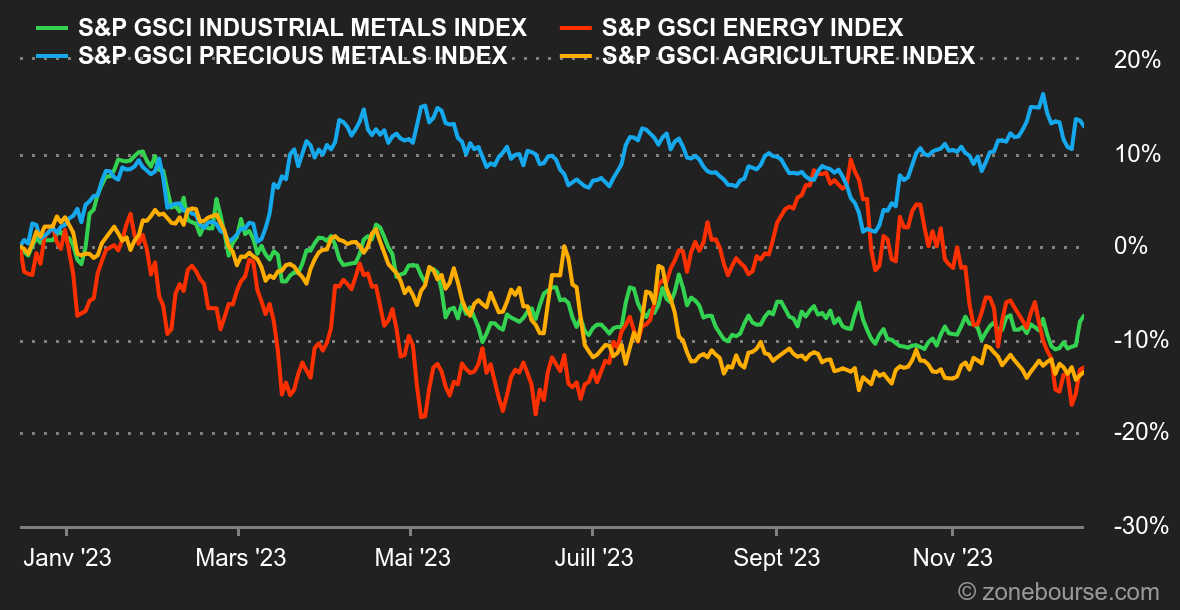

Energy: Oil prices finally recovered last week. However, the weekly advance was well below that of other risky assets, which are continuing their long Christmas rally that began in November, but at least the seven-week run of consecutive declines should come to an end. The latest OPEC report has contributed to this rebound, as the cartel expects record demand next year. Despite economic uncertainties, demand growth is expected to be around 2.2 million barrels per day, synonymous with a market in deficit as OPEC+ strives to reduce production. By contrast, the International Energy Agency's forecasts are more nuanced, as it still expects a market surplus in 2024 despite demand growth of 1.1 mbpd next year. In terms of prices, Brent is trading at around USD 78.4, while WTI is trading at around USD 73.7.

Metals: Risk appetite, a falling dollar and reassuring economic data from China: the stars are aligning again for industrial metals, which rebounded this week in London. Industrial production continues to recover at a steady pace in China. It rose by 6.6% in November. As a result, a tonne of copper rose to USD 8550 on the LME, as did aluminum (USD 2200) and zinc (USD 2500). Gold is back above the USD 2,000/ounce mark, thanks to the spectacular easing of bond yields.

Agricultural products: Cereals lost ground overall in Chicago. The price of corn fell to around 480 cents a bushel, with a similar dynamic for wheat, which traded at around 615 cents.

By

By