Block 1: Essential news

- Cristiano Ronaldo gets tackled in the Binance affair

Cristiano Ronaldo is being sued by investors for promoting Binance. In 2022, he had signed a partnership to promote his NFTs on the platform. The investors accuse this promotion of influencing their investment decisions, particularly in derivatives considered as securities. They believe that Ronaldo should have been aware of the nature of these products and of his duty to protect investors. This case is part of a wider context in which Binance is facing several lawsuits in the United States, including with the Securities and Exchange Commission (SEC).

- Game over for the BUSD

Binance's BUSD stablecoin, affected by SEC actions, will cease to be maintained by Binance from December 15, 2023. Binance has announced that the remaining BUSD will be automatically converted into the stablecoin FDUSD, except in certain countries such as France and Japan. Paxos, the BUSD issuer, will continue to accept exchanges for dollars until February.

- South Korea: Towards a digital won (MNBC)

The Bank of Korea (BOK) has announced that it will allow 100,000 citizens to test the prototype of its central bank digital currency (MNBC) in the fourth quarter of 2024. The test, which will require volunteers between September and October next year, is part of the country's efforts to develop its own digital won. However, a full-scale rollout could take several years. The test will be limited to specific payments, using tokens issued by the central bank. The Bank of Korea is also working with Samsung to integrate NFC technologies into the MNBC system, enabling offline payments.

- Changpeng Zhao leaves Binance.US Board of Directors

Changpeng Zhao, former CEO of Binance, has stepped down as Chairman of the Board of Binance.US. From now on, his involvement in the company will be purely economic. This decision comes after he pleaded guilty to breaches of the US Bank Secrecy Act, resulting in his departure from the position of CEO of Binance and a personal fine of $50 million. Binance.US, now under the management of Norman Reed, has emphasized its independence from the legal problems of Binance and Zhao, who remains in the USA pending trial next February.

We wanted to provide an update to the https://t.co/AZwoBOgsqS community in light of last week’s news regarding CZ and https://t.co/IZwa5M2U8b.

— Binance.US 🇺🇸 (@BinanceUS) November 28, 2023

As you know, https://t.co/AZwoBOgsqS was launched with the express purpose of serving United States customers in accordance with all…

Block 2: Crypto analysis of the week

In the hustle and bustle of Asia's financial sector, Singapore and Hong Kong are increasingly vying for the title of the region's pre-eminent center for tokenization, a fast-growing area of blockchain technology. According to analysis by Citigroup, the tokenization market is set to reach a staggering $5 trillion by 2030.

This market encompasses digital versions of tangible assets such as bonds, real estate and private equity. One of the main advantages of tokenization is that it can facilitate trading in otherwise illiquid assets, thereby broadening the investor base and making the market more fluid.

Although tokenization is still in its infancy, and there is still some skepticism about its benefits, Singapore and Hong Kong are proactively asserting themselves as leaders in this field, anticipating significant growth over the next few years. Hong Kong recently updated its regulations to allow tokenized funds and bonds for retail investors, a move that aligns with its year-long efforts to develop a crypto hub. Notably, the city has issued HK$800 million (US$102 million) worth of digital green bonds via Goldman Sachs' GS DAP platform, proving to be a world first in government-issued tokenized green bonds.

In an interview with Bloomberg, Julia Leung, Chief Executive of Hong Kong's Securities and Futures Commission, expressed the city's willingness to expand the green bond market. the city's desire to broaden access to these tokenized products to a wider range of investors, notably by aligning itself with the progressive evolution of cryptocurrencies. On the other hand, Ravi Menon, head of Singapore's central bank, revealed plans for Singapore to implement strict consumer protection policies for cryptocurrencies by next year, while fostering an environment conducive to tokenization.

Menon highlighted important blockchain initiatives by traditional financial institutions in Singapore, focusing on the use of tokenized assets to reduce back-office costs and improve risk management in capital market transactions. A pilot project, entitled "Project Guardian", in Singapore involving HSBC, UOB and Marketnode has demonstrated the potential of using blockchain for the issuance and distribution of structured products, hinting at potential improvements in terms of cost, settlement and personalization.

However, Singapore and Hong Kong have divergent approaches to retail investor participation in cryptocurrency exchanges. Singapore remains cautious in limiting access to the general public, while Hong Kong offers regulated platforms for the exchange of major tokens such as bitcoin and ether, albeit with strict safeguards.

Ultimately, the competition between Singapore and Hong Kong to dominate the tokenization space is intensifying. This rivalry is a glimmer of hope for blockchain enthusiasts, especially as the USA, for its part, is more likely to tighten the screws on the sector than try to democratize it. Will the future of blockchain technology lie in Asia?

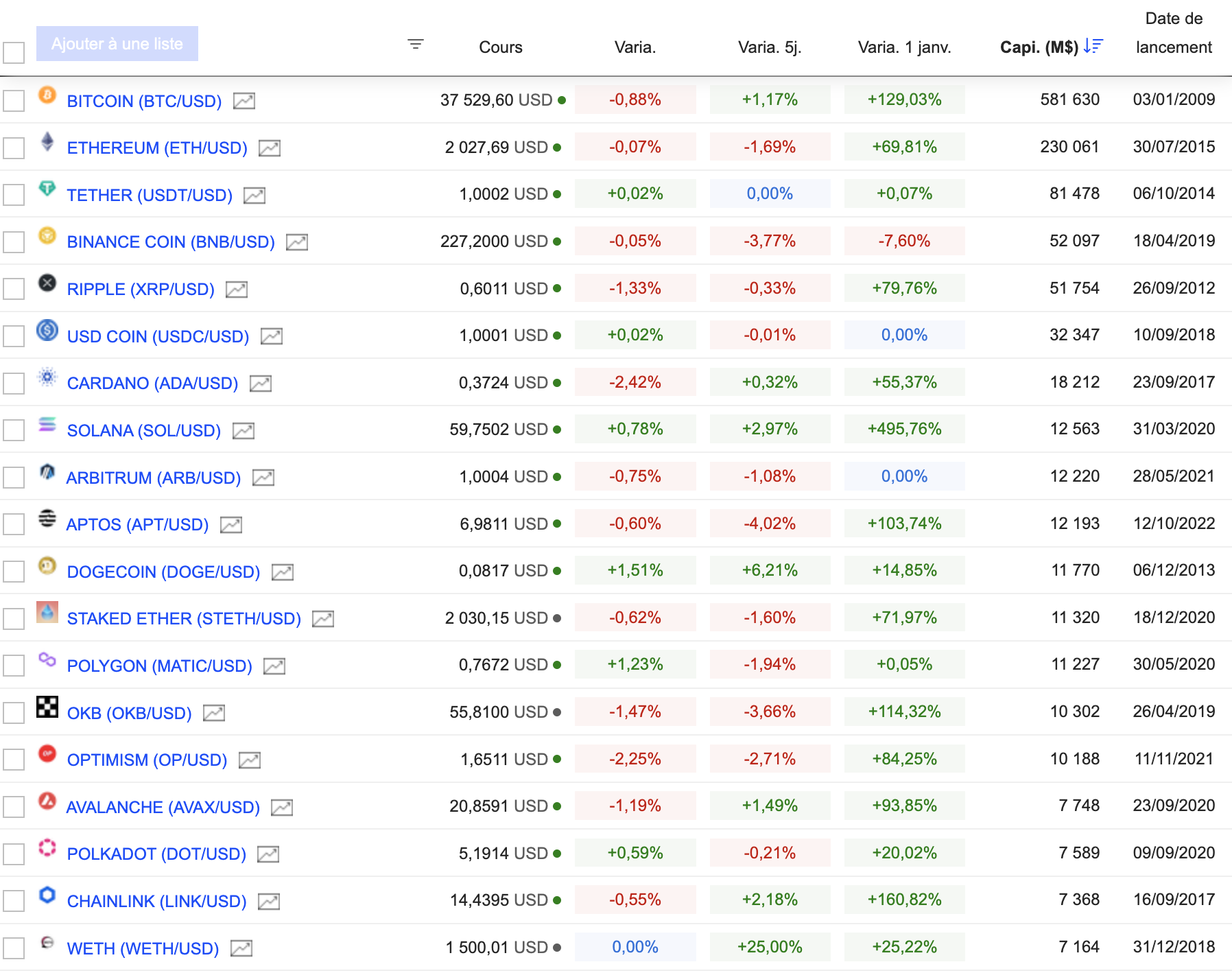

Block 3: Gainers & Fallers

New Bitcoin hype shows crypto just can't help itself (Wired)

As one crypto party was ruined, another raged in Amsterdam (The Information)

Charlie Munger had no love for crypto (WSJ)

By

By