|

Monday June 3 | Weekly market update |

|

The further deterioration of Sino-American trade relations, the tensions between Italy and the European Commission and the ongoing fears of an economic slowdown all caused the financial markets to experience a new phase of weakness this week. These concerns are reflected in the decline we see in bond yields to their lowest level since the end of 2017. Donald Trump added some extra fuel to the fire by announcing the introduction of tariffs on Mexican products starting from June 10. The idea behind this is to put pressure on and fight against illegal emigration. |

| Indexes Over the past week, all geographical areas have experienced heavy clearances. In Asia, the Nikkei lost 2.44% and the Hang Seng -1.7%. On the other hand, the Shanghai composite gained 1.6%. In Europe, the Dax and the Footsie lost respectively 2.5% and 1.7% and the CAC40 fell by 2.4%. In the peripheral countries, we observe various trajectories. Portugal gained 2.1% while Spain (-2%) and Italy (-3.1%) accumulated their losses. The Greek stock exchange welcomed the defeat of Tsipras' party and became interesting again for investors. The ESA went up 11.8% over the past week. In the United States, at the time this article was written, the Dow Jones recorded a weekly performance of -2.7%, the S&P500 lost 2.4% and the Nasdaq100 went down 1.8%. Rise of the Greek index after the European elections  |

|

Commodities The drop in crude oil prices continues this week, with unprecedented weekly scores. The Brent fell by nearly 8.6% during the reference period, as the market was caught up by the constant rise in US production in a more and more gloomy economic context. The rising tensions between the Chinese and the Americans could have a considerable impact on the global demand for crude oil, even though the global reserves are struggling to shrink despite the efforts from the OPEC+. Despite the strong dollar, gold is benefitting from the international tensions to get to the 1300 USD level. Silver on the other hand is stabilizing close to its annual lows at 14.52 USD. Industrial metals remain under pressure and are mostly declining over the week. As a result, copper and tin lost ground at 5823 and 18900 USD respectively. |

| Equities markets In the list of index performances in Europe, the SMI stands out, accumulating more than 13% over the 2019 period. Investors are trading more in safe haven assets. Besides sovereign bonds, Swiss equities have also always offered this possibility. In the current state of stress on the financial markets, Swiss stocks still demonstrate great resilience and prove to be a safe haven. The Swiss Market Index (SMI) accumulates the 20 most important shares in the Swiss universe, hence representing approximately 85% of the market capitalization of the market. The defensive nature of the SMI, with stocks such as Nestlé, Novartis and Roche, should enable the index to continue this outperformance in an international context that is still under pressure. The index' largest capitalisation, Nestlé, has with 23% the best stock market performance over the year. Novartis also prospers by 17% in this climate of concern, as did Roche Holding (+8.5%). The upward behavior of the Nestlé share  |

|

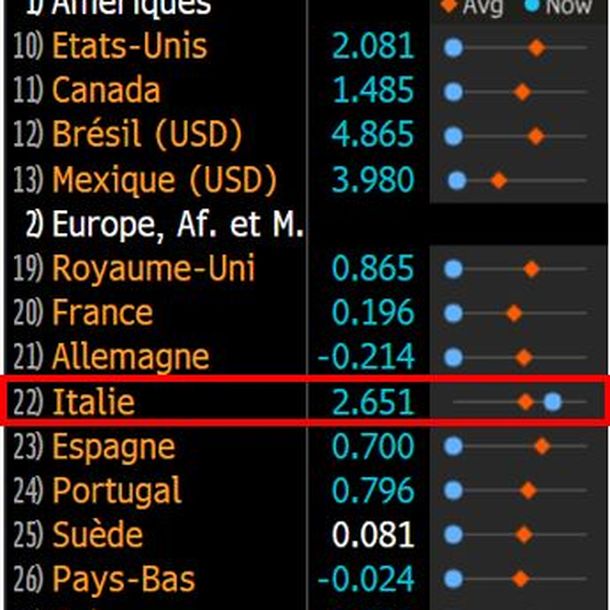

Bond market The interest rate markets continue to grow, acting as a safe haven and mechanically pushing interest rates even lower. The US sovereign yield curve is going through its largest reversal since 2007, on the eve of the "subprime" crisis. The ten-year reference trades on a basis of 2.08%. We observe the same deterioration in yields in all European debt. The Bund remains negative at -0.21%, the OAT benefited from this and traded at 0.19%. The movement is even stronger on the Gilt (British bond at 0.86%). Only Italian bonds saw their yield rise to 2.65%, following the deterioration of the national deficit. The Italian rate is now close to the Greek reference, which fell to 3%. Still in high demand, the 10-year Swiss debt generates a negative rate of -0.52%, as does Japan, which can borrow at -0.10%. List of ten-year yields at their lowest level in three months (blue dots), except Italy.  |

|

Forex market The absence of volatility has marked the foreign exchange market during the first quarter of 2019. Since the relaunch of the conflict over world trade, however, traders have been showing an apparent nervousness, upsetting many currency pairs. Traders are massively switching to safe haven currencies. The Yen is gaining ground and records an annual high of 108.8 JPY against the dollar. The same progress can be seen against the euro, which fell against the Japanese currency to 121.20 JPY, a two-year low. The Swiss franc also benefits from trades in favor of less risky currencies. The British pound did not resist the political stalemate in the United Kingdom, and dropped to 0.88 GBP against the euro and 1.26 against the dollar (-200 basis points over the week). The Mexican peso fell sharply following Trump's decision to impose tariffs on goods imported from Mexico. |

| Economic data Across the Atlantic, many indicators have been released. The Case Shiller index of house prices disappointed, as did the Richmond Fed manufacturing index and the housing sales promises (-1.5% versus +3.9% expected). Consumer confidence on the other hand rose sharply in May (to 134.1 points from 129.2 in April), to its highest level since November 2018. Household spending (+0.3%) and household income (+0.5%) also exceeded expectations. The quarterly GDP came out as expected at 3.1%, as did the PCE price index (0.2%). The weekly jobless claims were slightly better than expected (215K instead of 216K) and crude oil inventories fell by 0.3 million barrels (consensus -0.9M). At the beginning of the week in the euro zone, investors will be informed about the PMI indices (manufacturers and services). The unemployment rate, retail sales, consumer price index, producer price index and the latest GDP estimate for Q1 2019 will be released ahead of the ECB press conference on Thursday. In the United States, the PMI indices of the Institute For Supply Management (ISM), construction spending, industrial orders and ADP job creation are expected, before the publication of the Fed's Beige Book on Wednesday. Then, the employment report (average hourly wage growth, non-agricultural job creation and unemployment rate) will close the week. |

| Investors are looking for safe havens The escalation in the commercial cold has reached its peak. The opposite sides are showing their muscles in order to make the opponent bend. As a reaction to Trump's statements, the Chinese respond with a possible embargo on rare metals, even if the latter should be difficult to enforce. A blockade would lead to a surge in prices that would make many mines in the world exploitable and Beijing does not want to lose its near-monopoly (80% against 20% in Australia) of these metals, which are essential for the electronics industry. This does not prevent investors from transferring a part of their allocations to less sensitive underlyings such as stocks from more resilient indices like the SMI, or safe haven assets (Yen, Swiss Franc, gold) out of concern. The same thing goes for trades that involve sovereign debt that no longer yields anything - or even negative rates - as if it were necessary to pay (or receive negative interest) to be safe. |

By

By