What's the economic situation in the United States?

In macro-economic terms, the US economy was fairly resilient in the first half of the year, with growth of 2% in Q1, and early indicators suggesting that it will also be around 2% in Q2. The good surprise came mainly from the residential real estate market, as house prices held up despite rising interest rates. Household consumption has also been relatively resilient.

The real question concerns the second half of the year. It's always difficult to say precisely, but most leading indicators suggest that a recession could occur in the second half of the year and probably in the 4th quarter.

🇺🇸 *US MAY LEADING INDICATOR FALLS 0.7% M/M; EST. -0.8% (14th straight drop) - BBG

— Christophe Barraud🛢🐳 (@C_Barraud) June 22, 2023

*On a YoY basis, the index fell 7.9%.

*Usually, this level is associated with #recession. pic.twitter.com/RV2A3m8TNj

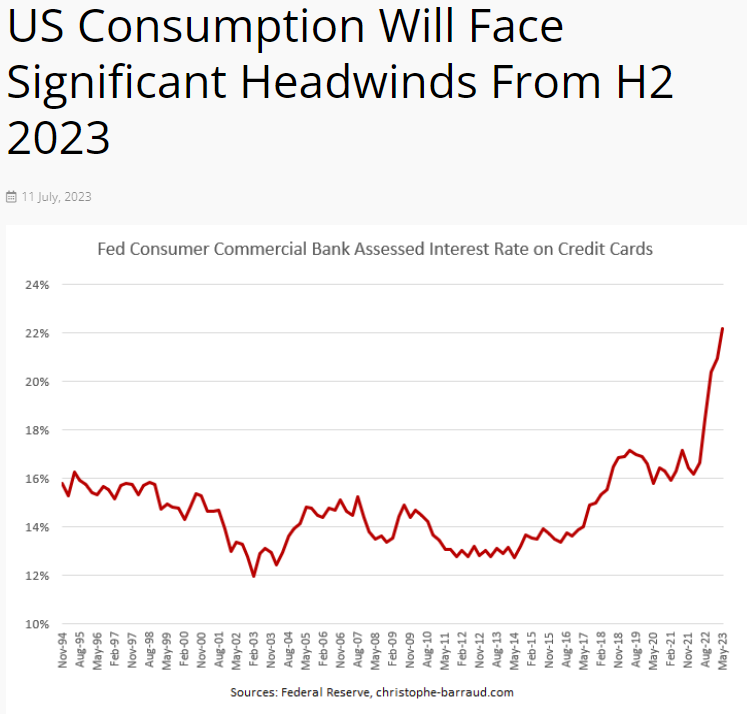

Household consumption will slow, for three reasons:

- Savings accumulated during the Covid pandemic have reached or will soon reach maturity.

- Consumption has held up largely because households have turned to credit. However, credit growth is slowing well beyond expectations, due to the deterioration in credit conditions in Q1 (and probably Q2 (cf. latest FED quarterly report)), and rising interest rates. For example, interest rates on credit cards rose above 22%.

- The third factor, which makes a recession more likely in Q4 than in Q3, is that just over 40 million households will once again have to pay off their student loans. This is bound to cut into these families' spending.

The same phenomenon that applies to households also applies to businesses. We are witnessing a general tightening of credit conditions for businesses, whether small, medium-sized or large. This, combined with rising interest rates, will have an impact on investment. Today, banks are rather conservative. In the banks' Q2 earnings, we should see an increase in credit provisions.

🇺🇸 *US MAY LEADING INDICATOR FALLS 0.7% M/M; EST. -0.8% (14th straight drop) - BBG

— Christophe Barraud🛢🐳 (@C_Barraud) June 22, 2023

*On a YoY basis, the index fell 7.9%.

*Usually, this level is associated with #recession. pic.twitter.com/RV2A3m8TNj

What about inflation?

In June, CPI (consumer price index) inflation reached 3% year-on-year, in line with my expectations. The real question lies over the next six months and beyond. Many factors are pushing for disinflation:

- The existing vehicle price index is showing a decline among distributors, which should be reflected at retail level in the next two to three months.

- Food prices will remain contained because agricultural commodity prices have fallen.

- On the rental component, several leading indicators suggest that rental price growth will slow at least over the next 12 months, with the economy expected to slow at best, and contract at worst.

🇺🇸 #Inflation | On a YoY basis, market #rents suggest that CPI Shelter growth should slow significantly in the coming months.

— Christophe Barraud🛢🐳 (@C_Barraud) July 1, 2023

*Most of market rents' measures are likely to turn negative on a YoY basis soon ⬇https://t.co/S2NnXATOLH pic.twitter.com/TjWUeCeQ02

- We should also see a slowdown in the other components. This is all the more true given that on the Core services side, excluding rents, indicators on prices paid in the services sector are showing a normalization. Note, for example, that the prices paid component of the ISM services index has reached its lowest level since March 2020.

All these factors suggest that we are on a disinflationary trend at annual rates. We should therefore break the 3% annualized threshold on the downside in Q4 in my opinion, but not before, because there are positive base effects in Q3. I'm aiming for a return to 2% inflation around Q2 2024.

What will the Fed do in this context?

For July, I'm leaning towards another rate hike, despite the scenario described. There are three factors that could push rates up:

- The labor market has not deteriorated significantly.

- Neither have financial conditions, which have even improved slightly since the end of May, according to the Bloomberg index.

- The housing market is resilient and prices are rising slightly.

I'm not convinced that they have the capacity to make two rate hikes between now and the end of the year, as they have announced, because disinflation signals will start to materialize.

What's the economic situation in Europe?

Today, the EU is in a technical recession, with a negative Q4-Q1 ratio, and it's going to be difficult to get out of it permanently. Indeed, the latest indicators, notably the composite PMI, show that it was below the 50 threshold in June. Momentum is therefore rather negative, despite the resilience of certain sectors, notably hospitality (tourism, catering), which is posting fairly solid figures. On the other hand, the manufacturing sector remains under pressure.

I think monetary conditions are already fairly restrictive overall, and we're expecting a further rate hike. The ECB has continued to remove liquidity. Loan growth in Q3 could already be negative. On housing, it's already negative (if we take the 6-month annualized average), and it could extend to other credit components.

In the United States, annualized credit growth will be negative in Q3, or even Q2. In Europe, they're likely to follow the same trend: we're already witnessing a deposit outflow phenomenon, albeit on a smaller scale than in the US. In this context, it's difficult for banks to lend. In France, they've already started to tighten the screws on credit lines for companies, and on real estate in general, and are asking for much more significant capital contributions. So it's more or less the same pattern as in the US, but with a slight time lag and, above all, weaker growth momentum. The risk of remaining in a zone of zero or even slightly negative growth is real.

The continent faces a number of challenges: geopolitical, energy (although less so than last year), political and social risks. Above all, the situation is set to become more complicated in 2024, as European countries, which had benefited from derogations until the end of 2023, are expected to return (at least gradually in 2024) to the Maastricht criteria, lifted until the end of the year. Fiscal support from governments is therefore set to dry up.

Against this backdrop, how will inflation fare?

Inflation will continue to slow, mainly because the energy component is contracting. The core component may be a little resilient this summer, boosted by positive base effects linked to government support measures, notably in Germany for transport.

We should see a normalization from September onwards, but probably at a slower pace than in the United States. Indeed, European countries are gradually rolling back the support and inflation-reduction measures they have put in place, which should slow disinflation. I believe the ECB's objective is for interest rates to exceed inflation in September.

I'm leaning towards a rate hike in July and potentially one in September. But in the event of a negative economic shock, if the figures really deteriorate in consumption and investment, they may revisit the September hike. We'll have to keep an eye on credit figures, which extrapolate to a negative GDP trajectory. The evolution of the economic situation will really depend on the fragile geopolitical situation. But the consensus on Europe is still fairly optimistic.

As far as savings are concerned, Europeans are much more conservative: depending on the zone, there are still between 3% and 5% of GDP in excess savings, even if it is starting to diminish. The problem is that these savings will quickly be eaten away by inflation, in an uncertain environment that doesn't encourage spending either.

What's the situation in China?

Chinese growth has rebounded slightly, but the latest figures for June are rather disappointing. Even on high-frequency data (car sales, house sales), we saw a downturn at the beginning of June. Several factors are weighing on the economy:

- Despite vast accumulated savings, the Chinese are not spending their money. Consumer confidence has never returned to its pre-Covid level.

- Manufacturing sectors, as shown by the PMIs, are contracting.

- The sharp slowdown in global growth is weighing on the country's economy.

- China is suffering from the migration of international companies, which are reallocating their resources to India, Vietnam and Thailand.

- Companies are investing little, and spending on infrastructure has ground to a halt.

- The blockades introduced under the Trump presidency persist.

- The country's zero Covid policy has limited the return on investment.

- Unit labor costs have soared and are now, in some segments, higher than in other neighboring countries.

- Exports are down.

- Real estate, which rebounded slightly in Q1, became a drag again in Q2.

🇺🇸 #Inflation | On a YoY basis, market #rents suggest that CPI Shelter growth should slow significantly in the coming months.

— Christophe Barraud🛢🐳 (@C_Barraud) July 1, 2023

*Most of market rents' measures are likely to turn negative on a YoY basis soon ⬇https://t.co/S2NnXATOLH pic.twitter.com/TjWUeCeQ02

What is the CCP going to do in this context

The government is continuing to support the economy, particularly in real estate and via the recent monetary easing. It is trying to calibrate the monetary and fiscal measures to be adopted, but faces a problem: if it is too aggressive on the monetary front, the yuan will devalue.

Inflation was at zero in June, due to this persistent consumer problem. It may bounce back in the second half of the year, but is unlikely to exceed 2% on a sustained basis. It should then accelerate in 2024.

The People's Central Bank of China is likely to act first on liquidity, via cuts in reserve requirements for banks, or via more injections, or via slight rate cuts on certain programs (such as mortgages). We can also expect an increase in the relending quotas it gives to banks. I don't think it will change the key rate, except in the event of a severe economic slowdown.

What are the global issues to watch in Q2?

Above all, I'd be watching corporate earnings and bank guidance, whether on credit volume or credit provisions in particular. Next, I'm keeping a close eye on the outcome of the Fed's July meeting, and the rhetoric it advocates, which should be the forerunner of Jerome Powell's Jackson Hole speech in August.

By

By