Block 1: Essential news

- Lugano: The crypto Eldorado

The Swiss city of Lugano has taken a further step in the adoption of cryptocurrencies by allowing all municipal bills to be paid in bitcoin (BTC) and USDT. The initiative is part of Lugano's Plan B, in collaboration with Tether, to integrate blockchain and Bitcoin technology into the city's daily life. Payments will be able to be made via a QR code to be scanned from a crypto wallet. This measure, in partnership with Bitcoin Suisse, adds to Lugano's previous initiatives, such as accepting cryptocurrencies at 400 points of sale via the local Web3 application MyLugano

- Brazil: The country's largest bank offers BTC trading

Itaú Unibanco, Brazil's largest bank, has announced that it will now offer bitcoin (BTC) andether (ETH ) trading services to its customers, with plans to expand into other cryptocurrencies in the future. The bank will act as custodian of crypto-assets on its own behalf, differentiating its value proposition from that of other local players who mostly outsource this service to external players. This initiative is part of a broader context of "de-dollarization" in Brazil, where the government is exploring the use of blockchain and considering a central bank digital currency (MNBC), despite a still uncertain regulatory framework for crypto-currencies.

- Bonds and blockchain: the French Touch

Societe Generale has issued its first digital green bond on the Ethereum blockchain, an innovative initiative led by its SG Forge branch. The bond, worth 10 million euros and with a maturity of 3 years, was underwritten by AXA Investment Managers and Generali Investments. Issuing on a public blockchain naturally offers greater transparency, unlike a private blockchain, particularly with regard to ESG criteria according to the company's press release. The bank also highlights the availability of carbon footprint data and the use of EUR CoinVertible, a stablecoin backed by the euro. These initiatives demonstrate Societe Generale 's commitment to combining blockchain technology and traditional finance.

- When is a Bitcoin ETF due?

LATEST: Look for updated S-1 filings this week (which answer round two comments from SEC which I heard were exhaustive and poss final). But.. we won't see updated 19b-4s bc SEC asked issuers to send back offline for now. Those prob be re-filed just bf approval date (see below) https://t.co/ZhtN86f0Q3

- Eric Balchunas (@EricBalchunas) December 4, 2023Around two years ago, the cryptocurrency market reached its peak, with bitcoin (BTC) nearing the $70,000 mark in November 2021. However, the landscape rapidly darkened in 2022, dragging many crypto entities into the abyss of the cryptosphere. This culminated in the FTX scandal in November of last year, which will forever leave deep scars in cryptocurrency history and inevitably resulted in dry losses for many investors.

But 2023 was a completely different story. The market surged remarkably, driven by growing enthusiasm for potential bitcoin spot ETFs and the prospect of lower interest rates. Bitcoin has jumped over 160% since the start of the year, from $16,000 to over $43,000 today, a peak last seen in early 2022.

More generally, the cryptocurrency market is experiencing a revival reminiscent of the days preceding the collapse of major entities such as Celsius, Voyager, Three Arrows Capital, FTX and Genesis in 2022. The atmosphere was one of FOMO (Fear of Missing Out) and YOLO (You Only Live Once). An explosive cocktail that often sends investors scrambling.

Meanwhile, BTC miners are dumping their bitcoins to regain their health. Since the beginning of November, miners have mainly been selling their bitcoin holdings, taking advantage of the recent surge in prices to bolster their cash reserves.

Glassnode

The bitcoin mining sector seems to be thriving in 2023. Hash rates have reached record levels, and miners are said to be earning, cumulatively, over $14 billion in annualized revenues, if the income generated via network transactions is to be believed. Some listed mining companies have even seen their share prices far outstrip the growth in bitcoin's price. These include :

- Marathon Digital: +359%

- Iris Energy: +356

- Cleanspark: +356

- Riot Platforms: +349

A trend in line with previous cycles. Shares in bitcoin mining companies outperform when BTC rises, but fall much more sharply when it falls.

With the marketing prowess of BlackRock, Fidelity and Franklin Templeton backing Bitcoin Spot ETFs, still awaiting regulatory approval, many expect a substantial influx of capital into the cryptocurrency sector. However, whether this will translate into a sustained market rally to the point of shattering bitcoin's all-time highs remains a matter of debate.

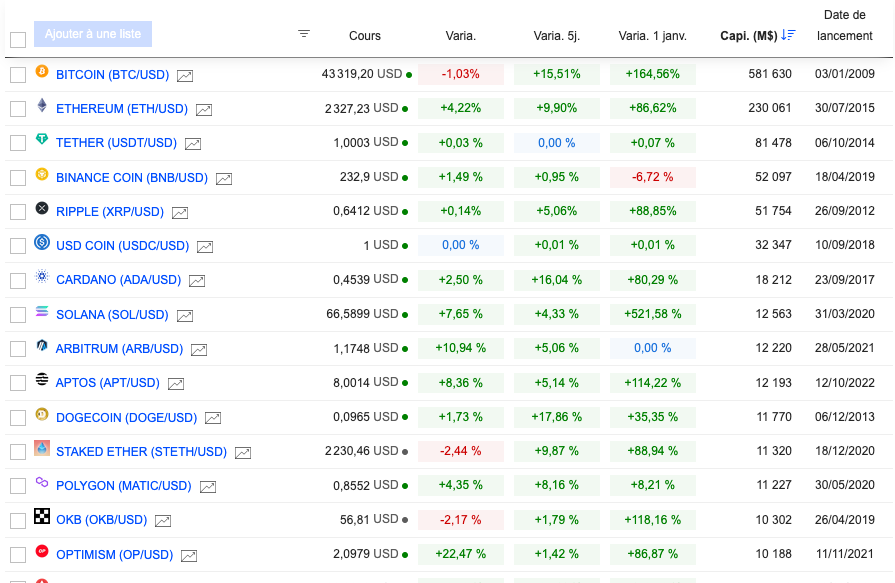

Block 3: Gainers & Losers

Binance crackdown will be 'unprecedented' boon for crypto watchdog (Wired)

In Binance's French backyard(Financial Times)

Satoshi's mistake (Bitcoin Magazine)

By

By