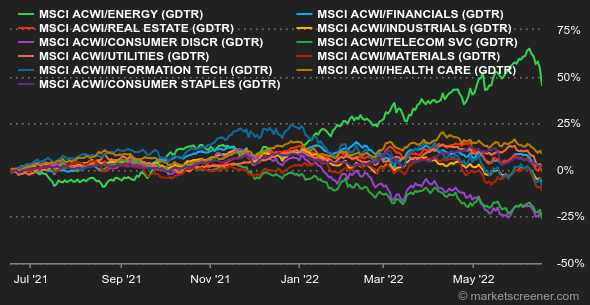

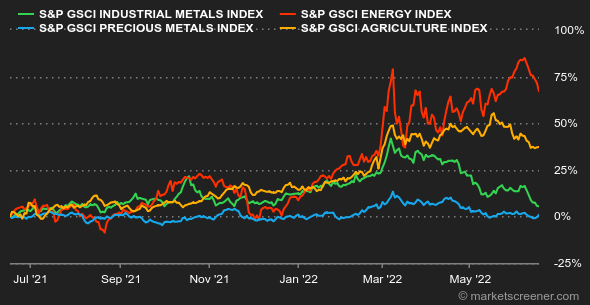

Atmosphere: The austerity push by central banks this week, from the Fed, the Bank of England and even the Swiss National Bank has put investors on edge. The determination of the world's big money makers to turn off the liquidity tap is raising fears of a recession, as the demand shock looms (the latest indicators in the US and Europe are hardly encouraging). In the days and weeks ahead, investors will be keeping their fingers crossed that the fight against inflation does not turn sour. They will also be looking for the inflection point at which central banks will feel that their policies are too restrictive and will start to ease again. But clearly, we are not quite there yet.

Interest rates: There has been a lot of movement in the sector on both sides of the Atlantic this week. In the United States, yields went a bit in all directions as the Fed's intentions were uncertain. By the end of the week, the inversion of the yield curve had disappeared and the 10-year had eased to 3.2%. In Europe, the spread between German and Italian debt reached such a wide gap at the beginning of the week that the specter of 2010 and 2012 resurfaced. The ECB was forced to call an emergency meeting on Wednesday to announce that it was going to draw up a special program to counter the "fragmentation" of the euro zone. In other words, to prevent investors from fleeing southern countries and taking refuge in those in the north, which are considered more robust. The communication operation has been successful: the spread between Italian and German debt has fallen to less than 200 points (1.67% over 10 years for one and 3.61% for the other). Greek bond yields also fell considerably.

Currencies: Over the past week, the dollar has recovered against the ruble, but the Russian currency remains positioned above its pre-invasion level in Ukraine, which is a small event in itself. The recovery of the Russian currency after Moscow's efforts to make its creditors pay in rubles led the country's central bank to cut rates. It currently takes RUB 55.50 for USD 1. On March 13, it was RUB 133 for USD 1. At the same time, Japan kept its accommodative policy, which keeps the dollar near JPY 135, its best level of the millennium. We end with the Swiss National Bank's surprise rate hike, which brought the franc back to CHF 0.9714 to USD 1, which is down 1.84% for the week.

Cryptocurrencies: Bitcoin had a difficult week. The digital currency is shedding 20% of its capitalization this week and is back to hovering around $20,550. A price zone that represents the peak of bitcoin's price during its 2017 bullish rally. After losing 70% of its capitalization since its all-time high of $69,000 last November, the fall could be extended further in this hyperinflationary environment unseen in the digital asset's short history.

Calendar: The week starts with a holiday in the United States (Juneteenth). Over the rest of the week, there will be many speeches by central bankers, too many to mention. This will give the Fed, the ECB and the BoE the opportunity to fine-tune their speeches. Thursday will be devoted to the leading PMI indicators for June. They will show how much purchasing managers are affected by the current situation.

|

By

By