While at the age of 24 I already considered myself as a connoisseur in gaming, always aware of the latest news in the sector, I realize how fast this industry is changing. As a big fan of PC games, I'm always surprised to read that revenues from mobile games are far ahead of those from computer or console games and I have to admit that the big franchises often show an impressive originality to conquer bigger and bigger market shares with games that I personally would never install. This industry, which experienced a clear acceleration during the different phases of lockdowns, seems to have lost its momentum during 2021 as we observe corrections on the price of Tencent, Activision Blizzard, NEXON or Netease. In a tense economic and health context and with the return of restrictions in some regions of the world, it is perhaps time to consider more seriously the few leading stocks that have corrected to take advantage of a possible rebound.

The gaming market

Recognized as one of the markets with the most potential, gaming has been doing relatively well in recent years, with an acceleration during 2020. The development of online games, and more recently the adaptation of the biggest licenses to mobile platforms, have done a lot of good for the sector. However, given their fundamentals, the shares of the industry's giants are currently trading at prices that are far from staggering.

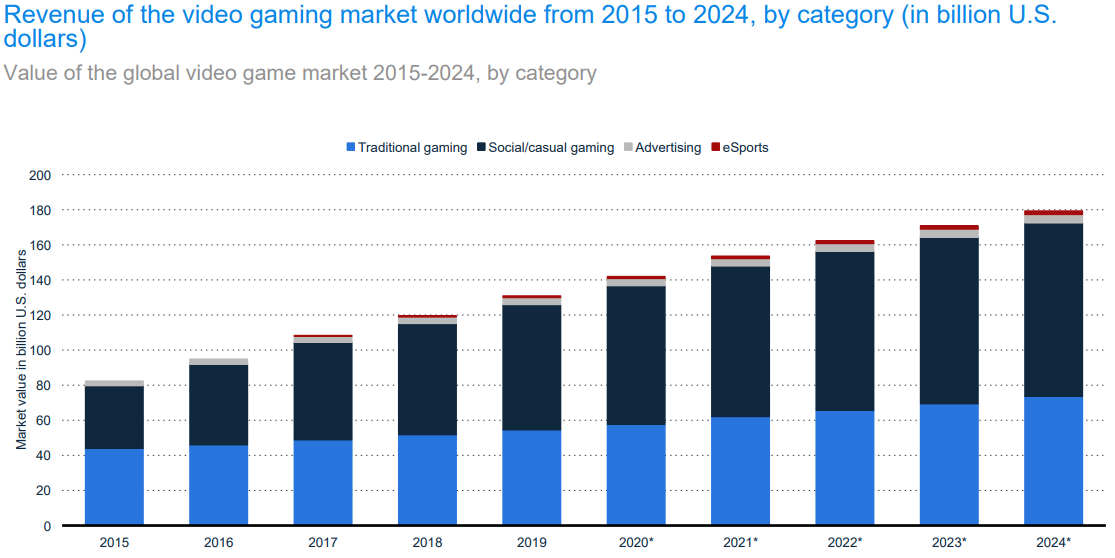

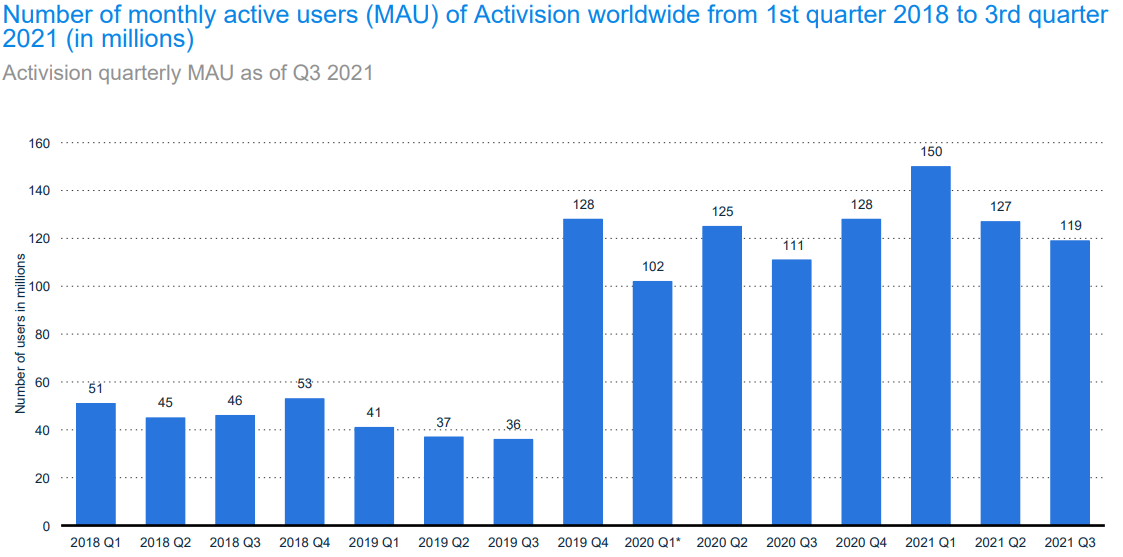

In 2020, the video game market is estimated at 175 billion dollars by Newzoo and 139 billion by SuperData, which already says a lot about the transparency of this market. Compiling data from the biggest players, we can estimate the number of gamers at around 2 billion. However, once again, I would like to draw your attention to the fact that the numbers of users do not necessarily reflect the real activity. With this in mind, Activision Blizzard points out that a player who plays the same game on two different platforms is counted twice, as is a player who plays on two different devices (mobile and PC for example).

In terms of devices used to play games, the phone comes in first place. 45% of games downloaded are mobile games, compared to 28% for consoles, 19.5% for PCs and 7% for tablets. The mobile game market is growing partly due to the evolution of screen size, the progress made in technical glasses (better touch experience), but especially the development of emerging countries where people use the phone much more than computers or consoles, due to lack of money. Let's note that the smartphone, in addition to providing entertainment, meets a number of other needs. You can even make a phone call with it.

In terms of revenue generated by geographic region, it is unsurprisingly China that comes in first place. 43.7% of revenues come from the world's most populous country. 26.9% come from the United States, 16.2% from Japan, followed by South Korea (5.5%), the UK (5.4%) and India (4.6%). France is the 7th most interesting market, with 2.4% of revenues generated there.

The main actors are: Tencent, Roblox Corporation, Sony, Microsoft, NetEase, Nintendo, Activision Blizzard, Electronic Arts, Ubisoft, Take-two interactive, Bandai Namco, Nexon, Alphabet Inc, WeChat and Apple. It should be noted that among the companies mentioned, some have the advantage of being developers of operating systems, downloading platforms or manufacturers of consoles on which the others depend.

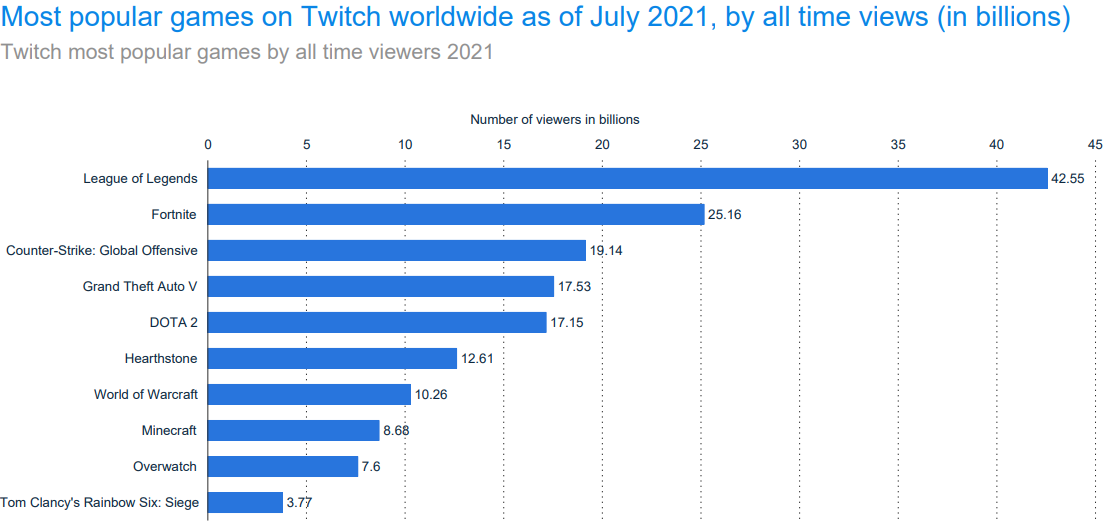

It is impossible to rank the most played games in the world without giving more details. Are we talking about active users, the number of downloads, accounts created, a ranking of all devices combined ? That's why we tend to think in terms of revenue generated. In 2020, Honor of Kings, Peacekeeper Elite and Call of Duty shared the podium with revenues estimated between 2 and 2.5 billion dollars for each of these three licenses.

In this industry, it is the business model that has undergone the most radical changes in recent years. From now on, free-to-play is THE strategy used for most of the licenses. The revenues generated come from the sale of additional content and advertising space that the user encounters while playing.

The gaming market is all the more complex as the major groups exchange licenses, sometimes delegate the exploitation to third-party companies or subcontract certain phases of development abroad to remain competitive. It is also worth noting that some conglomerates are invested in other gaming players, such as Tencent, which has stakes in Ubisoft, Activision Blizzard and Epic Games.

Market risks

Consumption patterns that are difficult to predict

These multiple transformations are not without consequences for game publishers. Users' consumption patterns are cyclical and difficult to predict. Desires change quickly and even an extremely popular game can lose its audience. Nothing can be taken for granted. So publishers must be original, implement updates and add new exciting content. To do this, you have to listen to your players and make sure that the relationship lasts. In this idea, the Battle.net platform operated by Blizzard allows the group to gain independence and understand the consumption patterns of its players.

An increasingly open market

It is also worth remembering that a few years ago, the number of game publishers was much smaller. Today, a new entrant with a bit of talent, luck and ideas is able to disrupt the market without really being established. One example would be Fortnite. The ease with which publishers outsource critical phases of development partly explains this.

A player does not identify with the publisher

A gamer rarely identifies with a publisher. They are willing to change of game at any time without really caring about the development team behind it. To stay competitive and maximize the chances that the gamer will choose one product over another, a publisher must present a game that is close to perfection, without errors or bugs that would compromise the gaming experience. A bit like luxury companies, a publisher must create a need that doesn't exist and force the urgency with all the methods at its disposal, like partnerships with steamers followed by millions of people or huge events like the World Championship of League of Legends. The Call of Duty league and Overwatch league events are very successful and allow Activision Blizzard to assert its position as a great editor on the e-sport scene.

Increasingly high expectations

Gamers' expectations are getting higher and higher in terms of quality and performance. Release delays can be truly expensive, especially since development teams cost a fortune. There are several reasons for a delay, and it is interesting to note the dependence of editors on other players such as smartphone or console manufacturers. Internal management problems, semiconductor shortages and rising metal prices are all events that game developers fear, especially since their most advanced games can only be played on the latest PCs, mobile and consoles. Activision Blizzard is currently experiencing delays on two of its best sellers: Overwatch 2 and Diablo 4.

A volatile job market

Regarding development teams, several publishers point out that the job market in this sector has never been so volatile. There are a lot of jobs out there, and the positions are known to be some of the most lucrative in terms of income. So a publisher, like any other company for that matter, has to care about the work environment in which its teams operate, not just its customers. Scandals, such as the one Bobby Kotick (CEO of Activision Blizzard) is going through right now, are fatal for the group.

A strong dynamic of technological advances

Technological advances have been exceptionally dynamic since the beginning of the 20th century. Publishers must adapt to these changes and be able to understand which investments are the most strategic. Motion capture, which enables more real-world cinematics than ever before, is an example of a widely used technology that requires significant investment.

Dependence on distribution platforms

The proportion of revenue from digital distribution is increasing compared to traditional distribution methods. This observation allows us to understand the dependence of game designers on download platform providers. These platform providers have a very important influence on the visibility and the price of the developed products. The business of publishers is therefore largely dependent on the success of consoles and smartphones as well as the availability of games on a particular platform.

The risk of F2P

The business model based on Free to Play presents a significant risk. Publishers do not have the right to make mistakes and a game must go viral as quickly as possible. With a low number of users, Free-to-Play (F2P) online games cannot work and it will be impossible for the publisher to amortize its expenses. The risk is all the greater as the most successful games are those with the most potential in F2P.

Seasonality of sales

The seasonality of game sales is a factor that the publisher must be concerned about. Again, a delay in the development cycle may force the game developer to postpone the release of the game to the following year, even if the technical delay is only a few weeks.

Business abroad

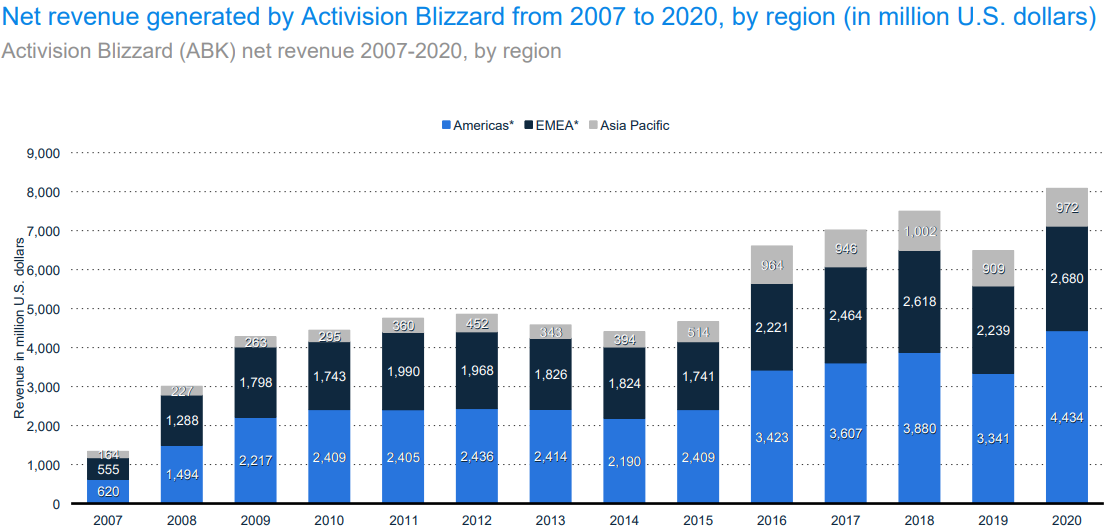

As the distribution of video games is largely facilitated by digital technology, publishers reach a large audience abroad and are exposed to risks related to increased tariffs on international flows, currency fluctuations, international politics and economic activity in regions of interest. For a U.S. publisher such as Activision Blizzard, it is very difficult to achieve equivalent margins in other regions of the world.

All of these risks need to be identified and the analyst's role is to understand how the company manages to mitigate them. We could have added to this list the risks related to server operations, hacking risks and legal risks...

Activision Blizzard

In terms of capitalization, Activision Blizzard is among the top 5 largest video game publishers alongside Tencent, Sony, Netease and Electronic Arts. Its games are available in 190 countries and they have an estimated 400 million active players (over 100 million in the Americas, Europe and Asia). The company operates through three distinct entities, each of which has internally developed game licenses.

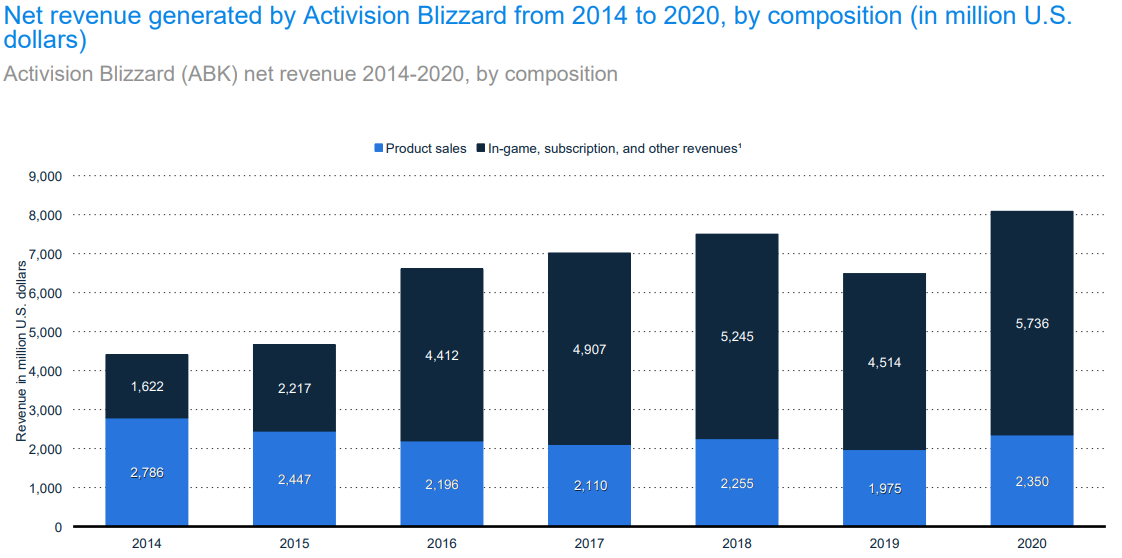

Activision

Activision operates premium and free-to-play games and generates revenues from game sales, in-game spending by users and royalties from licenses granted to third-party companies. This segment includes the operations of the Call of Duty League, an international professional e-sports league.

Blizzard

Blizzard also operates premium and free-to-play games. Revenues are generated from game sales, in-game spending and subscriptions to the battle.net platform, which facilitates the distribution of Blizzard and Activision content. This business also includes the activities of the Overwatch League, an international professional e-sports league.

Blizzard games: World of Warcraft, Overwatch, Hearthstone, Diablo

King

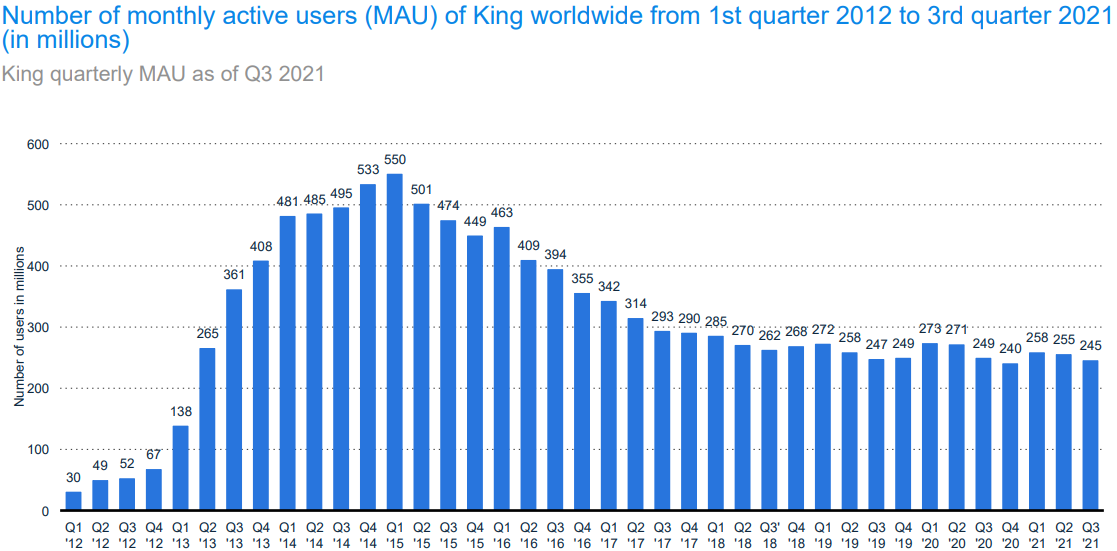

King operates free-to-play games and generates revenue from advertisements that the player encounters during the game on the mobile platform.

King games: Candy crush, Farm Heroes, Bubble Witch, Pet Rescue Saga, Knighthood, Blossom Blast Saga

2019 was a breakthrough year for the group with the launch of Call of Duty mobile. Let's be a little clearer related to this game as many have questions about its origin. Call of Duty Mobile, a big competitor to PUBG Mobile is not a Chinese app despite the small logo seen at the app's launch. The game is indeed published by Activision, in association with Garena. Even though it is developed by TiMi Studios, a subsidiary of Tencent, the revenues go to the publisher who took care of the financing, that is Activision.

Since its release, the group has understood that the potential of a game is not limited to one platform or one business model. The success of Call of Duty Mobile (more than 400 million downloads) has validated this new growth strategy that the group will be able to transpose to other games when it is consistent. Activision has also revealed that it is in the development phase for an episode 2 on mobile.

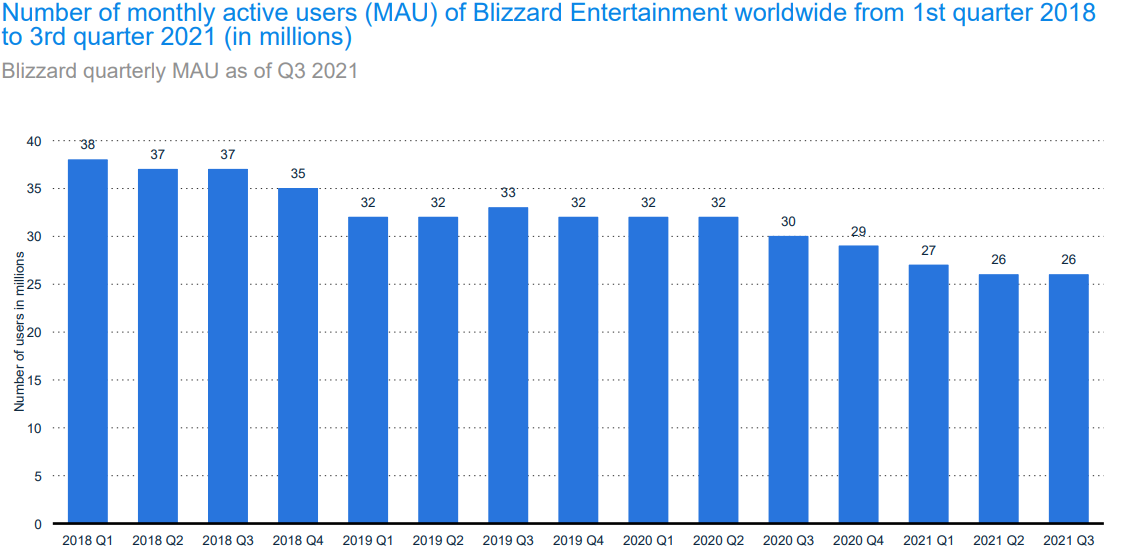

A second strategic move (or not) of the group concerns the release of World of Warcraft classic, a re-release of the version from 15 years ago, much requested by the community of a game that has been dying for several years. Why did they wait 15 years to release a game that was already developed? Because Bobby Kotick, who is far from being an idiot when it comes to business, waited until the last moment to release an honorary barroud, supposed to allow the company to take back the few hundreds of thousands of players who are passionate about the original game experience on the private servers. A maneuver that costs little and has enough to delight the shareholders. However, it is obvious that this re-release of the first version of the game in which everything takes longer (leveling up, finishing a quest, finding a group for a raid) is now competing with the game with multiple expansions. In any case, the number of people playing World of Warcraft has only decreased since 2016, reaching about 4.74 Million active players in 2021 according to Statista. For its part, World of Warcraft classic would have 215,000 active players, including 108,000 on US servers and 107,000 on EU servers, down by about 40% compared to 2020. This drop is far from surprising given the little effort Blizzard has made to make it a success (low investment in servers worthy of the name, interminable waiting time to play). However, we can read in the group's annual report that the teams are thinking about extending Warcraft (a strategy game different from World of Warcraft but set in a comparable universe) to the mobile platform. Currently in the final stages of development, this game based on a universe that has already convinced more than 100 million people over the past 15 years, could be Blizzard's next success. Again, let's hope (both as a player and an investor) that the group chooses the Free-to-Play strategy, or even a Play-to-Earn strategy using NFTs and Blockchain to give players the means to resell their equipment and characters in exchange for cryptocurrencies.

As for other licenses, the results are mixed. The release of Diablo II: Resurrected in September 2021 has gotten off to a good start, and it feels like Blizzard is seeing the end of the tunnel (active player numbers on Blizzard licenses have been in freefall since 2017). The company didn't release specific sales figures, but management points out that the 20% growth in revenue in Q3 2021 compared to the same quarter last year is largely due to the successful launch. On the other hand, Diablo 4 and Overwatch 2, which are considered future best sellers (Overwatch generated more than $1 billion in revenues in less than a year after its release with about 60 million downloads and Diablo III sold more than 30 million copies), are delayed and the Blizzconline of early 2022 is cancelled. Added to this are the harassment scandals that have plagued Blizzard for several years, involving several dozen employees. The game publisher has begun a staff clean up, but many believe that the problems come from the top management and more particularly from Bobby Kotick and his inappropriate behavior, revealed in an investigation by the Wall Street Journal. Kotick said he was ready to leave his position if the climate does not stabilize, an event that employees (more than 1700 have signed a petition) are waiting impatiently to get back to work in good conditions. However, as I write these lines, CEO Bobby Kotick is still in office and the demands for his resignation are intensifying on social networks.

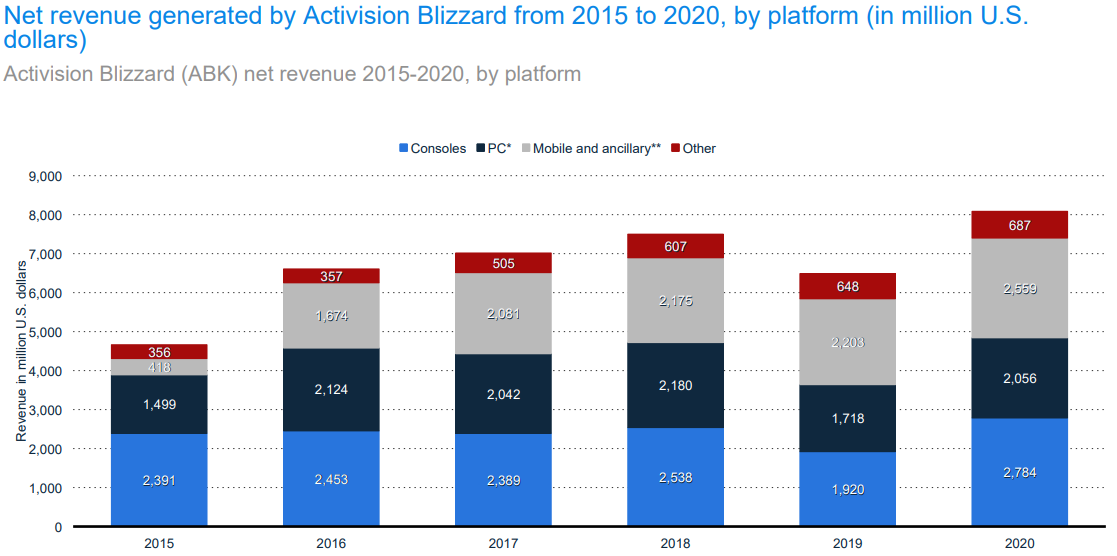

It is worth remembering that Activision Blizzard, one of the biggest video game publishers (390 million active players), is currently going through a phase of uncertainty where shareholders are sorely lacking visibility regarding the future of the stocks they own, which have lost more than 45% of their value in 7 months. The group, whose revenues come from Activision licenses (35.9%), King licenses (36.5%) and Blizzard activities (27.6%), is currently implementing a new strategy based on mobile games, which is proving to be very successful. Release delays and corporate issues have dealt a deserved blow to the stock, which is now trading at industry-leading prices. If these issues are resolved (and they probably will be), then the company's share price would have good reason to continue its rebound.

By

By