Two main stock exchanges:

India has two main stock exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE, founded in 1875, is the oldest stock exchange in Asia, while the NSE, established in 1992, is the largest in terms of trading volume. Both exchanges are regulated by the Securities and Exchange Board of India (SEBI).

Indexes:

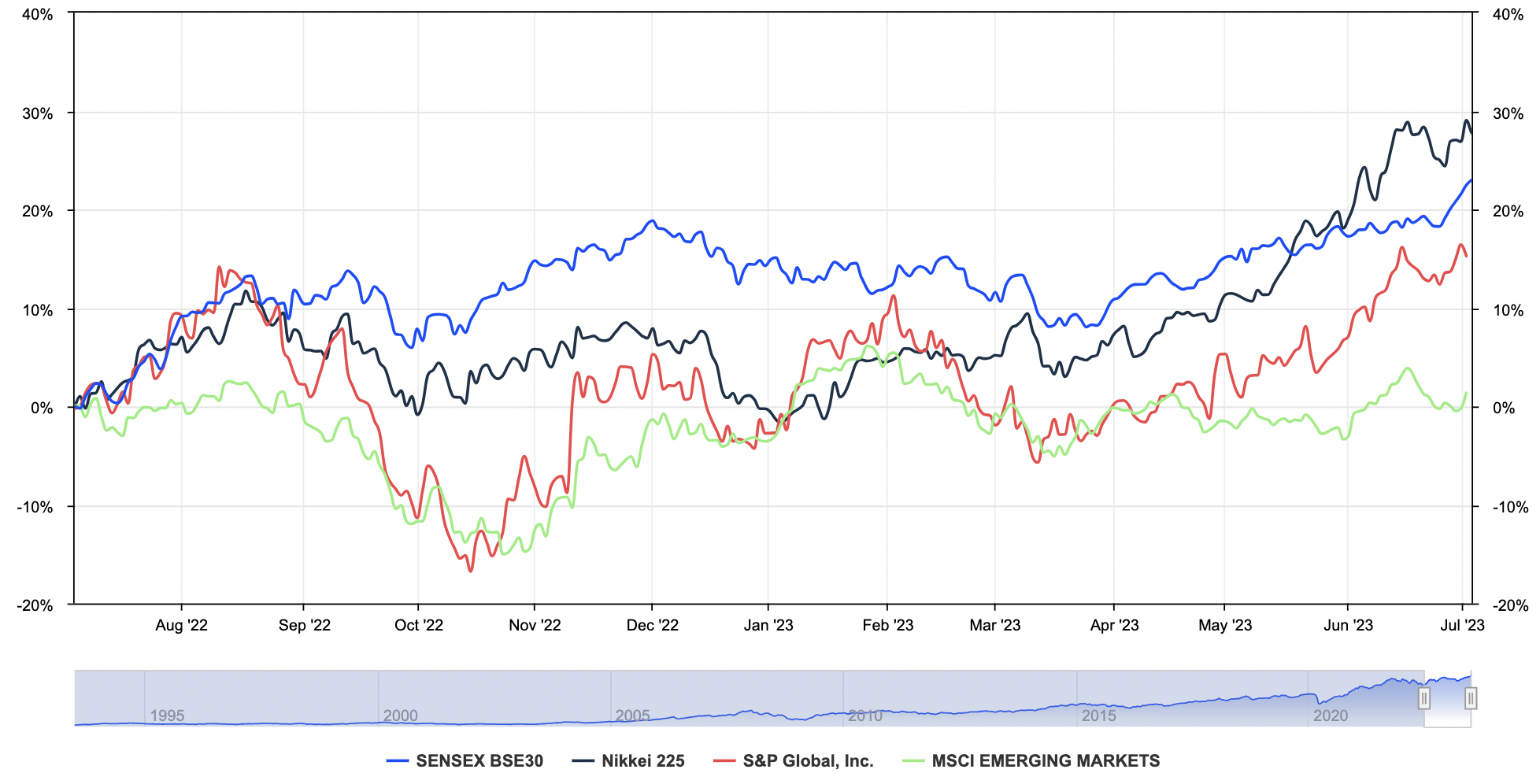

Like other financial centers, India has numerous indexes, but three stand out when considering this market: the Sensex BSE30, the Nifty 50 and the MSCI India.

- The Sensex BSE30: this index is weighted according to market capitalization. This means that companies are included according to their relative size. It is made up of the 30 largest companies listed on the BSE and is Bombay's flagship index. Reliance and HDFC Bank are the two most influential stocks in the index.

- Nifty 50: this index is often used as the benchmark for the national stock exchange. As its name suggests, it is made up of the 50 largest companies listed on the NSE.

- MSCI India: this index covers around 85% of the local stock market universe and includes 114 Indian companies, among the country's largest capitalizations.

Quotation times:

- Pre-opening: 11h30 am (EST) - 11h45 am (EST)

- Normal: 11h45 am (EST) - 6h00 am (EST)

- Closing: 6h00 am (EST) - 6h30 am (EST)

Trading in India is mainly electronic, with a centralized, anonymous order system. Investors can place buy and sell orders via SEBI-approved brokers. Transactions are generally settled in Indian rupees (INR).

Numerous Large Caps:

As of July 2023, the Indian market includes just over 52 stocks with capitalizations in excess of $10 billion. Fourteen exceed $40 billion, and three behemoths are above the symbolic $100 billion mark: HDFC Bank, the largest Indian bank; information technology and consulting giant Tata; and the largest Reliance.

A market dominated by four sectors:

The Indian economy is characterized by the predominance of certain sectors, such as information technology, financial services, consumer goods and infrastructure. Companies listed on Indian stock exchanges include giants such as Reliance Industries, Tata Consultancy Services, and HDFC Bank. India boasts 52 companies with market capitalizations of over $10 billion, including 14 with market capitalizations of over $40 billion.

The financial sector dominates with 28% of total gross capitalization. Technology follows at 18%, ahead of energy (12.5%) and non-cyclical consumption (12%). Healthcare and real estate account for almost nothing.

Investing in India: It's still complicated for foreigners

Access to the Indian stock markets is not the easiest. As an individual investor, you can't trade directly in Indian shares, unless you're wealthy enough to qualify for the special status of FPI (Foreign Porfolio Investment). India grants two types of authorization:

Foreign Institutional Investors (FII): these are authorized to invest in equities, bonds and derivatives on Indian markets, subject to certain restrictions and prior authorization from the Securities and Exchange Board of India (SEBI).

Foreign Porfolio Investment (FPI): these too can invest in Indian stock markets, but their access is more limited than that of FIIs. In particular, they must use approved intermediaries and comply with investment ceilings.

Investing in India: ETFs

ETFs are a classic alternative for avoiding exposure to a limited number of stocks and the limitations of brokers. There are generalist ETFs that simply provide exposure to this market and track the performance of the country's main indices.

iShares MSCI India ETF (INDA) is a heavyweight in the sector, with $5 billion in Net Assets of Fund. Fees are 0.64% and it comprises 114 positions.

iShares India 50 ETF (INDY) aims to replicate the performance of India's 50 largest companies. It is dollar-denominated, has slightly higher fees (0.89%) and full replication.

India is transforming itself, and is beginning to overshadow its powerful neighbors, notably China. It has been stealing market share since conflicts between Washington and Beijing intensified. India is still an emerging market, however, and regulation is not yet up to the best international standards, while the transparency of certain activities could be improved. The attacks launched by the bearish Hindenburg fund at the beginning of the year on the Adani empire highlight a certain "fragility".

By

By