The centerpiece of its services is CLEAR Plus, a subscription offering that accelerates the airport security experience. Beyond just airport settings, Clear Secure operates 147 CLEAR Plus lanes across 56 U.S. airports, partners with 19 sports and entertainment venues for priority lanes and offers virtual queuing in 20 global airports via its RESERVE service, backed by a network of B2B CLEAR Verified partners. It also extends its capabilities to businesses through CLEAR Verified, which includes identity verification, virtual queuing, and credential validation tools. Additionally, the company provides a free consumer app that offers functionalities such as health documentation sharing and virtual line management.

CLEAR Plus, the consumer aviation subscription service, is the most utilized component of Clear Secure's platform, followed by its business partners, marking roughly 181 million total cumulative uses supported by 3,700 ambassadors and field managers focused on hospitality and security.

It also prioritizes acquisitions to maintain its market and technological leadership. For example, in the 2023 fiscal year, it acquired SORA ID, a company offering one-click know your customer (KYC) solutions, and Whyline, a company specializing in virtual queuing technology that helps customers manage lines. Additionally, in 2021, it purchased Atlas Certified, which automates the verification of professional licenses and certifications across various industries.

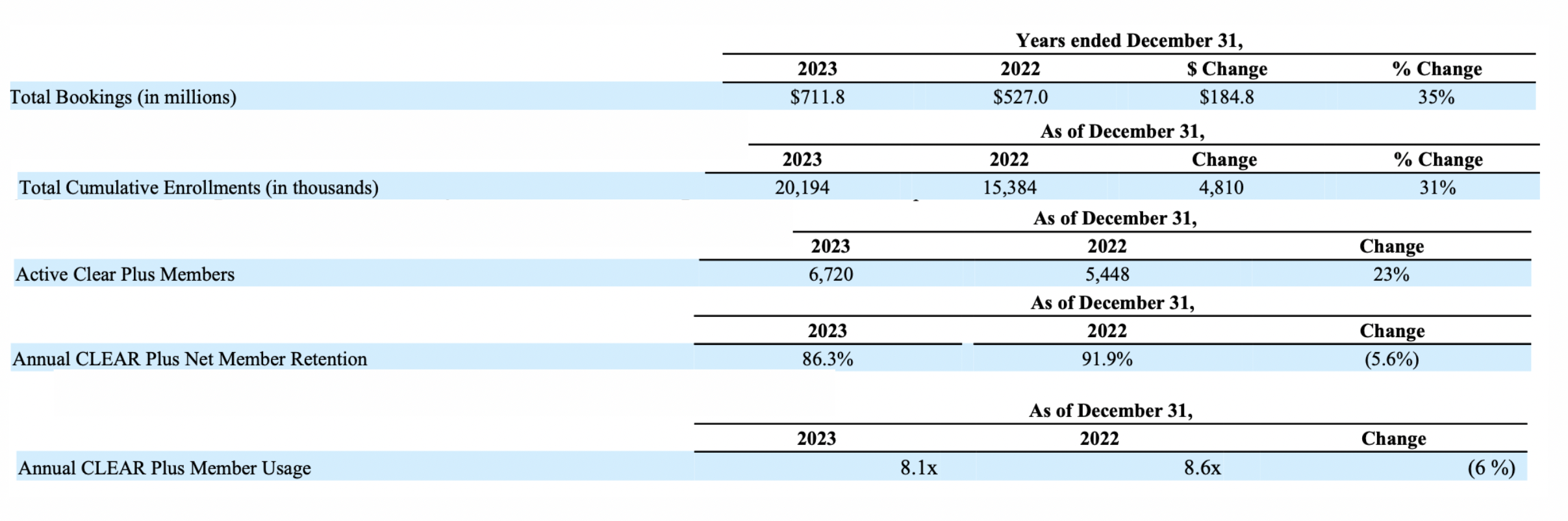

To evaluate the company’s performance, we have to take a closer look to certain key measures such as the Total Bookings (sales to new and renewing CLEAR PLUS subscribers plus any accrued billings to partners), Total Cumulative Enrollments, Total Cumulative Platform Uses, Annual CLEAR Plus Net Member Retention (total ca, Active CLEAR Plus Members, and Annual CLEAR Plus Member Usage.

The data in the table above indicates a successful year for Clear. The post-COVID pandemic recovery and a more favorable economy have contributed positively. Total Bookings rose by 35% from $527 million to $711.8 million, while Total Cumulative Enrollments (TCE) increased by 31% from 15,384 to 20,194. Additionally, the number of active Clear Plus Members has grown, and the annual Clear Plus net member retention rate has dropped, which is positive as it suggests that users appreciate the app's features and associated benefits.

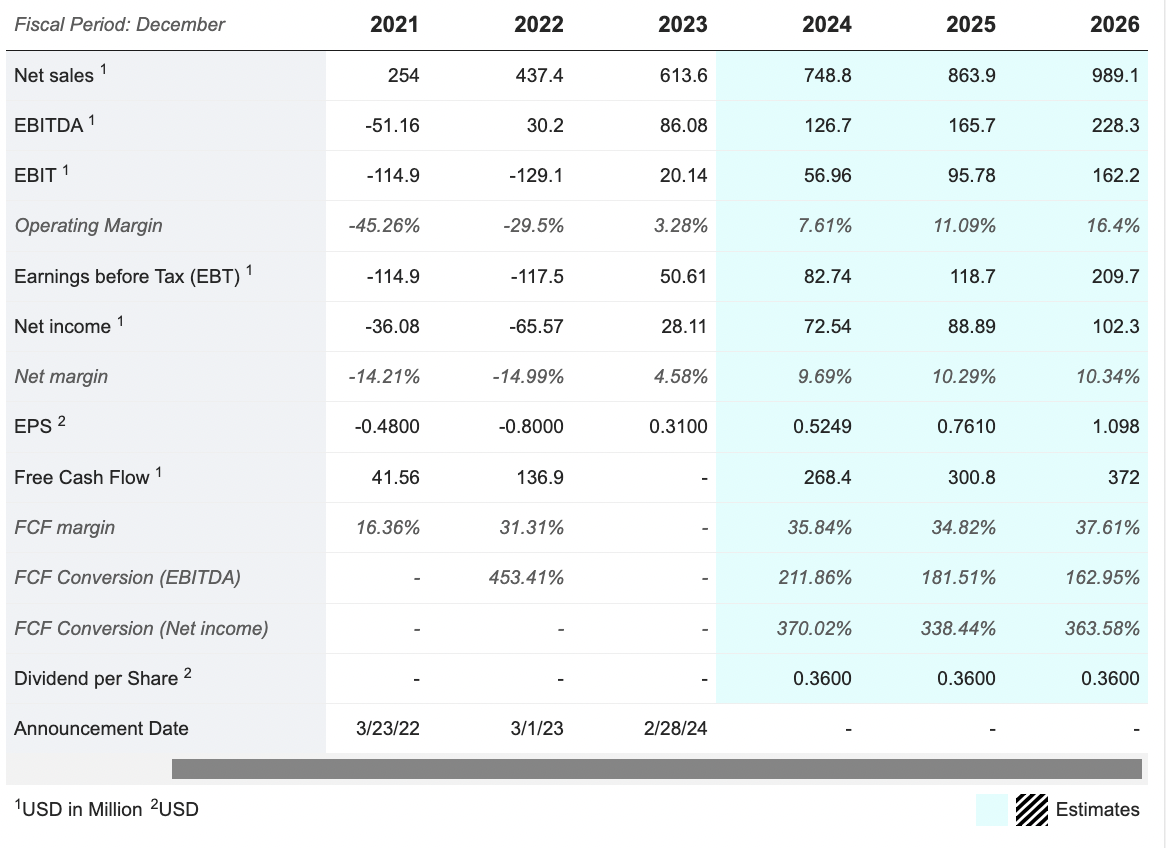

Clear Secure reported a solid financial performance, with a 40% increase in revenues from $437 million in 2022 to $613 million in 2023. Operating margins increased significantly, by more than 1,300 basis points, leading to an operating cash flow of $225 million and free cash flow of $200 million (+46% YoY). Cash and cash equivalents stood at $728 million, even after the company allocated a considerable portion of capital to shareholder returns through share repurchases, regular and special dividends (approximately $209 million).

EBITDA soared by 186% from $30 million to $86 million, and future forecasts are optimistic. By 2026, projections include net sales of $989 million, EBITDA of $228 million, and a net income of $102 million. These figures represent annual growth rates (CAGR) of 12.7% for net sales, 27.6% for EBITDA, and 38% for net income. Additionally, the operating margin is expected to grow from 3.28% to 16.4%, and the net margin is anticipated to increase from 4.58% to 10.34%.

Clear faces challenges, including security risks. For instance, in August 2023, CBS reported that TSA plans to require CLEAR Plus users to show an ID at airports because of security concerns. Despite the software and services sector's rapid growth expected through 2025, Clear competes with major players like Telos Identity, Idemia Identity & Security, Avigilon, AxxonSoft, BOSCH Security Systems, and Honeywell International.

Clear Secure appears well-positioned for future growth, but expectations from analysts and consensus are high, and any errors will be severely penalized. With a P/E ratio of approximately 66.6, there's little margin for error. The company must also address security concerns that could threaten its core operations. It's worth keeping an eye on the company and monitoring its future projections.

By

By