|

Friday October 22 | Weekly market update |

| Reassured by mixed statistics that cast doubt on the short-term trajectory of central banks, but above all galvanized by good quarterly results, the major global indexes have continued their rise this week. While Europe seems to be more tempered, Wall Street is clearly benefiting, setting new all-time highs in the process. |

| Indexes Over the past week, Asia was mixed, still concerned about inflationary fears and the news surrounding the Chinese real estate giant Evergrande. The Nikkei lost 0.9%, penalized by the rebound of the yen, while the Hang Seng gained 3.2% and the Shanghai Composite only 0.3%. For Europe, volatility persists and weekly variations are not very significant. The CAC40 has gained 0.4% over the last five days, the Dax has barely risen by 0.1% and the Footsie has remained stable. For the peripheral countries of the euro zone, Italy climbed 0.6%, Spain fell symmetrically by 0.6% while Portugal stood out again, with a gain of 1.8%. However, it is the American indexes that are benefiting above all from the good corporate results, particularly in the tech sector. At the time of writing, the Nasdaq100 recorded a weekly performance of 2.2%, the Dow Jones of 0.9% and with the S&P500 (+1.7%), they both signed new historical records. |

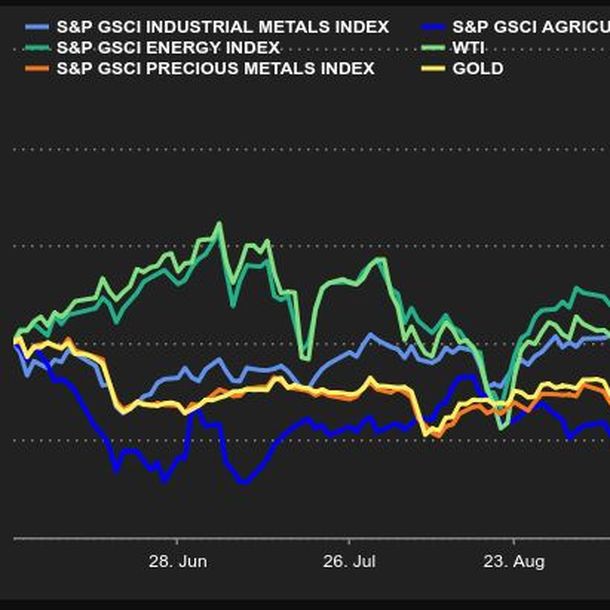

| Commodities A flat consolidation sequence for oil markets, which are stabilizing at their highest level of the year. It is therefore time to take a breath, which seems legitimate after all given the path of oil prices. The rise is almost indecent: A 70% increase since January 1 and more than 100% year-on-year. A tightly controlled supply by OPEC+ and a sharply rising demand contribute to this result. Brent crude is trading around USD 85 per barrel while WTI is trading above USD 82. Precious metals have been on the rise this week, supported by a weaker dollar but also a push of real rates into negative territory. This has benefited the gold metal, which has risen for the fourth consecutive session, once again topping the USD 1,800 per ounce mark. In industrial metals, the barometer of the global economy, copper, is taking a breather, dragged down by the slowdown in Chinese growth in the third quarter. A ton of copper is trading at USD 10,200 on the London Metal Exchange. Nickel and lead, on the other hand, are extending their upward trajectory to USD 20,500 and USD 2,400 respectively. Precious metals are up  |

| Equity markets Between Mark Zuckerberg's shattering announcements that he aims to metamorphose the social network into a metaverse, the 25% plunge in Snap's share price and now the potential takeover of Pinterest by PayPal, the technology sector is not left out this week. Here we'll focus on this latest shakeup. Pinterest, the photo-sharing focused platform that now has over 450 million monthly active users has seduced the payment system in a growing "social commercial" context. The app is defined as a catalog of ideas where each user can build an album of images related to their interests (note that 100% of revenues come from advertising). Has the giant across the Atlantic found the missing piece of the puzzle to become a "super app"? After launching a digital asset trading tool for customers across the UK and integrating shopping solutions into the app, PayPal wants to be as close as possible to its 400 million users. The acquisition of Pinterest is another step in the social dimension of the American company. According to the Bloomberg agency, discussions are underway for an acquisition price of $70 per share, a valuation that would gravitate around $45 billion for the social network. Pinterest was launched in 2009 but the IPO came only ten years later. The announcement of the possible buyout by PayPal had the effect of a bomb on Wednesday's stock market, causing the social network's share price to take off by 13%, ending up close to $63 at the bell, but gravitating at the time of writing below the $60 threshold (we're still far from the potential buyout price). While at the same time these rumors made PayPal's share price plunge by 5%. In terms of financial results, Pinterest posted a revenue of $ 1.69 billion in 2020, an increase of 48% compared to 2019 and quarterly revenues of the firm up more than 120% over a year to $613 million for a profit of 70 million. The acquisition represents an opportunity for the payment giant to become an all-in-one app like Alipay or WeChat. The opportunity to offer a significant presence in social networks, a fast growing segment for e-commerce. Snap and Intel take a hit this week  |

| Macroeconomics Macroeconomics seems to have taken a backseat to the increasing number of quarterly corporate results, which have clearly taken over as the driving force behind equity markets. But it is never far away, as two important events this week have shown. First, the release of Chinese Q3 2021 GDP marked by a visible slowdown. We can't say that economists were taken by surprise, but growth has slowed enough for financial markets to be a little alarmed. Secondly, the continued rise in bond yields. The 10-year debt in the United States reached the symbolic 1.7% mark during the week. Germany's is at -0.09% for the same period. A month ago, the T-Bond was at 1.33% and the Bund at -0.33%. A rise which seems logical in an inflationary context and which does not seem to disturb the financiers too much. As we regularly point out in these columns, it is the violent variations that scare the markets more than anything else. In the foreign exchange market, the euro has regained some color over the week, gaining a few cents on the dollar. It takes USD 1.1636 for 1 EUR today. The EUR/CHF pair is trading at CHF 1.0661. Not much is happening on the FOREX right now, waiting for the masks to really come off on the central bank policy side. The coming week will be punctuated by a number of very important indicators for the markets. US durable goods orders for September will be released on Wednesday, before the first estimate of US Q3 GDP on Thursday. On Friday, German Q3 GDP will be followed by a session focused on the sacrosanct American consumer: September's consumption and income and October's University of Michigan consumer confidence index. |

| Investors breathe a sigh of relief Most of the first results published are above expectations. investors are relieved. indexes are rebounding after a few weeks of turmoil. This situation is reminiscent of Greek mythology. Among the Greek gods, there was Chronos who controlled linear time and Kairos who controlled favorable time, in other words, for us investors, the time to seize opportunities on markets. It is important to remember that Kairos can only be seized if one is prepared for it. The market turmoil of the past few weeks is reminiscent of the multiple index declines of the past few years. They are often synonymous with opportunities. In the modern world, Kairos is often called "end of October". |

By

By