Block 1: Essential news

- Solana overtakes Ripple

In terms of valuation, Solana's SOL has overtaken Ripple's XRP, becoming the fifth most capitalized cryptocurrency with a value of $37.3 billion. This rise is partly attributed to the rise of "memecoins" such as Bonk (BONK) and Dogwifhat (WIF) on Solana's blockchain. Solana's Decentralized Finance Ecosystem (DeFi) is enjoying parallel success, with Total Value Locked (TVL) in excess of $1 billion. However, it remains to be seen whether this craze will continue after the waning enthusiasm for memecoins, a phenomenon that is by its very nature speculative.

- Michael Saylor is hot on bitcoin

Michael Saylor, CEO of MicroStrategy and a fervent Bitcoin supporter, sees the potential approval of a Bitcoin Spot ETF as the "biggest development on Wall Street in 30 years". In his view, such an ETF would enable massive access to bitcoin for the general public. Saylor is all the more optimistic in view of the upcoming "Halving Day", which will halve BTC rewards for miners, a phenomenon that has been favorable for BTC's valuation in the past. This mechanism could, he believes, lead to a very positive 2024 for bitcoin. On the other hand, it's worth taking a step back from Saylor's comments. Given that MicroStrategy currently holds the largest number of bitcoins in the world, 174,530 BTC to be exact, it's rather natural to see the CEO being (perhaps a little too) positive about the digital currency. Find an interview with the CEO on the subject below:

- BlackRock revises its copy

BlackRock has (again) updated its application for a Bitcoin spot ETF, favoring a cash creation and redemption model. This model facilitates transactions for investors, allowing them to buy shares with dollars rather than bitcoins. This approach is in line with the preferences of the Securities and Exchange Commission (SEC). The ETF, named iShares Bitcoin Trust, will be listed under the ticker IBIT on Nasdaq. In addition, other entities, including Ark Invest & 21Shares and Wisdom Tree, have also submitted Bitcoin spot ETF applications to the SEC, suggesting a trend towards wider acceptance of Bitcoin ETFs by the regulator.

- Coinbase battles SEC

The Securities and Exchange Commission (SEC) has rejected Coinbase's petition to clarify cryptocurrency regulations. In response, Coinbase has again taken the matter to court, criticizing the SEC's decision as "arbitrary and capricious". Two SEC commissioners, Hester Peirce and Mark Uyeda, disagreed with the decision and encouraged others in the cryptocurrency industry to continue advocating for regulatory changes. They hope to see proposed rule changes and guidance that would help the crypto industry grow in the US, despite the SEC's refusal to engage in discussions on these issues.

Block 2: Crypto Analysis of the Week

In 2023, the cryptocurrency industry had its moment in the ruthless corridors of justice, after a turbulent and bloody 2022. The market wallowed by over 64% in 2022, which had crypto aficionados in a tizzy when it came to debating it at Christmas dinner. But in 2023, things have changed, and pro-BTCers will be able to boast that they've kept their crypto-assets. With an increase of over 160% since the beginning of January, bitcoin will once again arouse curiosity around the table.

MarketScreener

But not everything has been rosy this year - quite the contrary. Leading figures such as Changpeng Zhao of Binance, Alex Mashinsky of Celsius and Su Zhu of Three Arrows Capital (3AC) saw their freedom curtailed after the US justice system stuck its nose into the labyrinthine corridors of the cryptosphere. Meanwhile, the saga of ex-FTX boss Sam Bankman-Fried unfolded before the eyes of a jury in what was billed as one of the most important white-collar trials in the annals of American history. However, we'll have to wait until March 2024 to find out the final verdict and whether the 30-year-old American will end his life behind bars or not.

But that's not all. Other court decisions will continue to influence the market in 2024. Will Terraform Labs' Do Kwon be extradited from Montenegro to South Korea or the USA? How will Mashinsky fare in his criminal trial? What's certain is that putting cryptocurrency bigwigs who have defrauded in one way or another out of business is undoubtedly useful and essential if the sector is to thrive in the long term.

But have they all been brought to light? And can the sector take off again without a shadow on the horizon? Nothing is less certain, as Kristalina Gerogieva, Managing Director of the International Monetary Fund, pointed out in a speech on December 14: "In short, over the past 15 years, the cryptocurrency sector has not forged a glorious reputation for itself. Nor is it out of the woods".

Despite these uncertainties, the sacrosanct blockchain, which underpins cryptocurrencies, is gaining ground. Traditional financial institutions are exploring its potential, and the Monetary Authority of Singapore is studying its applications in real asset tokenization and decentralized finance.

The other hot topic on the table will inevitably be BlackRock's Bitcoin Spot ETF. It might even eclipse everything we've talked about so far. After a decade of SEC rejections of various Bitcoin Spot ETF applications, BlackRock, the world's largest asset manager, has entered the fray and taken a whole wave of speculation with it.

Over the past ten years, more than 30 applications for Bitcoin Spot ETFs have been submitted, all of which were rejected on the grounds of: lack of market transparency, risk of fraud and market manipulation, and insufficient oversight. But BlackRock's presence could change all that.

The American behemoth, with over $10,000 billion in assets under management, wields considerable power and influence in the global financial industry. BlackRock CEO Larry Fink is an influential figure in the Democratic Party, which also includes SEC Chairman Gary Gensler. BlackRock has also pledged to implement a monitoring program to curb market manipulation, which has been a major stumbling block in previous Bitcoin Spot ETF rejections.

Given BlackRock's impressive track record (575 ETF applications accepted against just one rejection), it's logical to think that the Bitcoin ETF project could well be accepted.

And investors don't seem to see BlackRock's move as a potential failure. If approved, BlackRock's Bitcoin ETF could, for BTC's most fervent speculator-defenders, potentially emulate what BlackRock achieved for gold, taking bitcoin from its current market capitalization of $850 billion to over $10,000 billion.

But the crypto landscape remains littered with uncertainties, prompting questions about the sustainability of the market's current enthusiasm. As a reminder, the SEC approved its first bitcoin futures-linked ETFs in 2021, a move traders believed would mark a turning point in mainstream cryptocurrency adoption. In the end, the year that followed was probably the most dramatic that crypto-investors have experienced.

Then at the time, the first issuer to launch absorbed most of the demand, leaving little volume for the other funds that followed later. This war is expected to repeat itself this time around, with BlackRock, Invesco and Fidelity vying for the lead. Only time will tell whether the approval of such an ETF will encourage investors to pour astronomical sums into a stock market product backed by the price of the cryptocurrency market leader. An answer to the Bitcoin Spot ETF applications is expected early next year from the SEC.

By the time you've debated these topics, and whether or not to buy bitcoin, you'll probably have reached the time to eat the log. But as the effects of the champagne take their toll, you'll probably have to move on to something a little lighter. In any case, you're ready to debate, whether with your pro-crypto cousin or your slightly more recalcitrant uncle.

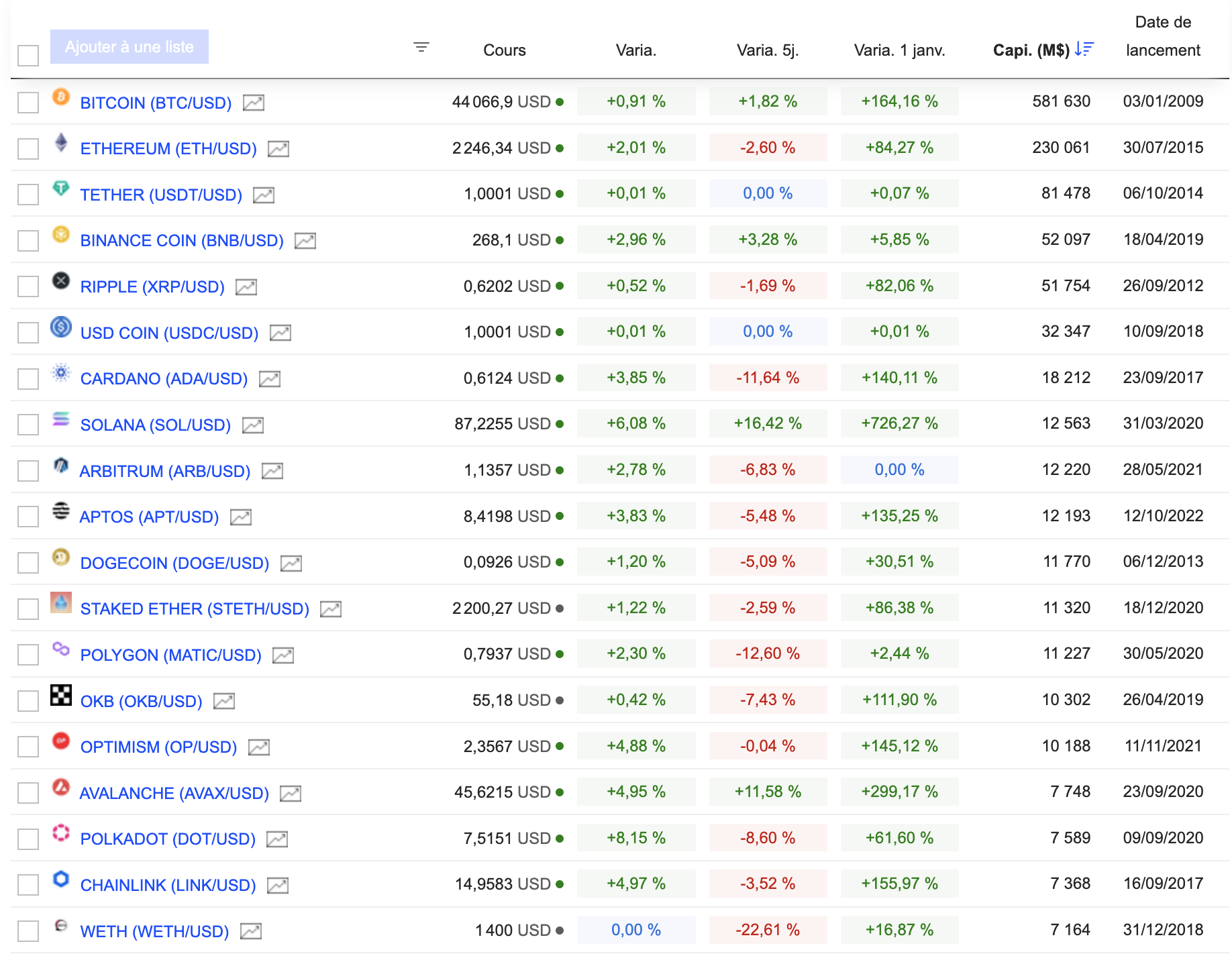

Block 3: Gainers & Losers

Crypto chart

(Click to enlarge)

Block 4: Things to read

The race to fill FTX's hole (Wired)

Bitcoin as a CBDC (Bitcoin Magazine)

By

By