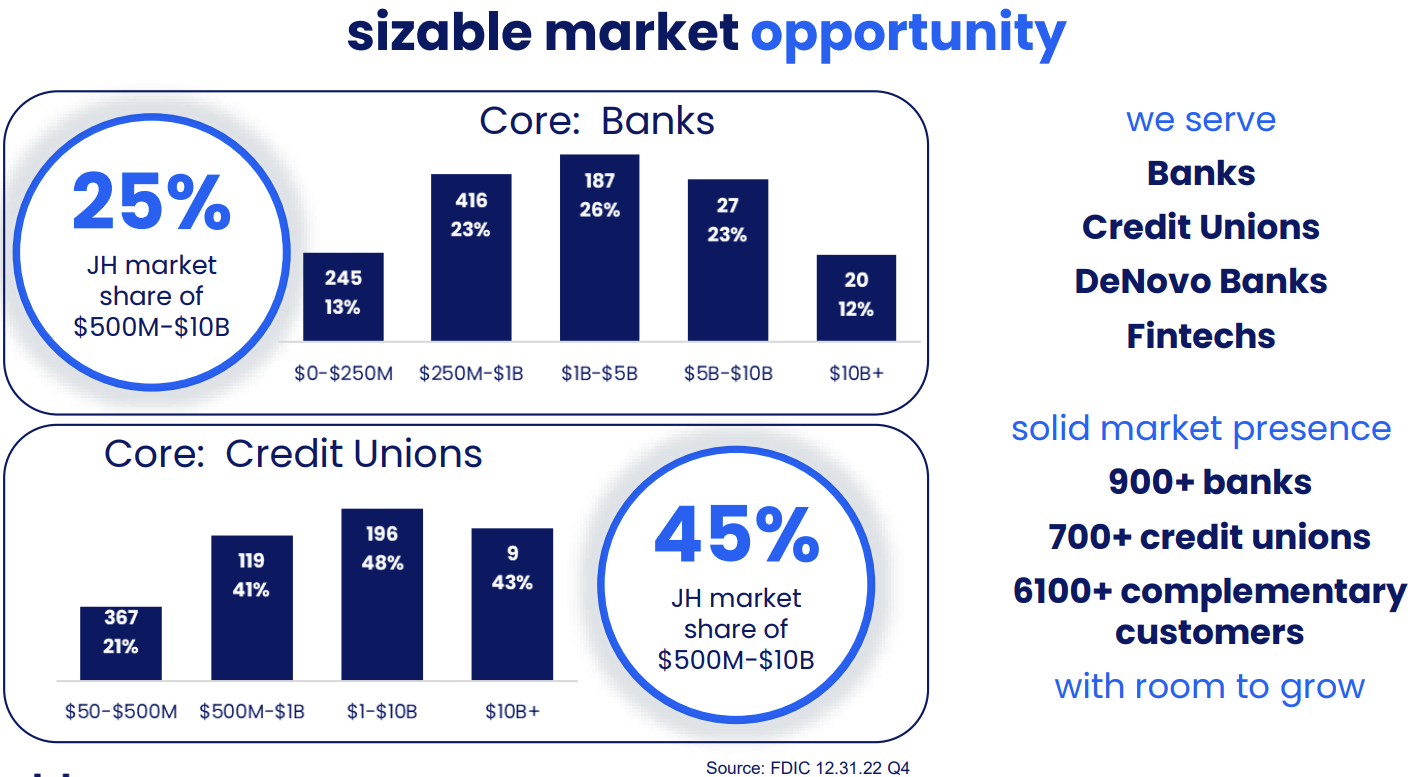

Based in Missouri, this company offers an information and transaction processing platform for the banking and credit industries. The tool enables a wide range of tasks to be carried out, including traditional banking management, account opening, deposit and payment processing, information security, document imaging and much more. This all-in-one solution meets a wide range of customer needs. In fact, they are highly satisfied with Jh&A's services. The annual satisfaction survey conducted by the company shows a rating of 4.74 / 5 for last year.

Well positioned in its market (source: JH&A)

The group's many strengths

The company has a well-stocked and diversified customer base. Its solution is used by more than 7,800 institutions, ranging from small regional banks to large groups with tens of billions in assets, as well as numerous credit unions. JH&A can also adapt its platform to a specific solution to meet the needs of smaller entities. Despite this, the number of customers per se is not a crucial factor, as the sector is subject to a large number of mergers and acquisitions. In fact, the number of customers actually fell last year, even though growth was strong.

JH&A does not really depend on the health of the financial and banking sectors, in the sense that its business does not depend on the volume of transaction flows, nor on the evolution of interest rates and the various vagaries that make these institutions tick. The technology platform is sold on a subscription basis, so that over 90% of revenues are recurring. Growth is therefore largely predictable for the coming years.

Well-calibrated finances

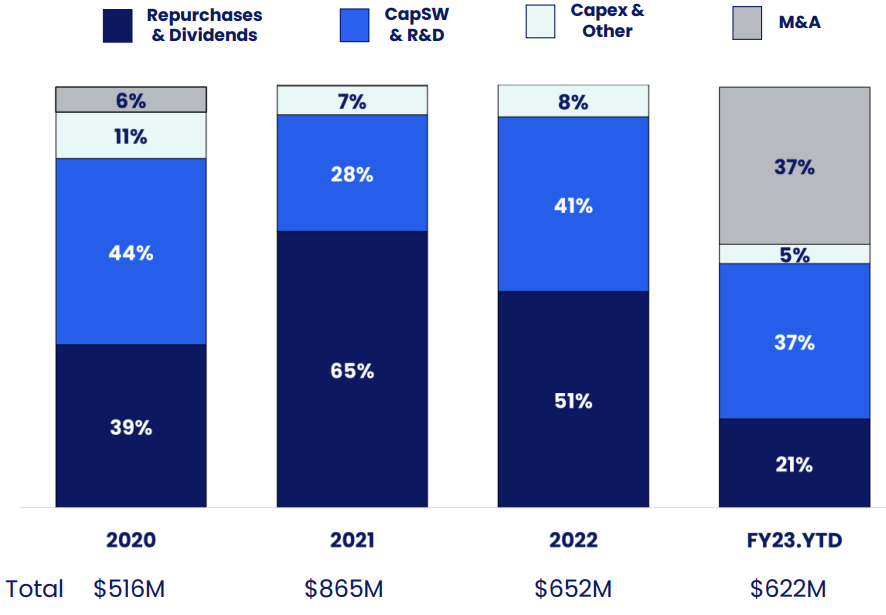

The subscription-based model has enabled steady but rather low growth over the 2013-23 cycle. CAGR stands at 6.2%. All indicators are in the green. Margins generated are solid, with net profitability at around 18%. Admittedly, they are not increasing, which suggests that the company has achieved - at least for the time being - the best it can do. However, earnings per share rose almost linearly over the period. Share buy-backs (16.1% of capital in just 10 years) have played a big part in this. With dividends also rising steadily, the company's policy of returning profits to shareholders is well advanced. The payout ratio is 99%.

JH&A gates its shareholders (source: JH&A)

Despite this payout, JH&A has sufficient liquidity to meet its other cash requirements. Last year, 51% of cash was allocated to shareholders in the form of dividends and share buy-backs, with the remainder used for development costs and R&D (41%) and various growth investments (8%). For the time being, the company intends to focus on acquisitions.

Capital allocation (source: JH&A)

What about valuation?

JH&A has historically commanded a fairly high price. Its positioning in the large fintech segment and its business model give it a fairly high valuation. On a PER basis, the multiple has averaged 33.3 times over the last ten years. For this year, the company anticipates revenue growth in line with previous years, but operating margin is expected to be down by almost 2 points. While the Group regularly exceeds its own and analysts' expectations, we cannot rely on this basis. On the other hand, Fiserv, the main competitor, which is now 8 times bigger than JH&A since its $22 billion takeover of First Data in 2019, has better prospects. At least, in the short term, as its margins should be better oriented by 2024, a sign of the successful integration of First Data. Fiserv is less valued than its smaller competitor, but the debt resulting from the acquisition still leaves investors rather skeptical.

For 2024, JH&A is trading at 32.5 times earnings, and 29 times for 2025. The other ratios are also very high, and no longer seem really consistent with short-term prospects. The Group has all the makings of an excellent growth and quality company, undoubtedly among the best in the sector. Nevertheless, this is no reason to see the stock climb to the top. A pullback would be an excellent opportunity to seize. JH&A is a small-cap ($11.8 billion market capitalization in the USA, that's not very big) to keep a close eye on.

By

By