @ 1.82g/t Au & 22.6% CN Rec | 1.52m @ 2.17g/t Au & 30.4% CN Rec

3.05m @ 3.72g/t Au & 25.4% CN Rec |

|

|

DSC23-02 | 43.89 | 49.53 | 5.6 | 0.32 | 70.1 | 1.82 | Oxide | 1.52m @ .55g/t Au & 47.3% CN Rec |

|

|

|

|

DSC23-02 | 64.01 | 65.53 | 1.5 | 0.17 | 86.7 | 0.26 | Oxide |

|

|

|

|

|

DSC23-02 | 97.84 | 112.78 | 14.9 | 0.65 | 86.9 | 9.78 | Oxide | 6.25m @ 1.27g/t Au & 85.6% CN Rec | 1.22m @ 4.29g/t Au & 90% CN Rec | 1.22m @ 4.29g/t Au & 90% CN Rec |

|

|

DSC23-02 | 130.15 | 143.10 | 13.0 | 0.30 | 94.5 | 3.85 | Oxide | 1.37m @ .76g/t Au & 99.1% CN Rec |

|

|

|

|

DSC23-02 | 162.31 | 250.39 | 88.1 | 2.50 | 90.8 | 220.20 | Oxide | 69.13m @ 3.14g/t Au & 89.5% CN Rec | 55.17m @ 3.64g/t Au & 90% CN Rec | 30.48m @ 5.69g/t Au & 92.8% CN Rec | 2.13m @ 11.96g/t Au & 88% CN Rec

1.37m @ 13.6g/t Au & 91.5% CN Rec |

|

Criteria: Cut off grade Ox/Tr 0.17g/t Au & Sx 0.50g/t Au, minimum length 1.5m, maximum consecutive internal waste 6m |

Table 3: South Railroad Drill Collars

Hole number | Target | Hole type | Grid | Easting m | Northing m | Elevation m | az_utm | dip | Depth (m) |

DR23-01 | Dark Star | RC | NAD27 / UTM zone 11N | 588164.7 | 4480033.83 | 2009.1 | 270.0 | -75.0 | 292.6 |

DR23-02 | Dark Star | RC | NAD27 / UTM zone 11N | 588140.9 | 4480160.80 | 2024.4 | 270.0 | -75.0 | 262.1 |

DSC23-01 | Dark Star | DD | NAD27 / UTM zone 11N | 588120.3 | 4480264.29 | 2024.6 | 270.0 | -90.0 | 819.3 |

DSC23-02 | Dark Star | DD | NAD27 / UTM zone 11N | 588122.3 | 4480192.28 | 2030.9 | 270.0 | -75.0 | 311.8 |

PC23-01 | Pinion | DD | NAD27 / UTM zone 11N | 585305.1 | 4478648.90 | 2101.5 | 270.0 | -60.0 | 297.5 |

PR23-01 | Pinion | RC | NAD27 / UTM zone 11N | 585215.3 | 4478694.68 | 2088.8 | 90.0 | -75.0 | 265.2 |

PR23-02 | Pinion | RC | NAD27 / UTM zone 11N | 585215.9 | 4478695.21 | 2091.3 | 0.0 | -90.0 | 259.1 |

SOURCE Orla Mining Ltd.

© Canada Newswire, source Canada Newswire English