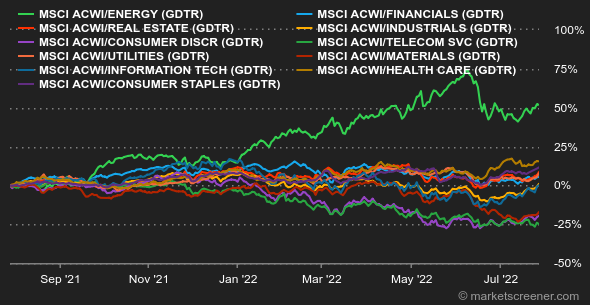

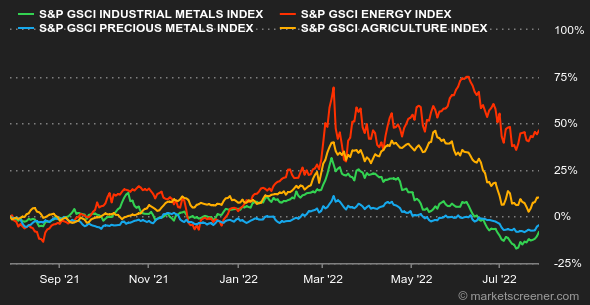

Atmosphere: The week was full of macroeconomic events: a Fed rate hike, second quarter GDP and the latest inflation figures in the US and in the Eurozone... If we had to remember only one thing, it is that the slackening of the US economy was rather well received by investors... because they saw it as a valid reason for the Fed to slow down its rate hikes. The U.S. central bank had, shortly before, raised rates by 75 basis points as expected, in a bid to curb rising prices. Elsewhere, inflation was higher than expected in the euro zone in July (8.9% estimated over one year). We therefore remain in a situation where central banks are seeking to curb inflation without (over)-disturbing the economic dynamic or sinking into stagflation. A real balancing act.

Rates: The second consecutive quarter of (modest) contraction in the US economy has led to an easing in US bond yields. The 10-year fell back to 2.7%, as investors slightly lowered their expectations of an aggressive Fed rate hike. Shorter maturities (6 months, 2 years and 5 years) are still paying better than the 10-year, given the economic slowdown at work. In Europe, the German Bund is at 0.89% on 10 years, the French OAT at 1.45% and Italy at 3.10%.

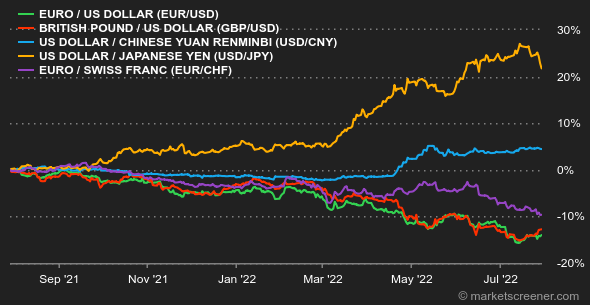

Currencies: The euro has returned to around USD 1.02 after breaking through the parity threshold in the middle of the month. This improvement is based on comments from Jerome Powell, which were considered slightly more accommodating than expected, on the sidelines of the rate hike announcement this week. The single currency, on the other hand, has suffered lately against the Swiss franc (at CHF 0.9741 ) and the British pound (at GBp 0.8401 for 1 EUR). "Short-term rates will rise in Europe, but the ECB is really caught between a rock and a hard place," Nordea reminds us, meaning that the potential for rates to rise is still higher across the Atlantic than on the old continent.

Cryptocurrencies: For the second week in a row, crypto-assets have continued their ascent in the wake of US stock market indexes. Bitcoin is back above $23,400 and ether is above $1,650 at the time of writing. Note that ether has clearly outperformed bitcoin since the beginning of July, posting +56%, its best monthly performance since January 2021, compared to +18% for the market leader. Caution remains the order of the day, however, as macroeconomic conditions are not really favorable for a definitive return of capital to risky assets.

Calendar: The first week of August will be marked by several statistics on the US labor market. The JOLTS job openings survey (Tuesday), weekly jobless claims (Thursday) and June employment data (Friday). There will also be the Bank of England's monetary policy decision on Thursday and two US activity indicators, the ISM Manufacturing (Monday) and the ISM Services (Wednesday). |

By

By