|

Friday August 27 | Weekly market update |

| Friday was circled in red on investors' agendas, as US central bank boss Jerome Powell was scheduled to take the microphone at the Jackson Hole symposium. The predictions were right: the central banker confirmed that the reduction of the Fed's asset purchase program has a good chance of starting to be reduced this year, while stressing that this event will not necessarily affect the level of interest rates. Understand: they will remain low and pro-business for as long as possible. The initial market reaction to the announcements was positive. |

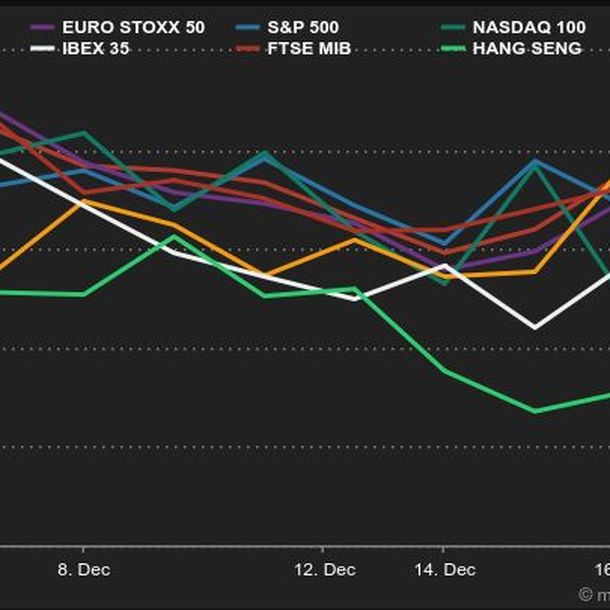

| Indexes Over the past week, in Asia, the Nikkei recovered 2.3%, the Shanghai Composite 2.8% and the Hang Seng 2.2%, after having lost 5.9% over the previous weekly sequence. Once again, Wall Street is on the rise, setting new records. The Dow Jones recorded a weekly performance of 0.9%, the S&P500 gained 1.4% and the Nasdaq100 2%. In the euro zone, the CAC40 gained 0.7%, with the trend still weighed down by health and defensive stocks. The Dax rose 0.2% while the Footsie gained 0.8%. For the peripheral countries of the euro zone, Italy lost 0.15%, Portugal 0.6% and Spain 0.7%. New records on Wall Street  |

| Commodities Oil prices are once again hovering around the USD 70 per barrel mark. Operators are always on the lookout for the slightest data that could allow them to adjust their forecast on the evolution of demand, which has recently been undermined by the new epidemic wave. At the same time, investors were scrutinizing the path of the tropical storm in the Gulf of Mexico, which could have an impact on U.S. production if oil rigs are shut down. Gold continues its long stabilization sequence around USD 1800. Silver, platinum and palladium are not much better and are trading near their lowest levels of the year. In the industrial metals segment, supply difficulties from the large mines in Chile are supporting copper prices, which are now trading at USD 9,300. Finally, more optimistic forecasts for wheat production in Russia are easing the wheat market, with prices in Chicago up nearly 35% year-over-year. |

| Equity markets A big name in British retailing bounces back After years of difficulties, British retailer Marks & Spencer is making a comeback. Its turnaround plan is starting to bear fruit after more than a year of restrictions due to the pandemic. It just posted better-than-expected results, including strong online sales. In the 19 weeks prior to August 14, revenues from its clothing and home division jumped 92.2% year-on-year and declined by only 2.6% from levels recorded before the pandemic. Revenue from food grew 10.8% compared to the same period in 2020 and 9.6% compared to 2019, supported by cost reductions implemented to counter inflation and supply chain disruptions. Since posting these strong results, the share price shot up from GBp 142 to GBp 178 today. As part of its restructuration plan, Marks & Spencer closed underperforming stores, announced the elimination of 7,000 jobs in August 2020 and focused on online sales. The group raised its full year guidance for fiscal year ending in March 2022. It estimates that its adjusted pre-tax profit will be higher than the previously targeted range of £300 million to £350 million. Marks & Spencer  |

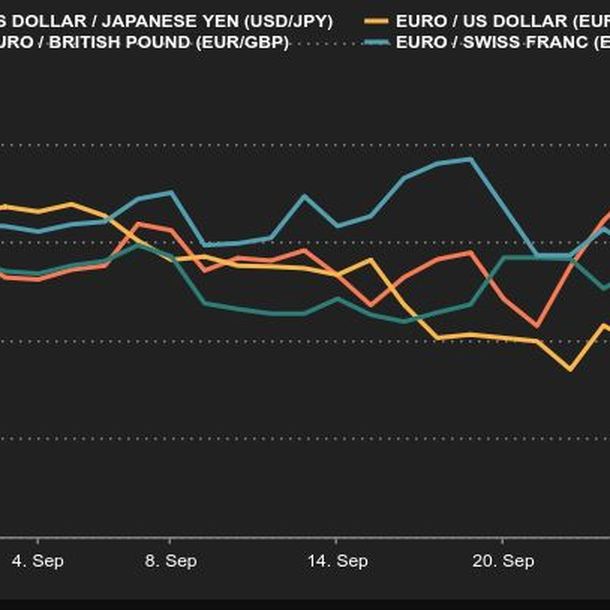

| Macroeconomics The week started with August Flash PMI indicators, always closely watched by investors as they are good markers of future economic momentum. Purchasing managers are still very optimistic, even if some inflexions appeared compared to expectations, positioned at a high level. German data disappointed somewhat. Durable goods orders in the United States, on the other hand, remained dynamic, while core inflation supported by households remained in line with expectations (+0.3%), with however a clear acceleration of income (+1.1%). In the sovereign debt market, yields recovered slightly from the previous week, with the US T-Bond at 1.33% over 10 years and the Bund at -0.42%. The French OAT also recovered but remains in negative territory (-0.06%). The Dutch (-0.18%) and Swiss (-0.38%) signatures are better anchored below zero, while at the other end of the spectrum, the Greek 10-year (0.68%) is back above the Italian 10-year (0.65%). In the foreign exchange market, the euro recovered a little against the dollar until Friday, climbing back to USD 1.1765, then towards USD 1.18 after Powell's speech. The single currency lost ground against the Scandinavian currencies (SEK, NOK) and the Australian dollar (AUD). The franc had a complicated week with the publication of the Credit Suisse confidence index, which corrected heavily in August. It went from CHF 1.0715 at the beginning of the week to CHF 1.079 for 1 EUR in four sessions. The dollar drops against the euro this week  |

| Markets left in a state of limbo Markets held their breath until the last moment this week; a few quiet sessions before the Fed Chairman's speech this Friday afternoon. The result of all this is that markets are now in a state of limbo. Equity markets can stay in their comfort zone for a while longer. In his announcements, Jerome Powell confirmed what many traders assumed, namely that tapering could happen as early as this year, but he was reassuring about rate hikes, which should happen later. |

By

By