|

|

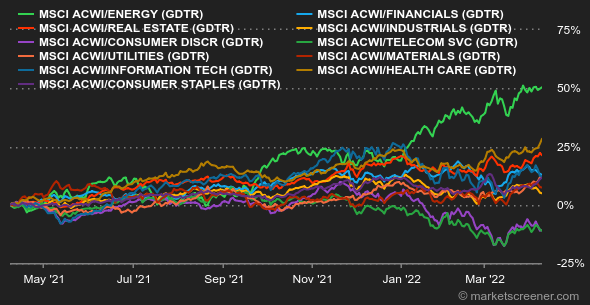

| This week's gainers and losers |

|

|

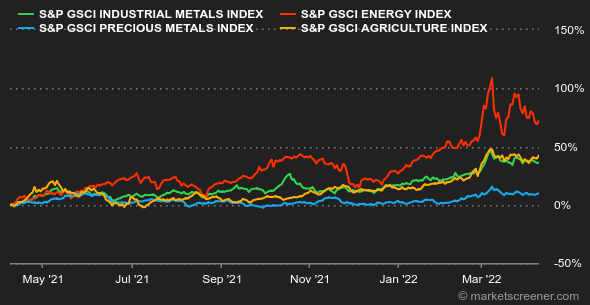

| Commodities |

|

Oil prices recorded another week of decline, bringing prices to around USD 100 per barrel for the Brent. Members of the International Energy Agency (EIA) will release 60 million barrels from their stocks, which seems to be bearing fruit. Remember that the United States has pledged to draw on its reserves the equivalent of one million barrels per day for six months, a total of 180 million barrels, an effort to curb rising energy prices and offset the decline in Russian oil supplies. At the same time, traders are keeping a close eye on the progress of containment measures in China, which is synonymous with compressed oil demand. Despite inventories struggling to recover and supply still depressed by high energy prices in Europe and further disruptions in China, industrial metals prices have lost some height this week. Zinc, which recently hit a 15-year high, is trading at USD 4,250. Copper and aluminum are trading at $10290 and $3345 respectively. On the precious metals side, there is not much to report, as the price of an ounce of gold has stalled. The price of the barbaric relic moved narrowly between USD 1920 and USD 1940. In agricultural commodities, the European Commission expects wheat production in the European Union to increase by 1.5%. While this increase seems modest, exports are expected to jump by more than 20% year-on-year. This is the result of high prices, but especially the decline in Russian and Ukrainian supply on world markets. In Chicago, wheat is trading around 1020 cents per bushel. |

|

| Macroeconomics |

|

The fed sought this week to prepare investors for an aggressive policy against rising prices. It was about time, according to the market, which is still not reassured. Will the Fed be able to reduce its forced support measures without shattering the economic momentum? That is the multi-billion dollar question of the moment. The central bank's aggressive stance, confirmed by the minutes of the last meeting in March, has caused bond yields to rise. The US debt is paying 2.71% on 10 years. For the record, this rate was 2.15% two weeks ago, and 1.97% a month ago. Yields on long and medium term maturities are intermingled, a sign of some confusion among investors. In the foreign exchange market, the euro lost 2% on the week against the dollar at USD 1.0895. The Fed is much more hawkish than the ECB at the moment. But the biggest slide of the week was against the greenback, which gave back 10% to the ruble, at RUB 76.50 to USD 1. Half of the low recorded a month ago, at RUB 154 for USD 1... And a parity that returns to its pre-war levels in Ukraine. The joy was ultimately short-lived for crypto-investors. Still tied to the Nasdaq, bitcoin is closely following the signs of nervousness in the US index but, obviously, with larger swings. After rising close to $48,000 at the start of the week, the digital currency has shed more than 8% and its price is now hovering around $43,000 at the time of writing. Next week, important economic events will return, including US inflation in March (Tuesday 12), the ECB's decision on monetary policy and US retail sales in March (Thursday 14). |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By