|

Friday October 8 | Weekly market update |

| Financial markets were once again volatile this week, as bond yields, the main driver of central bank monetary policy expectations, changed. Inflationary pressures remain in the background, with the surge in commodity prices, but also the Chinese economic slowdown which could weigh on the global economic outlook. This phase of volatility is expected to continue with the start of the quarterly earnings season next week and US inflation data. |

| Indexes In Asia, performances were mixed. The Nikkei is down 2.5% over the last five sessions while the Hang Seng is up 1%. The Shanghai Composite, meanwhile, recovered 0.67% on Friday, after a week of closure due to the Chinese New Year. In Europe, indices showed volatility but green dominates. The CAC40 recorded a weekly performance of 1.1%, the Dax gained 0.6% and the Footsie 1%. For the peripheral countries of the euro zone, Italy recovered 1.8%, Spain and Portugal gained 0.7%. In the United States, at the time of writing, the Dow Jones climbed 1.3% over the week, the S&P500 rose 1% and the Nasdaq100 0.7%. |

| Commodities The new increase in US inventories has not stopped the upward march of oil prices, which are at their highest level this year thanks to OPEC+, which kept its production control policy unchanged. The European energy crisis, which has a drastic shortage of gas for the coming winter, is also contributing to this upturn in oil prices. Brent crude is trading at around USD 82 per barrel, compared with USD 79 for the US benchmark, WTI. As for precious metals, investors are still navigating with their eyes open. After all, they have reason to wonder about its characteristics. Safe-haven, inflation hedge, nothing seems to be enough to bring the barbarian relic back into a bullish momentum. Gold is trading lower this week, around USD 1755 per ounce. Silver has been treading water, literally, as prices have remained narrow, moving between USD 22.4 and USD 22.6 over the past five days. Industrial metals overall had a positive week and are rebounding despite signs of a slowdown in the Chinese manufacturing sector. Supply disruptions have pushed the latter into the background, as evidenced by the gains in copper (USD 9177), aluminum (USD 2916) and nickel (USD 18240). The oil pair is rising  |

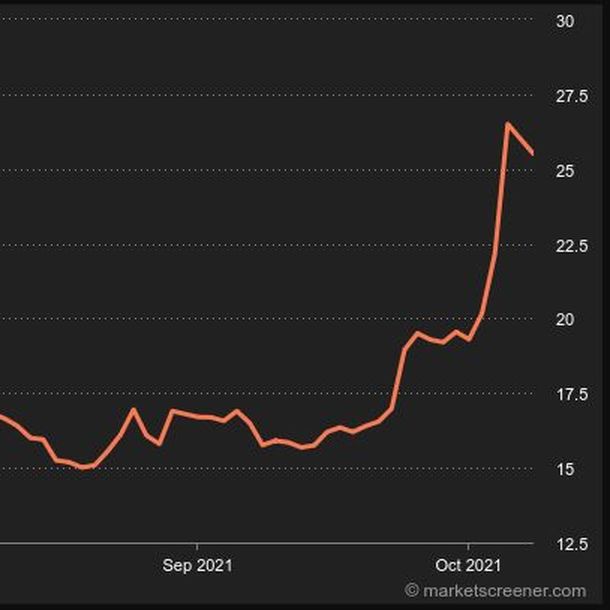

| Equity markets Hertz Global Holdings has rallied this week, gaining more than 34%, after the announcement of a new interim CEO for the company, the former chief of Ford Motor, Mark Fields. It is also benefitting from a good trend around the whole rental car market, which is considered healthy by investors, with good growth prospects, as the wave of New Covid-19 infections started to subside in the US. The global chip shortage is also supporting rental-car pricing, and these shortages are expected to last well into 2022. The nomination of Mark Fields is seen as a fresh start, after the company announced in May an agreement on a $6 billion plan to get the car rental company out of Chapter 11 bankruptcy, where it had filed in May 2020. Knighthead Capital Management, Certares Opportunities and Apollo Capital Management funds agreed to recapitalize Hertz. It also had the support of individual investors active on social networks, who bet on a rescue of Hertz when it was badly battered by the coronavirus crisis. Hertz is currently valued at $12 billion, and its net corporate debt reaches around $3 billion, excluding debt backed by its fleet of vehicles. New CEO, new hope  |

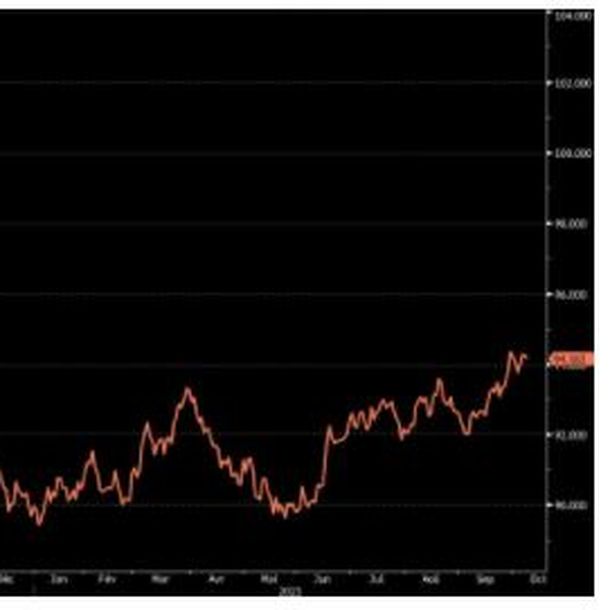

| Macroeconomics This week, there was clearly a mid-week tipping point on financial markets. On Monday and Tuesday, investors were still crushed under a pile of uncertainty made of inflation, energy prices, supply chain disruption, the end of central bank support programs, the U.S. debt ceiling, and fragile growth in China. As of Wednesday, two events helped lighten the mood a bit. Vladimir Putin helped deflate the gas price spike by declaring that Russia was in a position to strengthen its supply to Europe. And Mitch McConnell, the Republican senator, rallied enough of his peers to push back the issue of renegotiating the federal debt limit to December. This has given investors some breathing space, as they keep their foot on the brake. Risk aversion is present, as evidenced by the strength of the dollar, which is trading at around EUR 1.1555, at its best levels of the year and at its highest since the summer of 2020. Oil's bullish momentum is benefiting commodity-related currencies such as the Australian and Canadian dollars. The Australian currency is trading at EUR 0.63122 to AUD 1. Bond yields have resumed their ascent. The T-Bond and the 10-year Bund are at 1.59 and -0.15% respectively, compared to 1.5% and -0.22% a week ago. The upward movement, which accompanies higher inflationary expectations, brings the yield on Dutch debt close to equilibrium (-0.03%), while the French OAT flirts with 0.2%, a first since June. The U.S. economy created the fewest jobs in nine months in September amid worker shortages. Nonfarm payrolls gained 194 000 jobs last month, compared with 500,000 expected in a Reuters poll. U.S. sept. unemployment rate fell to 4.8%, vs 5.2% expected. Next week, there are three appointments with US economic indicators in September, and not the least: inflation on Wednesday, producer prices on Thursday and retail sales on Friday. It is hard to see what could derail the Fed's desire to start dismantling its support plan this year. The statistical triplet could confirm this scenario. Dollar Index rises to one-year highs  |

| Nervousness before the start of earnings season A hectic week for the world indices in Europe and Asia while the US stock markets are rising at a slow pace. Next week, the quarterly results reports begin with US banks. We will have to wait until Wednesday to get the figures for the consumer price index (CPI) in the United States and listen to the FOMC's conclusions that same evening. The day after this announcement, producer prices (PPI) will be published. A busy week ahead... |

By

By