Autozone and O'Reilly specialize in the sale of products for the automotive sector, including spare parts, maintenance items and accessories of all kinds. Both companies operate stores, most of which are strategically located in high-traffic areas on the outskirts of cities. Autozone has 7140 and O'Reilly 6157. Both competitors do most of their business in the USA, but Autozone is a little more diversified, with a significant presence in Mexico (740 stores vs. 42 for O'Reilly) and Brazil (100 stores, none for O'Reilly).

A market driven by strong trends

To understand the market in which Autozone and O'Reilly operate, it's important to bear in mind that growth in spare parts sales is directly linked to vehicle repairs and maintenance. Vehicle wear and tear is therefore a determining factor. In fact, the older a vehicle gets (both in terms of kilometers and years), the greater the need for restoration. The market is very dynamic, underpinned by strong trends. In addition to healthy employment - which is driving people to make greater use of transport - and the increasing size of towns and cities, which is increasing travel distances, there are two main trends.

Firstly, vehicles are becoming increasingly complex, prompting customers to delegate repairs and maintenance to professionals rather than doing them themselves. In industry jargon, this is known as "Do it for Me" (DIFM). Both companies do a significant proportion of their business with professional customers. This clientele accounts for 45% of O'Reilly's sales.

Secondly, the vehicle fleet is ageing. S&P Global Mobility reveals that the average lifespan of a vehicle in the USA has risen from 10.8 years in 2010 to 13.1 years today. This increase in longevity, largely due to the premiumization of car models - which are therefore more expensive - manifests itself in higher maintenance and repair expenditure. This creates regular demand, hence the counter-cyclical aspect of both groups.

The electric vehicle: a threat?

The view that the market could be undermined by the growth of the electric vehicle fleet needs to be qualified. It's true that battery-powered vehicles have fewer moving parts and require less maintenance than combustion-powered vehicles (since exhaust systems, transmissions and other engine parts are removed). But this reduction is more than offset by more expensive sensors, batteries and other additional parts specific to this type of vehicle. Autozone and O'Reilly are well placed to adapt their models to meet this new demand. But let's keep things in perspective: for the moment, there are only 5 million battery-powered vehicles on the road in the USA, out of a total fleet of 285 million units. Mass adoption will take time, especially as American consumers are concerned about the lack of recharging infrastructure, purchase prices and range. If we follow the projections of Mizuho Securities, which anticipate that the car fleet will include 14% electric and hybrid vehicles by 2030, and that maintenance work will take place after around 5 years of use, concerns are clearly premature.

Building an intelligent model

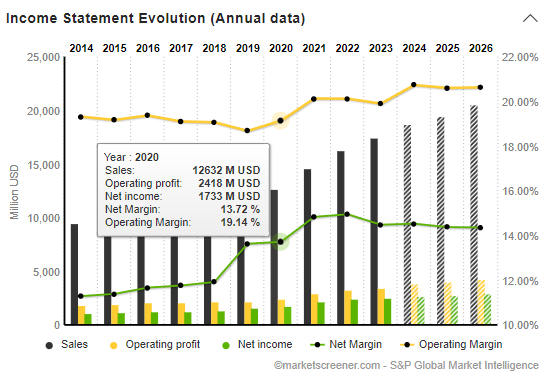

Both companies are highly profitable. Operating margins exceed 20%. The cash flow generated by their business models is colossal. As a result, they are investing heavily in store refreshes and technological improvements to supply chain and logistics. Satisfaction is essential, because quality service makes it easier to justify price increases. This means, for example, short delivery times. Delivery between 30 and 60 minutes is possible on a majority of items, given that both companies operate thousands of stores in the country. Traditional e-commerce and smaller retailers cannot compete with such efficiency.

Autozone and O'Reilly also have considerable pricing power, which has enabled them to increase margins in a controlled way over the last ten years. Customers, often unaware of the rates charged elsewhere for an equivalent part, are prepared to accept a high price if the expertise and service are there, and the required task is completed quickly. As a result, both companies have a reputation for charging higher prices than the competition.

Let's talk about the competition. The market is huge and highly fragmented. O'Reilly has just 8% market share (5% 5 years ago) and Autozone a little more. Advance Auto, the biggest listed competitor (11 billion in sales) is in great difficulty. Growth is virtually non-existent and margins are sinking. Autozone and O'Reilly are well placed to capture this company's customer base.

To continue to gain market share and pursue the growth cycle, both groups will also be able to rely on geographical coverage with new store openings and expansion abroad. With this in mind, O'Reilly acquired Vast-Auto at the beginning of the year to strengthen its position in Mexico. The market is beginning to consolidate. Autozone and O'Reilly are once again well placed to take advantage.

What's the financial picture?

Who to choose between Autozone and O'Reilly? A glance at the valuation ratios shows that O'Reilly is honored with higher multiples. The stock trades at 26.8 times earnings for this year and 24.2 times for 2025. Autozone's PER is lower, at 20.7 and 19.1 times respectively for this year and the next.

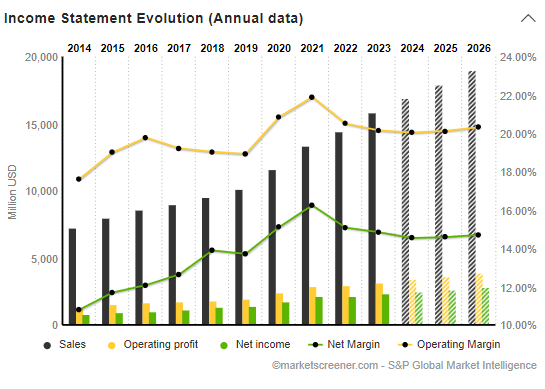

O'Reilly's growth trajectory is a little faster, thanks to a more aggressive strategy. Sales have risen from $7.2 billion in 2014 to $15.8 billion in 2023, representing a CAGR of 9.1%. Autozone is lagging a little behind, with a CAGR of 7% over the period.

Margins are very similar between the two companies. Net profitability is between 14% and 15%, and has tended to increase slightly in previous years. Nevertheless, future profit growth will depend largely on the ability to increase revenues, as the levers for further margin expansion are fairly weak.

O'Reilly (source: MarketScreener)

Autozone (source: MarketScreener)

O'Reilly uses its resources more efficiently. The balance sheet is better protected overall. Debt levels are much lower than at Autozone. Financial expenses are limited. Share buy-backs are slightly less aggressive (41.8% of capital bought back over the decade versus 46.9% for Autozone), but this is enough for O'Reilly to see its earnings per share (EPS) curve rise faster. BNA CAGR has been 20.8% for O'Reilly since 2014, versus 17.3% for Autozone. O'Reilly has a broader capital allocation, with more investment resources.

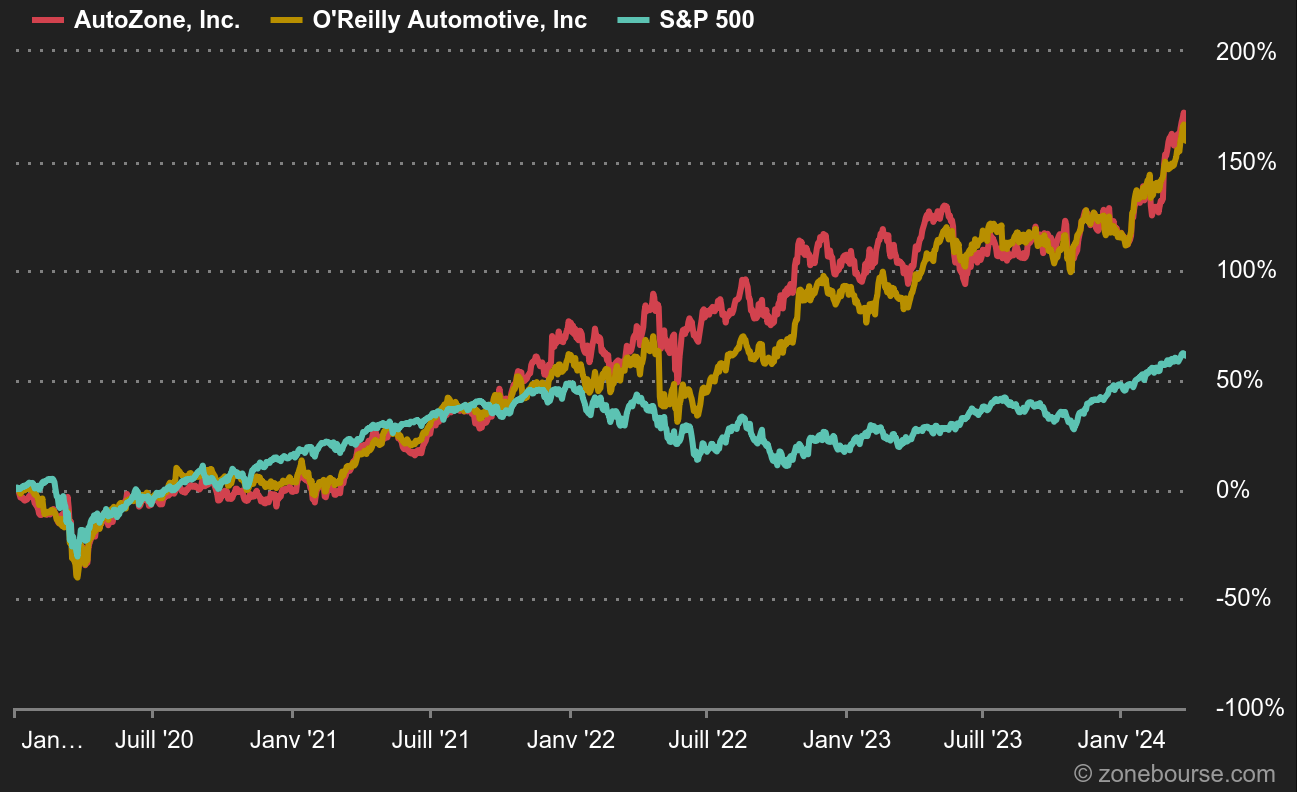

These differences, fairly minimal in absolute terms, need to be qualified. Both groups are very well managed and easily fit into the classification of growth and quality stocks. They clearly outperform the market and their competitors Advance Auto, Genuine Parts, Driven Brands, Monro and Valvoline. O'Reilly has played its role as outsider, moved a little faster and now outperforms Autozone by capitalization ($67.1 bn vs. $54.8 bn).

Both companies have recently published good results and solid prospects, in line with their past growth trajectories. The correlation between the two share prices is strong. Investors therefore have a choice between a larger but less valued company - Autozone - and the competitor - O'Reilly - which has made up much of its lost ground and is benefiting from buoyant momentum. Visibility is optimal for both. It's up to each of us to place our bets...

The two stocks are tracking each other and outperforming the S&P500 (source: Zonebourse)

By

By