|

Monday October 12 | Weekly market update |

|

Despite Trump's dissonant speech and his recent proven contamination with coronavirus, financial markets have moved forward last week. As the earnings season approaches, risk appetite remains intact, with Wall-Street outperforming Europe to some extent. |

| Indexes Over the past shortened week in Asia, indices have picked up again. The Nikkei won 2.5%, the Hang Seng 2.6% and the Shanghai Composite 1.6%, after several days of closure. In Europe, the rise also dominates, like the CAC40 which gained 2.4%. The Dax rose by 2.7% and the Footsie by 2%. For the peripheral countries of the euro zone, Spain gained 2.8%, Portugal 2.3% and Italy 2.7%. Across the Atlantic, indices also recovered, with financial stocks and energy in particular. The Dow Jones recorded a weekly performance of 3%, the S&P500 of 3.5% and the Nasdaq100 performed by 3.7%. |

| Commodities After the cold snap, oil markets rebounded. Fears of a global supply surplus at a time when the Covid-19 is weakening demand, oil prices have regained strength thanks to the intervention of Saudi Arabia. The Kingdom, an OPEC heavyweight, believes that it would be premature for the cartel to increase its production by two million barrels per day from 2021. This declaration paves the way for a stabilization of OPEC's supply. Brent and WTI rebounded this week to USD 43 and USD 40.8 per barrel respectively. The barbaric relic has had the luxury of progressing last week, a performance to be put into perspective with the rise of equity markets. Gold thus traded at USD 1915 against USD 24.30 for silver. Concerning base metals, copper is gaining ground at USD 6,611 per metric ton. Miners at one of Chile's largest mines, the Candelaria mine, have begun a strike, raising concerns about the supply of the world's leading copper producer. |

| Equities markets Headquartered in San Francisco, Sunrun is active across the entire value chain of solar energy systems, from design to installation and maintenance. Its products are mainly intended for the residential sector. The company claims that by installing its solar panels, customers can save 10 to 40 percent on their electricity bills. It currently has 309,000 customers in 22 states and has experienced 71.7% growth in customer acquisition since 2017. This growth is also reflected in revenues, which jumped 58.3% between 2017 and 2019. This trajectory is expected to continue as Sunrun estimates the potential market at 75 million homes and is targeting 13% market penetration by 2029. With a 15% market share in 2019, Sunrun is the leader in the residential segment compared to competitors such as SunPower, Vivint Solar, Sunnova or even Tesla. However, its CAPEX to revenues ratio is close to 100%, indicating that it is investing heavily, which can be positive if these assets generate revenue. But with such a high ratio, Sunrun also puts itself in a difficult financial situation. Its cash flow for the last quarter is negative at $189.3 million and more than $1 billion in 2019. The evolution of Sunrun's share price shows investors' enthusiasm for the stock. The share price rose by 411% over 2020, enabling Sunrun to reach a market capitalization of 8.9 billion dollars. Strong year-on-year increase in Sunrun shares  |

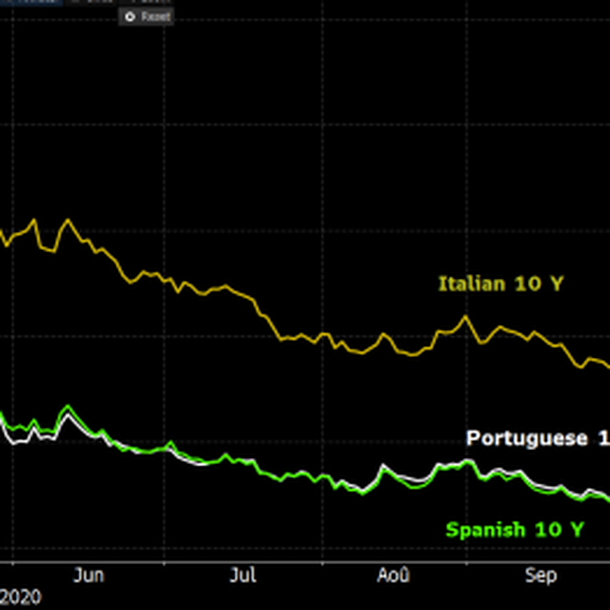

| Bond market In Europe, the trend is towards a prolonged easing of yields, as in the case of Spanish (0.18%), Italian (0.75%) and Portuguese (0.18%) ten-year sovereign bonds. These benchmarks are paying at historic lows, which reduces spreads with the German Bund (-0.53%). For its part, the French OAT remains largely negative with a rate of -0.27%. The ECB continues to buy the available securities like a vacuum cleaner, so that it holds an increasing share of the bond market. In the case of German government bonds, they already account for about half of all outstanding bonds. The divergence marks the trajectory of bond prices. Indeed, the opposite movement is occurring in the United States, in the run-up to the American elections. The Tbond is trading on the basis of a 10 basis point increase in yield over the fortnight, to 0.76%. New historical lows for some 10-year references in Europe  |

| Forex market The pound continues to yo-yo on political interventions. Johnson had agreed with Von der Leyen to intensify negotiations, but they remain deadlocked after a ninth round of talks. BPG is treated on a basis of USD 1.29 and EUR 0.91. In the euro zone, the single currency is gaining ground against the yen, as traders have momentarily abandoned safe haven currencies. The euro's upturn is now facing the greenback at USD 1.179. President Trump's turnaround on the economic aid program has supported stock markets and thus weighed on the dollar. In a conference, the ECB President said the economic recovery remains incomplete and left the door open for a new monetary stimulus plan, but the EUR was insensitive to this statement. In the southern hemisphere, the New Zealand dollar weakened against all of its major competitors after the national bank said it may have to be more aggressive in boosting the economy to boost inflation and employment. Among emerging currencies, the Turkish lira hit a new low after the U.S. warned that it was "deeply concerned" about Turkey's behavior that is dangerously stirring up geopolitics. The currency is trading at TRY 7,885 against the greenback (see chart). New low for the Turkish Lira  |

| Economic data With the "golden week", only one statistic was on the program in China. The Caixin PMI services index exceeded expectations, at 54.8 (54.5 expected against 54 last month). Data from Europe also reassured, with a PMI service index at 48 (consensus 47.6) and retail sales up 4.4% (2.4% expected). This week will again be another light week in terms of publications, with mainly the German Zew, Euro-Zone Trade Balance, and CPI index. In the U.S., the ISM Services index exceeded expectations (57.8 vs. 56.9 last month), but the trade deficit widened slightly (-67.1N) and weekly jobless claims came out at 840K vs. 820K expected. Coming up on Monday, CPI and PPI indexes, PhillyFed, Empire State Manufacturing and Michigan indexes, then import prices, retail sales, industrial production... so many data likely to assess the health of the American economy. |

| When will we see a stimulus plan? Market volatility is in line with Donald Trump's interventions on whether or not to negotiate a recovery plan, which seems inevitable in any case. It is therefore all a question of content and timing. The recent index hikes demonstrate the positive attitude of investors on this theme. The immediate consequence of these indispensable recovery plans, which are complementary to conciliatory monetary policies, is the explosion of government debt, with an average debt ratio close to 120% of GDP. A heavy legacy that is certainly part of a lasting change in the economic environment and which is itself the result of another transformation, that of the low interest rates since 2008. |

By

By