Peter Lynch's career

From the age of eleven, while caddying at a top golf club, Lynch developed an interest in the stock market. These early experiences led to a degree in finance from Boston College in 1965, followed by an MBA from the Wharton School of Business. His first job in finance was with Fidelity, where he began as a summer intern. After several positions, he enlisted in the US Army, where he spent two years. On his return, Lynch returned to the Fidelity offices as an analyst of the textile and metals sectors. In 1977, at the age of 33, he became manager of the Fidelity Magellan Fund, taking it from $18 million to over $14 billion in 13 years. His active, diversified management led to an average annual return of 29.2%, outperforming the S&P 500 index almost every year. Lynch took early retirement at the age of 46, underlining the importance of work-life balance.

Peter Lynch's investment strategy

In books such as "One Up on Wall Street" (1989) and "Beating the Street" (1993), Lynch advocates a long-term investment approach, focusing on companies whose assets are undervalued by Wall Street. He advises investing in companies and products that people understand and use, thus fostering a better assessment of investment opportunities.

For Lynch, investment must be based on a solid understanding of the company's prospects, financial situation and expansion plans. He also stresses the importance of patience and discipline in the quest for long-term returns.

Here are some of the traits that appeal to Peter Lynch:

- A ridiculous name and a boring industry: Lynch believed that companies with unattractive names or in industries considered boring could often be undervalued. This offered investors the chance to find shares at a good price.

- He identified spin-offs, where a company splits off one of its divisions to create a new listed company, as often overlooked by Wall Street, and therefore potentially undervalued.

- Fast-growing company in a slow-growth industry: According to Lynch, a fast-growing company in an otherwise stagnant industry can be an excellent investment opportunity, as it attracts less attention and competition.

- Niche company with high barriers to entry: Companies that dominate a specific niche and are protected by hard-to-overcome barriers to entry can generate steady profits.

- Consumer staples producers: He liked companies producing goods that people buy all the time, such as soft drinks or razor blades, because their demand remains stable.

- Low institutional ownership and analyst coverage: Companies neglected by Wall Street are not necessarily bad businesses and can offer good investment opportunities.

In addition, Lynch paid attention to the presence of insiders in the capital, considering that strong ownership by insiders, notably the CEO, was a positive sign of confidence in the company. He also appreciated share buybacks by the company, interpreting them as a sign that management considered the share price favorable.

He taught investors to look for value where others might not look. His ability to unearth nuggets in sectors often ignored by the headlines made him an iconic figure in the investment world. His legacy lives on, inspiring investors to adopt a pragmatic, value-based approach when selecting stocks for their portfolios.

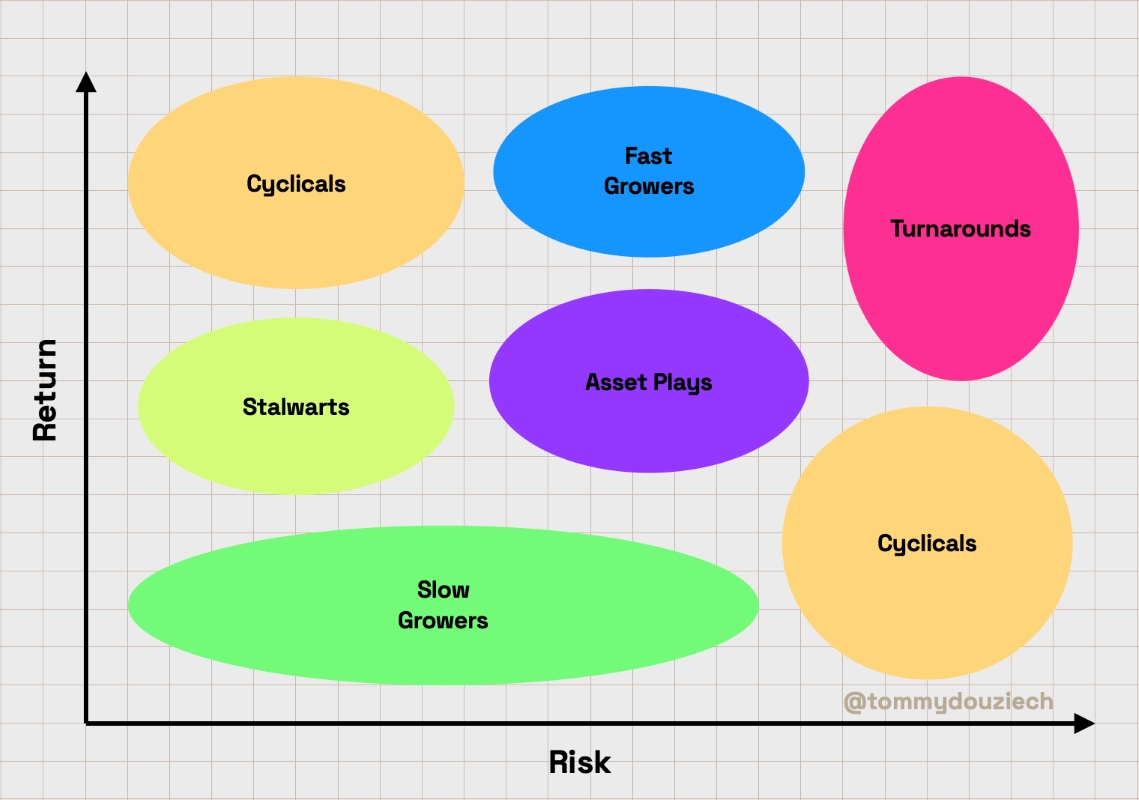

Peter Lynch's six stock categories

- Slow Growers: mature companies with slow growth.

- Stalwarts: large companies offering stable growth.

- Fast Growers: fast-growing companies with strong potential.

- Cyclicals: companies whose performance depends on the economic cycle.

- Turnarounds: companies in difficulty but with a potential for recovery.

- Asset Plays: companies with assets that are not recognized by the market.

Over the course of its life, a stock can move from one category to another, depending on its maturity, the macro-economic context and the quality of its management. For example, a company like Domino's Pizza was once a "fast grower", before becoming a "stalwart". It went through a "turnaround" phase in 2008-2010. Tomorrow, it may become a slow grower.

This classification of stocks within a portfolio enables us to identify the investment strategy and reasons for selling the stock. A cyclical company can only be held for the duration of a bullish economic cycle. An "asset play" stock is held until it is revalued at its estimated intrinsic value.

This classification highlights different degrees of risk and potential performance. We don't expect the same risk (as measured by volatility and maximum drawdown) from a "turnaround" stock as we do from a "slow grower" stock.

Investment legend

Peter Lynch is regarded as a legendary investor not only for his exceptional returns, but also for his ability to demystify investing for the general public. His "invest in what you know" philosophy has enabled many individual investors to succeed in the stock market by focusing on companies and sectors they truly understand.

Its investment philosophy is based on in-depth company knowledge, a long-term approach and investing in familiar areas. His strategies and teachings continue to influence investors around the world, proving that simplicity and insight are powerful tools in any investor's arsenal.

By

By