|

|

| This week's gainers and losers |

Top Gainers:

Top Losers:

|

|

| Commodities |

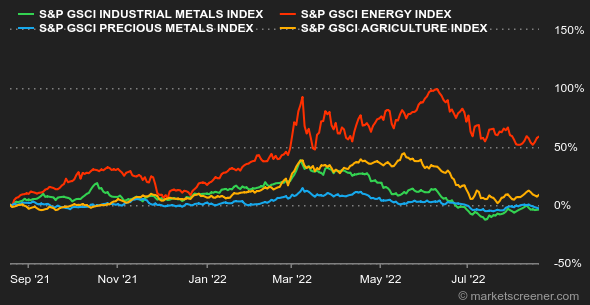

| Energy: Oil prices retreated this week and remain below USD 100 per barrel. North Sea Brent is trading around USD 95 while US WTI is trading at a discount of nearly USD 6 at USD 89 per barrel. This discount favors U.S. exports, which tends to compress weekly inventories. Weekly inventories plunged by 7.1 million barrels according to the latest EIA data. Against this backdrop, investors are still pessimistic about demand dynamics due to the risks of recession. They are keeping a close eye on a potential Iranian nuclear deal that could change the supply/demand balance. On the natural gas side, tension is not easing in Europe, where the Dutch benchmark, the Rotterdam TTF, reached a new record at EUR 245/MWh. Metals: Industrial metals prices have stabilized overall this week with a ton of copper trading at USD 8,000 on the LME against USD 2,400 for aluminum. Soaring gas prices are making life even more difficult for producers, who are having to give up part of their production capacity due to lack of profitability. This is the case of Norsk Hydro, which has announced the suspension of its aluminum production at its smelter in Slovakia. As for precious metals, gold has fallen for five consecutive sessions and is now trading around USD 1,750 per ounce. Agricultural products: Ukrainian grain exports are gradually recovering from the port of Odessa. According to local sources, Ukraine exported just under 1 million tons of grain in the first half of August - a number that could rise to 3 million tons for the month of September - according to estimates by Ukrainian authorities. In terms of prices, wheat has fallen sharply in Chicago to 750 cents a bushel, while corn is stabilizing at around 620 cents. |

|

| Macroeconomics |

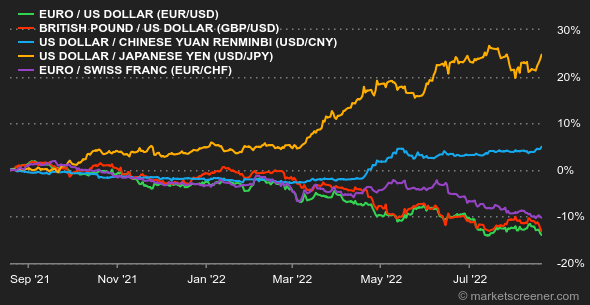

| Atmosphere: Not everything makes sense. One day it's better than expected (consumption, Philly Fed index, unemployment), the next day it's worse (Empire State index, real estate): US macroeconomic statistics are confusing investors. In the UK too, with annual inflation exceeding 10% in July, but retail sales improving. In China, it is clearer: consumption is failing and the central bank is trying to give small shocks by lowering some of its rates. Rates: Until Friday, everyone thought that the issue of bond yields had been put to rest by the subtle dip in inflation in July in the United States. Then, bang, that pesky doubt came back. The yield on the US 10-year went back up to 2.95%, while remaining below the yield on 5-year, 2-year and even 6-month securities. Fears of recession or even stagflation have not been completely dispelled. In Europe, the ECB has its work cut out for it with a new wide spread between German spreads (1.21%) and those of Italy (3.48%) and Greece (3.66%) in particular. The French 10-year OAT stands at 1.79%. Here too, it was not until Friday that tensions rose. Currencies: The dollar rose against the major currencies, especially against the yen (at JPY 136.88 per USD) and against the euro (at USD 1.0058 per EUR). The dollar index, which measures the strength of the greenback against a well-stocked basket (57.6% euro / 13.6% yen / 11.9% pound sterling / 9.1% Canadian dollar / 4.2% Swedish krona / 3.6% Swiss franc), is once again flirting with 108, as was the case around July 14. Only the ruble is currently holding its own, with the Russian currency gaining 4% in one week, at RUB 58.935 for USD 1. The strength of the dollar is due to the confirmation by the US central bank of a restrictive monetary policy, despite the first signs of easing inflation. Cryptocurrencies: While bitcoin had, since the beginning of July, begun its ascent into positive territory, letting crypto-investors regain some optimism about a potential sustainable bullish recovery on the digital currency, the fall was brutal this week. After trading around $25,000 on Monday, BTC is now hovering just above $21,000, 15% lower, at the time of writing. This end of August is therefore shaping up to be tumultuous and full of doubts in the cryptosphere. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By