Rising sea freight prices have been making headlines since the Fall, and especially since March when the Ever Given got stuck across the Suez Canal, highlighting the strategic importance of shipping routes to global trade. "Prices on several trade routes have tripled compared to last year, and container ship charter prices have seen similar increases," say economists Joanna Konings and Rico Luman. they do not really see the situation unraveling in the short term, for five reasons.

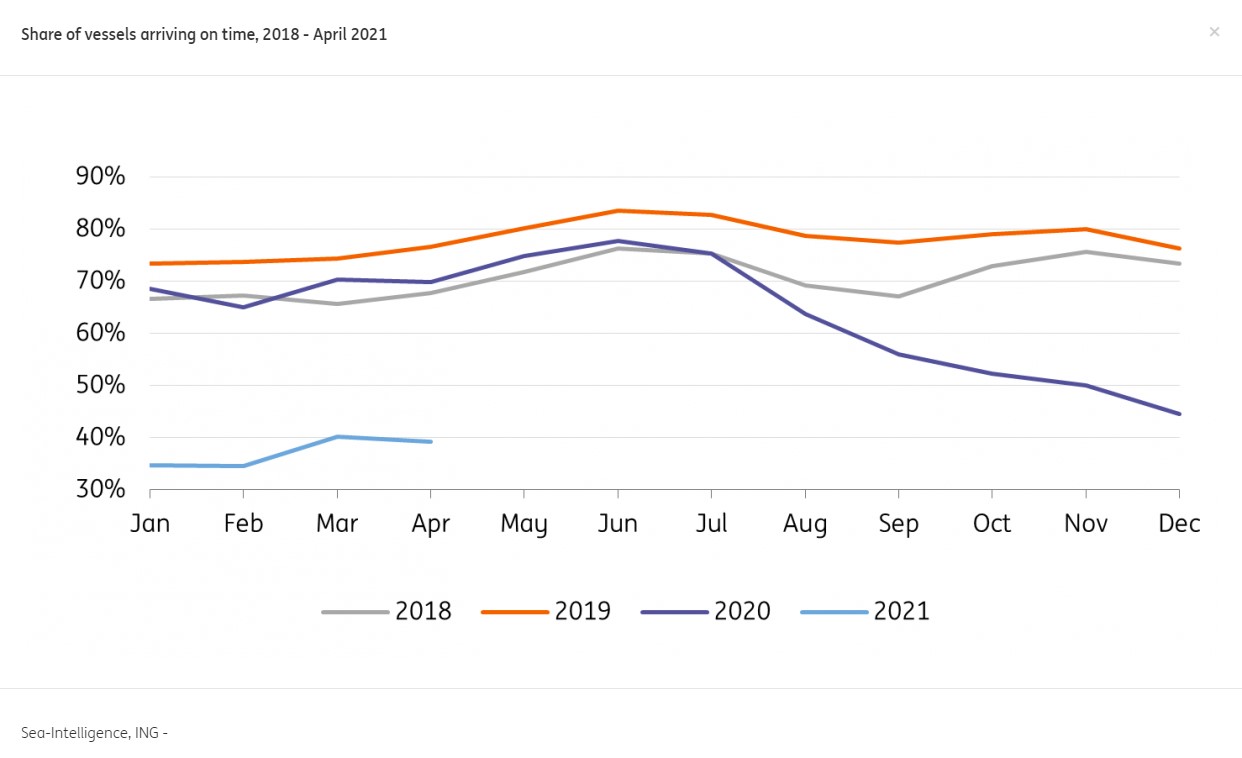

First, the imbalances between production and demand for goods will continue, as a result of the global disruption caused by the pandemic. Second, ocean freight remains unavoidable and the usual alternatives (air, rail), generally used for sophisticated products, have been taken over and have also seen their prices soar. Also, the imbalances in the recovery will continue this year, with some countries almost on track and others still mired in health restrictions. In addition, cancellations or cancellations of stopovers (blank selling), although decreasing, are still present, which weighs on capacity. Finally, congestion is still an issue, although the data show that the proportion of ships reaching their destination on time stopped falling in April, and average delays have improved.

ING believes that the influx of new container capacity will ease price pressures, but that this will not happen until 2023. Container ship operators have been performing exceptionally well for over a year and new container ship orders have reached a record 229 vessels (2.2 million TEUs). This capacity will increase global supply by 6%, despite the decommissioning of older vessels.

"With global growth past the catch-up phase of its recovery, the coming increase in ocean freight capacity will put downward pressure on shipping costs, but will not necessarily return freight rates to pre-pandemic levels, as container carriers seem to have learned to better manage capacity in their alliances," say the two ING economists, who believe that in the short term, freight rates can reach new highs... and so can prices.

By

By