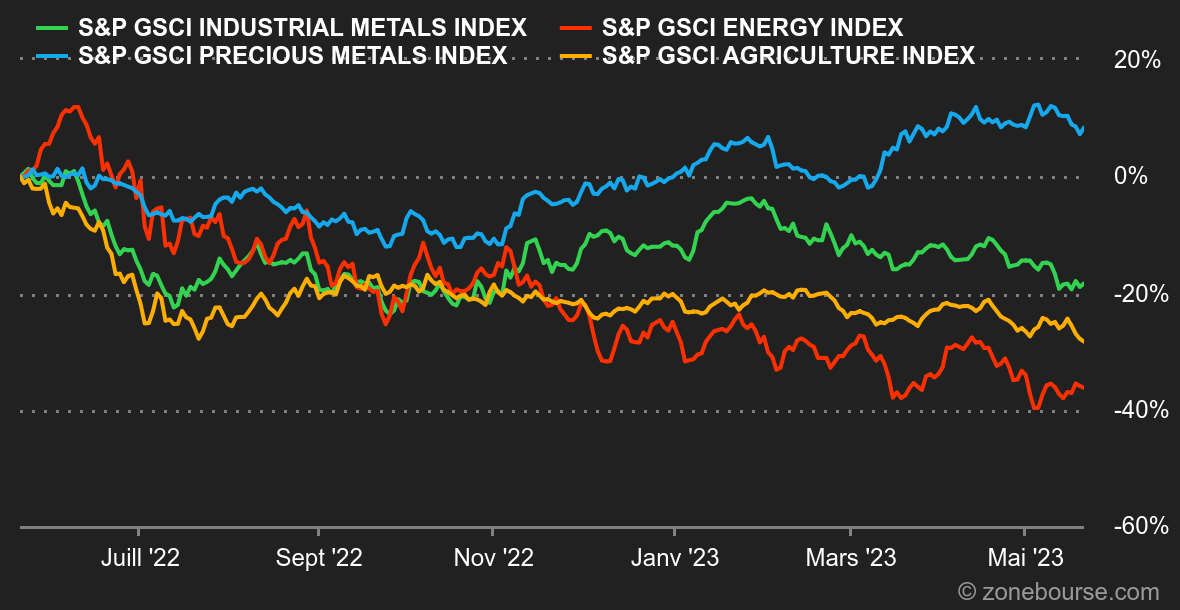

Energy: Weekly oil inventories rose sharply last week, by about 5 million barrels, while economists were expecting a decline of 1.3 million barrels. However, this statistic did not prevent crude oil prices from rising by about 3% over the past five sessions. The reason is that traders are looking to the future, which looks more likely to see a price recovery for two main reasons. First, the U.S. Department of Energy announced the purchase of crude oil to begin filling its strategic reserves. We are talking about 3 million barrels at the moment, which is relatively small, but the information is clear: the United States is starting to rebuild its strategic reserves, which, remember, have been melting like snow in the sun since last year. Secondly, the International Energy Agency has raised its demand growth forecast for 2023 and thus foresees a tighter market in the second half of the year. Against this backdrop, oil prices have recovered, with Brent crude at USD 76 per barrel while WTI is trading at USD 72. In European natural gas, the Dutch benchmark, the Rotterdam TTF, is trading at EUR 30/MWh, a level not seen since November 2021.

Metals: A drop made in China. China is struggling to revive its economic machinery. As proof, the latest statistics on its industrial production are not very flattering. Industrial production did grow by 5.6% year-on-year, but the market was hoping for almost double that due to the lifting of Covid-19 restrictions. As a result, industrial metal prices have quite logically lost ground over the past week. A ton of copper is trading at USD 8100 on the London Metal Exchange. Lead, aluminum and tin also lost ground. Only aluminum rebounded to USD 2280. As for precious metals, gold dropped back below USD 2,000 per ounce.

Agricultural products: Russia and Ukraine agreed to extend the agreement on grain exports in the Black Sea by 2 months. Uncertainties have thus faded in Chicago, at least until the next round of negotiations. Wheat and corn fell last week to 620 and 560 cents per bushel respectively.

By

By