|

Monday July 20 | Weekly market update |

| Hopes for a recovery in the global economy and a cure for Covid-19 kept the trend alive this week, with main indices picking up as the quarterly earnings season starts. Nervousness remains palpable as contaminations reach records in the United States, which could threaten the economic recovery. |

| Indexes Over the past week, while Europe and the United States have made progress, Asia has been plagued by profit-taking, with rising Sino-American tensions. The Nikkei returned some of its gains from the start of the weekly sequence, but still managed to reap 1.8% over the last five sessions. Hang Seng is down 2.26% over the same period and Shanghai Composite is down 7.6%, after its 7.3% rise last week. In the euro zone, all indices recovered. The CAC40 gained 1.7%, the Dax 2.1% and the Footsie 2.3%. Spain also gained 1.2% and Italy 2.8%. In the United States, for once, the Nasdaq100 recorded a weekly loss of around 2.4%, while the Dow Jones gained 2.2% and the S&P500 performed by 0.8%. Ratio between the Dow Jones and the Nasdaq100  This curve highlights the recent outperformance of industrial stocks over technology stocks |

| Commodities Oil prices are sluggish, offset by renewed concerns about coronavirus, while OPEC continues to cut production next month. In the United States, weekly stocks fell sharply (-7.5 mbpd), but this was partly explained by the drop in domestic imports. Brent is trading at USD 43 per barrel while WTI is trading around USD 40. According to a World Gold Council survey, 20% of central banks plan to buy gold by the end of the year. The gold metal is therefore still in demand and is still flirting with the USD 1800 mark. Silver also recorded another week of gains at USD 19.15. The time has come for consolidation for industrial metals, a more than legitimate pause after the rally achieved by the entire compartment. Copper is back at USD 6385, nickel blows to USD 13200, while aluminum is trading at USD 1627 per ton. |

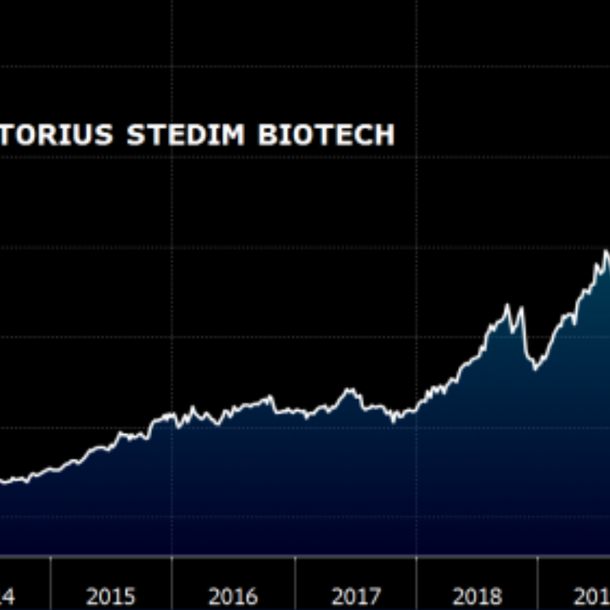

| Equities markets Sartorius Stedim Biotech Founded in 1978, the French biotech company Stedim was listed on the Paris Stock Exchange in 1994. Some 13 years later, it merged with the Biotechnology Division of the German group Sartorius AG to create Sartorius Stedim Biotech, which specializes in equipping the bio-pharmaceutical industry. With its own production and R&D facilities in Europe, North America and Asia as well as an international distribution network, the new group is distinguished by its worldwide business, despite the 33% share in the United States. For the financial year 2019, SSB achieves a turnover of € 1.44 billion, confirming a recurrent double-digit growth. With an expected net margin of 18.1% for 2020, net profit should jump by 35%. Admittedly, the uninterrupted rise in the share price over the last 10 years (+4450%) has given it a tense valuation (76 of PER for 2020), with investors paying the price of growth. As a covid value, the Aubagne-based company's share (13) has enjoyed an exceptional performance since January 1, with a return of 82%, giving it a historic capitalization of $25 billion. Sartorius Stedim Biotech  |

| Bond market Market players seem to be waiting in the wings for the results of the EU summit. Deliberations in Brussels focus on the proposed EU Reconstruction Fund and the long-term budget for the period 2021-2027. Both subjects have recently been controversial, with the emergence of a group of four countries that have so far opposed the European Commission's proposal. On the ECB side, Lagarde said the uncertain nature of the economic recovery in the euro zone justifies an extremely high degree of monetary stimulus. Eurozone governments will therefore benefit from ECB purchases until at least the summer of 2021, which will keep rates low overall. Over the week, the various European benchmarks remain stable, such as the German bund, which sees its yield balanced at -0.46%. The negative territory is confirmed for the French OAT at -0.15%. There was also very little drift in ten-year rates for Spain (+0.40%) and Italy (+1.91%). In Switzerland, the same reference is -0.50%. In the United States, the bond market is also stable, with a Tbond at 0.60%. The Fed's promise to support the corporate bond market has generated strong support for the bond market. |

| Forex market Equilibrium dominates trading in the foreign exchange market. On the one hand, safe havens that keep their defensive qualities and on the other, currencies that recover ground on every good economic or health news. Sterling's performance is an exception, with declines against all of its counterparts. The British economy is in a delicate state. Between March and May, under the effect of the coronavirus crisis, gross domestic product plunged by 19.1%, compared to the previous three months... And the future looks bleak. According to the forecasts of fiscal officials, the country is on the verge of its worst recession in three hundred years, with an annual contraction in GDP of more than 10%. The shock of the coronavirus is compounded by the threat of an unregulated Brexit. The pound is currently trading at GBP 1.26 against the greenback. The Swedish krona has emerged as one of the winning currencies since the global containment, with substantial gains on the dollar. At its recent low in early March, the USD/SEK was trading at SEK 10.40 SEK, it now only takes SEK 9.1 SEK to trade a dollar. This winning streak is being confirmed against the single currency, as the Swedish currency has moved from SEK 11.2 to SEK 10.35 to the euro. The euro is in a positive trend against the greenback at over USD 1.14. Forex traders are positioning themselves against the single currency a few hours away from the crucial summit for the continental recovery plan. The euro is positioned for gains against the yen at JPY 122 (+150 basis points) and against the Swiss franc (CHF 1.08), a sign of easing financial market stress. Evolution of the Swiss franc against the euro  |

| Economic data Last week's statistics were mixed in China, with a trade balance of $329 billion against an expected $410 billion and retail sales down 1.8% while the market was expecting +0.5%. On the other hand, GDP exceeded expectations at +3.2%, with an unemployment rate of 5.7%. In the euro zone, industrial production rose by 12.4% (consensus 14.9% against -18.2% last month). The trade balance was slightly better than expected, with a surplus of 8 billion euros. Following this weekend's European summit, traders will be taking note of the Flash PMI manufacturing and services indexes on Friday. In the U.S., most of the figures exceeded expectations, such as the Empire State manufacturing (17.2) and PhillyFed (24.1) indexes, industrial production (+5.4%) and retail sales (+7.5%). Michigan's index came out at 73.2 against an expected 79. This week, statistics will focus on housing and the Flash PMI manufacturing and services indexes. |

| Will earnings reports bring hope? Markets are showing a certain resilience. In this uncertain context, this gives investors' hope for an effective recovery, a hope strengthened by central banks, which are constantly pushing back the limits of monetary policies. Nevertheless, at this stage of the recovery, the additive booster is not only to be found in the form of a V-shaped recovery, but also in the bell ringing from companies about their ability to project themselves into the second half of 2020 or even 2021. This quarterly episode should therefore provide a ray of light to this economic and health environment, which is still largely obscure. |

By

By