For those of you who were on vacation last week, I'd like to remind you that equity indexes remains well oriented, despite the Nasdaq's sluggish performance at the end of the week. On the Old Continent, equity indexes are not far from their all-time highs. That's when they haven't simply broken their record, like the CAC40 GR (the version of the CAC40 with dividends reinvested), which reached a new closing high of 22421 points on Friday.

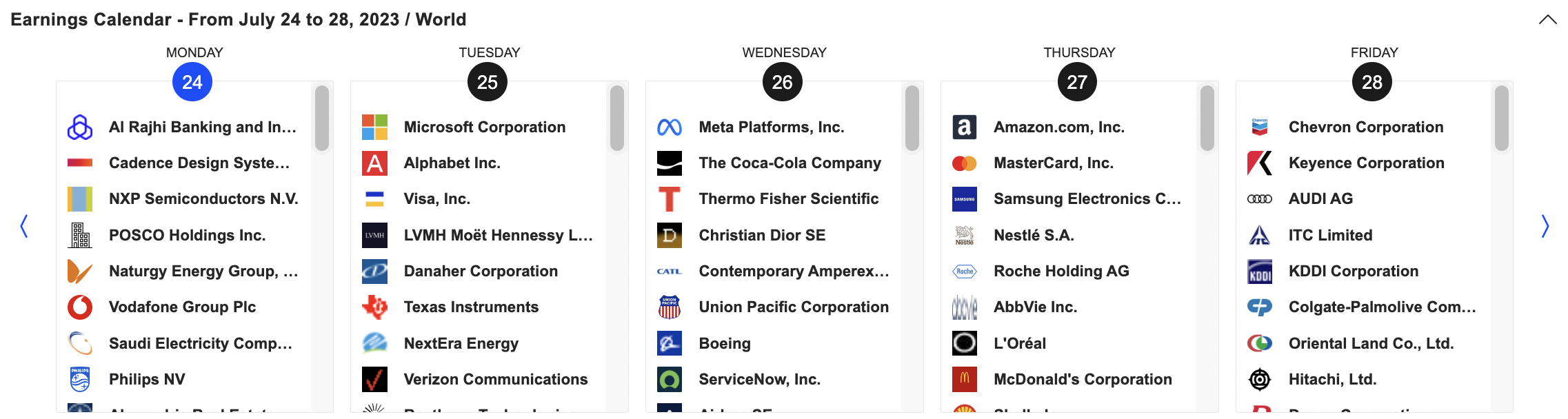

This time of year is traditionally very busy for the stock market world. The next few sessions will feature several hundred corporate results, which means a very concentrated window of opportunity. To give you a taste of what's to come, here's a list of upcoming releases, limited to the largest market capitalizations (> $50 billion): Microsoft, Alphabet, Amazon, Meta Platforms, Chevron Corporation, Visa, The Coca-Cola Company, Mastercard, Boeing in the US, and LVMH, TotalEnergies, Unilever, Nestlé, Airbus and Roche in Europe. You can access the full list from our super tool dedicated to corporate financial diaries.

This week's corporate earnings releases

On the macroeconomic front, the market has a date with three central banks. Firstly, on Wednesday, the Federal Reserve is expected to raise rates by 25 basis points, within a range of 5.25% to 5.50%. As CME's FedWatch tool demonstrates, there's no suspense: the probability of such a hike is practically 100%. The next day, it's the European Central Bank's turn to take the stage. Here too, a further monetary tightening is expected, again by 25 basis points, taking the refinancing rate to 4.25%. Finally, the Bank of Japan will take center stage on Friday. Even if inflation exceeds the institution's targets, the BOJ is likely to leave rates at the floor.

The final section is the economic statistics. Several of them are circled in red this week, starting with the manufacturing and services PMIs today for the eurozone and the United States. On Thursday, we'll take a look at second-quarter US GDP figures, before ending the week with a bang on Friday with US PCE inflation.

Among the lessons learned, I have retained three:

- Predicted loser in Spain's parliamentary elections, the Socialist Party finally puts up a fight.

- Russia targets port infrastructure in Ukraine. Last night, a drone attack hit Moscow.

- The G20 energy ministers failed to agree on a timetable for gradually reducing the use of fossil fuels.

In Asia this morning, markets were in the red, except in Tokyo, where the Nikkei 225 gained 1.23% at the end of the day. The ASX 200 is down slightly, while Chinese indices are contracting more sharply, by around 2% for the Hang Seng and 0.50% for the CSI 300.

Today's economic highlights:

July's leading PMI indices will be published throughout the day. You can find the full macro agenda here.

The dollar trades around 0.9015 EUR and 0.7790 GBP, while the ounce of gold remains unchanged at 1967 USD. Oil gains ground, with North Sea Brent at USD 81.44 a barrel and US light crude WTI at USD 77.69. US debt posted a 10-year yield of 3.8%. Bitcoin is trading at 29200 USD.

In corporate news:

- American Express: Piper Sandler downgrades to underweight from overweight. PT decreases 12% to $149.

- BancFirst: Piper Sandler raised the target to $82 from $73. Maintains underweight rating.

- Charles Schwab: Piper Sandle maintains overweight rating. Price target up 29% to $86.

- Comerica: Argus Research maintains buy rating. PT up 26% to $64.

- D.R Horton: Raymond James raised the recommendation to outperform from market perform. PT set to $160.

- FMC: Wells Fargo Securities cut the recommendation to equal-weight from overweight. PT set to $102.

- Omnicom Group: Wells Fargo Securities downgrades to equal-weight from overweight. Price target set to $88.

- Roper Technologies: Argus Research raised the target to $550 from $490. Maintains buy rating.

- Tesla: UBS cut the recommendation to neutral from buy. PT set to $270.

- Wintrust Financial: Truist Securities maintains buy rating. Price target upgrades 11% to $92.

By

By