We believe that a significant dividend yield starts at 2%. An uninterrupted dividend payment over 10 years, combined with regular dividend growth, is an indicator of the quality of the company's management and the management team's confidence in the future. Some of the companies mentioned in the article have been paying a dividend for several decades (e.g. Johnson & Johnson or Air Liquide).

We also look for companies with a solid financial base, i.e. an acceptable ratio of debt to traditional metrics (EBITDA, shareholders' equity, FCF). The payout ratio (the rate at which net profits are distributed to shareholders in the form of dividends) should not (for the stocks cited in the article) weigh in at more than 65%, so that sufficient liquidity remains to invest in organic growth, make acquisitions or consolidate cash.

The criteria used for the dividend are :

- Dividend yield > 2%

- Payout ratio < 65

- Dividend paid for more than 10 years

- Dividend growth every year for more than 10 years

- Annualized dividend growth over the last 10 years > 4%.

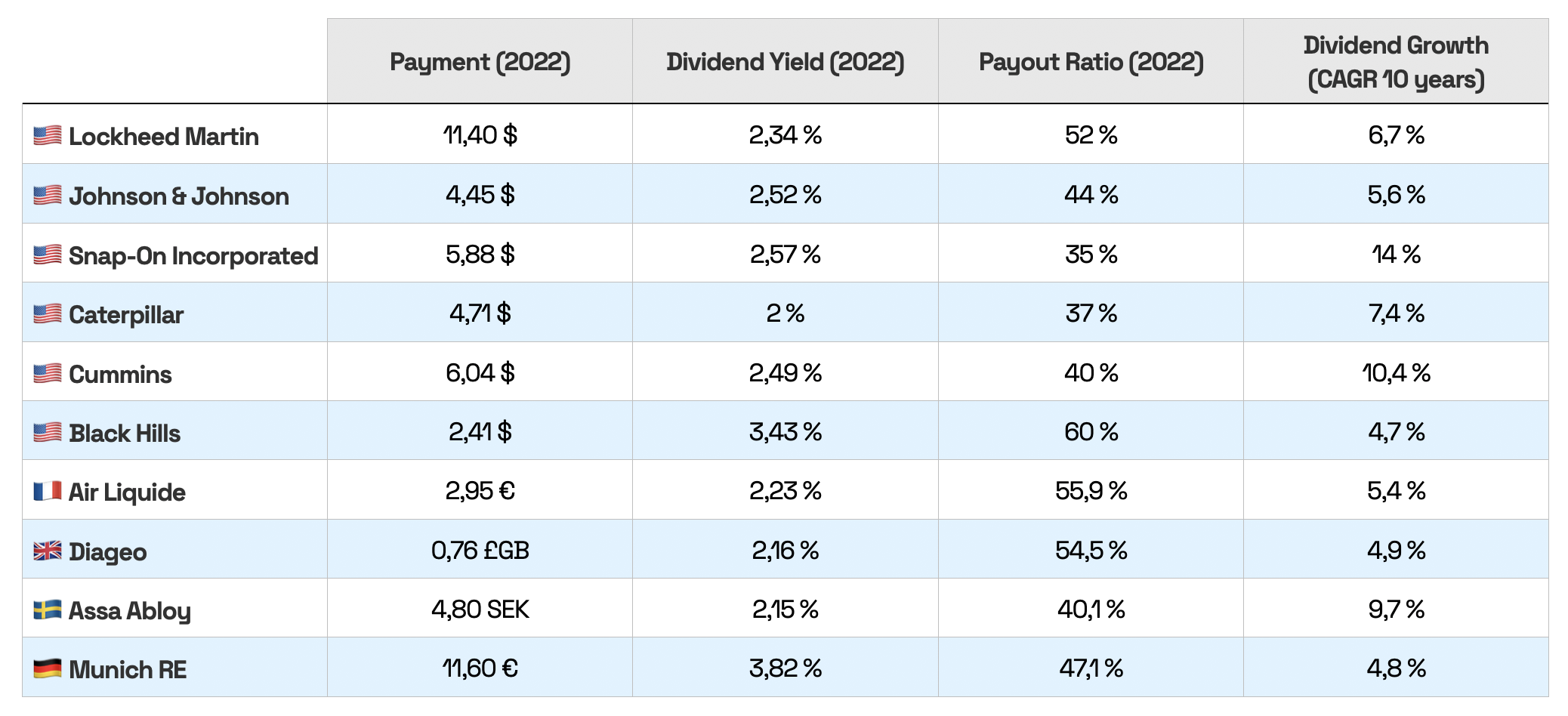

The list of 10 dividend growth stocks :

Lockheed Martin Corporation is a world leader in aerospace, defense, security and advanced technologies. Founded in 1995, it is headquartered in Bethesda, Maryland, USA.

The company is organized into four main segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS) and Space. Aeronautics produces military aircraft such as the F-35 and F-22. MFC develops missile, directed-energy weapon and missile-defense systems. RMS focuses on military helicopters, radar systems and maritime mission systems. The Space segment is involved in satellites, space launch systems and interplanetary probes.

Lockheed Martin is known for its solid financial performance, with sales of over $65 billion by 2022. It has a strong presence in the US and international defense markets, and is a key supplier to the US government.

However, the company faces challenges including dependence on government contracts, fluctuating defense spending and intense competition in the aerospace and defense sector. Despite this, it continues to innovate and position itself as a leader in its field.

The dividend has been growing for more than 10 consecutive years, at a rate of +6.7% a year. The company paid out $11.40 per share to its shareholders in 2022. The dividend yield is 2.34% (in 2022) and the payout ratio is 52%.

Johnson & Johnson is an American multinational founded in 1886, specializing in pharmaceutical, medical and consumer products. It is structured into three segments: Consumer, Pharmaceutical and Medical Devices. The Consumer segment offers a range of products used in baby care, oral health, skin care, over-the-counter products, women's care and wound care. The Pharmaceutical segment develops, manufactures and sells products in five therapeutic areas: immunology, infectious diseases, neuroscience, oncology and cardiovascular and metabolic diseases. The Medical Devices segment offers a range of products used in the orthopedic, surgical, cardiovascular and vision fields.

J&J is renowned for its ability to generate strong, stable cash flow. In 2022, it achieved sales of $93.98 billion. However, it faces challenges including product-related lawsuits and increased competition in the pharmaceutical sector. Despite this, J&J remains a major player in its sector, thanks to its diversified portfolio and stable financial performance.

The dividend has been growing for more than 10 consecutive years, at a rate of +5.6% a year. The company paid out $4.45 per share to its shareholders in 2022. The dividend yield is 2.52% and the payout ratio is 44%.

Snap-On Incorpor ated is a leading U.S.-based designer, manufacturer and marketer of tools, equipment, diagnostics, auto repair and solutions for automotive professionals. Founded in 1920, it has a long history of growth and innovation.

SNA operates through three segments: the Hand Tools Group, the Repair Equipment Group and the Diagnostics and Information Solutions Group. The Hand Tools Group is the oldest and most recognized, offering a range of quality tools for automotive professionals.

The repair equipment group offers solutions for vehicle maintenance and repair, while the diagnostic and information solutions group provides essential diagnostic software and services for repair shops.

In financial terms, SNA has shown steady growth over the years. In 2022, it achieved sales of $4.6 billion, up on the previous year. Net margin also increased, reflecting effective cost management.

However, like any business, SNA faces challenges. Intense competition in the automotive tools and equipment sector and fluctuations in raw material costs can affect financial performance. In addition, the transition to electric vehicles may require significant investment in R&D.

Snap-On is an impressive company with a history of sustainable growth, but it must continue to innovate to remain competitive in a rapidly changing sector.

As for the dividend, it has been growing for over 10 consecutive years at a rate of +14% per year. The company paid out $5.88 per share to its shareholders in 2022. The dividend yield is 2.57% and the payout ratio is 35%.

Caterpillar is the world's leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Founded in 1925, the company is headquartered in Deerfield, Illinois.

Caterpillar operates through three main segments: Construction Industries, Resource Industries and Energy & Transportation. The Construction Industries segment manufactures machines for infrastructure, building construction, mining, quarrying, waste management, demolition, forestry and more. The Resource Industries segment focuses on products specific to mining and quarrying. The Energy & Transportation segment manufactures products for a variety of industries, including oil, gas, power, railroads and shipping.

Caterpillar is renowned for its ability to innovate and adapt to market conditions. It has recently focused on automation, connectivity and electrification to remain competitive. The company also has a strong global presence, with production facilities in the USA and around the world.

In financial terms, Caterpillar has shown a solid performance with steady growth in revenues and profits. However, like any business, it is subject to risks, including fluctuations in raw material prices, changes in exchange rates, global economic uncertainties and environmental regulations.

All in all, Caterpillar is a well-balanced company with a long history of leadership in its sector. It is well positioned to take advantage of future trends, thanks to its commitment to innovation and diversification.

The dividend has been growing for more than 10 consecutive years, at a rate of +7.4% per year. The company paid out $4.71 per share to its shareholders in 2022. The dividend yield is 2% and the payout ratio is 37%.

Cummins is a world leader in the design, manufacture, distribution and service of diesel and natural gas engines, power generation systems and related technologies. Founded in 1919, the company is headquartered in Columbus, Indiana, USA.

Cummins operates in four main segments: engine, distribution, components and power. The Engine segment produces diesel and natural gas engines for on-highway, industrial, construction and agricultural vehicles. The Distribution segment offers parts and services for engines and power generation systems. The Components segment manufactures products for emissions control, fuel filtration and electronics. The Energy segment supplies power generation systems and alternative energy solutions.

In 2022, Cummins generated sales of $24 billion, up on the previous year, despite the challenges of the COVID-19 pandemic. The company has a solid reputation for its innovative technology, product quality and commitment to the environment. It recently announced investments in electrification and hydrogen, underlining its commitment to sustainability.

Cummins is listed on the New York Stock Exchange (NYSE) under the symbol CMI. The company has a market capitalization of approximately $33 billion as of July 2023. It has a robust financial performance, with a net margin of 8.5% and a return on investment of 13.2%.

As for the dividend, it has been growing for over 10 consecutive years at a rate of +10.4% per year. The company paid out $6.04 per share to its shareholders in 2022. The dividend yield is 2.49% and the payout ratio is 40%.

Black Hills Corporation is a diversified utility company based in the United States. Founded in 1941, it specializes in the production and distribution of electricity and natural gas.

BKH serves approximately 1.3 million customers in eight U.S. states: Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming. Its portfolio includes more than 1,000 megawatts of electricity generation capacity, from a combination of renewable and non-renewable energy sources.

In terms of financial performance, BKH has demonstrated stable growth in recent years. In 2022, it generated revenues of $1.8 billion, with net income of $214 million. It has also maintained a healthy debt-to-equity ratio.

BKH is recognized for its commitment to sustainability. It has invested in renewable energy projects and is committed to reducing its carbon emissions.

However, like all companies in the energy sector, BKH faces challenges including volatile energy prices, environmental regulations and the transition to a low-carbon economy.

Black Hills Corporation is well positioned to navigate the changing energy landscape thanks to its commitment to sustainability and diversification of energy sources.

The dividend has been growing for over 10 consecutive years at a rate of +4.7% per year. The company paid out $2.41 per share to its shareholders in 2022. The dividend yield is 3.43% and the payout ratio is 60%.

Air Liquide is a world leader in gases, technologies and services for industry and health. Founded in 1902, the company is headquartered in Paris, France. It operates in 80 countries, serves more than 3.7 million customers and patients, and employs over 66,000 people.

Air Liquide is divided into two main segments: Gas & Services and Engineering & Construction. The Gas & Services segment generates the majority of revenues, supplying industrial gases such as oxygen, nitrogen, hydrogen and many other specialty gases to a variety of industries, including steel, oil, chemicals, electronics, healthcare and others. The Engineering & Construction segment designs and builds industrial gas production units.

Air Liquide is known for its commitment to innovation and sustainable development. It invests heavily in research and development to improve the energy efficiency of its operations and develop solutions for the energy transition, such as renewable hydrogen.

Financially, Air Liquide has shown stable growth over the years. In 2022, it achieved sales of 21.9 billion euros, up on the previous year. Its operating margin was 17.3%.

Air Liquide is a steadfast company with a global presence, a strong innovation strategy and a stable balance sheet.

The dividend has been growing for more than 10 consecutive years, at a rate of +5.4% per year. The company paid out 2.95EUR per share to its shareholders in 2022. The dividend yield is 2.23% and the payout ratio is 55.9%.

Diageo is a world leader in the alcoholic beverages sector, with an outstanding presence in some 180 countries. Founded in 1997, it is headquartered in London, UK. Diageo boasts an impressive portfolio of over 200 brands, including such well-known names as Johnnie Walker, Smirnoff, Baileys and Guinness.

In financial terms, Diageo has shown a solid performance over the years. In 2022, the company generated sales of almost £12.7 billion, with a net profit of around £2.2 billion. Its operating margin was around 30%.

Diageo has a clear strategy focused on sustainable growth. It invests in high-growth brands, focuses on innovation and seeks to increase its presence in emerging markets. In addition, Diageo is committed to corporate social responsibility, with initiatives to promote responsible alcohol consumption and reduce its environmental footprint.

However, like all companies, Diageo faces challenges. Fluctuations in exchange rates, changes in alcohol regulations and changing trends in alcohol consumption can all have an impact on its performance.

Diageo is an unwavering company with a clear strategy, a diversified brand portfolio and a global presence. It is well positioned for further growth in the future.

The dividend has been growing for more than 10 consecutive years, at a rate of +4.9% per annum. The company paid out 0.76 GBP per share to its shareholders in 2022. The dividend yield is 2.16% and the payout ratio is 54.5%.

Assa Abloy specializes in access essentials: mechanical and electronic locks, cylinders, keys, security doors, automated entrances. At the same time, the group is developing new technologies around biometrics to continue innovating and stay ahead of the competition. From reliable home security to cutting-edge biometric technology for businesses, governments, airports and hospitals, Assa Abloy touches every aspect of our daily lives.

Founded in 1994 by the merger of two Swedish companies, Assa and Abloy, the company has grown rapidly, mainly through a series of strategic acquisitions.

With a presence in over 70 countries, Assa Abloy offers a comprehensive range of products, solutions and services for the security of residential, commercial and institutional buildings. Its portfolio includes mechanical and electromechanical locks, access control systems, automatic doors and mobile security solutions.

In financial terms, Assa Abloy has shown steady growth over the years. In 2022, the company achieved sales of SEK 94 billion, with an operating margin of 16.5%. The company has a solid reputation for its ability to generate stable cash flow and maintain a strong balance sheet.

Assa Abloy's strategy is focused on innovation and geographic expansion. The company invests heavily in R&D to remain at the cutting edge of technology, particularly in the fields of electronics, cell phones and the Internet of Things. At the same time, it is seeking to increase its presence in emerging markets.

Assa Abloy is a modest company with a leading position in the security market. Its strategy of innovation and geographic expansion should enable it to continue growing in the future.

The dividend has been growing for more than 10 consecutive years, at a rate of +9.7% a year. The company paid out SEK 4.80 per share to its shareholders in 2022. The dividend yield is 2.15% and the payout ratio is 40.1%.

Munich Re is one of the world's largest reinsurers, founded in 1880 in Munich, Germany. The company offers reinsurance, direct insurance and risk management services to an international clientele.

Reinsurance is its core business, helping insurance companies to manage risk by taking on part of their commitments. Munich Re is renowned for its ability to cover large-scale, complex risks, such as natural catastrophes.

The company also has a direct insurance division, ERGO, which offers a range of life, health and property-casualty products in Europe and Asia.

Munich Re is known for its risk management expertise, using data and analytics to assess risks and help clients manage them effectively.

Financially, Munich Re is robust, with stable revenues and earnings. However, like all reinsurers, it is exposed to market fluctuations and catastrophic events.

Munich Re is a key player in the reinsurance sector, with a solid reputation, risk management expertise and a global presence.

The dividend has been growing for more than 10 consecutive years, at a rate of +4.8% a year. The company paid out 11.60EUR per share to its shareholders in 2022. The dividend yield is 3.82% and the payout ratio is 47.1%.

Dividend summary table for this list of 10 shares :

Source : MarketScreener

By

By