|

|

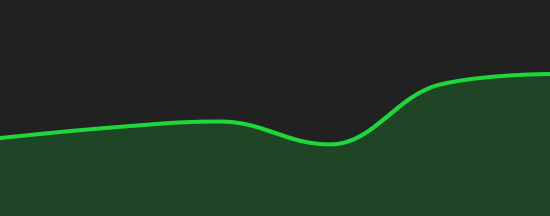

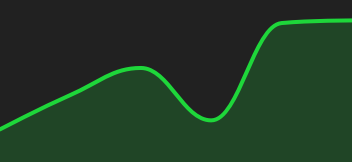

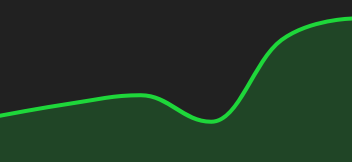

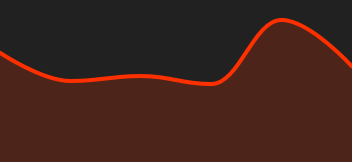

| This week's gainers and losers |

Gainers:

Losers:

|

|

| Commodities |

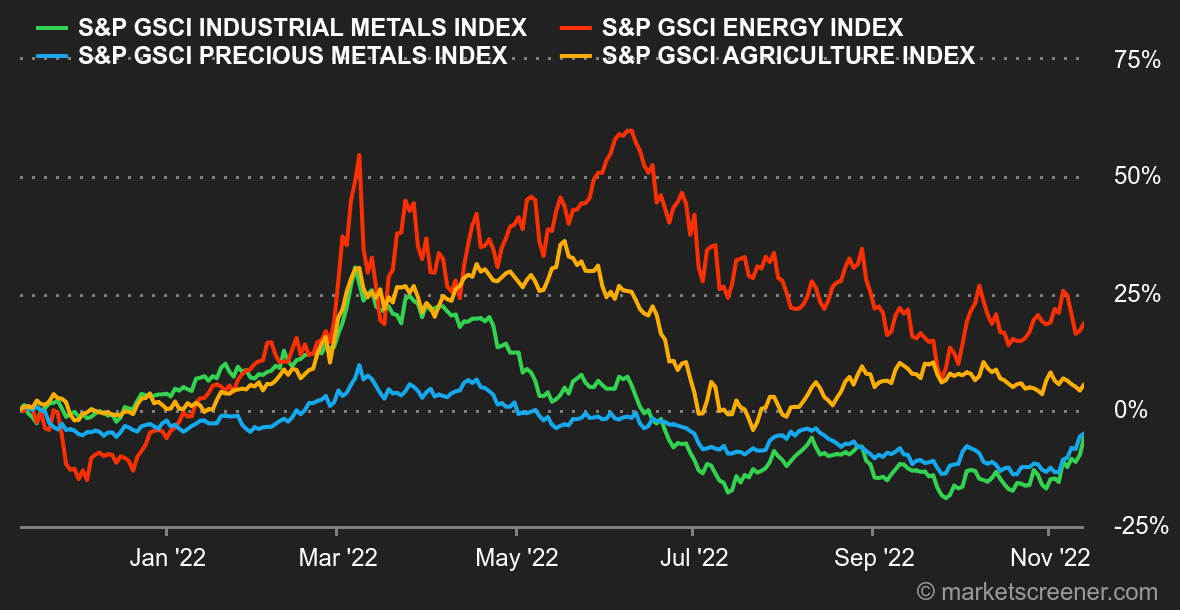

| Energy: The prices of the barrel marked a pause, penalized at the beginning of the week by the reversal of the situation in China, where authorities wish to maintain their zero-Covid policy. The market was instead hoping for a relaxation of this health policy, which would be synonymous with a growing opening of the Chinese economy and ultimately an increase in oil demand. China alone accounts for almost half of the expected growth in demand for 2023. In the United States, diesel prices continue to rise, driven by strong demand and historically low inventories. This dynamic is clearly putting pressure on the White House, which is already doing everything it can to curb the rise in energy prices. North Sea Brent is trading around USD 96 while US WTI is trading at USD 89 per barrel. In Europe, mild temperatures on the old continent are delaying the start of the heating season, allowing states to continue building up their gas stocks. The European benchmark, Dutch TTF, is trading at around 120 EUR/MWh. Metals: Despite mixed economic data from Beijing, base metal prices rose this week. Metal inventories remain low overall, prompting producers to charge higher premiums to their customers who want quick physical deliveries. In terms of prices, copper is trading at USD 8060 per metric ton, aluminum at USD 2270 and nickel at USD 24400. Gold recorded another weekly bullish streak as it broke through the USD 1,700 per ounce mark. Agricultural products: The French Ministry of Agriculture revised downwards its corn production estimate from 11.4 to 11 million tons. This downward revision is obviously linked to the numerous drought episodes that have undermined yields. In the U.S., the U.S. Department of Agriculture raised its corn and soybean production estimates, but only modestly. Wheat and corn are trading at 810 and 660 cents per bushel respectively. |

|

| Macroeconomics |

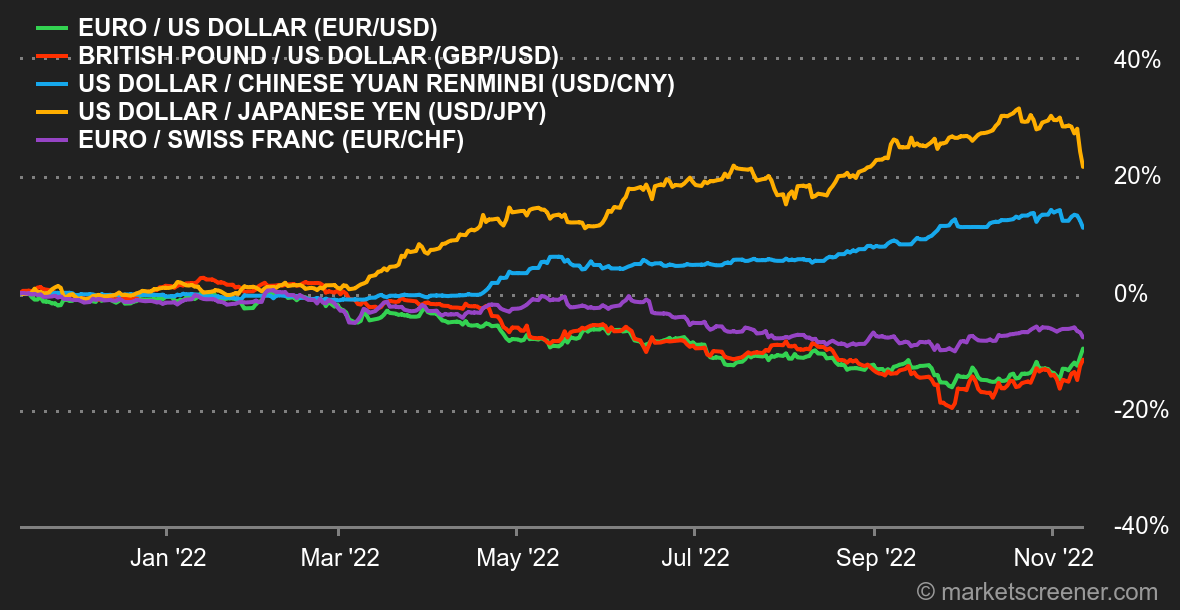

| Atmosphere: Habemus Pivotam. They have been waiting for this for a long time! Investors were desperate for a signal that would push the US central bank to moderate its restrictive monetary policy. They finally got it on Thursday, in the form of still strong annual inflation, but lower than feared. This statistic is the mother of all the gearing movements that took place this week, which we will detail a bit below. The annual price increase remains strong (7.7%) and the battle is probably not yet won, but this is the fourth consecutive month of moderating inflation, which mechanically brings the time when the Fed will no longer have to play whipping father closer. Finally, all things being equal. Interest rates: The continued moderation of inflation has caused 10-year bond yields in the United States to plunge. They went from roughly 4.1% before the announcement to 3.8% after. The yield curve remains inverted: 3- and 6-month maturities and 2- and 5-year maturities continue to pay better than 10-year maturities, but this is quite logical as the market has received confirmation that the economy may be stalling. In Europe, the trend is also easing, despite the confirmation of still rampant inflation in Germany in October (11.6%). Over 10 years, the Bund yields 2.05%, the OAT 2.56% and Gilts 3.33%. This is about 20 points lower than last week. Italian debt has fallen from 4.44% to 4.04% in a few days. Currencies: The third major consequence is that the prospect of the Fed easing its rate hike cycle has caused the greenback to fall. The dollar index lost nearly 2% in Thursday's session alone, a rare change in the index that had not been seen since 2010. The euro was able to recover to USD 1.0263, its best level since mid-August. But the dollar was not the most attacked currency of the week. It was the Brazilian real that bore the brunt of the new president's statements. Lula questioned the principle of spending limits in the constitution. The euro rose to BRL 5.5028 and the dollar to BRL 5.3705. The yen also took advantage of the dollar's weakness to return to just below JPY140 per USD for the first time since September. Cryptocurrencies: This was a difficult week for digital currencies. In the wake of the collapse of the FTX platform, the second largest platform in terms of trading volume, the entire cryptocurrency market has shed $180 billion as of this writing. In the general panic, bitcoin has fallen by 20% since Monday and is now back around $16,500. A level it had not revisited since late 2020. We do not yet know all the collateral damage that will cause the bankruptcy of FTX, but this event will leave a mark in the history of crypto-currencies. In the meantime, crypto-investors are seeing their digital windfall melt away like snow in the sun... Calendar: Next week, U.S. statistics will remain at the center of the game. There will be producer prices and the Empire State index (Tuesday) and then retail sales on Wednesday. A G20 is scheduled for November 15-16 without Vladimir Putin, who will not enjoy the delights of Bali with the other top world leaders. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By