|

Monday May 31 | Weekly market update |

|

Friday ended another week in the green for most financial markets, which welcomed the improving economic outlook, reassured by the accommodating tone of central bankers. Despite a surge in inflation, defined as temporary, it seems too early to consider raising rates or reducing the asset purchase programs necessary for the recovery. Traders should pay close attention to a possible change in tone in the coming weeks, which could be a source of volatility for indices. For the time being, the buying appetite remains. |

| Indexes In the latest weekly sequence, Asia is doing well. The Nikkei is up 2.9%, with the yen falling, despite the extension of the state of emergency in Japan until June 20. The Hang Seng gained 2.3% and the Shanghai Composite 3.2%. In Europe, performance was more mixed. The CAC40 gained 1.5%, the Dax 0.6% while the Footsie gained 0.3%. In the south, Spain is stable, Portugal is down 0.4% and Italy is up 0.6%. The Dow Jones was up 1%, the S&P500 1.3% and the Nasdaq100 up 2.3%. The technology stock index remains just under 3% off its annual highs. |

| Commodities Oil markets almost made a clean sweep last week, with four positive sessions out of five. Concerns about supply quickly dissipated thanks to the good US economic data, synonymous with robust demand for crude oil. As a result, Brent crude oil once again passed the symbolic USD 70 per barrel mark, while WTI is trading around USD 67. Gold caught the spotlight, briefly surpassing the USD 1,900 per ounce mark. The precious metal is hardly being shunned despite the relentless rise in equity markets and is benefiting from an easing in long-term real rates. Silver, on the other hand, continues its stabilization phase at USD 27.5. Industrial metals remain well oriented. As proof of this, copper has once again risen above USD 10,000 per tonne. Aluminum is back up to USD 2388, while nickel is trading at USD 17360. New annual record for WTI  |

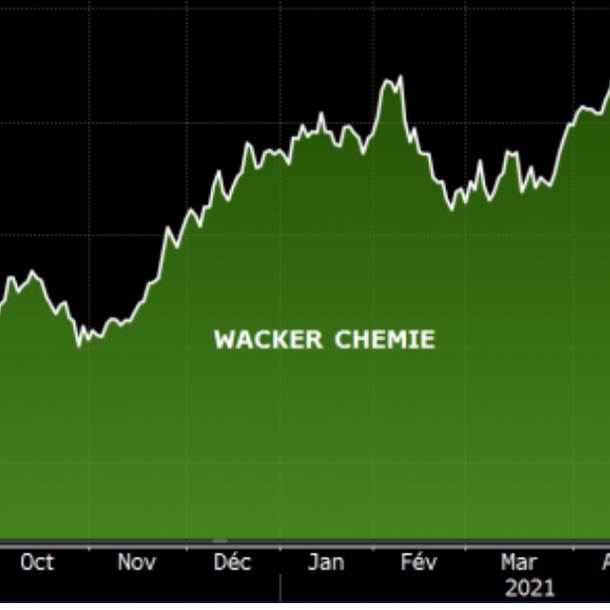

| Equity markets Wacker Chemie AG is a German company specializing in silicone. It supplies chemical products ranging from cosmetic powder to solar cells. While active in all major sectors, it is particularly in the automotive and construction industries. Wacker has about 14,000 employees, 26 production sites worldwide, and a range of 3,200 products. The company has achieved a 20% performance since the beginning of the year. The chemical industry in Germany is very optimistic about the economic recovery. Most of the country's industry representatives have revised their forecasts upwards. On the one hand, this is due to favorable signs of an expected economic rebound in the coming quarters, but also because demand has recently exceeded supply. Wacker Chemie is capitalized at 7 billion euros and is trading at 19 times its 2022 earnings. Acceleration of Wacker Chemie stock  |

| Bond market The bond market has shown little movement on the weekly sequence, with yields broadly replicating recent levels. The German Bund remained in negative territory at -0.17%, despite a slightly disappointing 15-year auction. Investors, in search of yield, were more inclined towards a US issue. In fact, on the other side of the Atlantic, the yield on the major bond stabilized at the upper end of the curve at 1.61%. In France, the OAT yields 0.17% and the payoff for Italy is more substantial, at 0.94%, while Spanish debt is yielding 0.48%. As for Switzerland, the ten-year national bond is increasingly advantageous, with a remuneration close to positive at 0.19%. |

| Foreign exchange market Pressure on the dollar continues with the greenback at its lowest level in three months against a basket of currencies. Bets on a robust global economic recovery continue to support currencies considered riskier. Investors are therefore scrutinizing monetary policies on both sides of the Atlantic, but the Fed and ECB are holding back from opening the door to a rate hike. The EUR/USD is trading around USD 1.22. Also in Europe, the pound is back on the rise after a member of the BoE spoke about a likely rate hike in early 2022. The British currency is trading against the EUR 1.17 and also marks a high against the Yen at JPY 156. In the southern hemisphere, the Kiwi is benefiting from the same announcement regarding the New Zealand central bank's key interest rates and is trading on a three-year high against the yen at JPY 80, down from 74 in January. The Indian rupee, which has been battered for several weeks, is regaining the confidence of traders, a confidence that has returned thanks to the slowdown in coronavirus infections and which reinforces the prospects of a partially locked economy. The currency took advantage of this to go from 75.40 to 72.60 against a dollar. |

| Economic calendar No statistics for the Euro zone last week. In Germany, GDP declined by 1.8% (-1.7% expected), but the IFO exceeded expectations at 99.2. Import prices increased by 1.4% (1% expected and +1.8% last month). In France, consumer spending fell by 8.3% (-0.3% last month), and GDP declined by 0.1% while analysts were expecting a 0.4% increase. The consumer price index rose by 0.3%. In the US, among the disappointments, new home sales rose by only 863K, pending home sales fell by 4.4% and durable goods orders declined by 1.3%. GDP was in line with the first estimate, up 6.4% annualized. On the positive side, weekly jobless claims fell to 406K, household income fell by only 13.1% (consensus -14.2%) and the Core PCE index rose by 0.4% in April (+3.1% year-on-year). |

| A quiet week Like an inertial movement that continues to build momentum, the MSCI World Index is headed straight for a seventh consecutive session of gains. Investors are playing short moves on low volumes and are reassured by the valuations of technology stocks, which are gradually returning to reasonable prices. However, they are not forgetting their concerns about inflation, which have been marked by a renewed interest in cash and gold recently. Banking and insurance stocks are benefiting from the recent rise in bond yields. In the East, Chinese stocks posted their best weekly performance in more than three months, as the strengthening of the yuan encouraged foreign capital inflows. It was a rather quiet week, with the reassuring speeches of the central banks. |

By

By