|

Monday December 2 | Weekly market update |

| With a week shortened in the United States due to Thanksgiving, Europe has finally gained some ground in the last five days, despite renewed tensions between Beijing and Washington. D. Trump has promulgated a law supporting pro-democracy demonstrators in Hong Kong, a decision that exasperates China and could worsen relations during a period of trade negotiations. A wait-and-see attitude also remained prevalent, before the figures for Black Friday and Cyber Monday, a barometer of household consumption in the run-up to the end of the year. |

| Indexes Most of the major showings gained ground over the last weekly sequence. In Europe, the SMI stands out, with a gain of 1.1%. The CAC40 grabbed 0.3%, the Dax and Footsie 0.6%. For the peripheral countries of the euro zone, Spain increased by 1.1% while Portugal lost 1%. In the United States, the American indices remained a few points from their historical records. The Dow Jones, S&P500 and Nasdaq100 performed 0.7%, 1.2% and 1.8% respectively over the week. On the other hand, Asia ended up in a scattered order. The Nikkei recorded a weekly performance of 0.8% while the Hang Seng lost 0.8% and the composite Shanghai 0.45%. |

| Commodities The commodity markets are calm, as are the staggering performances of oil prices, gold and silver or copper. Crude oil prices did not change much over this weekly sequence, as investors were cautious a week before the OPEC+ summit. The WTI is trading around USD 56.1 while the Brent is trading at USD 61.3 per barrel. The stagnation also characterizes the weekly trajectories of gold and silver, which are struggling to find buyer relays due to the extension of equity indices. Gold metal stands still at USD 1456, as does silver at USD 16.9. Overall, the "hard commodities" segment continues to correct, as did the further decline in lead and nickel to USD 1926 and 14070 respectively. |

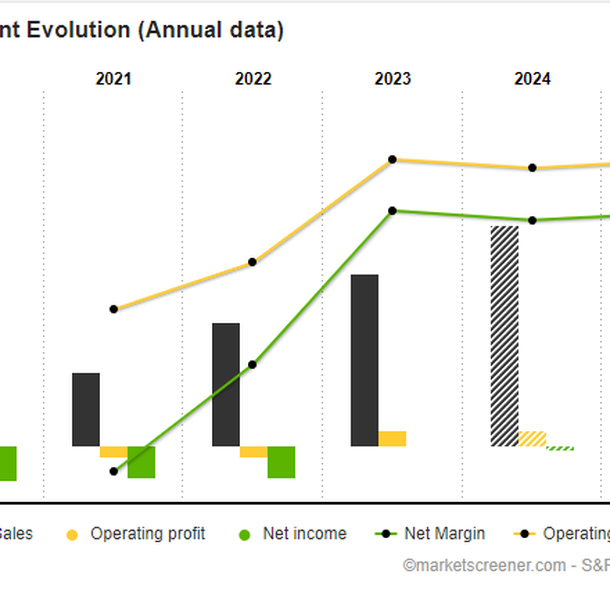

| Equities markets SIKA, a Swiss industrial company, had a brilliant year, with more than 40% growth within the SMI, positioning itself as the leader in annual performance. Founded in 1910 by Kaspar Winkler, the company enjoyed its first success in 1918 with the sealing of the Gotthard Tunnel. In 1930, the group was already present all over the world. Having suffered during the first decades of its existence from the vagaries of economic crises, Sika is moving towards diversification in order to increase its resistance to growth cycles. In 1989, the billion Swiss franc turnover was reached for the first time. The group accelerated its external growth in the 2000s, absorbing 38 companies, boosting its revenues to CHF 4.6 billion, with the following major areas of expertise: waterproofing, bonding, soundproofing, reinforcement and protection. Despite revisions of EPS, far from being attractive, the Zug group announces a positive balance sheet in its publications for the first nine months of the year, thus demonstrating its ability to deliver a solid performance in an uncertain macroeconomic context. By 2023, management aims for an operating margin of between 15 and 18%, compared to 14/16% in previous estimates. The share therefore strongly appreciated. Evolution of the Sika share since 2016  |

| Bond market The sideways trend in yields since the beginning of the week reflects the absence of current risk associated with an unsurprising macroeconomic data calendar. In Europe, German 10-year rates stabilized at -0.36%. There is reason to doubt that the future of the Bund will take a new direction in the coming days. The OAT is displayed on a recurring basis with a yield below zero. This stability confirms the ECB's control over these loans, three quarters of which are owned by the Frankfurt Institute. As far as the euro zone is concerned, Italy stood out, with a spread that is narrowing again. The fact that the European Commission has given the green light for Italy's 2020 budget has been a positive factor in this respect. The transalpine debt sees its yield fall to 1.22%. Switzerland retains its particularity of having the lowest yield curve (-0.66% over ten years). Greece, for its part, continues to be sought by investors, with Athens seeing its sovereign bond trading at an all-time low (1.39%). In the United States, the Tbond (1.76%) shows little movement, despite the good news on the growth front. |

| Forex market Forex traders have been cautious in recent weeks. Nevertheless, it should be noted that the pound sterling rose slightly to 1.29 against the Swiss franc or 0.85 against the euro. The British currency is increasing its gains after a very favourable poll in favor of the Conservatives. The market has a positive view of such a prospect because it would make it possible to put an end to the uncertainty of Brexit. On the single currency side, the EUR/USD parity remains stuck in a narrow range between USD 1.10/1.11. On the other hand, the greenback gained ground against the Japanese currency at JPY 109.5 (+100 basis points) following a decline in Japanese industrial growth (-4.2%), due to the impact of the VAT increase, the damage of Typhoon Hagibis and weak domestic demand. Regarding the situation in Chile, the national central bank has decided to intervene exceptionally in the foreign exchange market, with an amount of up to USD 20 billion to defend the Peso, which has been falling sharply for several weeks (see graph). Chilean Peso falls sharply against the Dollar  |

| Economic data US GDP growth proved stronger than expected in the third quarter, at 2.1% on an annual basis. The new publication of the Business Climate Index in Germany (IFO) did not cause large waves, as it is in line with analysts' estimates. For the Munich Institute, the sentiment of German leaders has improved slightly, however, in a country that is experiencing both an industrial recession (economic crisis) and a structural failure with the transformation of the automotive sector. Next week should generate more volatility in the markets, with the publication of the ISM American Manufacturer, the latest of which was 48.3. For three months now, this indicator has been stuck below the 50 mark, which is synonymous with an industrial contraction. Two days later, investors will wait for confirmation of the good performance of the ISM services, after last month's excellent level at 54.5. Finally, the latter, like the Fed, will have in line to focus on employment statistics (unemployment rate, job creation), figures that are crucial for monetary policy expectations. Gradual deterioration of the business climate in Germany (IFO)  |

| An equilibrium orchestrated by central banks The behaviour of financial centres can be characterized as balanced - as if the "Bulls" and "Bears" had put obstacles in their way. The currency market shows no volatility, the bond market remains under the yoke of central bankers who want to protect governments and equity indices remain at the highest levels. These atypical conditions therefore greatly reduce the level of stress. At the beginning of the last stock market month and despite political uncertainties, investors are maintaining their risky strategies, positively interpreting hyper-accommodating monetary policies. As a result, index courses have exceptional configurations, such as American equities, which would require a legitimate or even essential phase of graphic breathing, in order to establish a more relevant basis for the Christmas rally. We hope that this index push, which is expected at the end of each year, did not come a month ahead of schedule. |

By

By