Chart 1: Valuation of global equities

Source : J.P. Morgan

When we look at the valuation of the MSCI World index, which comprises the world's 1,512 largest listed companies from developed countries, we find ourselves very close to the historical average. In terms of valuation ratios, the P/E Forward, i.e. the price/earnings ratio for the current year, was 17x at the end of June, compared with an average of 16.3x over the last 33 years.

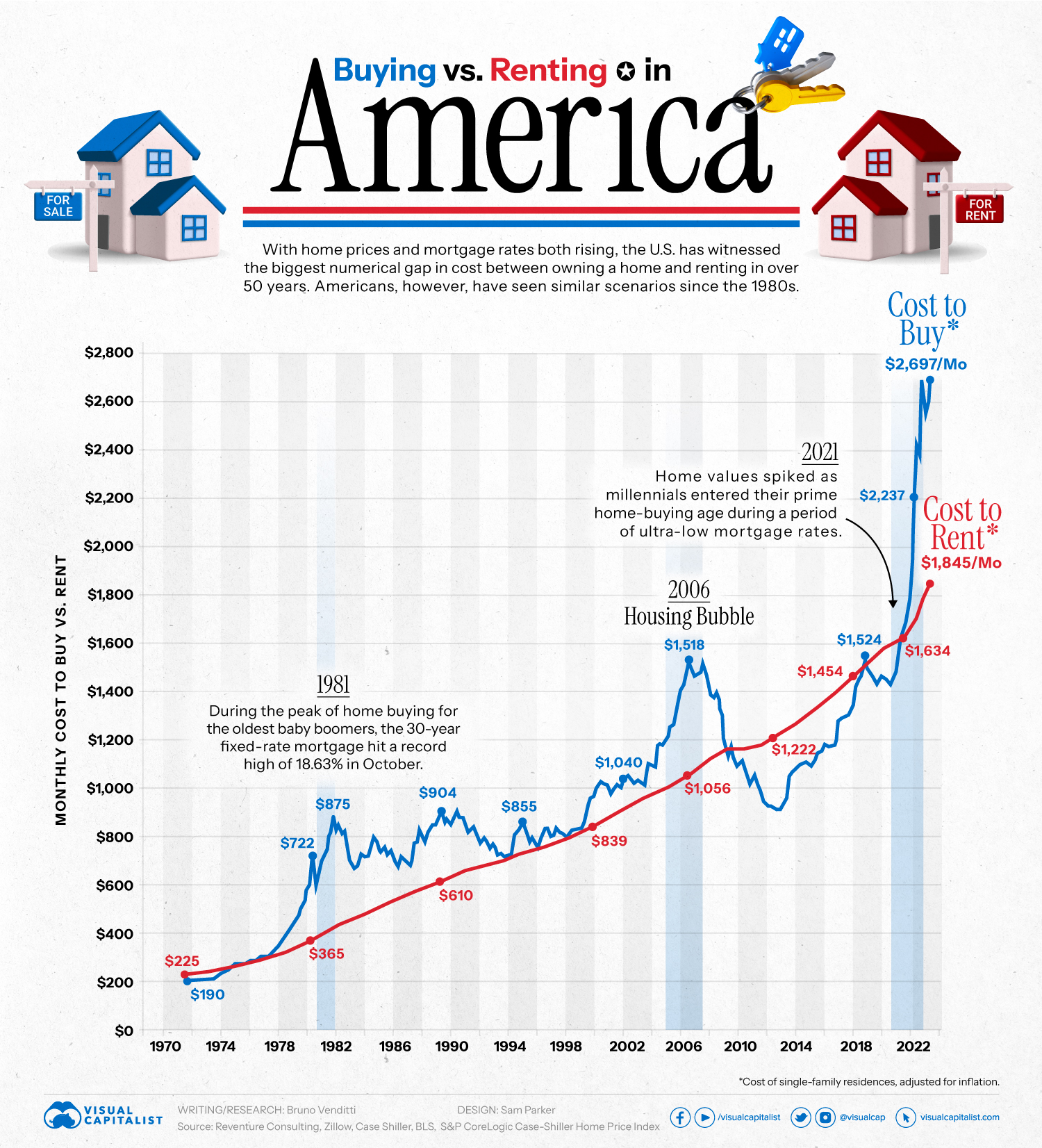

Chart 2: The monthly cost of buying versus renting a home in the United States

Source: Visual Capitalist

As a result of successive rate hikes and the rising cost of borrowing in the US due to persistent inflation, there has never been such a gap between the cost of buying a home and the monthly cost of renting the same property.

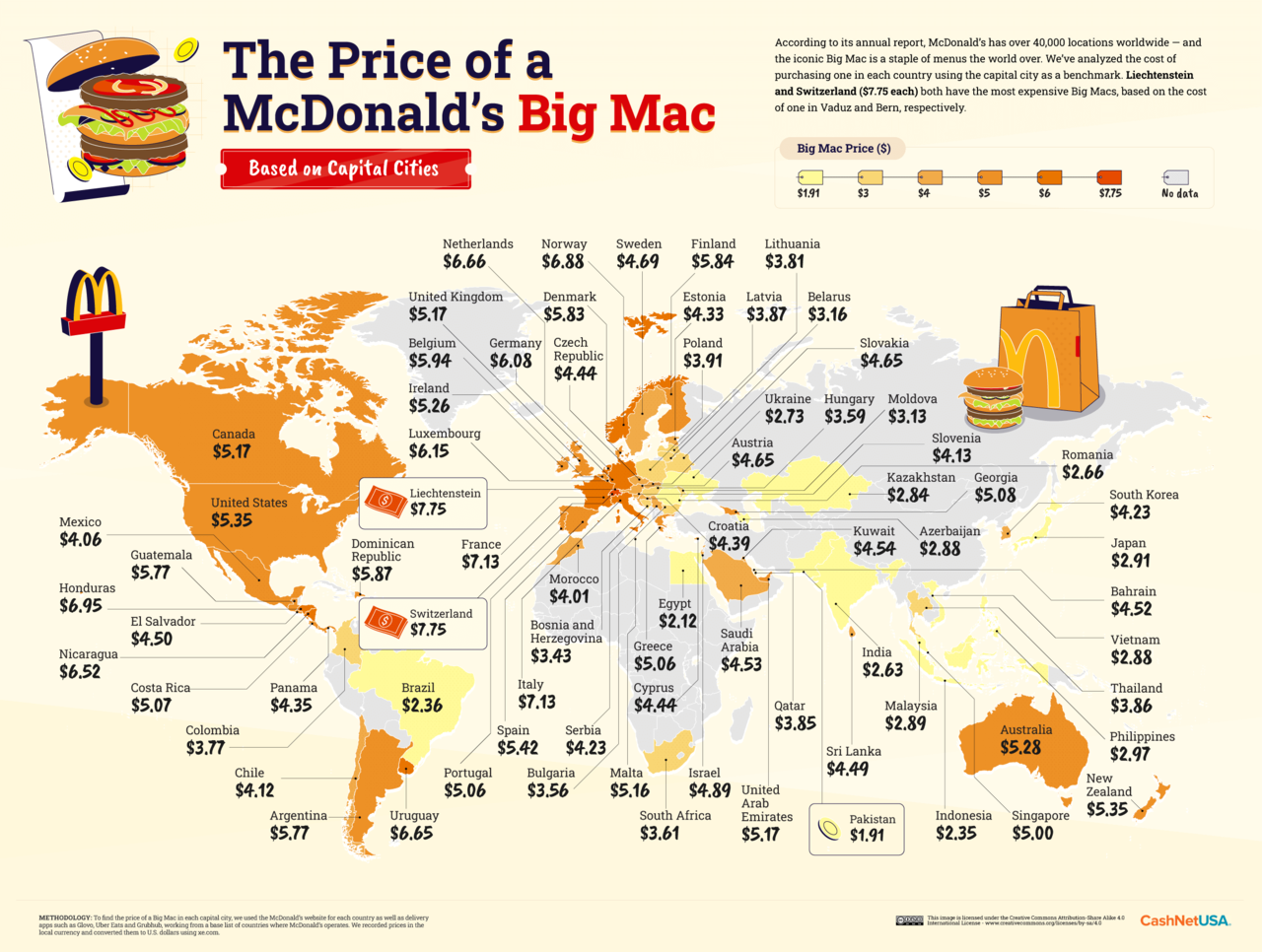

Figure 3: The Big Mac Index

Source: Cash Net USA

The Big Mac Index is a purchasing power parity (PPP) measure invented by The Economist magazine in 1986. The Big Mac Purchasing Power Parity Index is based on the price of a McDonald's hamburger. It has a number of advantages: it's easy to measure, and the composition and sale of a Big Mac require the input of both plant and animal raw materials (purchased on local markets), as well as services (cooks, vendors), chemicals and premises. This index is being studied more and more seriously by a number of economists, as it reflects the purchasing power of households in different geographical areas and currencies.

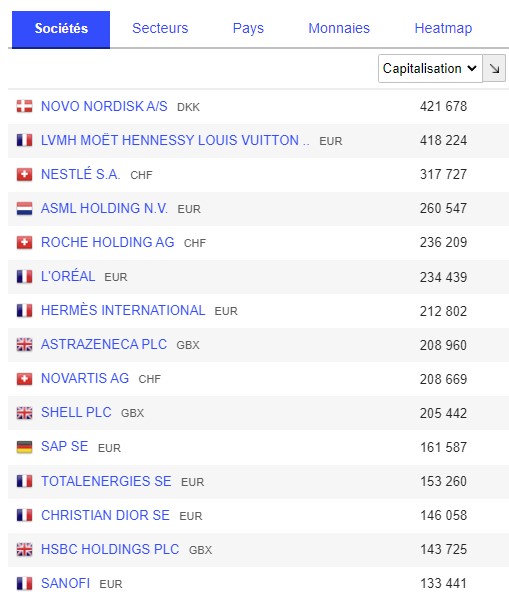

Figure 4: Novo Nordisk becomes Europe's leading capitalization

Source: MarketScreener.com

For a few sessions, Novo Nordisk became Europe's largest capitalization, ahead of luxury goods giant LVMH. The market has high hopes for the launch of its new weight-loss drug Wegovy.

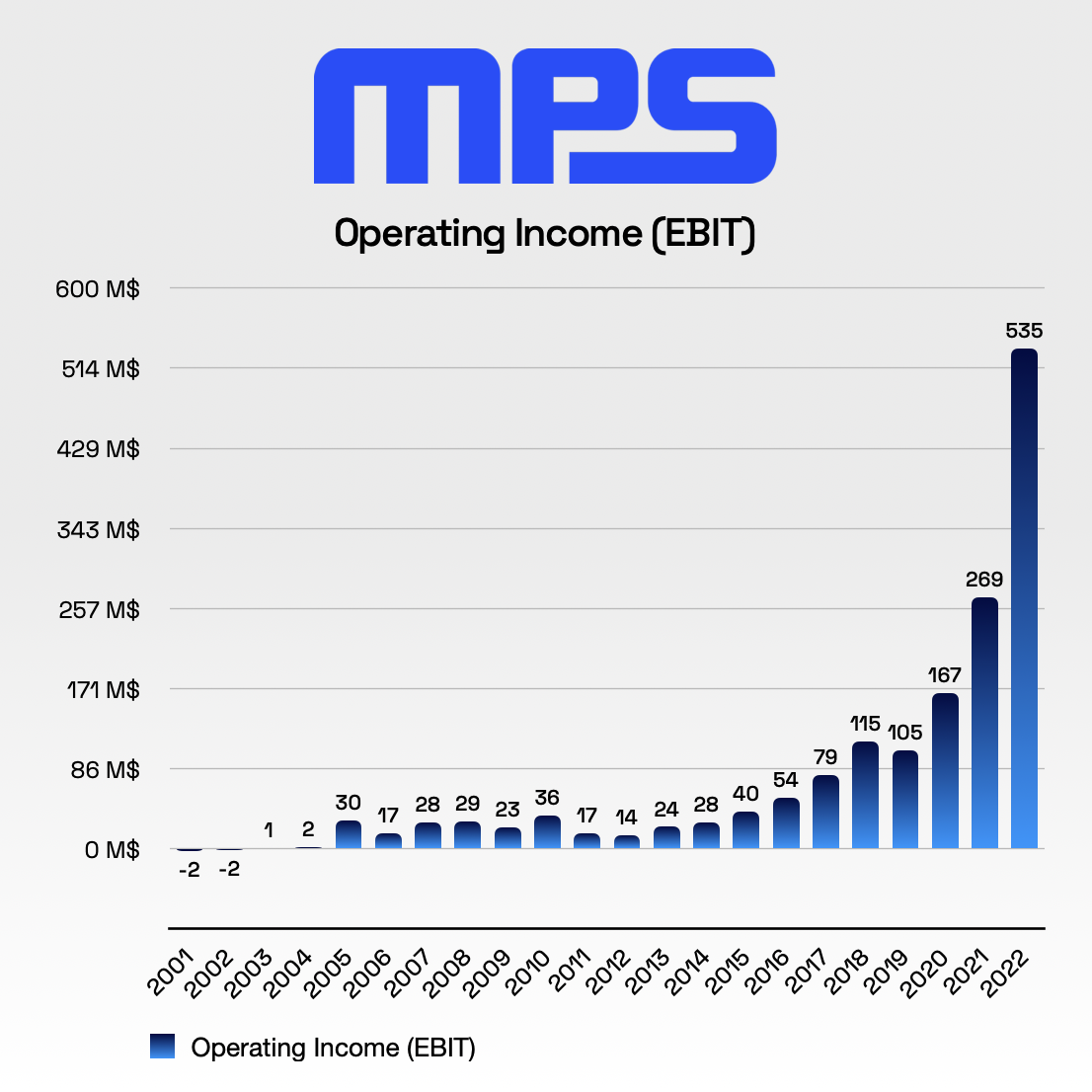

Chart 5: A quality company

Monolithic Power Systems (MPS) is a company specializing in the design, development and marketing of integrated energy management solutions. Founded in 1997, it is headquartered in San Jose, California. The company is listed on the NASDAQ stock exchange under the ticker MPWR.

MPS offers a wide range of high-performance semiconductor products that are used in a variety of electronic applications, including automotive, communications, computing and storage, consumer electronics and industrial. MPS products include DC-DC converters, voltage regulators, operational amplifiers, switches, LED drivers and current sensors.

The company is renowned for its technological innovation and its ability to provide efficient, compact power solutions. MPS also stands out for its commitment to quality, with rigorous quality control standards to ensure the reliability of its products.

The company has enjoyed steady growth over the years. Its operating profit (EBIT) has risen from $24 million to $535 million over the past decade. Profitability is very good, with ROE of 20.9%, ROCE of 20.9% and ROIC of 35.2%. Margins are 57% for gross margin, 28.9% for operating margin and 24.5% for net margin. Demand for Monolithic's semiconductor products shows no signs of drying up.

By

By