|

Friday November 5 | Weekly market update |

| All the stars aligned this week to propel indexes to new highs: good corporate results, accommodating comments from the Federal Reserve and robust macroeconomic data, confirmed this Friday by the US employment figures. As the end of the year approaches, the rally already seems to be underway, as risk appetite has never been strong in equities. |

| Indexes Over the past week, in Asia, the Nikkei gained 2.5%, the Shanghai Composite 0.3% while the Hang Seng went it alone and lost another 2.1%. In Europe, green is clearly dominant. The CAC 40 gained 3.3%, the Dax 2.4% and the Footsie 1.2%. For the peripheral countries of the euro zone, Italy climbed 3.6%, Spain by 1.1% while Portugal lost 1.4%. In the US, risk appetite remains intact. At the time of writing, the Nasdaq 100 recorded a weekly performance of 3.5%, the Dow Jones gained 1.6% and the S&P 500 2.3%. |

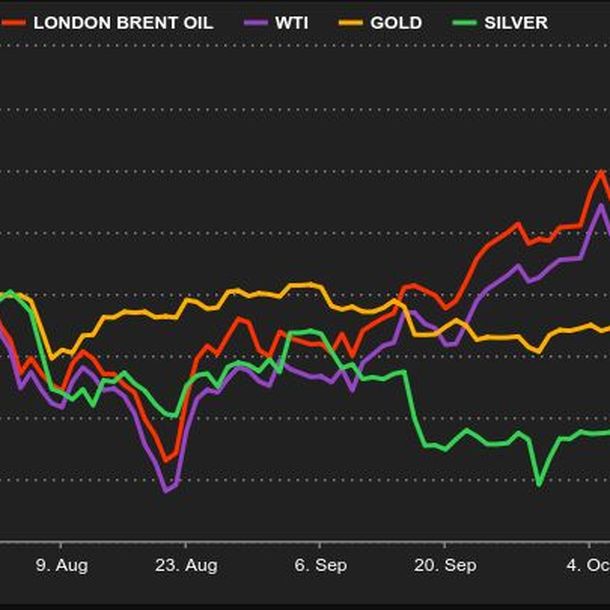

| Commodities The expanded cartel met this week and decided to stick to their roadmap of continuing to gradually increase their production. The twenty-three producers meeting by videoconference therefore chose to limit the increase in production to 400,000 barrels per day from December, despite the insistence of the Biden administration that called for a much larger gesture to temper energy price inflation. Nevertheless, the US is considering tapping into its strategic reserves to weigh on prices. As a result, prices retreated this week, with Brent trading at USD 81.3 and WTI at USD 79.8. Gold is once again hitting a wall, the USD 1,800 mark, which has so far blocked buying assaults. The barbarian relic is back on a bullish trajectory despite the rising dollar and the good job creation figures in the US. Silver is also regaining some height at USD 23.80 per ounce. As for base metals, weekly developments are rather mixed, as the rigor of the greenback has weighed on the compartment. As proof of this, aluminum fell to USD 2,640, copper stabilized at USD 9,700, as did nickel at USD 1,500. In agricultural commodities, grain prices are consolidating but remain at high levels, due to a depressed supply caused by difficult weather and relatively low stocks.  |

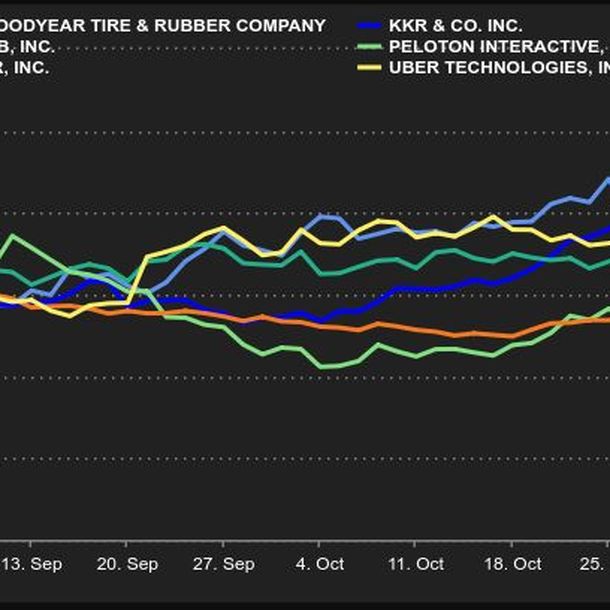

| Equity markets Pfizer announced very positive first results of its anti-Covid pill against severe forms of the disease. It is the second treatment of this type to demonstrate high efficacy after Merck's. In adults at high risk of developing a severe form of the disease, Pfizer's pill was 89% effective in preventing the risk of hospitalization or death, according to interim results of clinical trials. Antivirals work by decreasing a virus' ability to replicate itself, thereby slowing the disease. Easy to administer because they can be taken at home, these treatments are a complement to vaccines to protect against Covid-19. Uber Technologies signed its first profitable quarter and revealed a 72% year-on-year increase in revenues, driven in particular by the food delivery service. The adjusted Ebitda is indeed at 8 million dollars. However, the carrier's stake in its competitor Didi Global weighed on its performance. Peloton Interactive is taking a hit as people return to fitness centers. The stock of the home bike and treadmill specialist fell by more than 30% in Friday's trading. While its sales and subscriber growth are losing momentum, the fitness equipment maker is lowering its annual revenue and new customer targets. Several analysts have lowered their recommendations. Airbnb: a record year. The platform for renting accommodation between individuals has signed the best quarter in its history by generating a net profit of 834 million dollars, a jump of 280% over one year and 213% in two years. The turnover jumped to 2.23 billion dollars, an increase of 67% in one year and 36% in two years. A sign that tourism is picking up strongly, the platform now has a higher activity than before the coronavirus pandemic. For the end of the year, the giant on the other side of the Atlantic is aiming for a turnover of between 1.39 and 1.48 billion dollars, which would represent the largest increase compared to either 2020 or 2019. Is KKR the savior of Telecom Italia? The private equity group is considering investing more in Italy's largest telecom group as it comes under pressure from its largest shareholder Vivendi, among others. After a reduction in free cash flow forecasts and with a net debt of 22 billion euros, shareholders' concerns are being pushed to the limit. The CEO of the Italian group is reportedly in discussion with potential investors, including KKR, already present in the capital since 2020, to find solutions to improve the situation of the Italian company. Goodyear on the move. The tire manufacturer presented stronger-than-expected accounts. Net income rose to $132 million (46 cents per share) in the third quarter from a net loss of $2 million (1 cent per share) last year, and revenue jumped 42% to $4.9 billion in the same period, thanks in part to the merger with Cooper Tire. Year-to-date net income is up to $211 million, giving the company a boost.  |

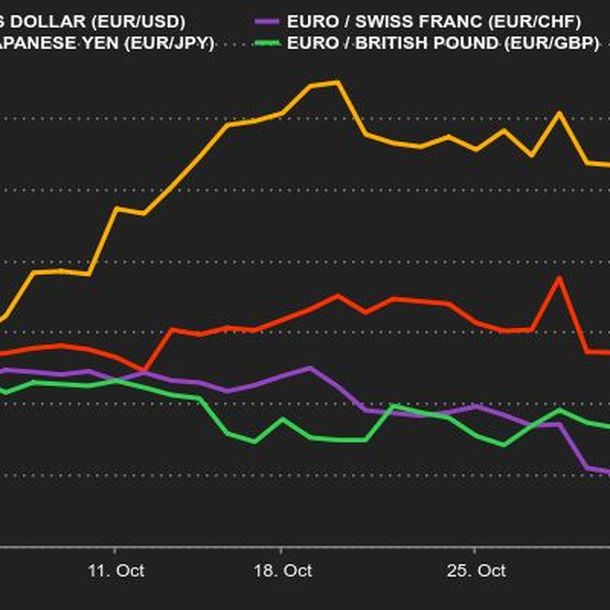

| Macroeconomics Several central bank interventions were expected this week. Caught in the grip of inflationary pressures, the institution chaired by Jerome Powell announced on Wednesday that it would reduce its asset purchase program by 15 billion per month. The goal is to end this program by December 2022. Nevertheless, the FED said it is ready to "adjust" this pace according to the evolution of the economy. It also decided not to raise interest rates - currently between 0 and 0.25%. On the ECB side, Christine Lagarde wants to maintain the provision of unwavering support to European economies that are facing a more fragile recovery. She also stated that an interest rate hike in 2022 is "very unlikely". More surprisingly, the Bank of England has decided to keep its monetary policy unchanged. Andrew Bailey prefers to wait for a more marked evolution of the labor market despite an inflation that could be around 5% next year. On the bond market, as most of the central banks' announcements have been known for a long time, there is little movement to report. The 10-year debt rate in the United States fell by 2.3% to 1.52%. Germany's and France's rates are respectively -0.24% and 0.1% for the same duration. Only Switzerland is subject to a more violent movement in the interest rate on its 10-year government debt. Over the week, the interest rate rose by +2900% to reach -0.18% on Friday evening. In the foreign exchange market, the euro lost some color on the week, giving up a few cents to the dollar. It now takes USD 1.1540 for 1 EUR. The EUR/CHF pair is trading at CHF 1.0560. Other than that, there is little to report this week in Forex. There are many important indicators to watch next week. The US Core Producer Price Index will be released on Tuesday. We will also see the ZEW indicator for the Eurozone. Then the CPI (October) will be released on Wednesday, allowing us to follow the evolution of inflation in the US.  |

| Not scared anymore! While central banks are starting to reduce their asset purchases in small steps, the main indices of the stock market planet do not seem to be disturbed by these announcements, which seem to have already been made. Several of them, such as the S&P 500, the Stoxx Europe 600 and the CAC 40, have taken advantage of the situation to set new all-time records. The bullish acceleration continues at the end of the week following the announcement of the effectiveness of the anti-Covid pill from Pfizer. Traders still seem to be in risk-on mode in the markets and cyclical stocks are benefiting. Next week, the US Producer Price Index will be released on Tuesday at 2:30 pm and the Consumer Price Index on Wednesday at 2:30 pm along with the new weekly jobless claims indicator. |

By

By