|

Monday November 2 | Weekly market update |

|

Financial markets have just recorded their worst week since the beginning of June, against a backdrop of concerns about the record spread of Covid-19, which required a new phase of containment in several European countries. Investors often choose to exit, fearing a marked impact on the world economy. The looming American elections and the lack of consensus on a new American recovery plan also prompted caution. This excessive nervousness is likely to continue in the coming sessions, accentuating market volatility. |

| Indexes Over the past week, red has clearly dominated, regardless of the geographical area. In Asia, Nikkei lost 2.3%, Hang Seng 3.2% and Shanghai Composite 1.6%. In Europe, the losses are even more significant, like the CAC40, which deteriorated by 6.4%. The Dax fell by more than 8.5%, with SAP, its largest capitalization, dropping by 25%. For the Footsie, losses amounted to 4.8%. Concerning the peripheral countries of the euro zone, Portugal recorded a weekly loss of 4.7%, Spain 6.6% and Italy 6.9%. In the U.S., the Dow Jones is down 6.9%, the S&P500 is down 5.8% and the Nasdaq100 is down 5.4%. |

| Commodities Brent and WTI prices are diving below USD 40 per barrel. The intensification of health measures in Europe is synonymous with less mobility on the Old Continent and therefore a drop in oil consumption. Brent is trading at USD 38.2 while WTI is sinking at USD 36 per barrel. Falling stock indexes do not necessarily rhyme with rising gold prices. The gold metal lost ground last week, weighed down by the strength of the greenback. Gold thus returned to its September lows near USD 1860. Silver is following the same path at USD 23.3. All components of the industrial metals segment recorded weekly declines, except lead which rebounded to $1,800 per metric ton. Copper trades at USD 6690, aluminum trades at USD 1796 while tin plunges to USD 17700. Return of silver on a relevant level  |

| Equities markets The Chinese Tesla NIO is a pioneer in the Chinese high-end electric vehicle market. The company designs and manufactures two SUV models, the ES8 and ES6, and can probably be compared to the Chinese Tesla. NIO also stands out with innovative services such as Power Swaps, which allows users to exchange their empty battery for a charged one in 3 minutes, Power Mobile, which allows users to order a truck to recharge their SUV anywhere, and finally, Power Express, a 24-hour on-demand recharging application that works like Uber, centralizing all its services. The Chinese company is therefore going far beyond the simple home charging station. NIO is gradually overcoming the problems of autonomy and recharging for electric vehicles, which are often seen as an obstacle to purchasing. This strategy is reflected in the company's latest figures, as its deliveries are only increasing. In fact, NIO delivered 12,206 vehicles in the last quarter, an increase of 154.3% year-on-year, bringing the total number of cars delivered over 2020 to 26,375. As a result, analysts expect strong sales growth, with revenues of 4,951 in 2018 (in millions CNY, equivalent to 634.3 million euros), which are expected to increase to 43,467 by 2022 (in millions CNY, equivalent to 5.6 billion euros). However, analysts also believe that NIO is not expected to be profitable before 2022. As with Tesla, this moment could be a catalyst for NIO's share price. Recently, the company took its 5,000th vehicle off the production line in the space of a month, a first made possible by an upgrade of its line. NIO's share price took advantage of this to jump by more than 16% yesterday, bringing its 2020 performance to 695%, a far cry from Tesla's 391% increase. Surge of the Nio stock  |

| Bond market The time has come to reduce interest rate spreads. ECB head Ms. Lagarde suggested that the size of the overall EPPP envelope could be increased and that all its existing instruments could be recalibrated, if necessary, in December. This press release mainly benefited debt securities in the peripheral segment. Spreads in the BTP-Bund narrowed by approximately five basis points. The yield of the German bond stabilized at -0.62% and that of the French OAT stabilized at -0.33%, while the Italian ten-year bond fell to 0.74%. Still in southern Europe, the debts of Portugal and Spain are approaching a soon-to-be negative yield of 0.11% and 0.14% respectively. On the other side of the Atlantic, a few days before the American elections and still without a recovery plan, the bond benchmark remains tense, with a gradual rise to 0.82%. |

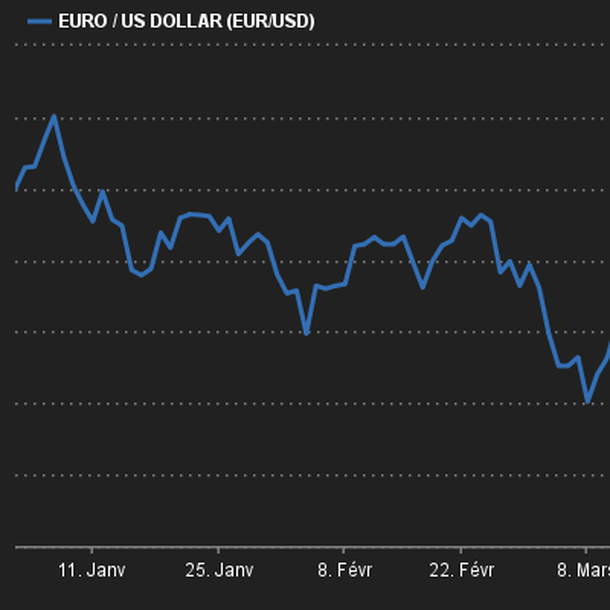

| Forex market The euro is falling. Indeed, the European currency is on the defensive after announcements of new lockdowns in Europe. Measures that prioritize health safety to the detriment of the economy in all euro zone countries penalize the currency. The EUR/USD is trading below USD 1.17 and is returning to its 20-week average (see graph). The level is meant to be relevant. This failure of the euro is verified against the yen, the big winner of the stressful situation. The EUR/JPY is losing 200 basis points over the week and is trading at JPY 122.5. The Japanese currency improves against all of its counterparts as a safe-haven currency. The USD/JPY trades to a 6-month low at JPY 104. For once, we highlight the course of Bitcoin, which has just reached a high since January 2018, at USD 13,850, increasing by more than 12% in one week. This winning run is partly due to the announcement made by Paypal to accept this encrypted currency as a payment currency. Consolidation of EUR/USD  |

| Economic data The statistics were mixed for Germany last week. The IFO declined to 92.7, retail sales by 2.2% (consensus -0.6%) while GDP grew by 8.2% in Q3 (-9.7% in Q2) and import prices rose by 0.3% (-0.3% expected). For France, consumer spending fell by 5.1% (consensus -1.5%), the CPI index stands at -0.1%, but GDP rebounded more than expected (+18.2% against +15% expected) after a 13.7% decline in Q2. For the euro zone, the CPI index was in line with expectations at -0.3%, GDP rebounded by 12.7% in Q3 (-11.8% in Q2) and the unemployment rate remained unchanged at 8.3%. In the United States, macroeconomic data was generally reassuring. Durable goods orders rebounded by 0.8%, Richmond's manufacturing index rose to 29 and Michigan's index to 82.18, GDP jumped 33.1% in Q3 (-31.4% in Q2), household spending and income increased by 1.4% and 0.9% respectively. The Conference Board index, on the other hand, disappointed at 100.9 and sales of older homes fell by 2.2%. |

| What will 2021 bring? The current context is anxiety-inducing, with economies and above all liberties that are strongly impacted. Nations, with the help of central banks, must always do more, "whatever it costs" as French president Emmanuel Macron famously said. It can be done because the debt conditions of countries are meant to be exceptional, with rates often negative or close to zero. Financial markets start imagining the future profile of growth. After another massive recessive shock in the last quarter in the regions of the world that faced lockdowns, what is the potential for recovery in 2021? The arsenal of monetary and fiscal measures should help, but this will again depend on the state of health. |

By

By