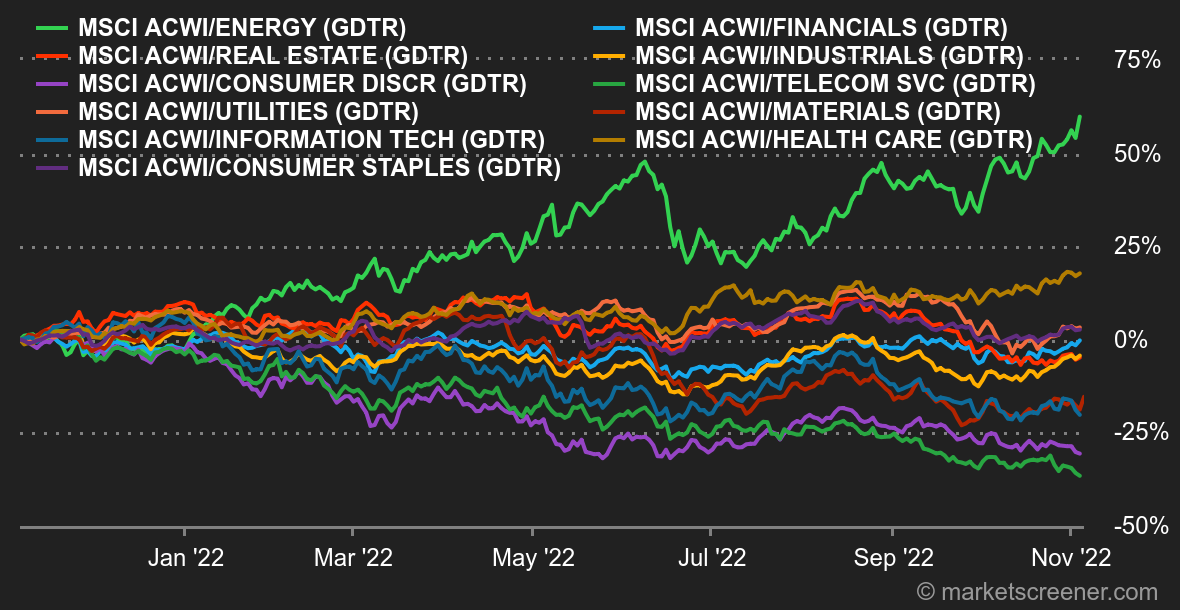

Atmosphere: Roller Coaster. On Wednesday, the U.S. central bank seemed to pave the way for a slightly less restrictive policy in the future, after raising its rates by 75 basis points. But statements by the Fed boss right after the announcement cooled investors. Jerome Powell indicated that the peak of the rate cycle envisaged by the market was probably a bit low. The equity markets then fell heavily. But on Friday, a slight rise in the US unemployment rate rekindled the flame of hope: after all, if the overheating of the labor market starts to cool down, the central bank might not need to be so punitive, who knows? As you can see, we are still in the realm of epidermal reactions. The end-of-week rebound was exacerbated by rumors of an upcoming change in Chinese zero-covid policy.

Yields: Yields remained on the upswing this week, after the aforementioned statements by Jerome Powell. Derivatives show that the market expects a rate peak of 5.25% for the Fed next year. The 10-year maturity of U.S. debt is paying 4.12% (3.98% a week earlier). The yield curve remains inverted relative to short maturities, so the market still fears a recession. Elsewhere in the world, the Bund rose to 2.27% and the OAT to 2.80%. Gilts confirmed their return to calmer waters, around 3.53%. The most expensive debts in the region remain those of Italy (4.44%) and Greece (4.65%).

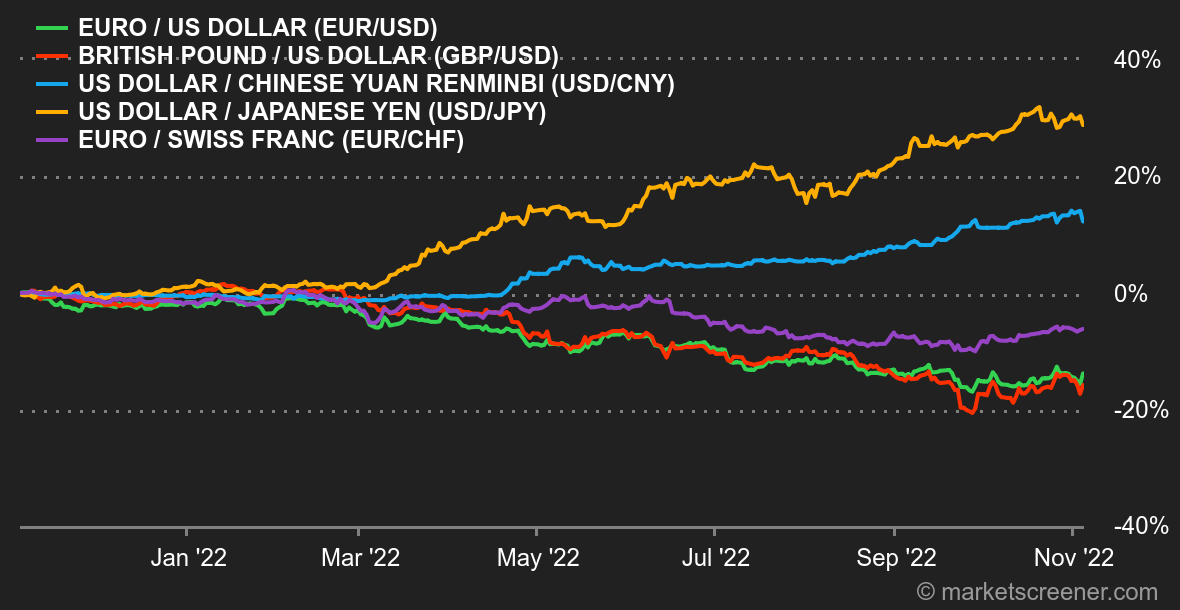

Currencies: It was a difficult week for the British pound, despite a new 75 basis point tightening by the Bank of England. The euro rose to GBP 0.8749 and the dollar to GBP 0.8923, gains of around 2% for the week. As for the euro-dollar pair, the single currency slid for four days before recovering strongly on Friday, after the release of the US unemployment rate increase, to return to USD 0.9924 .

Cryptocurrencies: This week, bitcoin held up better than US stock indexes by being slightly in the positive around USD 21,000 at the time of writing. On the other hand, it is still far from being out of the woods, even if the rebound started last week has given some optimism to crypto-investors. The digital currency is still gravitating not far from its yearly lows and is operating in a macroeconomic environment that is still fragile for risky assets. Bitcoin may take a while to recover as it plays with the nerves of crypto ecosystem aficionados in the coming weeks.

Calendar: Two big events next week for financial markets. First, the US midterm elections on Tuesday, November 8. Then the October US inflation figures, unveiled on Thursday. Canada and the United States will switch to daylight saving time over the weekend, which will restore the traditional time difference. There will be a holiday on November 11.

|

By

By