As previously mentioned, Eramet plans to start mining lithium next year, with the aim of producing 24,000 tons a year by 2026. The company has already secured the mining rights to a major lithium concession in Argentina's Salta province. Lithium is mainly used in the energy and storage sectors, particularly in batteries. Its price rose significantly at the end of 2022, reaching over €81,000 per ton. By May 21, the price had fallen back to around €40,000. This does not detract from the potential of the business, which will enable the mining group to position itself in a high-demand sector. However, mining is not expected to operate at full capacity until 2026 - at the earliest - which explains why the analyst consensus does not forecast growth before 2025.

Cyclical results

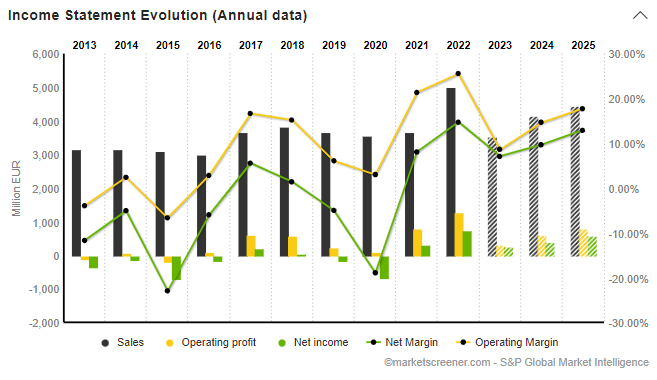

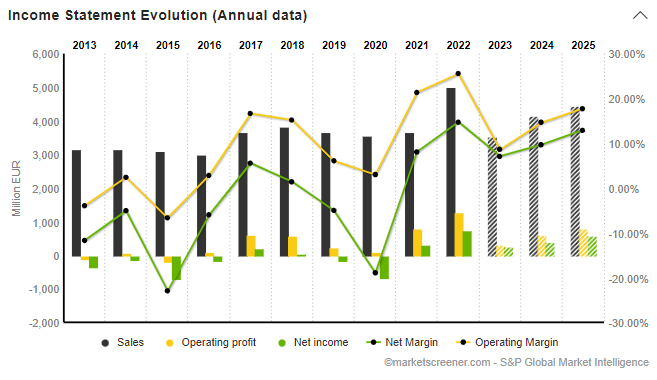

Last year, Eramet posted sales of just over 5 billion euros, with a record net margin of 14.8% thanks to rising metal prices. Nevertheless, the out-of-the-ordinary fiscal year 2022 should not hide the forest. Over the cycle from 2013 to 2021, growth is virtually nil, with sales falling from €3.16 billion to €3.67 billion. As for profits - profits and free cash flow combined - they alternate between high losses and low profitability. These mediocre performances are reflected in the share price, which is at its July 2014 level. Nevertheless, the quality of the balance sheet is noteworthy, with debt under control at close to 0.7 times EBITDA, according to forecasts for this year.

The current financial year is logically marked by a phase of normalization due to lower metal prices. The half-year results reflect a sharper-than-expected fall in manganese and nickel prices. As a result, the Group had to lower its EBITDA guidance to around €900 million, compared with an initial forecast of €1.1 billion. Profits fell by 86% and EBITDA by 71%.

Complex shareholder structure

Given its strategic activity, Eramet has an important role to play in the availability, control and supply of mining resources. And when it comes to national sovereignty, the private and public sectors are not dissociated. The French state is a 27.1% shareholder and has intervened on several occasions, whether to participate in various capital increases or to ease tensions, as was the case in 2021, during the conflict between CEO Christel Bories and the Duval family. The latter has controlled 37.1% of the capital since the mining group took over Aubert & Duval, a French company specializing in metallurgy. The family criticized Christel Bories for her lack of competence in managing the company, and in particular the nickel subsidiary and Aubert & Duval. An agreement on the sale of Aubert & Duval has been reached, allowing the various stakeholders to be appeased.

Eramet's shareholder complexity is not limited to the French state. Société Territoriale Calédonienne de Participations Industrielles (STCPI), a New Caledonian public entity, owns 4% of the group and 34% of the nickel mine on its territory. The Weda Bay nickel extraction site in Indonesia is 57% owned by the Chinese group Tsingshan. In manganese, the interests are again intertwined, with the Gabonese state holding a 28.9% stake in Comilog, the subsidiary dedicated to the activity. Finally, in mineralized sands, the Republic of Senegal holds a 10% stake.

In addition to this exceptional and complicated capital situation, Eramet suffers from a lack of critical mass, which is often necessary in this sector. Compared with its Australian, South African and Canadian competitors, Eramet remains a small player in the mining sector. As a result, Anglo-Saxon funds have a very limited presence in Eramet's capital.

A strategically essential company

Eramet plays an active role in France's metal supply needs. It is a strategically essential company if we are to move towards a transition model. Its complex shareholder structure creates a great deal of friction, as interests are not always convergent. The difficulties encountered in New Caledonia need to be monitored. Eramet is a speculative business, particularly with regard to expectations in lithium. This activity is not expected to reach cruising speed for several years. Lastly, half-yearly results are not mind-blowing. Visibility on future metal prices is poor, and we are therefore cautious in excluding the stock from our Europe-PEA Portfolio and Europa One fund.