Introduction

We are pleased to present the latest edition of

- The '

Focus Point ' Explores whether the beneficial concessional rate of 5% would be available after1 July 2023 to interest income earned by non-residents and FIIs/ FPIs. - Under the 'From the Judiciary' section, we provide in brief, the key rulings on important cases, and our take on the same.

-

Our 'Tax Talk' provides key updates on the important tax-related news from

India and across the globe. - Under 'Compliance Calendar', we list down the important due dates with regard to direct tax, transfer pricing and indirect tax in the month.

We hope you find our newsletter useful and we look forward to your feedback.

You can write to us at taxstreet@nexdigm.com. We would be happy to hear your thoughts on what more can we include in our newsletter and incorporate your feedback in our future editions.

Warm regards,

The Nexdigm Team

Concessional withholding of 5% under Section 194LC / LD for FPIs post

The taxability of interest income earned by non-residents (including interest on securities) is governed by Section 115A of the Income-tax Act, 1961 (the Act). Furthermore, Section 115AD of the Act specifically deals with the taxability of income earned on securities by

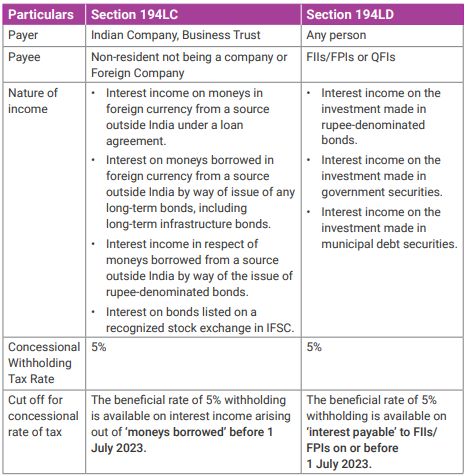

In order to incentivize foreign borrowing, create jobs and stimulate the economy, a concessional rate of tax was introduced in Section 115A and Section 115AD. Corresponding changes for withholding taxes were brought in under Section 194LC and Section 194LD of the Act.

Section 194LC of the Act provides for a concessional rate of Tax Deductible at Source (TDS) at the rate of 5% on certain interest income payable to non-residents, including inter-alia interest on rupee-denominated bonds. Furthermore, the section specifically provides that the concessional rate of TDS shall apply only on interest arising out of moneys borrowed before

Similarly, Section 194LD of the Act provides for a concessional rate of TDS at 5% when FIIs/FPIs earn interest income on rupee-denominated bonds of the Indian company and government securities. Furthermore, this section also specifically states that the concessional rate of 5% would be applicable only for the interest payable to the FIIs/FPIs before

For ease of understanding, both Sections are summarized hereunder:

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

2001

95 Ganpatrao Kadam Marg

400013

Tel: 226730 9000

Fax: 226730 9000

E-mail: jiten.ganatra@nexdigm.com

URL: www.nexdigm.com

© Mondaq Ltd, 2023 - Tel. +44 (0)20 8544 8300 - http://www.mondaq.com, source