|

|

| This week's gainers and losers |

|

|

| Commodities |

|

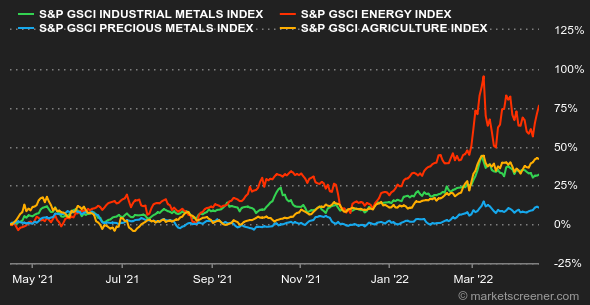

Vladimir Putin said peace talks have reached a dead end, which put pressure on oil markets. In this context, operators fear that the European Union could severely sanction Russian oil, which would obviously mean a tightening of the market. In addition, the Chinese authorities have begun to relax restrictions related to the coronavirus, a good point for oil demand, which has generated optimism on prices this week. Also on the demand side, OPEC lowered its forecast in its latest monthly report, as the cartel expects global economic growth to be slightly weaker than expected due to the economic impacts of the war in Ukraine. Brent crude is trading around USD 106 per barrel, compared to USD 104 for WTI. Gold also gained ground and is slowly approaching the USD 2,000 mark, despite rising yields in the major bond markets. In base metals, prices have moved lower overall due to the improving situation in China, where authorities are working to clear bottlenecks at logistics sites, including port terminals. Copper is trading at USD 10,290, compared to USD 3,200 per tonne for aluminum. Zinc, on the other hand, has set a new annual high on the LME, above USD 4500 per metric ton. Agricultural commodities continue to perform well. Wheat once again exceeded 1100 cents per bushel in Chicago. Price movements naturally remain closely linked to developments in the conflict in Ukraine, which has announced that its production is expected to fall by almost 50% year-on-year. |

|

| Macroeconomics |

|

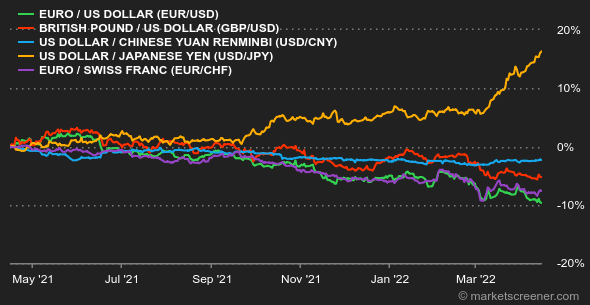

As you might have guessed, we are going to talk about monetary policy again. The stock market is still a bit scalded by the pace of rate hikes that the Fed is about to print. But they found some comfort this week, with the release of slightly lower than expected U.S. inflation. It's all relative, of course, as U.S. prices continue to soar. But the increase in prices excluding food and energy was a little less than expected between February and March, which helped to calm bond yields in the middle of the week. However, the easing did not last long. The U.S. 10-year rose to 2.8% on Thursday. The rather firm tone of US central bankers contrasted with that of the ECB, which met on Thursday. Christine Lagarde and her team confirmed the upcoming end of the asset purchase program but did not harden their speech on rates. The euro logically fell to 1.0792 USD. Against the franc, the single currency was trading at CHF 1.0172. The responsibility of central banks will remain heavy in the coming weeks, as they have to manage a soft landing without letting inflation slip. Almost squaring the circle, given the backlog. The crypto-currency market is still riding the coattails of the Nasdaq this week. The correlation between the price of the U.S. technology stock index and bitcoin is no longer in question. The crypto-currency continues its fall that began at the beginning of the month and is back to hovering around $41,000 at the time of writing. A scenario that, once again, has enough to put investors' nerves to the test. Next week, the macroeconomic agenda is heavy with Chinese growth (Monday), the German Ifo index (Wednesday) and the preliminary PMI activity indicators for April (Friday). All of this will be punctuated by speeches by central bankers, which will remain gospel for investors. |

|

|

| Things to read this week | ||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By