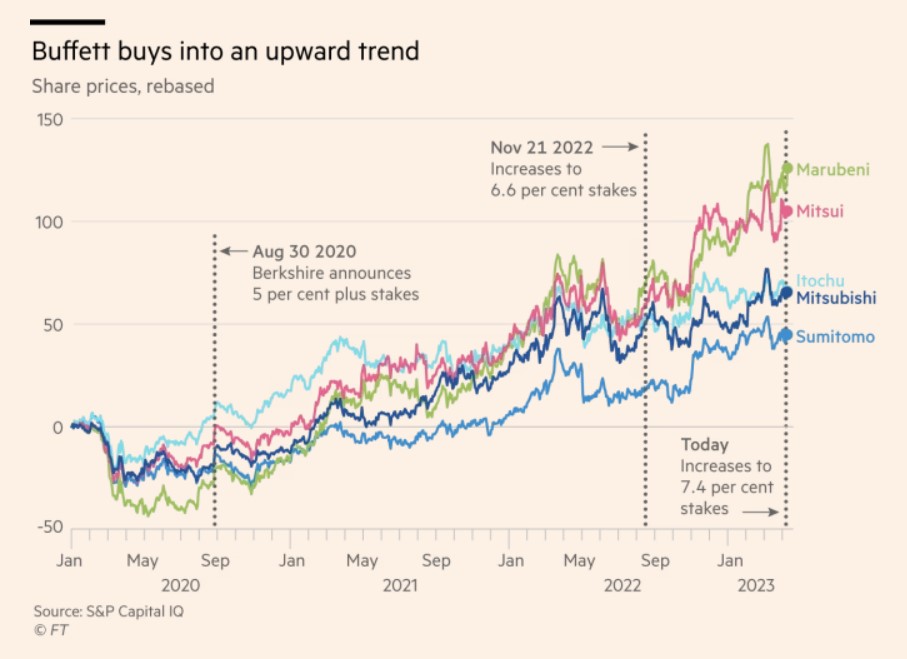

- Graph n°1 : Warren Buffett in the land of the rising sun

Source : Financial Times

The legendary American investor Warren Buffett bet $6 billion on five major Japanese companies three years ago, owning more than 5% of each. Berkshire Hathaway increased that stake last year to 7.4% in all five companies. Some question this fascination, as the companies have led international transactions since the 19th century but have slow growth and complex operations. The five companies, Mitsubishi Corp, Mitsui & Co, Itochu, Sumitomo and Marubeni have been hit by the disruption of the war in Ukraine. Despite this, stocks have climbed since Buffett's investment as followers have emulated him and profits have recovered from the lows of 2020.

Companies are trading below 10 times their future earnings, with high dividends like Sumitomo at over 5%. International investors could copy the investments made by these companies without suffering the conglomerate discount that weighs on Marubeni and Mitsui. Berkshire Hathaway raised yen funds before investing in these companies and recently launched a new yen bond offering.

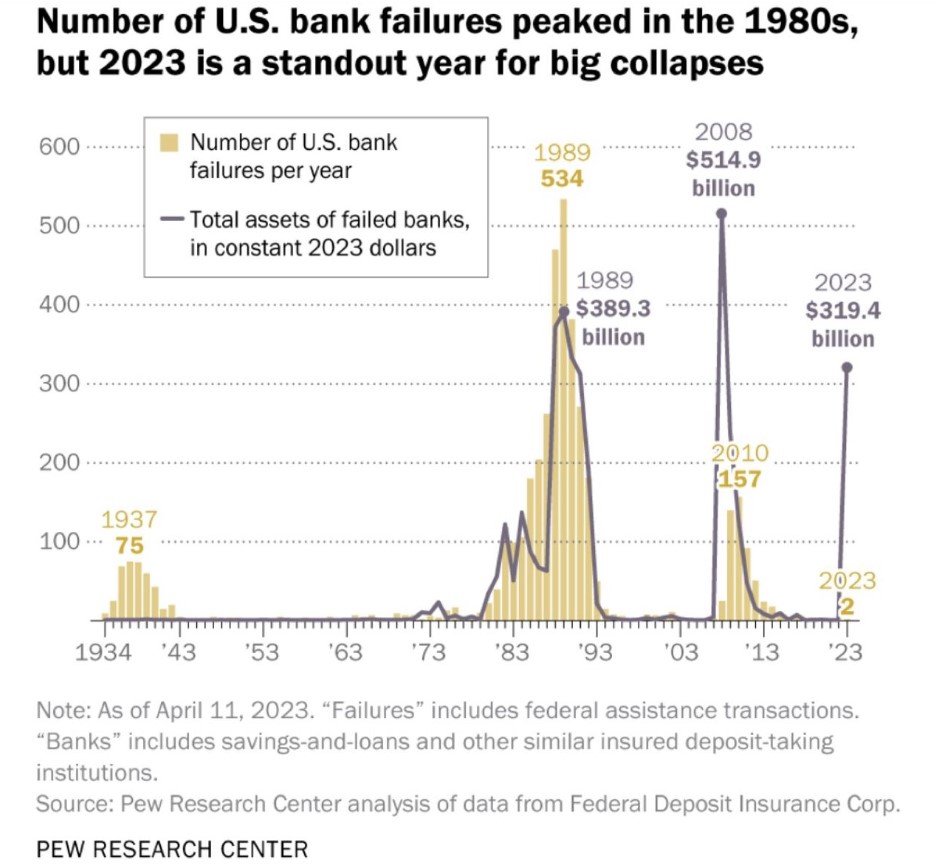

- Chart 2: A look back at US bank failures

Source: Pew Research Center

The banks in this chart represent US bank failures with deposit guarantees. In 2023, the SVB Financial Group and Signature Bank collapsed and with them, 319 billion assets went up in smoke. This is a far cry from the bankruptcies of 1989 (534) and 2010 (157), but the assets lost are on a par with the other peaks.

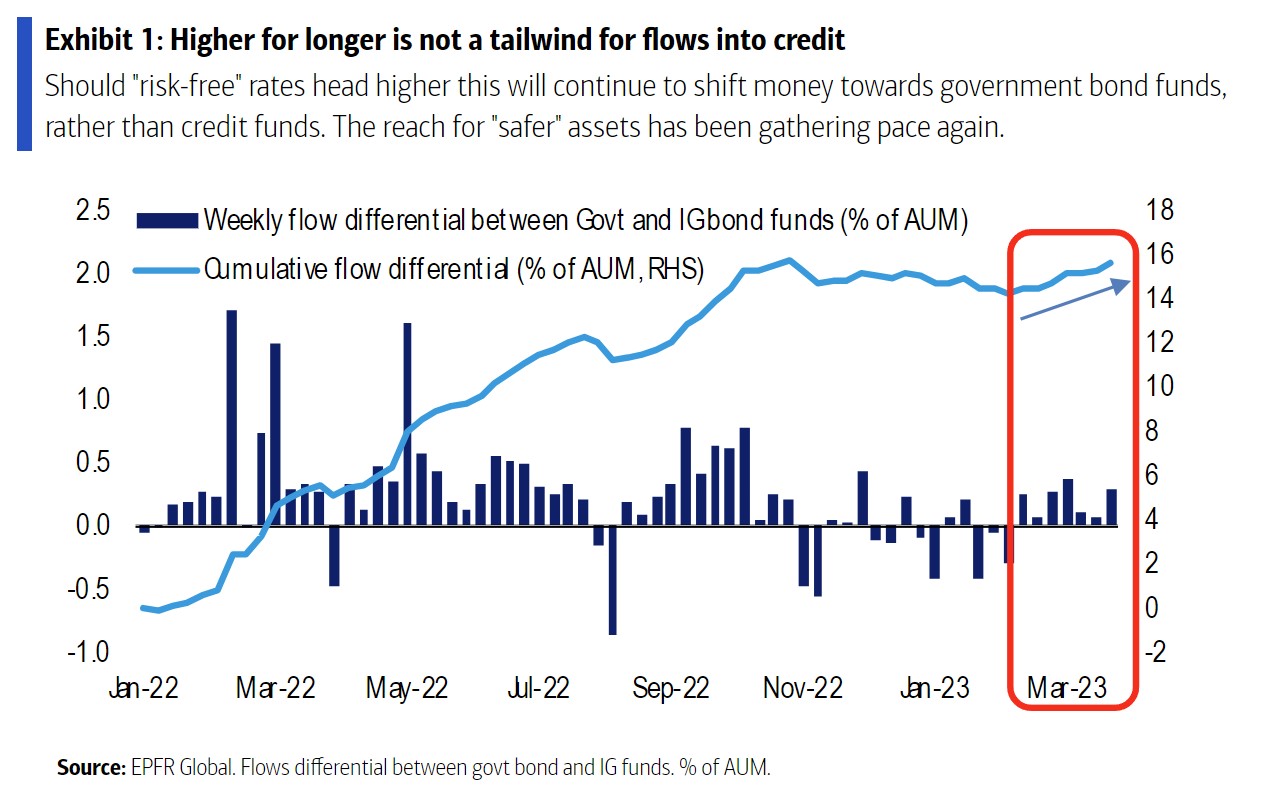

- Chart 3: Still a favorable wind towards investment grade

Source: Bank of America

Despite the drop in volumetric rates and the tightening of credit spreads, the increase in government bond yields last week resulted in negative flows for IG (Investment Grade) and HY (High Yield) funds. Higher "risk-free" rates are unfavorable for riskier assets. In this situation, money should continue to flow into sovereign bond funds rather than credit funds. A positive trigger would be needed for the flows to shift decisively to credit rather than to less risky assets such as government bonds.

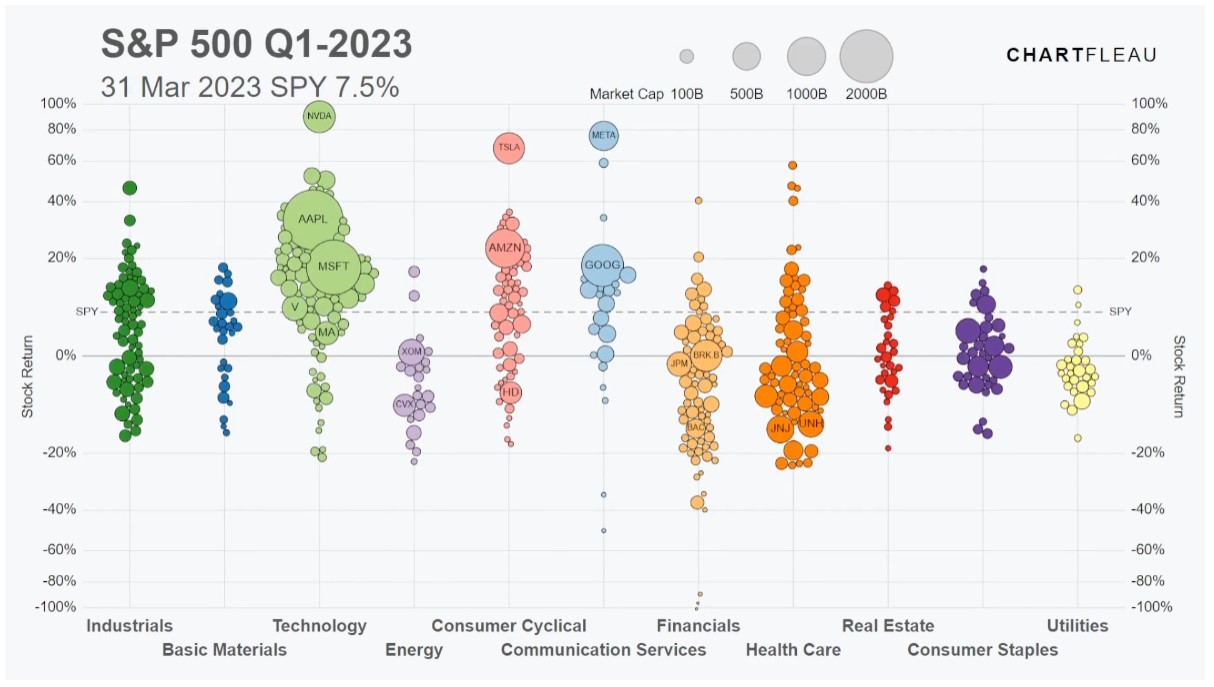

- Chart 4: S&P 500 Equity Performance in Q1 2023

Source: Visual Capitalist

The beginning of 2023 has been very favorable for the technology sector where we can easily see on this chart that the green dot cloud of technology stocks is mostly above 0%. Nvidia is the biggest riser in the S&P 500 index since the beginning of the year with its +90%. Just behind them are Meta Platforms, Tesla and Align Technology.

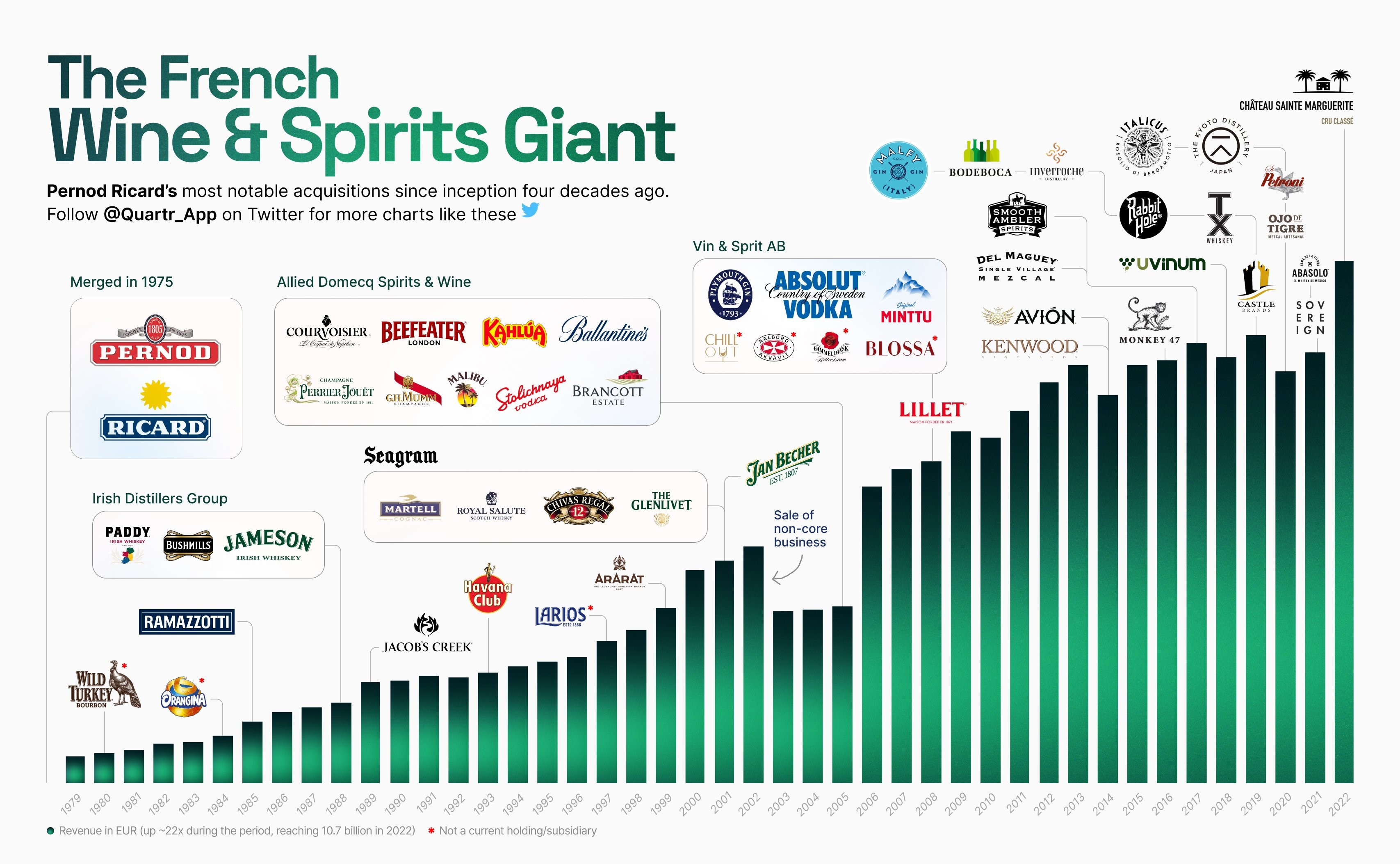

- Chart 5: A quality company in spirits

Source : Quartr

Let's meet again this week with the French stock Pernod Ricard, the world's second largest producer and marketer of wines and spirits. The company is known for its brands such as Jameson, Absolut, Havana, Ricard, Chivas, Mumm, and many others. For more than 40 years, the company has pursued a strategy of external growth with numerous acquisitions. The last one being Chateau Sainte Marguerite, producer of red, white and rosé wines. Recently, the company of the small yellow stopped delivering its Absolut vodka to Russia following the war in Ukraine.

By

By